Best Forex Trading Platforms For Beginners

We’ve rigorously evaluated established forex brokers to find the best trading platforms for beginners. Discover which forex brokers truly excel in supporting new traders based on our firsthand tests.

5 Top Forex Brokers For Beginners

These 5 forex trading platforms continue to stand out as the best for beginner traders:

- AvaTrade: Bite-sized forex courses. Beginner-friendly WebTrader. Trading Central research.

- IG: Best-in-class tools. Commission-free forex trading. IG Academy app with forex lessons.

- Vantage: Slick forex app. Partnership with Bloomberg Media. Forex-specific training guides.

- eToro: Social media-style resources. Industry-leading CopyTrader. Comprehensive web platform.

- FOREX.com: Beginner-focused Academy. AI-powered research tools. Dependable 24/5 support.

Forex trading is especially risky for beginners. Only risk what you can afford to lose.

Comparison of 5 Top Forex Trading Platforms For New Traders

| AvaTrade | IG | Vantage | eToro | FOREX.com | |

|---|---|---|---|---|---|

| FX Education Rating | 4.9/5 | 4.8/5 | 4.7/5 | 4.3/5 | 4.5/5 |

| FX Research Rating | 4.8/5 | 4.9/5 | 4.6/5 | 4.5/5 | 4.6/5 |

| FX Platform Rating | 4.9/5 | 4.7/5 | 4.5/5 | 4.7/5 | 4.6/5 |

| Demo Account Bankroll | $10k | $10k | $100k | $100k | $50k |

| Minimum Deposit | $100 | $0 | $50 | $50 | $100 |

1. AvaTrade

Why We Loved It

With forex-focused educational tools delivered in engaging formats, a growing social investment network, actionable trading signals, plus an intuitive web platform and mobile application that won our ‘Best Trading App’, AvaTrade provides a comprehensive trading experience for forex beginners, earning it our top spot.

Pros

- AvaTrade offers bite-sized, snappy articles and online courses broken down into 5-minute videos, with quizzes to help test your knowledge. For example, the ‘Quick and Dirty – Start Trading Now’ course contains 21 lessons, with 2 chapters focusing on forex, and takes around an hour to complete.

- AvaTrade’s WebTrader is perfect for new forex traders, sporting a modern feel and large typeface ensuring a clean design that I love. And crucially, it doesn’t feel as intimidating as MetaTrader 4 – the most widely available forex trading platform with a steep learning curve.

- AvaTrade offers a plethora of research tools to help identify opportunities, notably forex signals and Trading Central, a third party that uses pattern recognition technology corroborated by analysts to produce trading plans that even beginners can use. Plus, there is a daily strategy newsletter and morning news brief – ideal for forex day traders.

Cons

- An inactivity fee of $50 kicks in after 3 months and rises to $100 after 12 months, penalizing casual forex traders, a notable drawback compared to Vantage, which charges no inactivity penalty and secured a podium finish in our rankings.

- Some of the best features on AvaTrade’s web platform, notably the ‘Forex Featured Ideas’, are only accessible to fully funded account holders, which may deter beginners looking to ‘try before they buy’.

- While a growing trend across the industry, AvaTrade’s automated chatbot is frustrating – it struggles with most questions I ask that aren’t basic and I have to ask multiple times to get through to an agent – frustrating for beginners needing help getting started.

2. IG

Why We Loved It

With no minimum deposit, crystal-clear pricing, a standalone IG Academy app, plus the best selection of research tools and social analysis we’ve ever seen, IG is another superb option for new forex traders, securing its runner-up status.

IG has also earned the confidence of several of our team, comprised of active traders and industry experts, who use it for real-money trading.

Pros

- IG offers superior tools, notably its ‘Foreign Exchange (FX)’ forum which contains 6,600+ posts and its DailyFX website which provides comprehensive coverage of the foreign exchange market, alongside analyst picks that could help aspiring traders discover opportunities.

- IG is one of the only brokers to develop its own app for education, IG Academy. I’ve completed the ‘What is Forex?’ lesson and it’s perfect for newcomers, covering all the basics (forex market players, key trading sessions, example FX trades etc), while the exercises at the end are great for testing your knowledge.

- With complex pricing structures often overwhelming newer traders, it’s reassuring to see IG keeping things simple – you won’t pay a commission when trading forex CFDs – just a spread that starts from 0.6 pips and averages 1.04 pips on major currency pairs. There are also no account maintenance fees or deposit/withdrawal charges.

