BUX Markets Review 2024

Pros

- I was pleased to find a PRO account for eligible clients, offering spread rebates up to 15% on currency pairs, high leverage up to 1:200 and discounts on financing costs up to 0.5%

- I’m satisfied with the broker’s strong regulatory oversight from the UK’s FCA, as well as the CySEC for those registered with the European entity

- BUX Markets’ proprietary trading platform, TradeHub, is a feature-rich desktop terminal and app and I particularly appreciate the excellent library of 170 technical studies

Cons

- I am a little disappointed in the lack of payment methods compared to other brands. BUX Markets only offers payments via bank transfer and credit/debit cards

- It’s a shame that there are no educational materials and additional trading tools on offer, which significantly trails behind the standard available at top competitors

- I think the single proprietary account offering may disappoint traders who prefer to use popular third-party tools like MetaTrader 4 or 5

BUX Markets Review

BUX Markets is a UK-based CFD and spread betting broker. The brand offers retail investors access to a proprietary web terminal to trade several asset classes including stocks, forex, indices, and commodities. This BUX Markets review will assess the broker’s regulatory status, trading fees, payment methods, leverage, and more. Our team also share their verdict on BUX Markets.

Key Takeaways

- Our team found the broker’s proprietary trading software intuitive with useful features

- We liked that BUX Markets is licensed by a tier-one regulator leading to a high trust rating

- Prospective users may be disappointed by the 21-day expiry time on the demo account

- The broker falls short in terms of market research and education for beginners

- Ultimately, we found that BUX Markets is best for traders seeking a no-frills broker

Assets & Markets

We were impressed with the 1000+ instruments spanning CFDs and spread betting. There are plenty of opportunities to speculate on popular markets and build diverse trading portfolios. The selection of products is particularly strong for British traders.

Supported instruments include:

- Stocks – 1000+ company shares including Barclays PLC, Aviva, BP, and Tesco

- Forex – 36 major, minor, and exotic currency pairs including GBP/JPY and EUR/GBP

- ETFs – Seven exchange-traded funds including the iShares FTSE 100 and Vanguard MSCI Emerging Markets

- Commodities – Three precious metals, two energies, and one soft commodity including Gold and Brent Crude Oil

- Bonds – Seven government bonds and interest rates such as the UK Long Gilt and 3 Month Short Sterling Future

- Indices – 14 stock index futures contracts including the FTSE 100 and US Volatility Index. Alternatively, trade seven rolling cash index funds including the UK 100 Daily Rolling Cash

It is worth being aware that while you can receive 100% of dividends when dealing in UK shares, this drops to 85% when trading US stocks.

In addition, spread betting profits are tax-free in the UK.

Fees

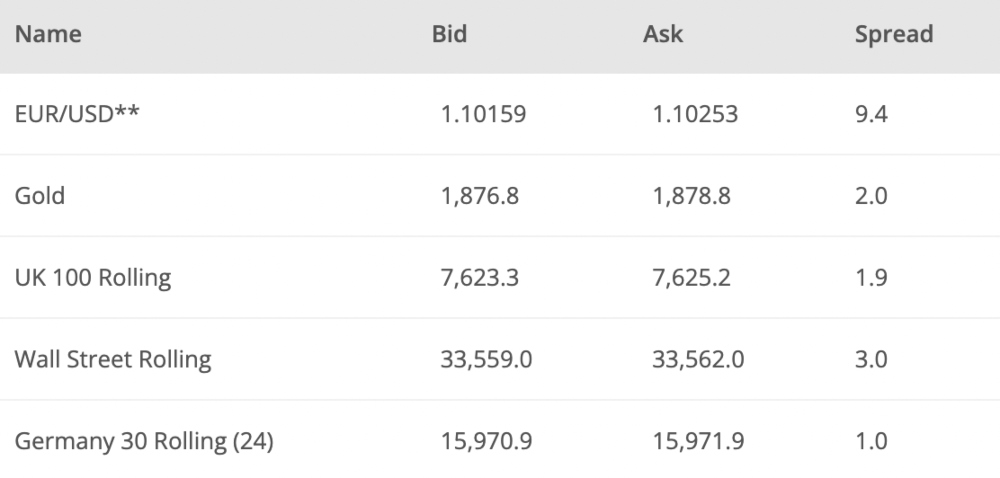

Our experts found a transparent pricing model with competitive fees. You can trade commission-free on all products, with low floating spreads. For example, we were offered spreads of 1.9 on the FTSE and a minimum of 1 pip on the EUR/GBP. This compares well with other brokers.

