Fibonacci Forex Trading

Fibonacci strategies in the context of forex trading use the Fibonacci sequence of numbers, ratios and patterns to inform entry and exit points. In this guide, we explain how to implement Fibonacci retracement levels and extensions. We also cover what you need from a broker, the best analysis software, resources, and how to get started Fibonacci forex trading.

Forex Brokers With Fibonacci Chart Patterns

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

FOREX.com

FOREX.com -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

Focus Markets

Focus Markets

Here is a summary of why we recommend these brokers in January 2026:

- Interactive Brokers - IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

- NinjaTrader - NinjaTraders supports the trading of popular currencies including the EUR/USD. The software also offers advanced features to streamline the trading experience, including complex order types like market if touched (MIT) and one cancels other (OCO).

- Plus500US - Plus500 US offers futures trading on a small selection of 13 currencies, including popular pairs like the EUR/USD and GBP/USD. Day trading margins are competitive, starting from $40, while the educational resources do an excellent job of breaking down the basics of forex futures for new traders.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

- OANDA US - OANDA offers a diverse selection of 68 currency pairs, more than many alternatives. The broker’s in-house platform offers superb day trading capabilities via powerful TradingView charts, including 65+ technical indicators and 11 customizable chart types.

- Focus Markets - Focus Markets offers forex trading on 50+ majors, minors and exotics with competitive conditions, including spreads from 0.0 in the Raw account with a $3.50 commission per lot or spreads from 1.0 pip on majors like USD/CAD in the Standard account.

Fibonacci Forex Trading Comparison

| Broker | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit | Regulator |

|---|---|---|---|---|---|

| Interactive Brokers | 100+ | 0.08-0.20 bps x trade value | / 5 | $0 | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| NinjaTrader | 50+ | 1.3 | / 5 | $0 | NFA, CFTC |

| Plus500US | 13 | 0.75 | / 5 | $100 | CFTC, NFA |

| FOREX.com | 84 | 1.2 | / 5 | $100 | NFA, CFTC |

| OANDA US | 65+ | 1.6 | / 5 | $0 | NFA, CFTC |

| Focus Markets | 50+ | 0.0 | - | $100 | ASIC, SVGFSA |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| GBPUSD Spread | 0.08-0.20 bps x trade value |

|---|---|

| EURUSD Spread | 0.08-0.20 bps x trade value |

| EURGBP Spread | 0.08-0.20 bps x trade value |

| Total Assets | 100+ |

| Leverage | 1:50 |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| GBPUSD Spread | 1.6 |

|---|---|

| EURUSD Spread | 1.3 |

| EURGBP Spread | 1.6 |

| Total Assets | 50+ |

| Leverage | 1:50 |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Account Currencies | USD |

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

Cons

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| EURUSD Spread | 0.75 |

|---|---|

| Total Assets | 13 |

| Leverage | Variable |

| Platforms | WebTrader, App |

| Account Currencies | USD |

Pros

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- Although support response times were fast during tests, there is no telephone assistance

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:50 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| GBPUSD Spread | 3.4 |

|---|---|

| EURUSD Spread | 1.6 |

| EURGBP Spread | 1.7 |

| Total Assets | 65+ |

| Leverage | 1:50 |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- The broker offers a transparent pricing structure with no hidden charges

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| GBPUSD Spread | 0.0 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.0 |

| Total Assets | 50+ |

| Leverage | 1:500 |

| Platforms | MT5 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

Cons

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

The Fibonacci Sequence

Italian mathematician Leonardo Pisano, nicknamed Fibonacci, introduced the West to what is now known as the Fibonacci sequence back in the 13th century.

The Fibonacci sequence is an infinite numerical sequence. Each number in the series is the sum of the proceeding two values (after 0 and 1): 0, 1, 1, 2, 3, 5, 8, 13, 21 etc. Each number is approximately 1.618 times greater than the previous. This ratio, 1.618, is also referred to as Phi or the Golden Ratio.