Cons

- The sheer wealth of research, education and trading tools may overwhelm newer forex traders, split across various platforms, apps, websites and social channels, especially compared to AvaTrade which delivers a smoother entry into trading.

- IG could do more to split out its forex education – it’s often wrapped up in multi-asset courses, for example ‘Introducing the financial markets’. I also came across two forex lessons where the integrated videos no longer work, dampening the learning experience.

- IG offers new client orientation 60-minute webinars that are ideal for forex beginners and you only need to open a demo account to add it to your calendar. Yet, they are only offered once a month – many newcomers will want to get started quickly.

3. Vantage

Why We Loved It

After teaming up with reputable third parties, including Bloomberg Media and Trading Central, Vantage offers a wealth of educational tools, tips and forex market coverage to support beginner traders.

It’s also responded to the trend towards mobile forex trading, delivering one of the slickest mobile apps we’ve used – making it immediately intuitive, even for complete novices.

Pros

- The free e-book ‘Trading Places: Understanding the Ups and Downs of the Financial Markets’, produced in partnership with Bloomberg Media Studios, is an excellent starting point for new forex traders. The 14-page e-book covers four key topics, including ‘FX: Trading The World’s Biggest Market’. I downloaded it immediately after signing up and recommend starting here if you’re new to forex trading.

- 5 minutes. That’s how long it took me to download the Vantage app, navigate to ‘Forex’, add the pairs I was interested in to my watchlist, and start viewing the analysis available at a tap under the mobile-optimized charts. It ensures a seamless start for new forex traders.

- The Vantage Academy offers educational resources tailored to forex traders and beginners. Content is kept up-to-date and covers all the basics, including ‘The Six Major Forex Pairs To Trade’, and ‘Forex Trading For Beginners’, as well as topical articles such as ‘The Role of AI and Machine Learning in Forex’.

Cons

- Despite the beginner-friendly Vantage app, after hours testing MT4, MT5 and Vantage ProTrader, it’s clear they’re geared towards advanced forex traders, limiting the choice of suitable desktop solutions for newcomers, especially compared to AvaTrade with its WebTrader.

- Demo accounts are an invaluable tool for new forex traders, yet I ran into multiple issues testing the paper trading environment at Vantage. The MT4 test mode kept taking me to the Vantage ProTrader platform when I pressed the ‘Trade’ button and eventually, I had to get a link from the support team – very irritating.

- While Vantage’s commission-free pricing structure in the Standard STP account will appeal to newer forex traders, spreads trail the cheapest brokers, starting from 1.4 pips on the EUR/USD, especially compared to IG which offers the same currency pair from 0.6 pips.

4. eToro

Why We Loved It

eToro makes our ranking of the top forex brokers for beginners thanks to its laser focus on providing services that cater to aspiring traders.

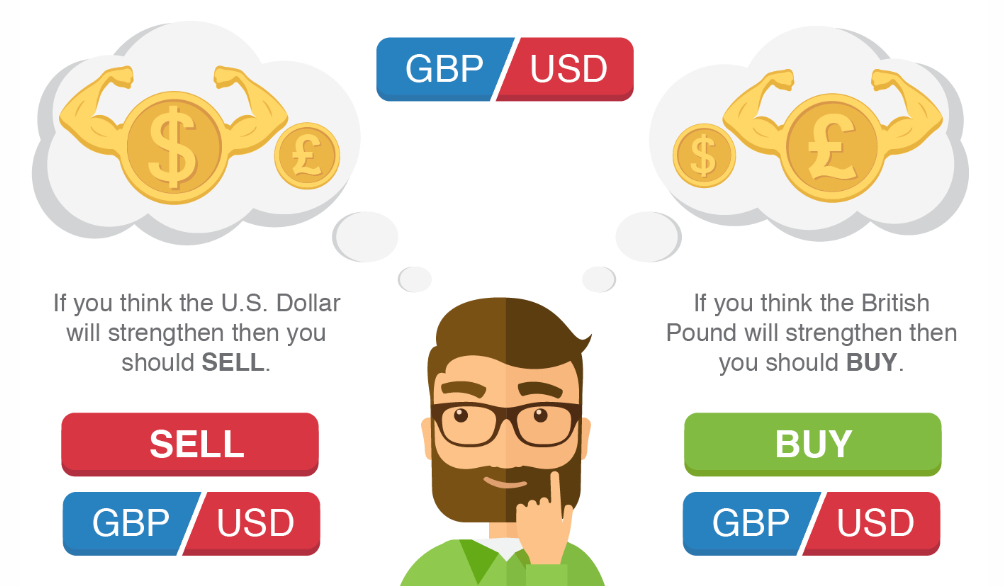

Its market-leading CopyTrader provides an excellent way to start forex trading without being bogged down with technical analysis, while its educational tools appeal to how newcomers increasingly consume content – through social media-type feeds, podcasts, and YouTube videos.

