Capital Street FX Review 2024

Pros

- New traders can access the standard accounts with just a $100 minimum deposit and choose between fixed or variable spreads

- There is a range of payment methods, from bank wire transfers to crypto deposits, with zero deposit fees

- Capital Street FX offers a range of 1000+ instruments covering a diverse selection of markets, including bonds, cryptos and commodities

Cons

- It’s disappointing that the best ECN spreads can only be accessed by those who can afford the steep $10,000 deposit

- The broker is only authorized by the Mauritius FSC - a weak offshore regulator with very little financial safeguards in place for traders

- Withdrawal fees apply for most methods, including a 5.5% charge for credit/debit cards and $50 to $70 per bank wire transaction

Capital Street FX Review

This Capital Street FX review will cover the different account types, minimum deposit requirements, bonus rewards and other features. Our experts also share their verdict on trading with Capital Street FX.

Assets & Markets

Capital Street FX offers leveraged trading through CFDs. There is a range of 1000+ instruments, spanning multiple markets and regions.

- Forex – Speculate on 70+ major, minor, and exotic currency pairs including GBP/USD, EUR/AUD, and CAD/JPY

- Cryptocurrencies – Trade 14 popular digital currencies including Bitcoin, Ethereum, Dogecoin, and Ripple

- Commodities – Invest in 17 soft and hard commodities including precious metals, agriculture, and energy

- Bonds – Speculate on five government bonds including 5-year US T-notes and Japanese Government bonds

- Indices – Invest in 21 global indices via futures contracts including the S&P 500, DAX 30, and FTSE 100

- ETFs – Access 21 exchange-traded funds including the MSCI Emerging Markets Index Fund, FTSE China 25 Index Fund, and S&P 500 VIX Short Term Futures ETN

- Shares – Trade 80+ company stocks including Apple, Morgan Stanley, and Meta

The average execution speed at Capital Street FX is reasonable at 0.1 seconds.

Capital Street FX Fees

The broker only offers competitive fees with the premium account tiers.

All accounts offer commission-free investing except for the VIP profile. The Basic account offers spreads from 2.5 pips, the Classic account from 2 pips, the Professional account from 1.5 pips, and the VIP account from 0.1 pips.

Spread also vary according to the asset; the GBP/USD currency pair, for example, is available with a minimum spread of 0.3 pips and a typical spread of 2.9 pips. The EUR/GBP currency pair, on the other hand, has a minimum spread of 1 pip and a typical spread of 2.7 pips.

Leverage

High leverage is available at Capital Street FX, varying by account type. The Basic, Classic and Professional accounts offer leverage of 1:2500, 1:3000 and 1:3500 respectively. The VIP account has a limit of 1:100 with higher leverage available upon request.

The level of leverage offered by Capital Street FX is extremely high; for perspective, brokers overseen by the UK’s FCA are able to offer a maximum of 1:30, and only on less volatile assets.

Inexperienced traders should take care while trading with high leverage, as it greatly enhances potential losses.

All accounts operate with a 50% margin call and a 10% stop-out level.

Account Types

Capital Street FX offers four live accounts with differing minimum deposits, spreads and other conditions: Basic, Classic, Professional, and VIP.

All accounts offer access to the full range of instruments and platforms, and operate with a trade size increment of 0.01 lots and USD as the base currency.

On the downside, fees are only competitive with the higher account tiers which require a large deposit of $1,000+. This will put it out of reach for many beginners.

