FxSign Review 2024

Pros

- Low minimum deposit

- Demo account

Cons

- No copy trading

- Low rating

- No MT4 integration

FxSign Review

FxSign is an online CFD broker that provides trading on 120+ instruments via the MetaTrader5 (MT5) platform. The deposit bonuses and high leverage on offer make FxSign an attractive prospect for some commodity, crypto and forex traders, though some will hesitate to sign up with this offshore broker due to the limited regulatory oversight.

This FxSign review will assess the firm’s platforms and apps, spreads and fees, account types, promotions, and safety ratings. Our experts also share their opinion on trading with FxSign.

Key Takeaways

- Crypto deposits

- 50% deposit bonus

- High leverage up to 1:1000

- Narrow range of instruments with no stocks

- Limited trading tools and education

- Poor regulations & license

- Withdrawal complaints

Assets & Markets

FxSign offers a limited selection of 120+ trading instruments via CFDs with ECN connectivity:

- Commodities – Invest in energy and precious metals such as oil, gas, and gold

- Forex – Trade 35+ major, minor, and exotic currency pairs including GBP/USD, EUR/GBP, and USD/JPY

- Cryptocurrencies – Trade some of the most popular digital currencies including Bitcoin, Ethereum, and Ripple

FxSign Leverage

The maximum leverage available when trading with FxSign varies by account type:

- Cent Account – Up to 1:500

- Standard Account – Up to 1:1000

- Professional Account – Up to 1:500

- Institutional Account – Up to 1:200

As with many offshore brokers, this leverage provides significant purchasing power with borrowed funds, but also amplifies risks, so beginners should beware of trading with high leverage.

Note that FxSign’s regulator does not require negative balance protection, which stops retail traders from becoming indebted to brokers through losing trades.

All accounts have a 50% margin call and a 30% stop-out level.

Account Types & Fees

There are four FxSign accounts that offer varying pricing structures and features: Cent, Standard, Professional, and Institutional.

The account you can access will depend on the amount you are able to deposit, and the main differences between them relate to trading fees and the number of instruments available. Put simply, the more you deposit, the less you will need to pay in fees and the more instruments you can trade.

Our account comparison lists the key details:

Cent

- Spreads from 1 pip

- $1 minimum deposit

- Maximum leverage 1:500

- $0.07 commission per lot

- Access to 30 instruments; forex and metals

Standard

- Commission-free

- Spreads from 0.5 pips

- $10 minimum deposit

- Islamic account available

- Maximum leverage 1:1000

- Access to 60 instruments; forex, CFDs and metals

Professional

- Commission-free

- Spreads from 0.2 pips

- $1000 minimum deposit

- Islamic account available

- Maximum leverage 1:500

- Access to 120 instruments; forex, CFDs, crypto and metals

Institutional

- Commission-free

- Spreads from 0.1 pip

- $5000 minimum deposit

- Islamic account available

- Maximum leverage 1:200

- Access to 120 instruments; forex, CFDs, crypto and metals

How To Register For An Account

To open an FxSign account:

- Complete the online registration form

- Select ‘Create Account’

- Login credentials will be sent to the registered email address

- Select the ‘Login’ icon from the top menu and sign in to the client dashboard to begin trading

You will need to upload identity verification and proof of address details to comply with the know-your-customer protocols. This can be done once you have signed in to the client portal and clicked on ‘KYC Documents’ from the side menu. Use the ‘Upload’ icon to begin.

Trading Platform

FxSign clients can trade on the reliable MetaTrader 5 platform. This software is similar to its predecessor, MetaTrader 4, but with additional features, some updated functions and compatibility with several asset classes beyond forex.

Features available include 38+ in-built technical indicators, netting and hedging options, real-time charting (bar, line, and candlestick), and 44 analytical objects. Graphs can be viewed across 21 timeframes, alongside an integrated economic calendar and a strategy back-testing feature.

MT5 traders can use the MQL5 programming language to develop and test expert advisors – automated trading robots that can provide signals or open and close positions autonomously according to the user’s parameters.

MetaTrader 5 can be downloaded to desktop devices or used directly through web browsers such as Google Chrome or Internet Explorer.

How To Place A Trade

Opening new positions on the MT5 terminal involves either right-clicking on the chosen asset from the Market Watch window, clicking F9 to initiate one-click trading, or right-clicking on the trade tab in the lower screen section.

To make a trade using the ‘New Order’ icon:

- Log into the FxSign client area

- Open your MT5 terminal

- Select the ‘New Order’ icon (white page with green +) from the toolbar along the top of the screen

- Add the order details to the pop-out window (e.g. volume, stop loss and take profit, comments)

- Select ‘Buy’ or ‘Sell’ to confirm the order

FxSign App

Our team were disappointed to see that the broker does not offer a proprietary mobile app. Instead, FxSign customers can make use of the MT5 mobile application, which is available for free download to iOS and Android devices.