On the downside, we noted that a $10 inactivity fee applies after 180 days of account dormancy, although this is fairly standard at large brokerages.

It is also worth bearing in mind that swap fees apply for positions held overnight, typically 0.0098% +ARR.

Account Types

Our team appreciated that there are no complex account structures to navigate when you sign up with BUX Markets. Traders of all experience levels get the same conditions.

With that said, you can sign up for a BUX Market PRO account if you satisfy two of the requirements below. Active traders will appreciate the benefits, including spread rebates, leverage up to 1:200, and discounted finance costs.

Pro account conditions:

- A current financial portfolio of at least £500,000

- Have executed at least 10 orders per quarter

- Have worked in the finance industry for at least one year

How To Open A BUX Markets Account

- Open the BUX Markets application form

- Confirm your country of residence from the dropdown list and select ‘Next’

- Enter your personal details in the first section

- Declare your financial status by providing income details, source of wealth, and employment status

- Enter your previous trading experience

- Register account information by creating a username and password, adding a security question, choosing a product, and selecting a base currency

- Activate your account by verifying the sign-up request through your registered email address

- Deposit funds, complete identity verification, and start trading

Payment Methods

Deposits

BUX Markets falls short when it comes to funding options. The broker accepts bank wire transfers and credit/debit cards only. There is no option to use e-wallets like PayPal, Skrill, or Neteller.

And whilst card payments are free, there is a $100 minimum vs the zero minimum with wire transfers. The drawback of wire transfers is that processing times are slow, taking up to five days while card deposits are usually processed instantly.

How To Make A Deposit

- Log in to the BUX Markets platform

- Select ‘Funds Management’ from the menu

- Choose ‘Deposits (Card)’ or ‘Deposits (Bank Wire)’

- Enter the payment details on the screen and select ‘Deposit’

Withdrawals

We weren’t surprised to see that withdrawals need to be made back to the original payment method. This is typical at reputable brokers.

BUX Markets processes all requests on the same day if received before 12:30 PM (GMT). Similar to deposits, the withdrawal time for credit/debit cards is much faster than wire transfers, which can take up to five working days.

Our team were pleased to see that the broker does not charge any withdrawal fees.

Regulation & License

The brand receives a high trust score for its regulatory status.

BUX Markets is the trading name of BUX Financial Services Limited, a company authorized and regulated by the UK Financial Conduct Authority (FCA), license number 184333. The FCA is renowned for its stringent rules and joining requirements, including restrictions on bonuses, which are not available with BUX Markets.

Our team are also comfortable that the broker operates with high levels of customer safety, including the provision of segregated funds and negative balance protection. We were also reassured to see annual client money audits are completed.

BUX Markets Leverage

You can trade with leverage on the BUX Markets platform. The amount of leverage available varies depending on your location and local regulatory requirements. EU and UK traders, for example, can access leverage up to 1:30 on major forex pairs and up to 1:20 for indices.

Importantly, leverage levels and margin requirements are similar to competitors. Traders should also take care to deploy suitable risk management tools when trading on margin.

Trading Platform

BUX Markets offers a proprietary platform, TradeHub. Our team was disappointed to find that there is no third-party software such as MetaTrader 4 or MetaTrader 5, so look for another broker if these are your preferred platforms.

Yet when it came to TradeHub, we were impressed with the choice of 13 chart types, notable vs the three offered by the MetaTrader terminals. Additionally, you get 170+ analysis tools, alongside one-click trading, custom watchlists and real-time price quotes. You can also view charts across eight timeframes and change the color scheme to find a layout that suits your trading style.

From a usability perspective, we are comfortable that most traders will find the platform easy to get started with. We particularly rated the simplicity of the search function and instrument filters.

The only major downside is the lack of automated trading options. There are no robot building capabilities or algo trading functionality.

Note, a downloadable TradeHub mobile app is also available from the Apple App Store and Google Play.

How To Place A Trade

For our first time using the terminal, we were able to open a position quickly and easily.

- Sign in to the BUX Markets platform

- Search for an instrument to trade (via the Product Search function or from an existing Watchlist)

- Select the instrument name to view product details

- Choose the ‘Buy’ or ‘Sell’ icons next to the product name

- A new order window should pop out

- Complete the trade details in this screen including the trade size and any stop loss or take profit levels

- Click ‘Place Trade’ to open the position

- Trade confirmation will be displayed on the following screen

BUX Markets Demo Account

BUX Markets offers a free demo account with $100,000 in virtual funds. Users can practise trading risk-free for 21 days, which is fairly short, particularly for those new to the platform.