The Golden Ratio can be depicted in a spiral shape and, interestingly, is a shape that crops up across the natural world. From rose petals to seashells, architecture, human faces and even constellations in outer space. There are some that believe that the spiral shape extends beyond nature and can be used to depict human behaviour too. The theory goes that as people adjust their behaviour in response to change, they do so at a rate proportionate to the Fibonacci ratios.

In the context of trading forex, it’s not the numbers in the sequence themselves that we’re interested in, but the difference between them. The ratios unveil patterns which in turn help highlight opportunities.

Setting Up A Fibonacci Forex Trading Strategy

The application of the Fibonacci sequence to forex day trading is relatively straightforward. It is most commonly used as part of a trend-trading strategy. Traders adopting this strategy anticipate that price will pivot at the points outlined by Fibonacci levels.

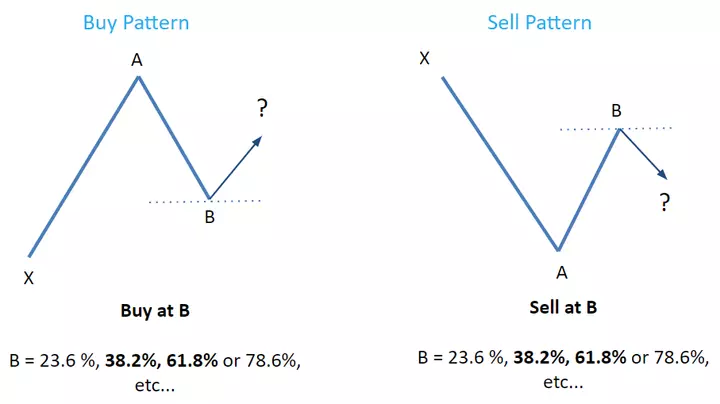

The basic premise is that in a market uptrend, you buy on a retracement at a Fibonacci support level, while during a downtrend, you sell at a Fibonacci resistance level. Ideally, you want to be looking at the highest and lowest swings.

Forex Trading Using Fibonacci Strategies

Fibonacci sequence ratios are used to predict retracement levels.

Retracements

The theory behind Fibonacci forex trading retracements is that after a significant market swing, price will return at least in part, to a particular point, before it continues in its initial direction.

So in practice, the numbers and formulas that feed into your retracement levels may allow you to predict future price points.

As we’ve seen above, each new number in the Finbonacci sequence is approximately 61.8 percent of the consecutive number. Which means that it is approximately 38.2% of the number after that, and approximately 23.6 percent of the number after that. These ratios: 61.8, 38.2, and 23.6 are our Fibonacci retracement levels.

On a chart, they are marked horizontally to make a grid within the parameters of the high and low levels chosen. When a trend is moving in a certain direction, the belief is that the price reversal point will coincide with the interception of these horizontal lines, before it resumes in the direction of the original trend. Fibonacci retracement levels help traders to identify potential price reversal points i.e points of opportunity.

Some models also use the 50 percent retracement level. Whilst it is not a Fibonacci ratio, it is widely acknowledged to be an important potential turning point as recognised in Dow theory.

The theory behind why trends unfold in this manner, is that human behaviour inherently follows the ratios of the Fibonacci sequence i.e. if a trend is moving too quickly in one direction, the market will respond relative to the ratios outlined in the sequence.

Extensions

The next step is supplementing your forex trading strategy with extension levels. Extensions use Fibonacci numbers and patterns to determine profit taking points.

Extensions continue past the 100% mark and indicate possible exits in line with the trend. For the purposes of using Fibonacci numbers for day trading forex, the key extension points consist of 161.8%, 261.8% and 423.6%.

Fibonacci Forex Trading Strategies In Action

Examples of forex trading strategies that use Fibonacci ratios include:

- Buying close to the 50 percent point with a stop-loss order just under the 61.8 percent mark

- Buying close to the 38.2 percent retracement point with a stop-loss order just under the 50 percent mark

- In a sell position towards the top of a substantial swing, using the Fibonacci retracement levels as profit collecting points

Limitations

Fibonacci retracement levels are not a guarantee. Whilst useful indicators, Fibonacci forex trading levels cannot actually guarantee a pivot point. The price may not reverse at a Fibonacci level or any other estimated level for that matter. They can be used to identify areas of interest but cannot guarantee a specific point of change.

