How to Calculate Deadweight Loss

In economics, deadweight loss is defined as the loss of economic efficiency that can occur when the market for a good or service is not in equilibrium.

The concept of deadweight loss is important for financial professionals to understand as it can help inform decision-making about pricing, output levels, and other factors that impact an economy, company, or other entities.

How to Calculate Deadweight Loss

In order to calculate deadweight loss, you will need to know a few things: the equilibrium price, the equilibrium quantity, the actual quantity, and the actual price.

The equation for deadweight loss is as follows:

Deadweight Loss = (Equilibrium Price – Actual Price) x (Equilibrium Quantity – Actual Quantity)

For example, let’s say that the equilibrium price of a good is $10 and the equilibrium quantity is 100.

However, due to market conditions, the actual price ends up being $12 and the actual quantity sold is only 90. In this case, the deadweight loss would be (($10-$12) x (100-90)), or $20.

Deadweight Loss and Inefficiencies

A deadweight loss refers to a type of inefficiency.

Deadweight loss and minimum wage laws

For example, a price control is a type of deadweight loss because it prevents the market from reaching its equilibrium.

This can also occur in labor markets most prominently through minimum wage laws.

Price formation in labor markets works just like it does in all other markets. There needs to be a certain level of productivity to justify a pay level.

If the minimum wage is $15 per hour, a business owner will expect at least $15 worth of productivity otherwise the job isn’t sustainable.

The $15 price floor prevents the market from reaching its equilibrium and some amount of labor will have to be cut back.

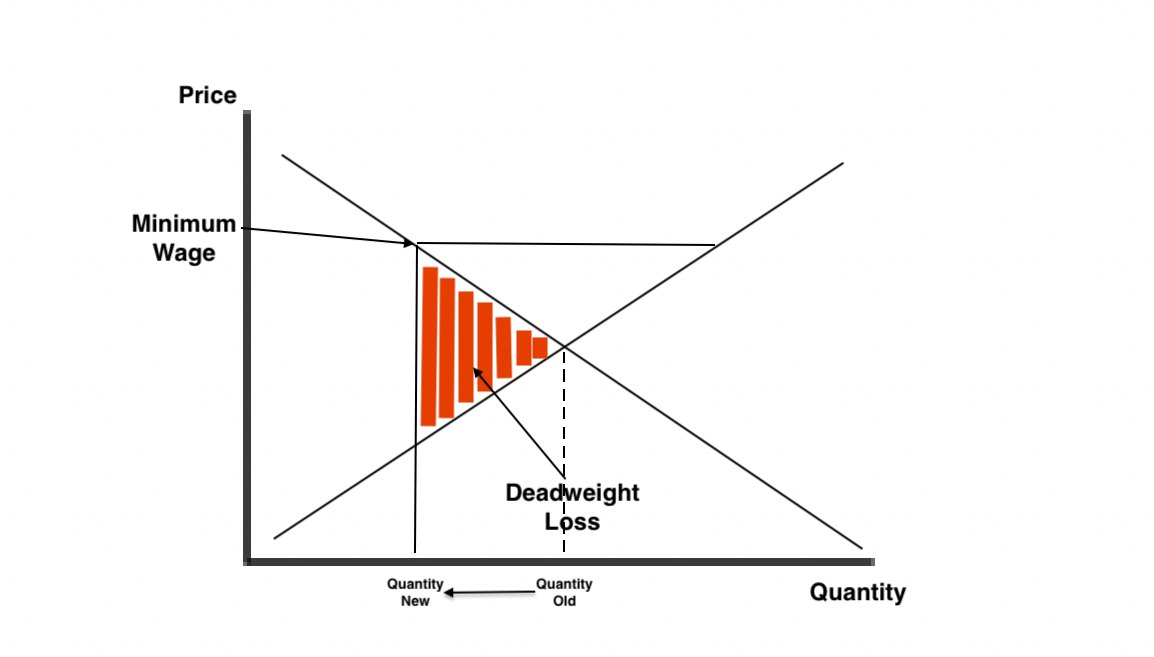

The diagram below demonstrates the concept of deadweight loss in a labor market.