Although not the most modern or sleek of designs, the MT5 app has all the features and functions needed for successful trade execution, with customizable charts, integrated technical indicators, and news updates. The price alerts and market notification tools are especially useful while trading on the move.

Demo Account

A free demo account is available to new FxSign day traders, offering leverage of between 1:10 and 1:1000, and with virtual funds available between $1000 and $1,000,000.

Demo account users have full access to the features and functions available on the MT5 platform, making these accounts ideal for practicing opening and closing positions, and the perfect way to sharpen your strategy and develop your technical analysis skills.

Given the firm’s unregulated status and user complaints, a paper trading account is also a good place to start before risking real funds.

How To Open A Demo Account

- Create an FxSign account and log in to the client area

- Select ‘Accounts’ from the side menu, then ‘Demo Account’

- Choose the ‘Open Demo Account’ icon from the page and select your desired leverage and virtual balance in the pop-out window

- Click ‘Submit’

- Login credentials will be sent to your registered email address

- Download the MT5 platform and sign in to start trading

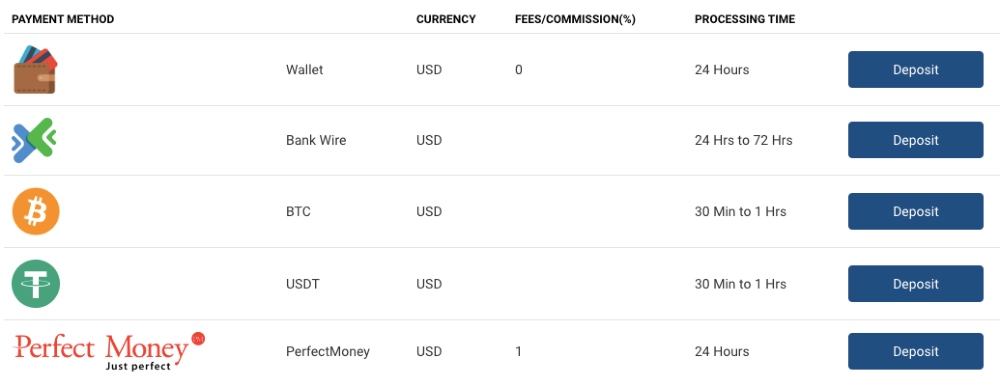

Payment Methods

Deposits

Deposits to an FxSign account can be made in USD only, and traders are liable for any currency conversion fees. This is a drawback vs other brokerages that cater to traders in different regions with local currency support.

The broker accepts payments via several deposit methods including PayPal, Skrill, bank wire transfer, and credit/debit cards. You can deposit funds directly to a trading account or transfer to a bespoke wallet.

A $1 commission fee applies for PerfectMoney only. All other methods are fee-free.

When we used FxSign, we could deposit through the following options:

- PerfectMoney – Up to 24-hour processing time, minimum $1 deposit, maximum $50,000

- FxSign Wallet – Up to 24-hour processing time, minimum $20 deposit, maximum $10,000

- Tether – Average 30-minute to one-hour processing time, minimum $1 deposit, maximum $100,000

- Bank Wire Transfer – Up to 72-hour processing time, minimum $500 deposit, maximum $100,000

- Bitcoin – Average 30-minute to one-hour processing time, minimum $1 deposit, maximum $10,000,000

How To Make A Deposit

- Sign in to the FxSign client area

- Select ‘Payments’ from the side menu and then ‘Deposit’

- Choose a payment method from the list of options and select the ‘Deposit’ icon from the right-hand menu

- Enter your details in the payment window, and ensure that the correct account is selected in the dropdown

- Click ‘Submit’

Note, a deposit receipt upload is required for bank wire transfers and crypto payments.

Withdrawals

You must withdraw back to the original payment method used to make a deposit, which is standard practice at many brokers.

Unfortunately, withdrawal fees apply for all methods, including a $50 charge for bank wire transfers and a 2% fee for PerfectMoney transactions. This is a major disadvantage vs competitors.

A minimum withdrawal amount of $500 is applicable for bank wire transfers, which is the highest of all payment methods. Allow up to 10 working days for payments to be processed via this method. E-wallet and cryptocurrency withdrawals can be processed within 24 hours.

Note, KYC documents must be uploaded before a withdrawal can be requested.

Bonuses & Promotions

FxSign offers a 50% bonus on all deposits except with Cent accounts. To claim this financial reward, you must deposit at least $200 and adhere to the broker’s requirements related to the size and volume of your trades.