It is also worth noting that when looking at small price movements, Fibonacci levels may not offer much insight. When levels are very close together it can seem that every point is important. They are best used on larger swings.

Furthermore, using Fibonacci tools is somewhat subjective. In a single day there will be multiple price swings, meaning that not everyone will be connecting the same two points. To help you identify areas of importance, draw retracement levels on all major price swings and look out for areas with a cluster of Fibonacci levels.

Our recommendation is to always use Fibonacci forex trading strategies in combination with other tools and insights. Trend indicators such as moving averages or Bollinger bands are useful in determining the direction of an asset whilst relative strength index and Bulls and Bears powers are often used to determine whether an asset has been overbought or oversold.

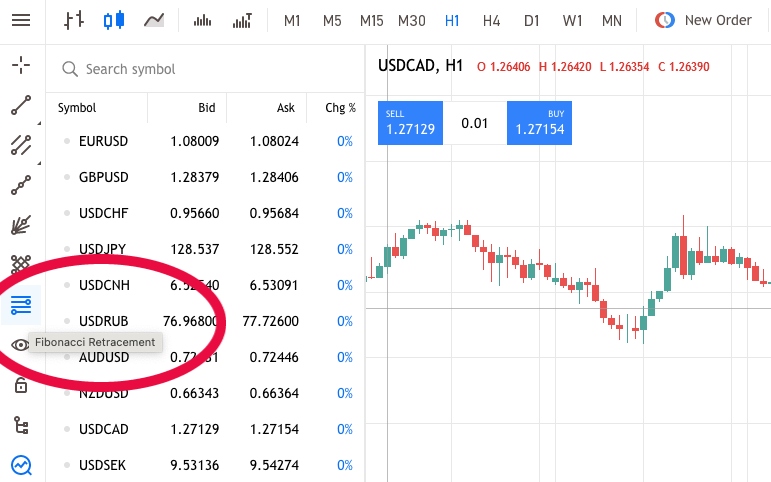

Broker Tools

When forex trading using Fibonacci strategies, the numbers, formulas, ratios and patterns can appear daunting.

However, advanced charting software will do the heavy lifting for you, offering retracement and extension level tools. So make sure you choose a broker whose software you’re comfortable using.

As with learning any new forex strategy, the more resources you can get your hands on the better. Therefore, it’s worth exploring whether your broker offers any Fibonacci forex trading strategy guidance, be it through PDFs or tutorial videos.

YouTube can also be a great way to see the numbers and patterns being applied in real life examples.

For further guidance, see our forex broker reviews.

Final Word

Trading forex with Fibonacci strategies uses ratios and formulas to determine where support and resistance are likely to occur. Whilst the sequence itself can seem daunting, its application to forex day trading is relatively simple. Fibonacci forex trading strategies are widely used by retail and corporate investors and most investing platforms offer the feature as standard.

Of course, every trader is different and there are no guaranteed returns with a Fibonacci forex trading strategy. With that in mind, always consider retracements and extensions as tools to help inform your broader market angle.

FAQs

When Is The Best Time To Use A Fibonacci Forex Trading Strategy?

The Fibonacci forex trading technique is most effective when the market is trending. Price action is often most prevalent when the market opens and closes.

What Do You Need From A Broker To Use A Fibonnaci Forex Trading Strategy?

The best forex day trading platforms and brokers will provide easy-to-use software with dedicated retracement and extension tools.

What Is The Best Way To Understand The Fibonacci Ratios?

Before you start trading forex with real money, open a demo account at a broker and play around with the Fibonacci numbers, patterns and formulas.

What Are The Limitations Of Using A Fibonacci Forex Trading Strategy?

Fibonacci levels cannot pinpoint an exact entry level. They only provide an estimated entry area. With that in mind, they should inform but not dictate your forex trading decisions.

Can A Fibonacci Forex Trading Strategy Work Alongside Other Techniques?

Yes, forex trading using Fibonacci & Elliott Wave PDFs are one good example.