Basic Account

- STP execution

- Commission-free

- Spreads from 2.5 pips

- Leverage up to 1:2500

- $100 minimum deposit

- 10 lots maximum trade size

- 300 orders permitted to be open at once

Classic Account

- STP execution

- Commission-free

- Spreads from 2 pips

- Leverage up to 1:3000

- $200 minimum deposit

- 10 lots maximum trade size

- 300 orders permitted to be open at once

Professional Account

- STP execution

- Commission-free

- Spreads from 1.5 pips

- Leverage up to 1:3500

- $1000 minimum deposit

- Telephone trading allowed

- 10 lots maximum trade size

- Bonuses and promotions

- Access to a personal account manager

- 300 orders permitted to be open at once

VIP Account

- ECN execution

- Spreads from 0.1 pips

- $10,000 minimum deposit

- Telephone trading allowed

- 15 lots maximum trade size

- Bonuses and promotions

- Access to a personal account manager

- 400 orders permitted to be open at once

- $15 commission fee for currency trading

- Leverage up to 1:100; more available on request

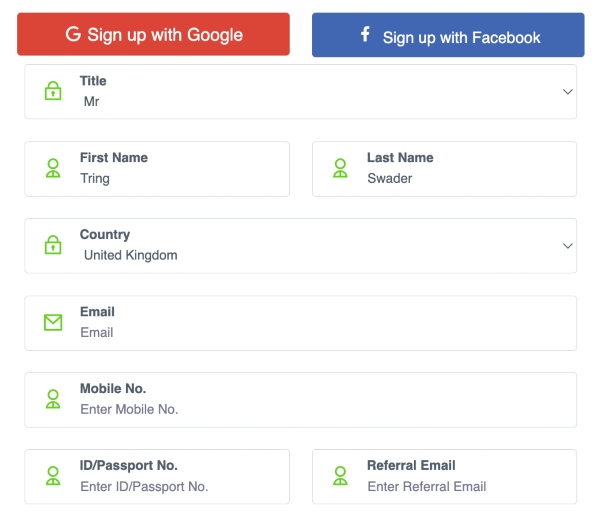

How To Register For A Capital Street FX Account

To register for a live Capital Street FX trading account:

- Select ‘Accounts’ from the top menu and then ‘Open An Account’ from the dropdown section

- Complete the online application form or sign up with your Facebook or Google account

- Click ‘Next Step’

- Account credentials will be sent to the registered email address

- Login to the client cabinet to start trading

Note, before you can start trading or make a deposit, proof of address and identity documentation are required.

Payment Methods

Deposits

Capital Street FX accepts a good range of deposit methods, including traditional payment systems and cryptos.

Deposit options:

- AdvCash

- Utrust Pay

- Perfect Money

- Bank wire transfers

- Visa/Mastercard credit and debit cards

- Cryptocurrency; Bitcoin, Ethereum, Tether, USD Coin

Minimum deposit requirements vary, the lowest being $100 for the basic account.

The broker charges no deposit fees, though third-party banking charges may apply. All deposit solutions are instant except bank wire transfers, which can take up to seven working days (notably longer than most brokers).

How To Make A Deposit At Capital Street FX

- Log in to the Capital Street FX portal

- Select the ‘Deposit Funds’ icon

- Choose a payment method

- Follow the on-screen instructions

- You may be redirected to an external site depending on the payment type

- Confirm the deposit

Withdrawals

Capital Street FX processes withdrawals back to the original payment method only.

The broker processes all withdrawal requests made during normal working hours within 24 hours, though the transaction may take longer depending on the payment method. Withdrawal requests sent during bank holidays and weekend dates may be subject to longer processing times.

While using Capital Street FX, we were disappointed to find that fees apply for all payment methods, and these can be costly, especially for traders making regular withdrawals.

- AdvCash – Instant processing, 4% fee

- Perfect Money – Instant processing, 2.5% fee

- Cryptocurrency – Instant processing, 2% gateway charge + blockchain fees

- Visa & Mastercard Credit/Debit Cards – Three to five day processing, 5.5% fee

- Bank Wire Transfer – Three to seven day processing, $50 to $70 fee per transaction

Capital Street FX Platform

Capital Street FX traders are limited to the ActTrader platform. The terminal is available as a desktop application or a web-based solution that is compatible with major browsers.

ActTrader offers various functions for day trading, including custom charts and graphs, access to trading bots, and one-click trading. The floating workspace design also offers a range of detachable windows that can be moved and displayed as needed.

Additional features include:

- Level II quotes

- 13 graphical objects

- 30 technical indicators

- Aggregated market depth data

- Netting and hedging permitted

- Line, bar, area and candlestick charts

- Automated trading robots with strategy backtesting

- 11 chart timeframes from one minute to one month

On the downside, traders familiar with MetaTrader 4 and MetaTrader 5 may find the change to ActTrader challenging. The interface takes some getting used to, so it could be worth starting with a demo account.

Making A Trade

The quickest way to open an order is via the one-click trading function.

Simply right-click on a chart, select ‘bid’ or ‘ask’ and the position will open immediately. You can amend the number of lots indicated in the ‘amount’ section. Note, you can enable or disable one-click trading from the settings menu.

To close a position, select the ‘Trade’ icon from the top menu and select ‘Close Position’. A full list of open positions will be displayed in a table; highlight the one you want to close and select ‘OK’.

Mobile App

ActTrader has a free mobile-compatible app for iOS and Android (APK) devices.

The mobile app has the same functionality and stable performance features as the desktop and browser-based solutions. Users can view price quotes in real-time, receive live financial news, and review multiple charts while on the go. All order types and execution modes on the desktop software are available.

