CapitalXtend Review 2024

Awards

- Best CFD Broker Asia 2022

- Most Trusted Broker 2021

- Best ECN/STP Broker 2021

- Best ECN Broker Pan Asia 2021

- Most Innovative ECN Broker Asia 2021

Pros

- Accessible deposit options

- MetaTrader 4 integration

- A free demo account is available

Cons

- Limited additional market insights

- Weak regulatory scrutiny lowers safety score

CapitalXtend Review

CapitalXtend is an offshore brokerage incorporated in Kazakhstan. It accepts clients from across the world to trade forex and CFDs across five asset classes. The broker’s platforms and tools are available in 7+ languages with 24/7 customer support.

This CapitalXtend review will unpack typical spreads, MT4 downloads, demo accounts, no deposit bonus rewards, and more.

Company History & Overview

CapitalXtend was founded in 2005. The company has a global presence with five offices serving an active customer base of 30,000 clients.

CapitalXtend has a registered office in Saint Vincent and the Grenadines and is incorporated in Kazakhstan as a Financial Services Provider.

The trading firm is also a member of the Financial Commission, a self-regulatory organization.

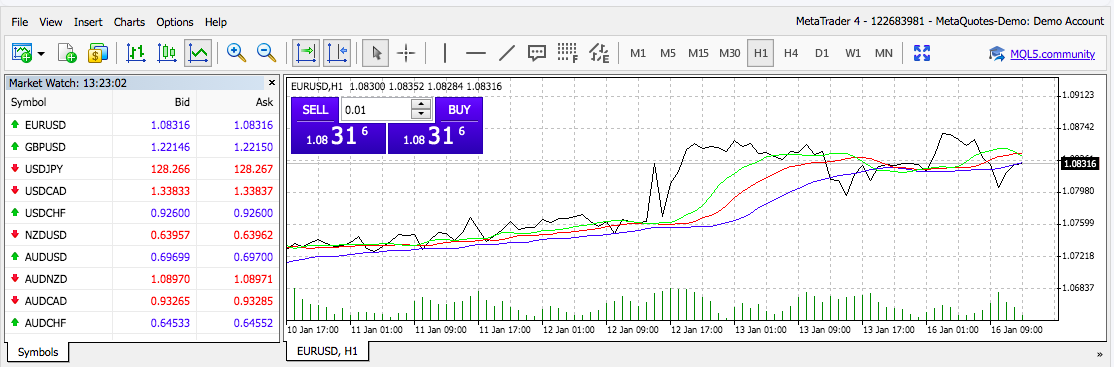

Trading Platforms

The broker offers two trading platforms; MetaTrader 4 and MetaTrader 5. The third-party terminals were created by the MetaQuotes software company and provide a user-friendly trading experience to millions of investors across the globe.

The platforms offer valuable tools, technical indicators, and several timeframes to analyze assets and determine profitable entry and exit points. Both solutions are suitable for beginners and experienced traders.

As industry-recognized terminals, there are also plenty of online user guides and tutorials to help traders get started.

Clients of CapitalXtend can use MT4 and MT5 directly through major internet browsers or they can download the application to desktop devices.

MetaTrader 4

- Live price quotes

- Three chart types

- 30+ technical indicators

- Four pending order types

- Automated trading with Expert Advisors (EAs)

- Nine timeframes from one minute to one month

MetaTrader 5

- 21 timeframes

- 44 analytical objects

- Full Market Depth

- 38+ technical indicators

- Integrated economic calendar

- Netting and hedging permitted

- Open up to 100 charts at a time

- Automated trading with Expert Advisors (EAs)

How To Place A Trade

- Register for a CapitalXtend live account

- Make a deposit ($100 minimum payment)

- Download MT4 or MT5 or open the WebTrader

- Log in with your registered credentials

- Search for an asset using the navigation bar

- Select the new order icon (white page image) from the top menu

- Enter the trade parameters such as execution mode, investment amount, and risk management elements

- Select ‘Sell’ or ‘Buy’ to confirm the order

Markets & Instruments

CapitalXtend offers a fairly decent range of instruments, with 300+ assets available:

- Indices – 16 global indices including S&P 500, FTSE 100, DAX 40 and ASX 200

- Currencies – 100+ major, minor and exotic forex pairs including GBP/USD, USD/EUR, and AUD/CAD

- Shares – 87 leading European and US company stocks such as Adidas, L’Oreal, Unilever, Ford, and JP Morgan

- Commodities – 3 spot energies and 5 precious metals including Gold vs USD, Silver vs EUR, and US Crude Oil

- Cryptocurrency – 30+ digital tokens vs fiat currencies such as Bitcoin vs USD, Ethereum vs Gold, Ripple vs Litecoin, and Binance Coin vs GBP

A full list of contract specifications is available on the broker’s website. This includes trading hours, contract size, and tick size.