When the price of something is not allowed to fall to its clearing price, the quantity demanded declines and there is some inefficiency from deadweight loss.

The implication is that it might hurt low-skilled workers willing to work for below minimum wage (e.g., high school students) and workers may react to minimum wage laws by reducing their workforce or increasing the amount of work they need out of each worker to get enough ROI from each worker.

Example

For example, say a small coffee shop has a labor budget of $10,800 each month.

They are open 300 hours per month and hire workers, with 6 workers for each shift and pay $10 per hour.

Then say minimum wage laws are passed such that they are not allowed to pay less than $15 per hour.

Simply paying each worker 50 percent more would eat into their operating margins and cause them to lose money if they paid an extra $5,400 per month extra.

Getting 50 percent more productivity out of each worker to stay profitable is probably not feasible.

So, they react by laying off two workers per shift and increasing the responsibilities of the remaining four (e.g., all workers being required to make coffee, run the cash register, and clean rather than specialize in certain tasks) to get enough work out of each to justify the $15 per hour wage.

Some workers may benefit from the pay bump but be expected to have more skills. And some workers may simply lose their job.

How to Minimize Deadweight Loss

There are a few ways to minimize deadweight loss:

- Remove any barriers that are preventing the market from reaching equilibrium.

- Change the tax structure so that it does not distort market prices.

- Increase competition so that there are more sellers in the market, which in turn encourages more buyers.

- Increase the availability of information so that buyers and sellers can make more informed decisions.

- Reduce transaction costs so that it is easier for buyers and sellers to trade.

All of these methods aim to allow the market to reach its equilibrium more efficiently so that there is less deadweight loss.

Taxes and Deadweight Loss

Taxes can cause deadweight loss in two ways.

First, taxes can distort market prices and prevent the market from reaching its equilibrium.

For example, if the government imposes a 10 percent tax on all sales of a good, the market price will no longer equal the equilibrium price because of the surcharge.

The market price will now be 10 percent higher than the equilibrium price and this may lead to a decrease in quantity demanded and an increase in quantity supplied.

Second, taxes can also reduce economic efficiency by causing resources to be allocated in a way that is different from what would happen in a free market.

For example, if the government taxes labor income at a high rate, this may discourage people from working or living in that area (e.g., high-tax New York relative to a place like low-tax Florida) and lead to a decrease in labor supply.

This may lead to a decrease in economic efficiency as resources are not being used in their most efficient way.

For this reason, tax plans need to be designed carefully because they can create certain disincentives and arbitrage effects and lead to lower overall tax revenue.

Price Ceilings and Deadweight Loss

Price ceilings can cause deadweight loss by preventing the market price from reaching its equilibrium.

For example, if the government imposes a price ceiling of $10 per gallon on gasoline, this may lead to a decrease in quantity supplied and an increase in quantity demanded.

This may lead to long lines, rationing, and other problems as people try to get their hands on gasoline.

It can also lead to black markets as people try to trade gasoline at prices above the government-mandated price ceiling.

Monopolies and Oligopolies and Deadweight Loss

Monopolies and oligopolies can also lead to deadweight loss.

This is because these types of firms often have high market power and can charge prices above the equilibrium price.

In such situations, it might incentivize competition – a good thing – to undercut prices and capture more of the market.

But in these types of markets there may be high barriers to entry.

For example, if Google charged very high prices for advertising through its main channels (search and video), it’s very difficult for another company to come in and create a new search engine or video platform to compete with them.

Competition may not be possible, or it may take a very long time for new firms to enter the market and compete.

In the meantime, deadweight loss is being created as consumers are paying high prices for goods and services.

Subsidies and Deadweight Loss

Subsidies can also lead to deadweight loss by preventing the market price from reaching its equilibrium.

For example, if the government subsidizes the production of wheat, this will lead to a decrease in the price of wheat.