However, the Capital Street FX mobile app is not as sleek as the proprietary software offered by some alternative brokers. Traders used to MT4 and MT5 may also find there is a learning curve.

Demo Account

Capital Street FX offers a demo account with $10,000 in virtual funds. The bankroll can also be topped up by the broker’s customer support team if required.

Given the relatively complex user interface and limited regulatory oversight, the paper trading mode is a sensible place to start. This is a risk-free way to learn the platform’s functions, allowing traders to familiarize themselves with the ActTrader software while testing the broker’s services.

New customers can open a paper trading profile from the client area.

Regulation & License

Capital Street FX is licensed as a Full Services Securities Dealer, authorized by the Financial Services Commission of Mauritius (FSC), license number C112010690.

However, this body has relatively relaxed joining requirements and minimum stipulations for businesses to adhere to. As a result, traders will not receive the same legal protections provided by brokers registered with the CySEC, FCA, or SEC, such as access to compensation schemes in the case of business insolvency.

Bonuses & Promotions

Capital Street FX offers various financial incentives and bonus rewards. This includes a risk-free trade for new account registrations and a 150%, 200%, 650%, or 900% deposit bonus.

Yet whilst rewards are large, withdrawing bonus credit is not straightforward. The small print on the broker’s terms and conditions states that customers must trade a number of lots equalling one-fifth of the cash amount of the bonus before they can withdraw the money.

For example, if you were to deposit $5000 to your account and sign up for the 650% reward, you would receive a bonus of $32,500. You would therefore need to trade 6500 lots (32,500/5) before you can request a withdrawal.

Additional Features

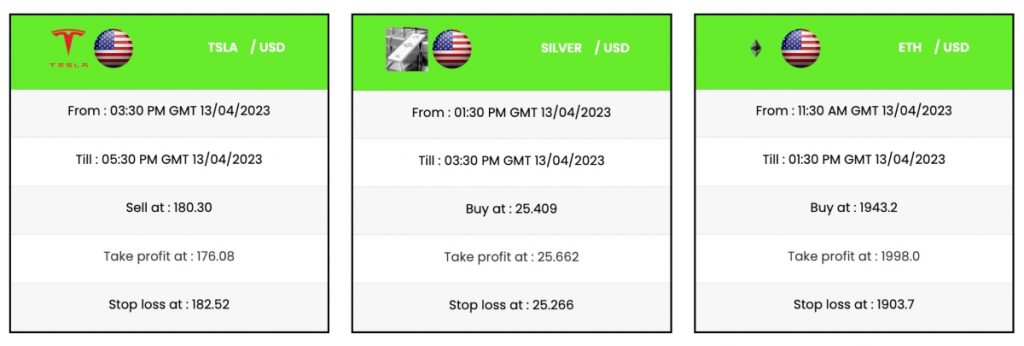

Our experts found that Capital Street FX offers a good selection of extra tools.

Clients can access a range of resources, including trading signals and an economic calendar with forecasts, statistics, and historical data, daily and weekly technical analysis reports, a ‘trade ideas’ blog-style forum for various asset classes and market news. Information and metrics are also updated frequently.

Other tools include a glossary of key terms, PDF tutorials with download options, several trading calculators and educational videos. Learning materials are categorized into basic, intermediate, and advanced concepts.

Step-by-step platform user guides, dashboard tutorials, and general Q&As are also available in the ‘Help’ section of the broker’s website.

Customer Support

Capital Street FX customer support is available 24/7 in more than 20 languages via telephone, live chat, and email. The FAQ section of the broker’s website also has information on fund transfers, account registration, trading conditions, and more.

Capital Street FX contact details:

- Telephone – +1(949) 391 1002

- Email – support@capitalstreetfx.com

- Live Chat – Bottom right of all webpages

- Online Contact Form – Via the ‘Contact Us’ webpage

- Office Address – Capital Street Intermarkets Limited, Level 2, Hennessy Tower, Pope Hennessy Street, Port Louis, Republic Of Mauritius

The broker is also present on social media channels including Facebook and Twitter. Followers can find company news and details of new promotions.

Company Background

Founded in 2008, Capital Street Group has 26,000 registered customers from 108 countries, with a monthly trading volume of $100 billion.

The broker is authorized as a Full Services Security Dealer by the Financial Services Commission of Mauritius (FSC). However, this is not a top-tier financial body, so traders may receive limited regulatory protections.

The company’s offices are located in Dubai, South Africa, and Mexico.

