Bitcoin Trading – How-To Tutorial

Bitcoin trading has seen a huge surge. With plenty of volatility and price movements, it’s an enticing day trading market with huge trading volume per day.

This guide will help beginners learn bitcoin trading, plus outline bitcoin strategies and tips.

Top Bitcoin Platforms

Best Bitcoin Brokers and Exchanges

What Is Bitcoin?

Bitcoin is part of the emerging cryptocurrency market. Whilst cash is made of paper, bitcoins are basically clumps of data. With no central bank or government to manage transactions, cryptocurrencies enable the transfer of money directly between individuals, utilising secure blockchain technology.

The blockchain is a secure ledger of transactions. Digital coins can be mined by processing complex mathematical algorithms.

The blockchain network records each transaction, securing the entire process – but crucially – speeding it up. Charges are made per transaction.

Bitcoin was the first cryptocurrency to utilise the technology, and subsequent growing pains have led to ‘forks’ in the process. This resulted in the introduction of Bitcoin Cash. Other currencies then tried to improve the process, both in terms of speed, but also, costs and energy requirements. Ripple, Ethereum and Litecoin all claim to be superior to Bitcoin.

For a deeper dive into how Bitcoin works, check out the original Bitcoin Whitepaper by Satoshi Nakamoto.

Bitcoin can be divided into 100,000,000 units called satoshis (0.00000001 BTC). At current prices, that’s a fraction of a cent per satoshi.

This means anyone can dabble and explains the boom in bitcoin trading volume per day.

According to a 2025 briefing from the US Congressional Research Service, the total cryptocurrency market recovered to around $2.8 trillion by April 2025 after previously peaking near $3 trillion, while Bitcoin alone was worth around $1.7 trillion and represents roughly half of the total market. This makes day trading bitcoin an appealing proposition.

Bitcoin accounts for around half of the cryptocurrency market, and Roger Ver, an early Bitcoin investor and former CEO of Bitcoin.com, believes ‘it’s the dawn of a better, more free world’. Whilst that remains to be seen, it does have certain attributes that make it tempting for those looking to make money day trading Bitcoin.

Why Day Trade Bitcoin?

- Never a dull moment – With swings of over 10% in a matter of hours, this volatile market should give you the chance to find traceable action and a potential profit for a savvy bitcoin day trader. Put simply, it’s an exciting market to day trade in. So, unless you hand over your trust to a day-trading bitcoin bot, you’ll have fun glued to the screen.

- Ideal for those comfortable with Forex – You don’t need to understand the complex technical world of cryptocurrencies and bitcoin. It’s basically a currency, enabling you to apply the same thought processes when you’re day trading Bitcoin as you would when you’re day trading Forex.

- Potential for leveraged trading – Some bitcoin exchanges offer leveraged trading, which could give you greater exposure to upside and downside price risk than your trading budget may normally allow.

- Universal access – The Bitcoin market trades 24/7 globally (though access depends on your local regulations and the hours offered by your broker or exchange). Plus, because you’re day trading, you don’t need to have a long-term view about whether cryptocurrencies will succeed. In addition, whilst the stock market can be a pricey place for normal investors, you can dive into the cryptocurrency market with just dollars or pounds.

- Day trading bitcoin fees and taxes can sometimes be low – Compared to many traditional exchanges, bitcoin-focused exchanges can sometimes offer low fees and minimums. However, UK tax rules on cryptoassets mean that profits are usually subject to Capital Gains Tax rather than being tax-free. For US traders, the IRS treats virtual currency as property, so disposals are generally taxable events, similar to selling shares.

- Go long or short – Each day is different, you can be bullish and bearish the same week.

Bitcoin Wallet

To actually own bitcoin (rather than speculate on the price), you need a digital wallet to store your cryptocurrency. There are a whole range of wallet providers out there, but we like Coinbase. It offers higher levels of security than most.

What You’ll Need To Start Trading

Now you understand how Bitcoin trading works, here’s a bit more detail on how in our step-by-step guide:

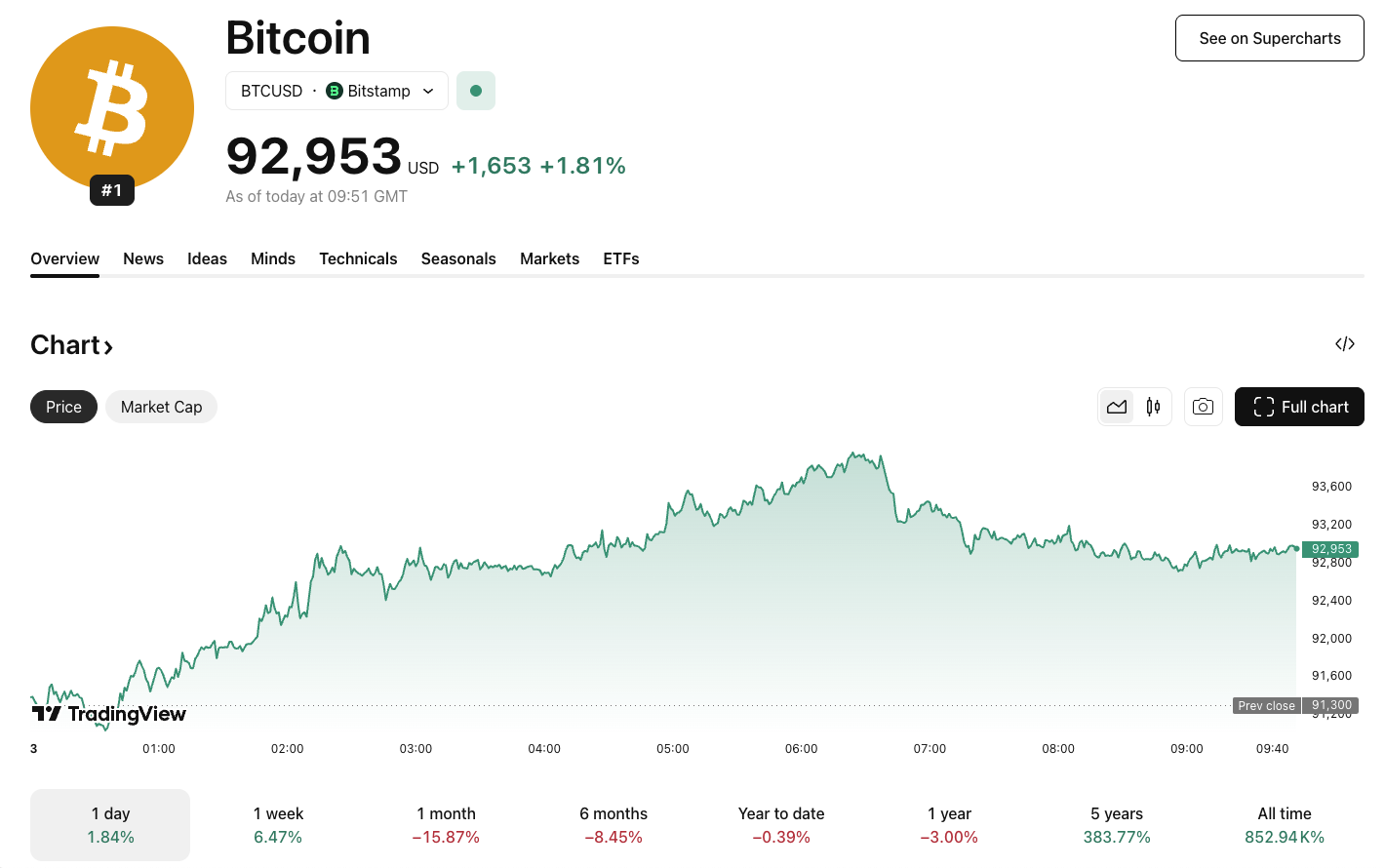

How To Trade Bitcoin Step 1 – Find out the price

One of the first things you’ll need to know is what the price is. To do that, you’ll need to head over to an index or exchange to see the latest traded value. You can also use orders – open orders or limit orders – to enter the market at the point you want to.

Step 2 – Pick an exchange

One of the biggest decisions you’ll have to make is which Bitcoin broker or exchange to deposit funds with. Day trading Bitcoin on Bitmex or Coinbase has become particularly popular in recent years. However, there are other choices too.

Away from the direct exchanges, some firms will allow you to trade the underlying asset of Bitcoin, without actually owning it. It can, for example, be traded within a forex pair against the US dollar.

It’s also worth considering brokers that accept Bitcoin payments. These firms offer seamless management and funding of BTC trading portfolios by reducing transfer charges and processing efforts.

Step 3 – Capital

Before you can make money day trading Bitcoin, you’ll need some capital to start with. The internet is packed full of warnings about losing all your money, so let’s keep this brief.

Whilst you find your feet, using a small amount is advisable. It’s also worth highlighting that you should never trade more than you’re willing to lose. Be strict and regimented with what you can and can’t afford to lose, and you’ll never need to worry about losing out to the cryptocurrency market.

Step 4 – Bitcoin strategies

Rodger Federer doesn’t step onto the tennis court without a clear strategy for how to beat his opponent, and you shouldn’t start day trading Bitcoin without one either. Some people seek the assistance of a Bitcoin day trading bot; others rely on their technical analysis and judgment.