Pros

- I really enjoy listening to eToro’s Digest and Invest podcast, available on YouTube, Spotify, Apple Podcast and BuzzSprout. eToro’s Global Market Strategist runs the show with his Daily Voice, giving financial tidbits in under 5 minutes. Plus, the Market Bites segment covers forex-relevant topics such as CPI, inflation, and geopolitical risks. Chatty, informal, and yet super informative.

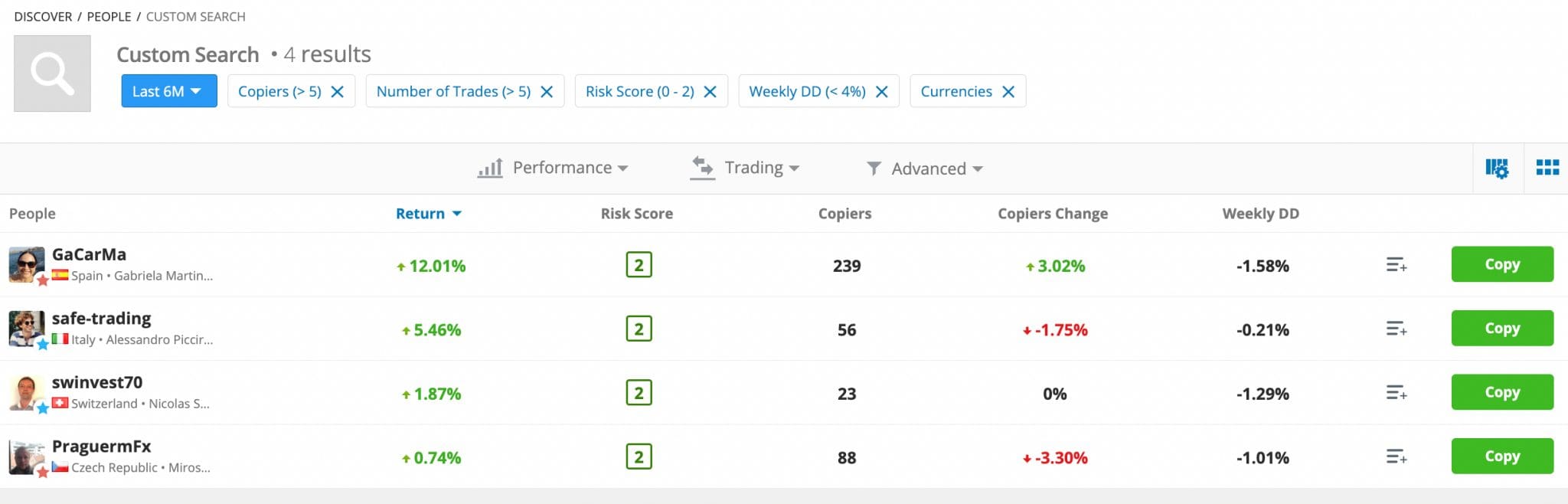

- eToro’s CopyTrader leads the pack, making online forex trading interactive and entertaining. The platform homepage shows a news feed of Popular Investors’ commentary on their trades and market conditions that feels very Twitter (or X)-style. You can filter investors to copy by their returns, risk score, number of trades, and more.

- eToro offers a comprehensive forex trading experience for newcomers with everything available from the web-accessible dashboard, including dynamic charts, currency pair-specific news, insights into other forex assets being traded on the platform, and uniquely – a social feed with discussions on the latest EUR/USD price action for example.

Cons

- There is a distinct lack of analysis and tips from reputable third-party sources. I would like to see forex ideas from the likes of Trading Central, which IG, AvaTrade and Vantage do very well. That said, we understand that eToro’s niche, and area of considerable strength, is its social and copy trading capabilities, which actually may suit beginner traders even better than the graph-heavy detail elsewhere.

- eToro emphasizes its stocks and crypto offerings, which means that a lot of the social and educational content is focused on these markets. It’s not a dealbreaker and it still offers 55 currency pairs and plenty of commentary, but you do get the feel using the platform that it’s not for forex purists, especially compared to FOREX.com.