On a more positive note, we liked that you can specify which product type to practise with (CFDs or spread bets), plus the choice of six account currencies, including USD, EUR and GBP.

How To Sign Up

We found the application form quite comprehensive for a simulator account, with the broker wanting plenty of personal details, including a postal address.

To get started:

- Navigate to the demo account registration link via the FAQ page

- Complete the application form with your personal details

- Select the product type to trade

- Choose a virtual base currency

- Agree to the terms and conditions

- Select ‘Submit’

- A verification link will be sent to the registered email address

- Select ‘Verify Email Address’ and choose email subscriptions (optional)

- An additional email will be sent which provides login details, select ‘Log In To Demo Account’

- Enter your login details in the new screen to access the dashboard

Additional Features

Our review of BUX Markets was less impressed with the extra tools and features available. There is no online trading academy, with information limited to a keyword glossary. Traders will not find any video content or tutorials which will be disappointing for beginners.

We did, however, find some overviews of CFDs and spread betting, including basic details of how they work and the risks. This is a good start but we think the broker could do more.

We also noticed the absence of tools like copy trading, profit calculators, and stock screeners. These are all useful extras that a growing list of alternatives now offers.

Customer Support

Customer service at BUX Markets is average. The team is available during office hours only; 8 AM to 5 PM (GMT). However, you can use separate contact details for the trading desk, which is aligned with competitors providing 24/5 support.

We were disappointed not to have access to a live chat function for basic information. Instead, we would recommend starting with the FAQ area on the broker’s website.

Contact details:

- Email – support@buxmarkets.com

- UK Telephone Number (Trading Desk) – +44(0)20 3326 2135

- UK Telephone Number (Customer Support) – +44(0)20 3326 2131

- UK Office Address – BUX Financial Services Limited, 3rd Floor, Canvas, 35 Luke Street, London, EC2A 4LH

Company Details

BUX Markets is a legitimate, FCA-regulated financial services provider, that was acquired by the BUX Group in 2019.

BUX Group has over two million registered customers in 100+ countries.

The firm is headquartered in London, UK, and has an additional office presence in Amsterdam, Holland.

Trading Hours

The BUX Markets online trading platform is available 24 hours a day, from 10 PM Sunday to 10:15 PM Friday (GMT).

You can also trade via the phone for some products, with lines open during respective market opening hours. For example, you can trade FTSE 100 futures contracts between 8 AM and 4:30 PM.

Our team found that opening/closing times are also reflected in the trading terminal. In addition, we would recommend keeping an eye on the ’Useful Dates’ section on the official website for upcoming bank holidays and market closures.

BUX Markets Verdict

BUX Markets is a good contender for traders looking for a simple online trading experience. The no-frills brand does not provide anything out of the ordinary, with a stripped-back approach that may put off some beginners. Experienced traders may also find the lack of advanced tools or market research limiting. With that said, the firm is a legitimate broker with strong regulatory oversight.

FAQs

Is BUX Markets Suitable For Beginners?

Our review found BUX Markets isn’t the best for beginners. Aside from a demo account and low starting deposit, there is no copy trading, educational content, or platform tutorials. As a result, we would recommend considering alternatives.

Is BUX Markets Trustworthy?

BUX Markets is regulated by the Financial Conduct Authority (FCA), license number 184333. This is a top-tier regulator and is a strong indication that the broker is trustworthy and relatively secure.

Does BUX Markets Offer A Demo Account?

Yes, BUX Markets offers a demo profile, with $100,000 in virtual cash. You can practise trading risk-free and learn the platform functions without having to invest personal funds.

On the downside, we were disappointed to find that the simulator account is only available for 21 days.

Is BUX Markets A Good Or Bad Broker?

We are satisfied that BUX Markets is a legitimate and safe broker, however, there is a lack of advanced trading tools and additional features available. There is little that stands out about the brand, aside from the bespoke trading software. Ultimately, it is the best fit for traders seeking a straightforward online trading and investing experience.

Does BUX Markets Have Good Customer Support?

BUX Markets offers reasonable customer service, via telephone or email 24/5. However, we were disappointed that there was no live chat service, as this often provides the quickest response times.

Top 3 Alternatives to BUX Markets

Compare BUX Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

BUX Markets Comparison Table

| BUX Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 3.5 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Spread Betting, Stocks, Indices, Commodities, Bonds, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | TradeHub | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by BUX Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| BUX Markets | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | Yes | Yes | No | Yes |

BUX Markets vs Other Brokers

Compare BUX Markets with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of BUX Markets yet, will you be the first to help fellow traders decide if they should trade with BUX Markets or not?