CapitalXtend Fees

Trading fees vary between account types but are competitive with a transparent pricing structure.

The Pro-ECN profile is the only account with commission charges. This is fixed at $3 per side, though retail investors benefit from tight spreads starting at 0.2 pips.

The Standard Account is commission-free, however, spreads average 3 pips which is less competitive. Having said that, we were offered spreads of 1.5 pips on the GBP/USD and EUR/GBP currency pairs, which is reasonable. The ECN profile has spreads from 1.6 pips and the Platinum Account from 0.2 pips.

It is also worth noting that swap charges will apply for positions held overnight.

Leverage

CapitalXtend offers high leverage due to its offshore regulation. For example, when we used CapitalXtend we were offered 1:1000 leverage on major forex pairs with a volume of 0-5 lots. Minor and exotic forex pairs can be traded with leverage up to 1:500 for the smallest volumes. This is reduced to 1:25 for trade volumes of more than 100 lots. Indices, spot metals, and spot energies can be traded with a maximum of 1:500 leverage.

All accounts have a 100% margin call level. The Standard Account has a 20% stop-out level and all other profiles have a 50% stop-out.

Mobile App

CapitalXtend does not offer a proprietary mobile app, which is a downside vs alternatives.

With that said, MetaTrader 4 and MetaTrader 5 both offer mobile app compatibility, though they can be downloaded to Android (APK) devices only, due to restrictions from Apple following non-compliance with app store guidelines.

Nonetheless, the applications offer traders access to all account management features. Additionally, you can utilize interactive charts, technical analysis features, view full trading history, and make use of all order types.

How To Place A Trade On The MT4 App

- Download or open the MetaTrader 4 mobile app

- Log in with your CapitalXtend account details

- Navigate to the ‘Quotes’ tab

- Choose an instrument to trade and click on ‘New Order’

- Specify the order type and volume

- Click ‘Next’

- Add a stop-loss or take-profit if required

- Click on ‘Buy’ or ‘Sell’

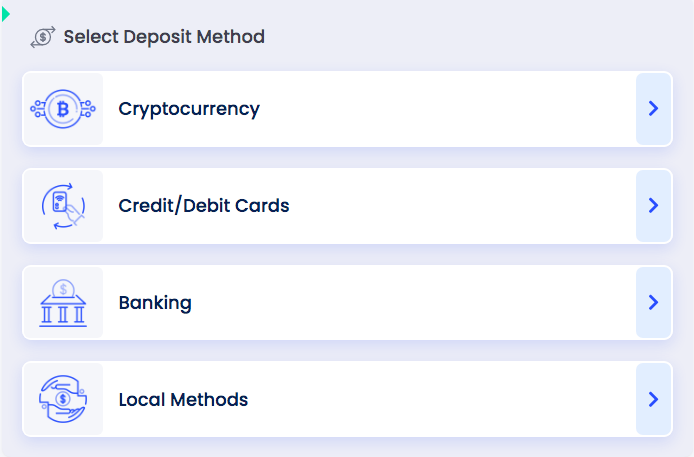

Payment Methods

Deposits

The broker accepts deposits in USD only. This will be disappointing for some global traders, meaning currency conversion may be required.

Having said that, we were impressed with the wide range of payment methods offered by CapitalXtend, many of which are commission free.

- Paylivre – 2.6% fee, up to 24-hour processing time

- Perfect Money – Commission-free, instant processing

- PayTrust – Commission-free, up to 24-hour processing time

- ThunderXPay – Commission-free, up to 24-hour processing time

- Local Bank Wire Transfer – Commission-free, up to 24-hour processing time

- International Bank Wire Transfer – Commission-free, up to 24-hour processing time

- VISA/MasterCard Credit And Debit Card – Commission-free, up to 24-hour processing time

- Universal Capital Bank Wire Transfer – Bank charges apply, immediate processing following confirmation

- Cryptocurrency – Accepted coins include Bitcoin, Ethereum, Litecoin, and Dogecoin. Fees and processing time are blockchain dependent

How To Make A Deposit

- Login to the CapitalXtend client dashboard

- Select ‘Wallet’ from the menu on the left

- Select ‘Wallet Balance’ from the dropdown

- Click the ‘Deposit In Wallet Now’ icon

- Choose a deposit method from the listed options

- Input the deposit amount below

- Select ‘Proceed’

Note, you will need to complete account verification before a deposit or withdrawal can be made in a live account. This can be actioned online via the client dashboard. CapitalXtend requires three relevant documents to be uploaded including proof of identity and residency.