- I’ve used eToro’s demo account to trade currencies and I’ve completed its ‘Forex Trading’ course in its upgraded Academy – they’re both very useful, but the educational content strays into topics that may overwhelm beginners and the broker could enhance the learning experience by providing more live trading sessions that you get at IG.

5. FOREX.com

Why We Loved It

FOREX.com offers a huge range of over 80 currency pairs, deep liquidity and excellent pricing, making it popular with advanced traders. Yet we’re increasingly finding it ticks every box for newer forex traders as well.

FOREX.com is doubling down on its niche to deliver the best forex trading environment and we think even beginners can benefit from its efforts, from its first-rate support to the terrific education.

Pros

- FOREX.com provides a Trading Central portal which gives tips in a user-friendly interface. The Market Buzz functionality is especially useful, utilizing AI to scour the internet for news, social and blogs to gauge market sentiment. Plus, technical details, such as where to place stop losses, timeframes and target price ranges are provided.

- The FOREX.com Academy offers short, snappy, and crucially – beginner-focussed content. There are seven lessons available designed for newer forex traders, each taking less than five minutes to complete, covering topics from placing an order, to using a stop loss.

- Fast, friendly and knowledgable, FOREX.com has 24/5 support you can rely on. Connected to an actual human within two minutes during each test, I fired off five questions all related to their resources for beginners and received fast responses that addressed my queries.

Cons

- FOREX.com’s platform offering primarily caters to intermediate and advanced traders with MetaTrader and TradingView, though its web platform, despite featuring an increasingly outdated design, is a better fit for newer traders wanting ease of use over charting power.

- The demo account expires after 90 days, a drawback compared to IG, Vantage and eToro with their unlimited demo accounts that will allow beginners to continue testing strategies with virtual funds even when they’ve upgraded to a real-money solution.

- The educational tools still trail the top forex trading platforms for beginners, notably Vantage and IG. I completed the ‘Mastering Forex’ course, for example, and it doesn’t provide enough detail to ‘master’ forex. It also lacks any challenge elements which could help cement what you learn.

How Did We Choose The Best Forex Trading Platforms For Beginners?

To find the best forex trading platforms for beginners, we personally tested 25 of the most established brokers in the industry and scored them in the most important areas for new traders.

The main areas we evaluated forex brokers in and how we applied our ratings are explained in more detail below…

- We evaluated the extent and quality of forex educational content. A single ‘How to trade forex’ article was not sufficient. We awarded points for snappy and engaging information. For example, we loved AvaTrade’s bite-sized lessons which took a few minutes each to learn.

- We considered whether education was specifically targeted at forex newcomers. For example, Eightcap is an excellent forex broker, however we marked it down because despite extensive educational content in its ‘Labs’, not much of it is beginner-centric.

- We evaluated the research tools available, taking into account whether forex news and market analysis were kept up-to-date. For example, FBS we marked down because their trading ideas were from 2023 and their Forex TV hadn’t been updated since 2022.

- We made sure research tools specifically covered the forex market, helping aspiring traders discover opportunities. For example, while we rated IG’s TipRanks, we couldn’t award points here as it is focused on stock trading.

- We made sure every forex broker offered a demo account. We also preferred simulators with no expiry or those that could be renewed. For example, FOREX.com’s demo account automatically expires after 90 days, but we found you can request a new one.

- We directly tested trading platforms and forex apps to make sure they have been designed with beginners in mind. MetaTrader 4, the most widely available forex platform, might be comprehensive, but we’ve found proprietary terminals are often simpler to learn. For example, we loved eToro’s web platform which will suit rookies who are used to social media.

- We checked there are no hidden fees and preferably commission-free accounts, which often appeal to new traders looking for straightforward pricing. For example, Interactive Brokers we marked down because it’s best suited to experienced traders due to its complex fee structure.

For new forex traders, I strongly recommend practising what you learn in a demo account before trading currencies with real money. Also prioritize risk management and develop a clear trading plan.

FAQ

What Is The Best Forex Trading Platform For Beginners?

AvaTrade is the best forex trading platform for beginners in 2026 following our in-depth tests.

Its educational tools are perfect for new traders, the web trader has clearly been designed with beginners in mind, and you get a wealth of research tools and signals to help you start forex trading.

Is Forex Trading Safe For Beginners?

Forex trading, like all forms of online trading, is never ‘safe’. The risks are particularly high for beginners.

Most retail investors lose money trading on the foreign exchange market so only risk what you can afford to lose, make use of demo accounts and prioritize education.