FXChoice Review 2026

See the Top 3 Alternatives in your location.

Awards

- Exceptional Customer Service 2019 - 2021 - LiveHelpNow

Pros

- VPS available

- FIFO rule not applicable

- GPS robot 100k EA download

Cons

- Limited selection of commodities

- Weak regulatory oversight

FXChoice Review

FXChoice is an ECN broker offering forex and CFD trading on the MetaTrader platforms, two live accounts, and a demo solution. Our 2026 website review uncovers fees, promos, regulations, and more. Find out if our experts recommend signing up for an FXChoice account.

FXChoice Headlines

Established in 2010, FXChoice Limited is headquartered in Belize and regulated by the Financial Services Commission (FSC).

Over the last decade, the company has evolved as a leading ECN broker, providing forex and CFD trading to both private and institutional clients. The brokerage follows a Non-Dealing Desk (NDD), market execution model with a daily trading volume of more than 150,000.

FXChoice offers award-winning trading platforms and customer service, as well as additional analysis tools. Crypto deposit bonuses, copy trading, and a dedicated forex training academy make it popular with beginners, while the Myfxbook AutoTrade solution facilitates advanced strategies for experienced traders.

Overall, the company’s substantial net worth demonstrates its success at meeting its clients’ needs.

Trading Platforms

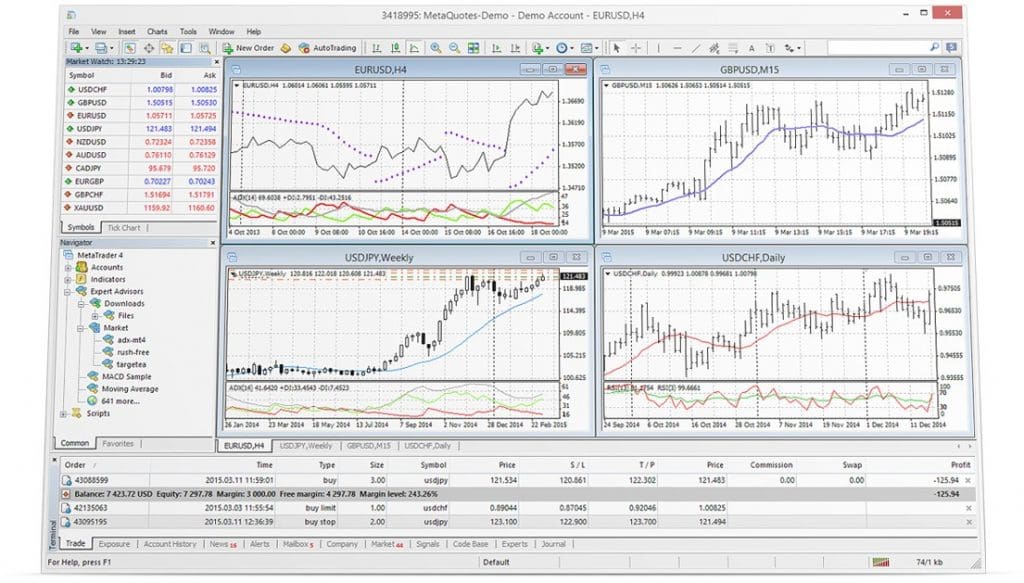

MetaTrader 4

Whether you are a beginner or a seasoned investor, MT4 is ideal for anyone looking for a tried and tested trading solution. The multilingual platform comes with plenty of sophisticated charting tools and customizable features that cater to various strategies. Our forex broker review found that traders enjoy rapid execution and interbank liquidity with:

- Quick & easy login

- Multiple timeframes

- 4 pending order types

- Expert Advisors and single-thread strategy tester

- Over 2000 technical indicators and graphical objects

MetaTrader 5

As the successor to MT4, users benefit from a more professional experience with MT5 and additional capabilities, including a market depth view, access to more tradable assets, extra technical indicators, timeframes, faster execution speeds, plus 6 pending order types. The spacious dashboard also makes the interface somewhat easier to use than its predecessor.

Both MT4 and MT5 are compatible with Windows and Mac PCs.

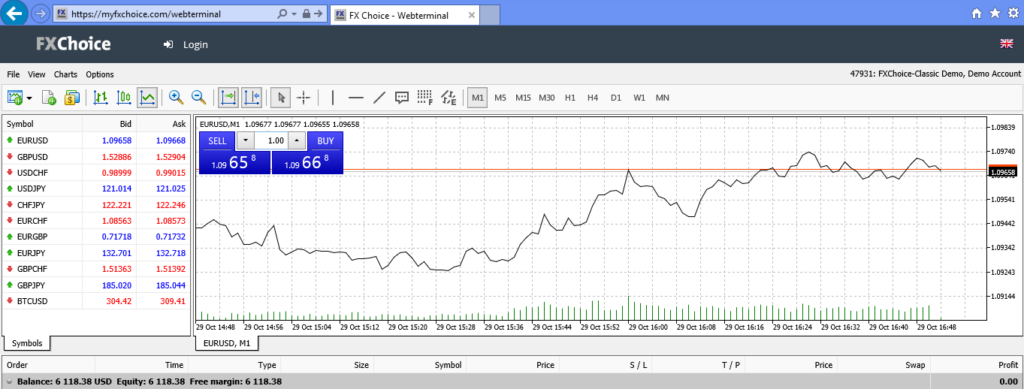

MetaTrader WebTrader

Available to both MT4 and MT5 users, the web terminal provides the convenience of trading anywhere with an internet connection, without the need to download any software.

