Brokers With QAR Accounts

Qatar riyal (QAR) trading accounts allow traders to deposit and withdraw in an account denominated in Qatar’s local currency. They are particularly popular with traders in the Middle East, enabling users to manage their online trading activities in a relatively stable currency.

Discover the best brokers with QAR accounts, chosen after hands-on tests by our experts.

Best Brokers With QAR Accounts

These are the top 2 trading platforms supporting QAR accounts:

Here is a short overview of each broker's pros and cons

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Brokers With QAR Accounts Comparison

| Broker | QAR Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Swissquote | ✔ | $1,000 | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

Swissquote

"Swissquote is an excellent choice for active traders looking for a customizable platform, such as its CXFD, which integrates Autochartist for automated chart analysis to aid trading decisions. However, its average fees and steep $1,000 minimum deposit might make it less accessible for beginner traders."

Christian Harris, Reviewer

Swissquote Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Regulator | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral |

| Minimum Deposit | $1,000 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:100 (Retail), 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, AED, SAR, HUF, THB, QAR, MXN |

Pros

- Swissquote is highly trusted owing to its position as a bank, its listing on the Swiss stock exchange, and authorization from trusted bodies like FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote supports powerful platforms for day trading, such as MetaTrader 4/5 and its own CFXD (previously known as Advanced Trader) which impressed during testing with customizable layouts and access to advanced charting tools and technical indicators.

- Swissquote provides advanced research services like Autochartist for technical analysis and integration of real-time news from Dow Jones. Its proprietary Market Talk videos and Morning News reports deliver expert analysis daily, appealing to active traders.

Cons

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

How Did We Choose The Best Brokers?

To identify the best trading platforms with QAR accounts, we:

- Examined our database of 139 online brokers and trading platforms

- Identified all those that offer an account denominated in the Qatar riyal

- Ranked them by their overall rating, combining 100+ data points with our observations during testing

What Is A QAR Account?

A QAR account is a trading account where the base currency is in Qatar riyals.

This means that trades (including opening and closing positions) and account transactions (deposits and withdrawals) are handled in QAR.