Withdrawals

Withdrawals can be made to the same payment methods listed above. The majority of payment methods are commission-free except for Perfect Money (0.5% charge), Paylivre (1.8% fee), cryptocurrency (blockchain dependent), and Universal Capital Bank Wire Transfer (bank dependent).

You should allow up to 24 hours for all withdrawal requests to be processed. This is in line with most major brokers.

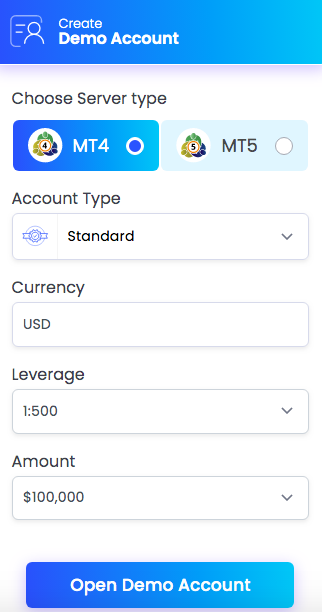

Demo Account

All traders can make use of the CapitalXtend demo account. Virtual funds of between $100 and $100,000 are available.

Our experts found that all customers can choose between each account type and the MetaTrader 4 or MetaTrader 5 platforms. This means you can get used to the typical pricing and execution speeds of each profile. Leverage is also available.

You must register for an account before requesting a practice profile.

- Open a CapitalXtend account via the ‘Register’ icon on the broker’s homepage

- Log in to your client area

- Select ‘My Accounts’ from the menu on the left

- Choose ‘Open Trading Account’ from the dropdown

- Complete the demo profile registration form including account type, leverage, and amount of virtual funds

- Select ‘Open Demo Account’

- Platform login details will be sent to the registered email address

- Launch the trading platform, sign in and start trading

Bonuses & Promotions

As an offshore trading firm, CapitalXtend is not restricted in terms of the deals and promotions it can offer new and existing users. This means the broker may occasionally offer a no-deposit bonus, welcome reward, or financial incentive based on trading volumes.

Our experts were offered a 30% deposit bonus up to $300, for example. We had to deposit at least $100 to qualify for the offer. A cashback reward program has also previously been offered with rebates available based on trading volume.

Keep an eye on the broker’s website and social media for news of upcoming promos. Also make sure you read the terms and conditions before signing up.

CapitalXtend Regulation

CapitalXtend is registered in Saint Vincent and the Grenadines. The company is listed as a Financial Services Provider with the Ministry of Economy in the Republic of Kazakhstan, business identification number 201240028219. With this licensing, the broker is permitted to conduct payment processing, plus forex and cryptocurrency trading for customers within and outside the Republic of Kazakhstan.

The broker is also a member of The Financial Commission, which offers retail investors up to €20,000 compensation in the case of disputes or business failure. However, this is an industry initiative and self-regulated body.

Ultimately, these are not top-tier financial watchdogs and global traders will not benefit from the same levels of protection afforded by brokers regulated by the FCA or ASIC, for example.

Account Types

CapitalXtend offers four live accounts, meaning there is a suitable profile for various trading styles and experience levels. Our traders were particularly pleased with the different pricing models and minimum deposit requirements.

All accounts feature a minimum 0.01 lots trade size, an unlimited number of pending orders, five decimal point pricing, and market order execution.

Standard Account

- Commission-free

- Spreads from 3 pips

- $100 minimum deposit

- MT4 trading platform only

ECN Account

- Commission-free

- Spreads from 1.6 pips

- $200 minimum deposit

- MT4 and MT5 trading platform

Pro-ECN Account

- Spreads from 0.2 pips

- $500 minimum deposit

- MT4 and MT5 trading platform

- $3 fixed commission per side

Platinum Account

- Commission-free

- Spreads from 0.2 pips

- $25,000 minimum deposit

- MT4 trading platform only

How To Open A CapitalXtend Account

While using CapitalXtend, we were able to register for a live account in under five minutes. It is relatively quick and easy to do, though we would recommend having identity verification documents and proof of residency details to hand.

- Click on the ‘Visit’ button at the top of this CapitalXtend review

- Complete the sign-up form including your email address and phone number

- Confirm the verification code which is sent via SMS and email

- From the client area, select ‘My Accounts’ from the side menu

- Select ‘Open Trading Account’

- Complete the live account registration form indicating the account type, platform, and leverage

- Click on ‘Open Live Account’

- Log in to your chosen platform with the credentials sent via email

- Make a deposit

- Start trading

Additional Features

CapitalXtend receives a good rating for its extra trading tools, but it falls short in terms of educational materials.