Investors can save time and disc space with virtually the same interface as the desktop version.

Available functions include one-click trading (MT5 only), real-time quotes, customizable charts, 9 time-frames, and basic analytical objects.

Assets & Markets

FXChoice covers CFD trading in four areas:

- Commodities – Speculate on gold, silver, crude, or US Brent oil

- Indices – 6 world-leading indices, including US30 and UK100

- Forex – 36 popular currency pairs, including EUR/USD and GBP/USD

- Stocks – 50+ shares in the most popular companies like Tesla and Apple

- Cryptocurrencies – Trade on Bitcoin (BTC), Litecoin (LTC), and Ethereum (ETH)

Note, FXChoice does not offer binary options or access to NASDAQ, USDTRY, or platinum.

Spreads & Commissions

Spreads and fees are slightly higher at FXChoice compared to similar brands such as FXTM.

Spreads start at 0.5 pips on the Classic Account with no commission, while the Pro accounts offers spreads from zero pips alongside a commission of $3.50 per side.

This drops to $1.50 per side, per $100,000, with the broker’s Pips+ loyalty programme.

Fortunately, FXChoice is transparent with its contract specifications and provides detailed cost breakdowns, including swap fees.

Note, the minimum trade size is 0.01 lots.

Leverage

Flexible leverage ranges from 1:25 to 1:200 across both account types at FXChoice. These rates are fairly high and are not subject to the 1:30 cap found at most CySEC-regulated brokers.

The margin level is 50% and the margin call/stop out levels are 25/15. Details of margin requirements can also be found in contract specifications and the product guide.

Mobile Apps

Mobile trading is made easy with the MT4 and MT5 mobile apps, compatible with both iPhone (iOS) and Android (APK) smart devices.

The apps offer much of the same functionality as the desktop platforms, with added benefits such as push notifications and interactive price charts. iPad users can also display multiple charts in one window.

To download the application, head to the App Store or Google Play.

FXChoice Payment Methods

Deposit Review

FXChoice offers a good range of deposit methods like card payments, e-wallets, and cryptocurrencies, including Bitcoin (BTC) and Ripple (XRP). Note that some methods are only available in certain jurisdictions.

The minimum deposit is 100 USD or currency equivalent and accounts can be opened in USD, EUR, GBP, AUD and CAD, among others.

Processing charges may apply, though some payment methods have 0% fees. These can be found on the deposits and withdrawals page or within your back office profile. Internal transfers can also be made from within the back office.

Withdrawal Review

Many of the same methods are available for withdrawals, which are processed within 24 hours Monday to Friday. After processing, all e-payment withdrawals are credited instantly, while timelines for cryptocurrencies can take up to a couple of hours.

Some options also involve a fee; details of which can be found in the cashier portal upon login.

Demo Account

You can open Classic MT4, Pro MT4, and Pro MT5 demo accounts. Users can access almost identical trading conditions in a no-risk environment, with a customizable amount of virtual funds to practice with.

Our experts found that paper trading profiles expire after 90 days of inactivity. Otherwise, they remain open for as long as needed.

If your paper trading solution has expired, you may need to contact customer service to reset the demo account.

Bonuses & Promotions

FXChoice offers a 65% or even 80% bonus if you deposit in Bitcoin or any other available cryptocurrencies.

A 50% welcome deposit bonus is also available in the UK.

Note that the percentage of the bonus may differ depending on the account type. Details are provided in the terms and conditions.

The forex broker also offers the Pips+ Loyalty program, in which all clients are automatically enrolled when they sign up for a Classic or Pro account. The program consists of five tiers and awards higher rebates and lower commissions for active trading.

Previous welcome bonuses and deals have also included a free VPS promo code, so it is worth checking the website for future promotions.

Regulation & Licensing

FXChoice Limited is a legitimate broker, authorized and regulated by the Financial Services Commission (FSC) under license number 000067/301. The broker ensures that all client funds are held in segregated bank accounts and offers negative balance protection.

FXChoice does not accept clients from the United States of America (USA). Clients from Canada to Nigeria can sign up for an account, however.

Additional Features

There are some useful trading services available, including the Myfxbook AutoTrade tool. There is also a selection of Expert Advisors for MT4 to download, including the GPSForexRobot for scalping, plus pip calculators.