Security & Safety

The broker claims to operate with SSL certificates and 256-bit encryption. All payments to and from a live trading account are processed via the external payment provider, meaning Capital Street FX does not have access to any sensitive financial data. Third-party audits are also completed.

Yet despite the various safety measures, the offshore nature of Capital Street FX does raise concerns.

Trading Hours

Capital Street FX’s general trading hours are 24 hours a day, Monday to Friday.

The investment window closes Fridays at 5:20pm (Eastern Daylight Time, UTC–4) and reopens on Sundays at 6pm each week. However, products have different trading hours, and these can be found in the platform interface (instruments section) in the ‘Non-Trading Interval’ column.

Capital Street FX Verdict

Capital Street FX offers an average selection of trading instruments, a reliable platform, and various account types. However, only the top account tiers offer competitive trading conditions. Also, the high leverage, withdrawal fees, and weak regulatory oversight bring the broker’s rating in our user reviews down. As a result, many traders will prefer alternatives.

FAQs

Is Capital Street FX Legit?

Yes, Capital Street FX is a brokerage operated by Capital Street Intermarkets Limited. The brand was established in 2008 and has over 26,000 customers.

Is Capital Street FX Regulated?

Capital Street FX is licensed as a Full Services Securities Dealer, authorized by the Financial Services Commission of Mauritius (FSC). However, this is not a tier-one regulator with fairly lax joining requirements for trading firms. Users will not receive adequate legal protections.

Is Capital Street FX A Good Broker?

Capital Street FX has several positives including 24/7 customer support, commission-free trading, and access to 1000+ instruments. On the downside, regulatory oversight is very limited, withdrawal fees are high, and spreads are only low if you can afford a deposit of $1000+.

Does Capital Street FX Accept US Clients?

Yes, Capital Street FX accepts US clients.

How Can I Deposit To A Capital Street FX Trading Account?

Capital Street FX accepts deposits to a live trading account via credit/debit cards, bank wire transfers, Perfect Money, AdvCash, Utrust Pay, and cryptocurrency. There are no fees at the deposit stage and payments can be made in the client area.

Does Capital Street FX Offer High Leverage?

Yes, Capital Street FX offers leverage up to 1:3500. This is significantly higher than most regulated trading platforms. Traders should ensure they take a sensible approach to risk and money management.

Top 3 Alternatives to Capital Street FX

Compare Capital Street FX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Capital Street FX Comparison Table

| Capital Street FX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.8 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Bonds, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSC Mauritius | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | Up to 900% | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | ActTrader | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:3500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 9 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Capital Street FX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Capital Street FX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Capital Street FX vs Other Brokers

Compare Capital Street FX with any other broker by selecting the other broker below.

Customer Reviews

3.7 / 5This average customer rating is based on 3 Capital Street FX customer reviews submitted by our visitors.

If you have traded with Capital Street FX we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Capital Street FX

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Out of last 3, I found this broker to be the best. I never felt the need of looking for a new broker after I started to use them. I’m specially satisfied with trade execution, which happens without the issue of slippage. It’s been almost 6 months here. I’ll also appreciate their support team for being so helpful and kind in my last 6 months of association with them. Hope we’ll make an ever lasting relation.

I have traded for over a year with them and I think Capital Street FX is a great broker. I got great promotional offers and leverage from them when I signed up first. At first, after reading their reviews I was thinking of giving them a try with a demo account but after that I signed up for a live account and truly amazed by their exceptional services. The user interface is smooth and easy to understand for beginners. In case of any doubts, their support staffs handles the queries pretty well. I have never faced any difficulties in reaching them and solving any issues that I may have faced. Overall, I am very much satisfied with them as a broker.

I would like you file a complaint about Capital Street FX forex broker. I feel they falsely advertise their bonus programs. I had been waiting to join them when they got MT4. I had multiple discussions with them about their great bonus of 900% if I deposit $5,000. That is the only requirement I was ever told. I have had many bonuses from other brokers. You are given the bonus and there are not hidden requirements to keep your money. I thought this was like any other bonus. After starting to trade I learned that you only get the bonus for 4 months. On top of this if you don’t make their unrealistic lot requirements of 9,800 lots in 4 months you lose all of the money you made to them. On top of that they are making commission and swap fees from your trading. You have to trade over 100 lots everyday to even try to come close to this lot requirement or else in 4 months all of the trading you did is a waste and they take all of the money you made. This bonus is built only for their benefit and none for the trader. I have requested my initial deposit to be refunded in the amount of $5,300. They have declined to help me in this matter.