Deriv Bolsters Its Synthetic Indices With Crash 150 & Boom 150

Deriv has announced two new additions to its line of synthetic indices – Crash 150 and Boom 150. They replicate the volatility found in fast-moving instruments, with price ticks every second and Crash/Boom events coming in roughly every 2.5 minutes.

Key Takeaways

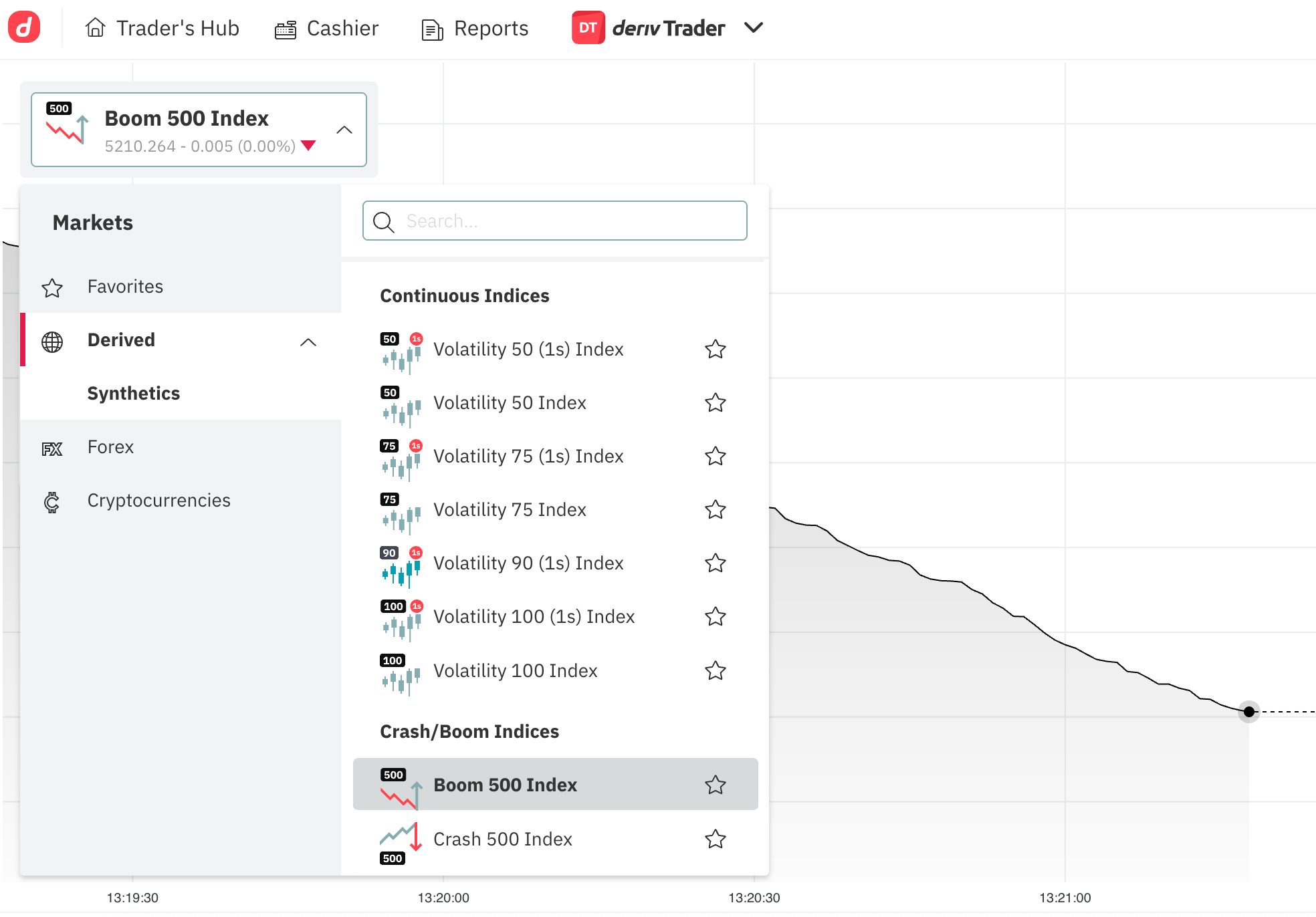

- Crash 150 and Boom 150 are available on Deriv’s MT5 Standard, MT5 Swap-Free, MT5 Zero Spread, and Deriv cTrader accounts.

- Spreads start from $0.1 with high leverage up to 1:2000 and maximum position sizes of 1000 lots.

- Crash 150 and Boom 150, like Deriv’s other synthetic indexes, can be traded 24/7 and aren’t affected by real news or liquidity gaps.

The Crash 150 and Boom 150 complement Deriv’s existing lineup of synthetic indices, including Crash 500 and Boom 500, however the new indexes ‘crash’ or ‘boom’ more frequently.

They’re built for active traders, especially scalpers and high-frequency traders, with more opportunities to execute short-term setups each session.

Trading over such short time frames requires skill though, making these products better to suited to experienced traders with a handle on risk management.

About Deriv

Deriv is one of the most unique brokers we’ve tested. It’s the industry leader for synthetic indexes, offering trading opportunities around the clock, including on weekends.

It’s stepped up its suite of tools in recent years, adding TradingView to compliment its own software, as well as third-party options like cTrader.

Deriv also scooped DayTrading.com’s ‘Best App’ in our annual awards, with Deriv X giving traders reliable, in-app support, along with fast and dependable charting tools.

New clients can start trading Deriv’s Crash 150 and Boom 150 indices with a $5 minimum deposit.