CMTrading Introduces AI Chart Analysis: Get Signals In Seconds

CMTrading has rolled out a new AI-powered chart analysis tool designed to help identify patterns and highlight potential trading signals in just three steps.

This new feature, AI Chart Signals, allows users to upload a screenshot of any price chart, which the tool then analyzes using artificial intelligence.

Within seconds, it returns suggested entry and exit points, along with profit targets, helping active traders make informed decisions.

We’ve seen several brokers rush to ride the AI wave, from SMART Signals at FOREX.com to Capitalise.ai’s no-code automation available at firms like Interactive Brokers. CMTrading’s latest addition joins this trend with a user-friendly approach.

Key Takeaways

- CMTrading’s AI Chart Analysis scans uploaded charts to detect key price patterns, potential buy/sell levels, and projected profit targets.

- It works in three steps:

- Open any asset chart (e.g. Tesla) on the CMTrading platform.

- Take a clear screenshot of the chart, ensuring price action and timeframes are visible.

- Upload it to the AI Chart Analysis section within the CMTrading dashboard, and review the results.

AI-generated signals can be helpful, but they’re not foolproof. Always do your own research and manage risk – there remains significant risk to your capital.

My Experience Using It

As someone who’s naturally skeptical of AI trading tools, I decided to test CMTrading’s AI Chart Analysis myself. I was curious whether this was genuinely useful or just more marketing hype.

Here’s what I did:

I logged into the CMTrading platform and navigated to Market widget to find a stock I was interested in.

Next, I pulled up a chart of Google (GOOGL), tweaked the settings like timeframes and captured a screenshot.

I then uploaded that image directly into the AI Chart Analysis service back in the client dashboard.

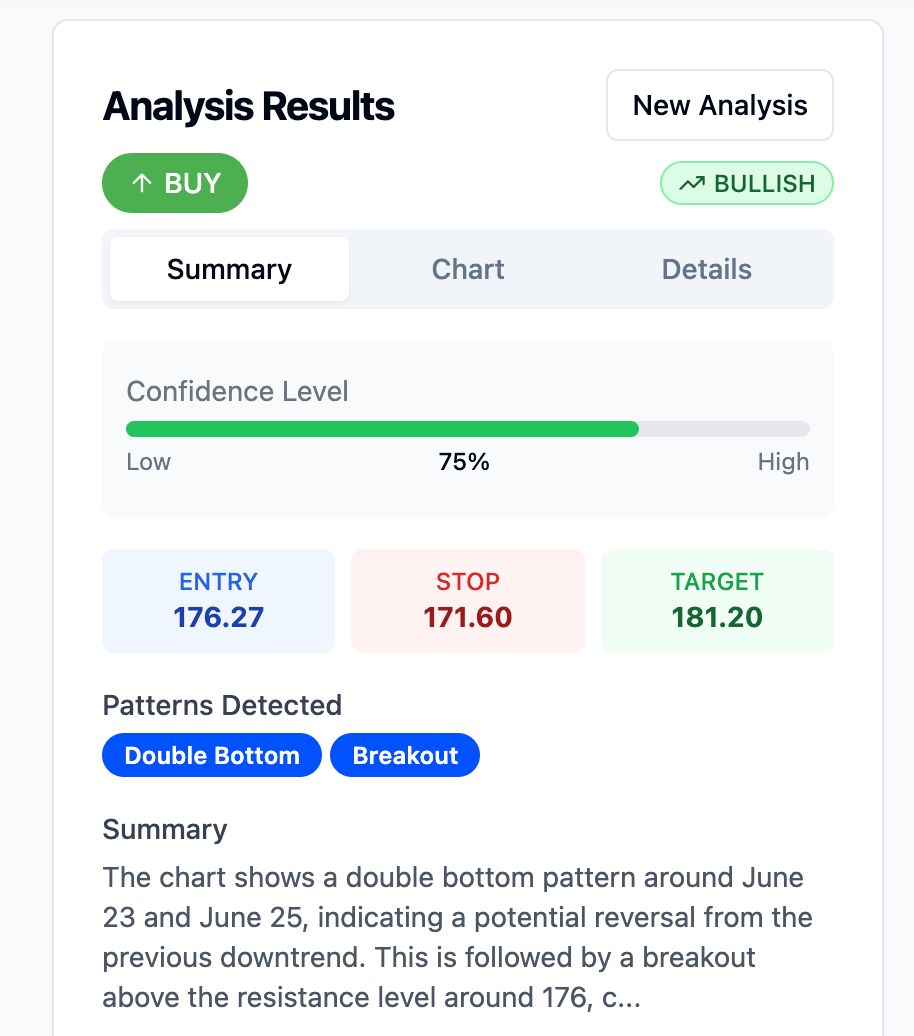

Within about 10 seconds, the system generated a clean report showing the chart’s recognized pattern, a proposed entry point, suggested profit target, and a stop loss.

The interface was straightforward, and the results were easy to interpret, so it may appeal to aspiring traders looking to speed up their research. The confidence bar is also a nice touch.

Nonetheless, I wouldn’t personally act on any signals without doing my own technical analysis to corroborate the findings.

About CMTrading

Established in 2012, CMTrading is an online broker offering forex and CFD trading across a modest selection of asset classes, including currencies, commodities, indices, and cryptocurrencies.

The broker is headquartered in South Africa and operates under the regulation of the FSCA and FSA. While not under top-tier regulators like the FCA or ASIC, CMTrading has gained a reputation in emerging markets, particularly across Africa and the Middle East.

CMTrading supports traders of various experience levels through five account types (Basic, Trader, Gold, Premium, and VIP), each with increasing benefits such as tighter spreads, risk-free trades, and access to Trading Central.

Getting started requires a minimum deposit of $100.