Copy Trading

CapitalXtend offers copy trading, suitable for beginners and retail investors with limited time to trade. The service offers full trading control with the ability to copy several experienced traders simultaneously. It can be a good way to diversify portfolios with limited prior trading knowledge.

You can filter through investors to copy by rating, total profits, or registration date. A performance breakdown is provided for all professional traders including the number of followers, total returns, and maximum drawdown.

Once you have decided who to copy, simply choose the investment amount and subscribe to the master account. Importantly, copying can be stopped or paused at any time.

PAMM accounts are also available, providing another way to let experienced traders manage your money.

Education

Our experts were disappointed with the educational resources offered by CapitalXtend. There is limited information for experienced traders with the majority of content covering market basics only.

Topics include learning the difference between forex and stock trading, a beginner’s guide to copy trading, and how to invest in precious metals.

Opening Hours

CapitalXtend trading hours are relatively standard. Both servers have a platform reset time at 9 PM (GMT) in which trading and live price quotes are not provided.

Market opening hours also vary by instrument. US shares, for example, are available between 1:30 PM to 8 PM (GMT). The forex market opens at 9 PM (GMT) on Sunday with currency pairs available between 12 AM to 23:59 on Friday. Cryptocurrency can be traded 24 hours a day with no market closure.

Customer Support

The broker’s customer support team is available 24/7, 365 days a year. This is an advantage over some competitors that do not provide support over the weekend.

Contact details:

- Telephone – +357 25056441

- Email – support@capitalxtend.com

- Live Chat – Icon located at the bottom right of the website

- Online Contact Form – Applications are to be made via the ‘Contact Us’ page

- Registered Office Address – Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St Vincent and the Grenadines

When we traded with CapitalXtend, the live chat channel was reliable. We received responses immediately with suitable platform, account and technical assistance.

Security & Safety

The MetaTrader platforms are renowned for top-tier security standards, with all transaction information fully encrypted. Traders can also add two-factor authentication (2FA) when they log in.

On the downside, the firm’s internal security measures are unclear, though negative balance protection is provided and segregated accounts are used.

CapitalXtend Verdict

CapitalXtend has a lot to offer. From its range of trading instruments and choice of platforms, account types, and copy trading tools, to 24/7 customer support and various payment methods. Our only major concern is the weak regulatory oversight, with many traders preferring to open an account with brokers that hold licenses with tier-one watchdogs.

Overall, CapitalXtend is a fairly decent broker for retail traders, particularly less experienced investors.

FAQs

Is It Easy To Open A CapitalXtend Account?

When we opened a CapitalXtend account it took less than five minutes. The online registration form is simple with basic personal details and a verification code required. Once identity verification documents and proof of residency are uploaded online, you can start trading.

Is CapitalXtend A Good Broker?

CapitalXtend offers a good range of trading instruments, a choice of account types and pricing models, copy trading, plus occasional bonus rewards. However, regulatory oversight is limited and the additional training resources and market insights are inadequate for experienced traders.

Is CapitalXtend Safe?

Our CapitalXtend review has confirmed that some aspects of the service are safe. The broker is a member of The Financial Commission providing retail investors with up to €20,000 compensation in the case of business failure, though this is a self-regulatory organization. CapitalXtend also offers negative balance protection and segregated client funds.

On the downside, the brokerage is not regulated by a top-tier financial agency like the FCA.

Does CapitalXtend Offer Mobile Trading?

CapitalXtend does not currently offer a proprietary mobile app. However, MetaTrader 4 and MetaTrader 5 are available as mobile applications that can be downloaded to mobile devices. You can open and close positions, make payments, conduct market analysis, and set price alerts.

Does CapitalXtend Offer A Demo Account?

Yes, CapitalXtend offers a practice account for the MT4 and MT5 platforms. You can choose the amount of virtual funds and leverage before getting started. A virtual bankroll of between $100 and $100,000 is provided.

Is CapitalXtend Good For Day Trading?

CapitalXtend is only good for day trading if you open a Pro-ECN or Platinum account, which provides spreads from 0.2 pips. However, you will need to deposit $500 or $25,000, respectively. The standard trading accounts do not offer low enough fees to make intraday trading competitive vs alternative brokers.

Top 3 Alternatives to CapitalXtend

Compare CapitalXtend with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

CapitalXtend Comparison Table

| CapitalXtend | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 4.3 | 3.4 |

| Markets | CFDs, Forex, Metals, Energies, Shares, Indices, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $10 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | Financial Commission | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | VFSC |

| Bonus | 30% Deposit Bonus | – | – | $100 No Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 9 | 6 | 6 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by CapitalXtend and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CapitalXtend | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

CapitalXtend vs Other Brokers

Compare CapitalXtend with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of CapitalXtend yet, will you be the first to help fellow traders decide if they should trade with CapitalXtend or not?