As an offshore regulated entity, FxSign is not restricted from offering incentives to customers, unlike many brokers that are overseen by major regulators. Importantly though, the broker’s bonuses typically have tough volume requirements, making withdrawals difficult.

Company Details

FxSign was founded in 2015 in Bulgaria before establishing branches in the EU and Asia.

The company is registered in St Vincent and regulated by the St Vincent and the Grenadines Financial Services Authority (SVGFSA). However, this is not a reputable regulator so traders may receive limited account protections.

The firm claims to offer ‘top-tier’ liquidity solutions with transparent market conditions and high-quality order execution with no order delays, slippage, or re-quotes.

FxSign Regulation

FxSign is listed on the St Vincent and the Grenadines Financial Services Authority (SVGFSA) entity search list under registration number, 1740. This is an offshore authorization with limited oversight and powers over registered companies.

FxSign is also registered to offices in Turkey and Dubai, though no financial oversight is apparent for these entities.

With unclear information regarding consumer safeguarding and the financial protection available, traders should ensure that they understand the risks and have researched the company thoroughly before investing their capital.

Alternatively, many regulated brokers are available to traders.

Customer Support

The broker offers several customer contact options for retail investors, available weekdays from 9 AM to 7 PM (GMT +4). Having said that, the live chat function was offline when our experts tested it during these hours.

There is also an FAQ section on the FxSign website, though trade and account information are limited.

Traders who are interested in joining FxSign can contact the broker using the following contact information:

- Email – support@fxsign.com

- Live Chat – Blue icon found bottom right of the broker’s webpages

- HQ Postal Address – Standard Chartered Tower, Level 5, No. 503, Emaar Square Downtown, Burj Khalifa, Dubai

- Telephone – +1 (614) 349 36 86 (Dubai), +1 434 533 0 465 (Saint Vincent & The Grenadines) or +90 552 423 22 44 (Turkey)

Additional Features

FxSign provides clients with very limited extra features in the form of educational content and market analysis.

While using FxSign, our experts found that many of the links were broken, expired, or outdated and did not provide particularly useful trade support. The information we were able to access was basic, with topics such as long-term trading vs short-term trading and the advantages of using a demo account.

Trading Hours

FxSign does not publish specific trading hours, but these are likely to follow the standard hours for the asset type, with cryptocurrencies available to trade 24/7, forex 24/5, and hours for commodities dependent on the exchange.

Security & Safety

The broker implements HTTPS data encryption through its website.

In addition, the MetaTrader brand is renowned for its security, operating with hidden IP addresses and RSA digital signatures.

FxSign Verdict

FxSign provides some competitive trading conditions with access to the MT5 platform, reasonable fees, high leverage, and 24/5 customer support. However, the lack of credible regulation from a top-tier authority is disappointing and leaves FxSign traders with few protections. The narrow range of trading instruments and limited additional tools also means the broker does not rival most alternatives.

FAQ

Is FxSign Regulated?

FxSign is registered with the St Vincent and the Grenadines Financial Services Authority (SVGFSA). This is an offshore entity with limited consumer protection and financial safeguarding for retail traders. This also increases the risk of the brokerage being a scam.

Is FxSign A Good Broker?

FxSign offers some useful features, with trading on the MetaTrader 5 platform and app, 24/5 customer support, commission-free trading solutions, and a demo account. However, there are multiple downsides, including the offshore regulatory status and the lack of educational content or advanced trading tools. The suite of tradable instruments is also limited vs competitors.

Is It Cheap To Trade With FxSign?

FxSign is not the cheapest broker. Trading fees vary by account type with the Cent profile offering the lowest minimum deposit of just $1, with a commission fee of $0.07 and spreads from 1 pip. The cheapest fees can be achieved via the Institutional account, with no commission and spreads from 0.1 pips. However, a $15,000 deposit is required.

Does FxSign Offer A Choice Of Trading Platforms?

No, FxSign offers the MetaTrader 5 (MT5) platform only. This can be used on a desktop terminal or on iOS and Android mobiles.

Is FxSign Legit Or A Scam?

FxSign claims to have been operating since 2015 with customers around the world. However, our review of FxSign found several issues, from weak regulatory oversight and withdrawal issues to unclear information on the firm’s background and management team. As a result, our experts recommend caution when opening an account.

Top 3 Alternatives to FxSign

Compare FxSign with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

FxSign Comparison Table

| FxSign | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.3 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Commodities, Crypto | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $1 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | SVGFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 50% Deposit Bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 10 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by FxSign and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FxSign | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

FxSign vs Other Brokers

Compare FxSign with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of FxSign yet, will you be the first to help fellow traders decide if they should trade with FxSign or not?