This may lead to an increase in quantity demanded and a decrease in quantity supplied.

It can also lead to overproduction as farmers try to take advantage of the subsidy.

And it can lead to inefficiencies as resources are allocated toward the production of wheat instead of other goods and services.

Externalities and Deadweight Loss

Externalities can also lead to deadweight loss.

This is because they often result in market prices that do not reflect the true cost or benefit of a good or service.

For example, if there is pollution from a factory, this may lead to a decrease in the quality of life for nearby residents.

But the market price of the goods produced by the factory will not reflect the cost of the pollution.

As a result, there may be too much production of the good and too little investment in pollution control.

This can lead to deadweight loss as resources are not being used efficiently and people are experiencing a negative externality.

Tying products together and Deadweight Loss

Tying products together can also lead to deadweight loss.

For example, if you want to buy a computer, you might have to buy the operating system, monitor, keyboard, mouse, and so on, from the same company.

This can lead to deadweight loss because you may not want the operating system or other products, or you may want a different one.

But you have to buy those things anyway because it’s tied to the computer.

As a result, you’re paying for something that you don’t necessarily want and resources are not being used efficiently.

FAQs – Deadweight Loss

What is the best way to prevent deadweight loss?

The best way to avoid deadweight loss is to design policies that are effective and efficient.

Policies should be designed to target the source of the market failure and correct it.

For example, if externalities are causing pollution, then environmental regulations or taxes on pollution might be implemented.

If monopolies are leading to high prices and deadweight loss, then antitrust laws might be put in place to encourage competition.

What is the relationship between taxes and deadweight loss?

Taxes can either lead to an increase in deadweight loss or a decrease in deadweight loss.

It all depends on how the tax is designed and what it’s targeting.

For example, if a tax is placed on a good that leads to negative externalities, then it might reduce deadweight loss.

This is because it would raise the price of the good and lead to a reduction in quantity demanded.

But if the tax is placed on a good that doesn’t have negative externalities, then it might lead to an increase in deadweight loss.

This is because it would raise the price of the good and lead to a reduction in quantity demanded without offsetting the negative externality.

What is the relationship between subsidies and deadweight loss?

Subsidies can either lead to an increase in deadweight loss or a decrease in deadweight loss.

It all depends on how the subsidy is designed and what it’s targeting.

For example, if a subsidy is given to a good that leads to negative externalities, then it might reduce deadweight loss.

This is because it would lower the price of the good and lead to an increase in quantity demanded.

But if the subsidy is given to a good that doesn’t have negative externalities, then it might lead to an increase in deadweight loss.

This is because it would lower the price of the good and lead to an increase in quantity demanded without offsetting the negative externality.

What is the relationship between monopoly and deadweight loss?

Monopoly can lead to deadweight loss because it can result in high prices and low output.

Monopolies often have significant market power and can charge high prices while still maintaining a large quantity of sales.

But at the same time, they often produce less than what would be produced in a perfectly competitive market.

This leads to deadweight loss as resources are not being used efficiently and people are paying more than they should for the good.

What is the relationship between externalities and deadweight loss?

Externalities can lead to deadweight loss because they can create a situation where the price does not reflect the true cost of the good.

For example, if there is pollution from a factory, the price of the good produced by the factory will not reflect the cost of the pollution.

As a result, there may be too much production of the good and too little investment being done in pollution control.

This can lead to deadweight loss as resources are not being used efficiently and people are experiencing a negative externality as a result of the pollution.

Conclusion – Deadweight Loss

Deadweight loss occurs when the market for a good or service is not in equilibrium. In order to calculate deadweight loss, you will need to know the equilibrium price, the equilibrium quantity, the actual price, and the actual quantity.

The equation for deadweight loss is as follows: Deadweight Loss = (Equilibrium Price – Actual Price) x (Equilibrium Quantity – Actual Quantity).

By understanding how to calculate deadweight loss, financial professionals can make better-informed decisions about pricing, output levels, and other factors that impact a company or ecnoomy.