The MQL5 Trading Signals service is also available. This feature allows investors to shadow the positions of experienced traders, known as Signal Providers. This add-on can work alongside Expert Advisors and the provided signals can be copied automatically in the MT4 platform.

In addition, FXChoice has partnered up with ZuluTrade to offer copy-trading solutions. A VPS is also available for investors who want to run their own software.

The FAQ section is quite extensive and does cover technical information and video tutorials for MT4 and MT5. However, other popular brands like Forex.com and IG, offer a more comprehensive range of educational tools and research.

Account Types

Traders can choose between two live account types: the MT4 Classic account or the MT4/5 Pro account. Both require a $100 minimum deposit and have a 0.01 minimum lot size. Account verification can be completed in a few steps from the broker’s website.

The main difference between the two accounts, aside from the availability of MT5, is the $3.5 commission and tighter spreads in the Pro account.

Islamic swap-free, MAM, and corporate options are also available at request. FXChoice does not offer PAMM or cent accounts.

How To Sign Up & Start Trading

- Follow our sign-up link to register for one of the broker’s live accounts

- Complete the registration form which takes a couple of minutes to fill in

- Verify your profile by logging into the back office

- Deposit funds into your FXChoice account using the list of accepted payment options (the minimum deposit is $100)

- Download MT4 or MT5 or open the WebTrader

- Open the trading platform, find a suitable opportunity and enter a long or short position

Trading Hours

Server times can be found below and in the online product guide. All times are in the GMT+3 time zone.

- Cryptocurrencies – Monday to Friday 01:00 – 23:45

- Gold and silver – Monday to Friday 01:00 – 24:00

- Forex – Monday to Friday 00:00 – 24:00

- Indices – varies; see website

- Oil – varies; see website

Customer Support

There are several ways you can get help at FXChoice. We found that the live chat service was particularly fast and helpful when tested.

- Submit a ticket via the online contact form to receive a response by email

- Telephone number: +52 556 826 8868

- Request a callback

- Live chat

You can also keep up to date with events, news, and holiday hours announcements on the broker’s social media pages.

The customer support team is on-hand should you experience any withdrawal problems or have questions about server locations, epayments, and copy trading. Note that they cannot provide guidance on taxes.

FXChoice Limited’s headquarters address is Corner Hutson & Eyre Street, Blake Building, Suite 302, Belize City, Belize.

Security Rating

When we used FXChoice we found that client transactions are processed safely. All communication is encrypted using SSL technology and all passwords are encoded.

Similarly, the MetaTrader platforms are both fully encrypted and allow users to apply two layers of authentication if they wish, including Google Authenticator.

FXChoice Verdict

FXChoice offers demo accounts, a multitude of third-party tools, and decent leverage in both the Classic and Pro accounts. The option of MetaTrader platforms cater to multiple strategies, making FXChoice a good broker for both beginners and experts. Alongside the positives, it would be nice to see a more diverse range of research tools to support traders looking to expand their knowledge.

FAQs

How Do I Register For An FXChoice Account?

You can open an account by clicking ‘Register’ on the website and completing the online form. New clients can then download MT4 or MT5 and make a deposit.

Does FXChoice Accept PayPal?

At the time of writing, FXChoice does not offer funding via PayPal, but a host of other standard deposit and withdrawal methods are accepted, including e-wallets, debit cards, plus cryptocurrencies.

Does FXChoice Offer A VPS?

FXChoice offers a Virtual Private Server (VPS) which is free if your account balance exceeds $3,000 and you trade at least five lots during each billing cycle. Users can benefit from fast delivery times, 2GB of virtual RAM, a server location in Europe, and more.

Is FXChoice A Regulated Broker?

Yes – FXChoice Limited is regulated by the Financial Services Commission (FSC). With that said, the FSC is not a top-rated financial regulator like the CySEC or FCA.

How Do I Make An FXChoice Deposit?

You can make a deposit via card payments, e-wallets, and cryptocurrencies. All deposits can be made from within your back office profile. The minimum starting deposit is $100.

Is FXChoice A Market Maker?

Yes – FXChoice is a market maker. It is quick and easy to sign up for an account from the broker’s homepage.

Best Alternatives to FXChoice

Compare FXChoice with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

FXChoice Comparison Table

| FXChoice | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 4.1 | 3.6 | 4.3 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptocurrencies, Shares | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | FSC | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | 50% or 65% Welcome Deposit Bonus | 100% Anniversary Bonus | – |

| Platforms | MT4, MT5 | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:200 | 1:200 | 1:50 |

| Payment Methods | 17 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXChoice and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXChoice | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | No | Yes | No |

| Silver | Yes | Yes | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | Yes |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | No | Yes | No |

FXChoice vs Other Brokers

Compare FXChoice with any other broker by selecting the other broker below.

The most popular FXChoice comparisons:

Customer Reviews

There are no customer reviews of FXChoice yet, will you be the first to help fellow traders decide if they should trade with FXChoice or not?