Nearly all Bitcoin day trading tutorials will suggest you utilise price charts and have an effective money management strategy. This will help you keep losses at a minimum and profits high.

Reading the charts

Whilst you will find an abundance of line and bar charts, don’t make them your bread and butter. Candlestick charts offer you the most information in the smallest amount of space. From them, you can learn several essential bits of information:

- What the price was when it opened and closed.

- How high the price got during the time frame, as well as how low it dropped.

- If the candlestick is green, then you know the price closed higher than when it opened.

- When it’s red, it tells you it closed lower than when it opened.

- If the chart is mostly green and heading upwards, you’re in an upwards trend.

- You know if the chart is mostly red, you’re in a downward trend.

When using your chart, ensure you have the right timeframe settings. For day trading bitcoins, you want charts that are between 1-30 minutes.

If you want to make money day trading Bitcoin, you’ll need to get familiar with candlesticks and their indicators (see example below). It isn’t uncommon for Bitcoin to fall into a repetitive trend for months on end. If three of the last four candlesticks have been red, then there’s a good chance it’s going to carry on heading that way, unless the RSI suggests it’s been seriously oversold.

On Balance Volume Indicator

When day trading Bitcoin, consider using the on-balance volume (OBV) indicator. It utilises an intelligent combination of price and volume activity to gauge whether volume is confirming or diverging from price trends.

How do you apply it to Bitcoin? If bitcoin trading is on the rise whilst the OBV trading is heading south, then you know people are selling into this rally; however, a move to the upside would not be sustainable. The same logic can be applied in reverse.

News

Another one of our top tips – It is imperative you utilise multiple news sources. Bitcoin value is extremely reliant on public perception, so news events can trigger spikes. Some of the most useful and user-friendly news sources out there are:

- CryptoCoinsNews

- Bitcoin Magazine

- Coindesk

- The Street

- Coin Telegraph

- Business Insider

- Brave New Coin

- CNBC

Some traders use sentiment and news flow as a rough guide when gauging price action. For example, zero negative news about Bitcoin and cryptocurrencies could mean it’s the right time to sell, while positive news could signal a good time to buy. However, news-based trading alone is risky and doesn’t guarantee profitable signals.

Risks

Trading Bitcoin for beginners introduces numerous risks – traders must be aware of them before putting money on the line. Learning bitcoin trading can involve expensive mistakes, so this list of risks hopefully offers new traders some tips to avoid the pitfalls:

- Regulation – Bitcoins and cryptocurrencies are relatively new, making their future somewhat uncertain. People don’t know how governments will react further down the line and how stringent regulations will be. Could regulations cripple the market entirely? At an EU level, EBA, ESMA and EIOPA have issued a joint warning that crypto-assets are highly risky and speculative, and that investors may lose all the money they invest.

- Dangers of volatility – Bitcoin is one of the most volatile, widely traded assets. This aligns with the Bank of England’s view that cryptoassets like Bitcoin can ‘move up and down a lot in a short space of time’ and are a risky option to use as money. Whilst volatility brings with it the opportunity to day trade Bitcoin for a profit, it also brings with it doubt and unpredictability. For example, in June 2017, Bitcoin was being traded at $2,983. It then lost 30% in value and crashed down to $1,992, only to climb up to $4,764 in September, boasting a 139% gain. You must ensure your Bitcoin day trading strategies take into account the uncertainty.

- Exchange risk – Bitcoins can disappear. The ledger itself doesn’t delete coins, but if you lose your keys or are hacked, your access to those coins can be gone permanently. This means you must only do business with those you either know, trust or are widely reputable. US regulators also highlight these issues; the SEC’s investor alert on Bitcoin and other virtual currency-related investments outlines fraud and custody risks for retail investors. Similarly, the US Commodity Futures Trading Commission’s customer advisory on virtual currency trading stresses the high risk of hacks, fraud and lack of recourse if your coins are stolen.

- Fees / Charges – If buying and selling Bitcoin directly, transaction costs can vary wildly. This can be a wider complaint with the concept as a whole, but for intraday traders making multiple trades, it is a significant risk. Derivatives such as CFDs and binary options may reduce on-chain transaction fees but introduce substantial additional risks, including leverage. In many jurisdictions (including the UK and much of the EU), crypto-linked derivatives and binary options are banned or tightly restricted for retail traders.

- Margin Trading – Derivatives can often be traded on margin. While this can increase profit potential, it also increases the risk. Losses can exceed deposits when trading on margin.

The UK regulator, the FCA, warns that cryptoasset investments are high-risk and that consumers should be prepared to lose all the money they invest.