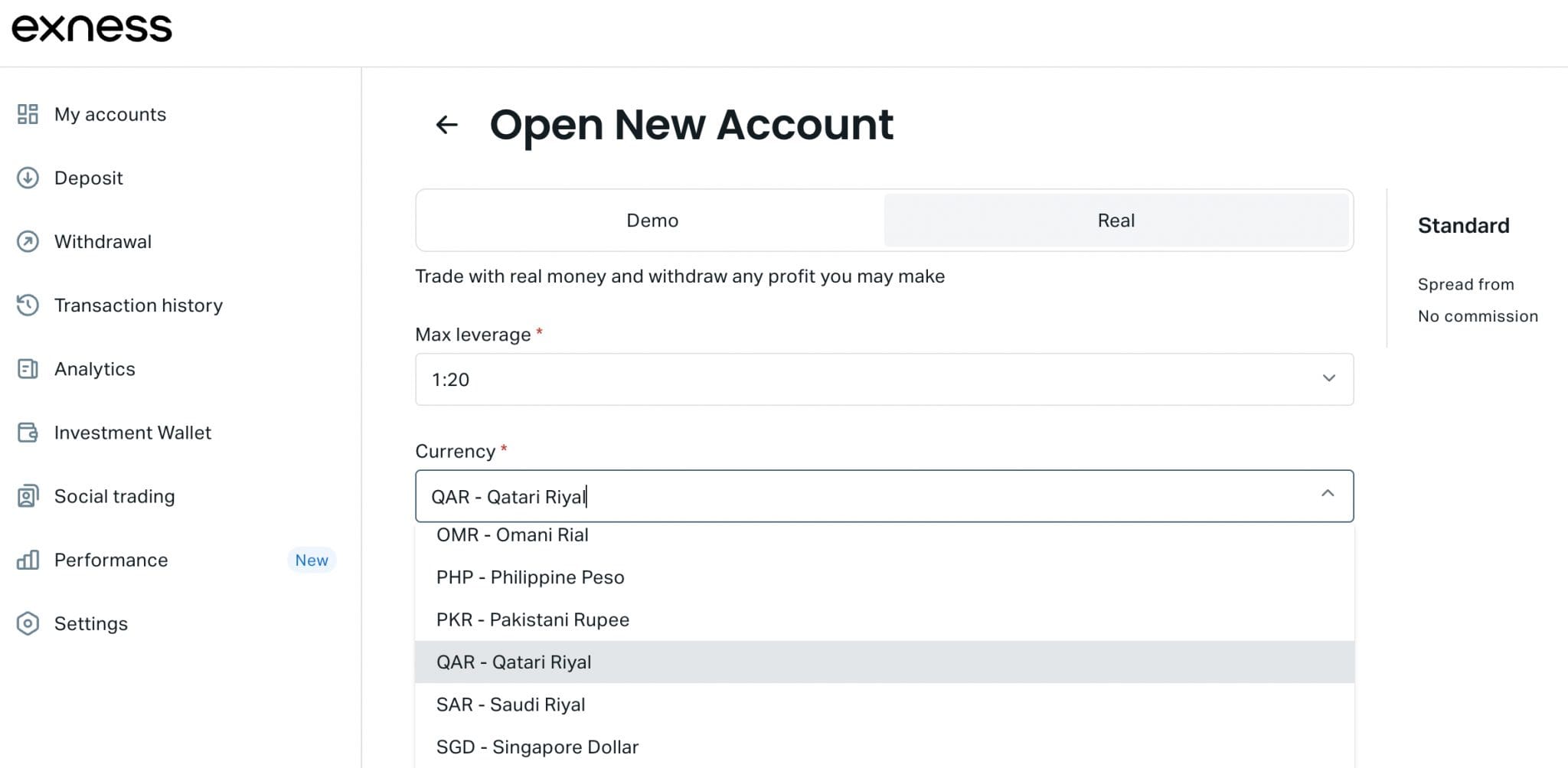

Below you can see a QAR trading account I opened with Exness.

Do I Need A QAR Trading Account?

A QAR account may be suitable if:

- You live in Qatar and earn or save in QAR because it’s cost-effective to hold a trading account in the local currency.

- You trade regional markets such as stocks in Middle Eastern energy companies, since the QAR is closely tied to oil and gas prices.

- You are an international trader looking to broaden your currency portfolio by holding investments in a relatively strong currency.

How Can I Check If A Broker Offers An Account In Qatar Riyals?

Follow these easy steps, which we used to ensure our recommended trading platforms offer a QAR account:

- Go to the account options section on the broker’s website to find the list of base currencies.

- Check that ‘QAR’ is listed as a supported account currency .

- Sign up for an account and select ‘QAR’ as your base currency.

Some brokers may require you to set your account currency, such as QAR, after registration is complete. I’ve found you can normally do this by navigating to account settings or contacting customer support.

Pros & Cons Of QAR Trading Accounts

Pros

- Brokers with riyal accounts can reduce or eliminate currency conversion fees on deposits, which is especially important for active traders for whom such costs can accumulate.

- Since the Qatari riyal is pegged to the US dollar, the currency maintains relative stability in the global markets and may provide some protection against exchange rate volatility.

- For Qatari day traders, an account denominated in QAR makes it more convenient to manage frequent trades, and view profit/loss reports in a familiar currency.

Cons

- QAR accounts are uncommon and amount to less than 1% of brokers we’ve tested, giving you slim pickings when selecting a trading platform, especially compared to brokers with USD accounts.

- Despite being pegged to the USD since 2001, economic and political tensions in the region could threaten the stability of the Qatari riyal and in turn the value of your account balance.

- Our evaluations show shares listed on the Qatar Stock Exchange are not widely offered by brokers, which is a drawback for QAR account holders looking to avoid conversion costs when dealing in securities different from their base currency.

FAQ

Which Is The Best Broker With A QAR Account?

We’ve thoroughly tested the best trading platforms with QAR accounts. Refer to our list to find a suitable option.

How Much Does It Cost To Open A Trading Account Based In Qatari Riyals?

Many brokers require up to 250 USD (approximately 910 QAR) to open a live trading account. However, our evaluations have found some QAR trading platforms go much lower.

Exness, for example, only requires 10 USD, around 36 QAR, to open an account, making it an ideal choice for beginners.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com