Brokers With KWD Accounts

Kuwaiti Dinar (KWD) trading accounts are denominated in Kuwait’s currency. They especially appeal to traders in Kuwait, ensuring a convenient trading experience in a familiar currency.

Find the best brokers with KWD accounts, selected following hands-on tests by our experts.

Best Brokers With KWD Accounts

These are the 2 top trading platforms supporting KWD accounts:

Here is a short summary of why we think each broker belongs in this top list:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- JustMarkets - JustMarkets is a multi-asset broker with both CySEC-regulated and offshore branches. Offering ultra-low spreads, copy-trading services, 170+ tradeable instruments and MetaTrader support, JustMarkets has a lot to offer both beginner and experienced traders.

Brokers With KWD Accounts Comparison

| Broker | KWD Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| JustMarkets | ✔ | $1 | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | CySEC, FSA |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

JustMarkets

"With some of the most affordable pricing in the game and access to the powerful MT4 and MT5 platforms, JustMarkets is a good choice for any investor."

Tobias Robinson, Reviewer

JustMarkets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures |

| Regulator | CySEC, FSA |

| Platforms | MT4, MT5 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:3000 |

| Account Currencies | USD, EUR, GBP, ZAR, MYR, IDR, AED, NGN, THB, VND, KWD, CNY |

Pros

- Multiple accounts to suit different strategies and experience levels

- Tight spreads from 0 pips

- Trustworthy and regulated by CySEC

Cons

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

How Did We Choose The Best Brokers?

To pinpoint the leading brokers with KWD accounts our team:

- Utilized our database of 140 online brokers and trading platforms

- Identified those offering an account denominated in Kuwaiti Dinar

- Listed them using their rating which considers 100+ metrics and our direct testing findings

What Is A KWD Account?

A KWD account is a trading account where your balance and tradable assets are based in Kuwaiti Dinars.

Any transactions including deposits and withdrawals, and positions including opening and closing day trades, will be processed in KWD.

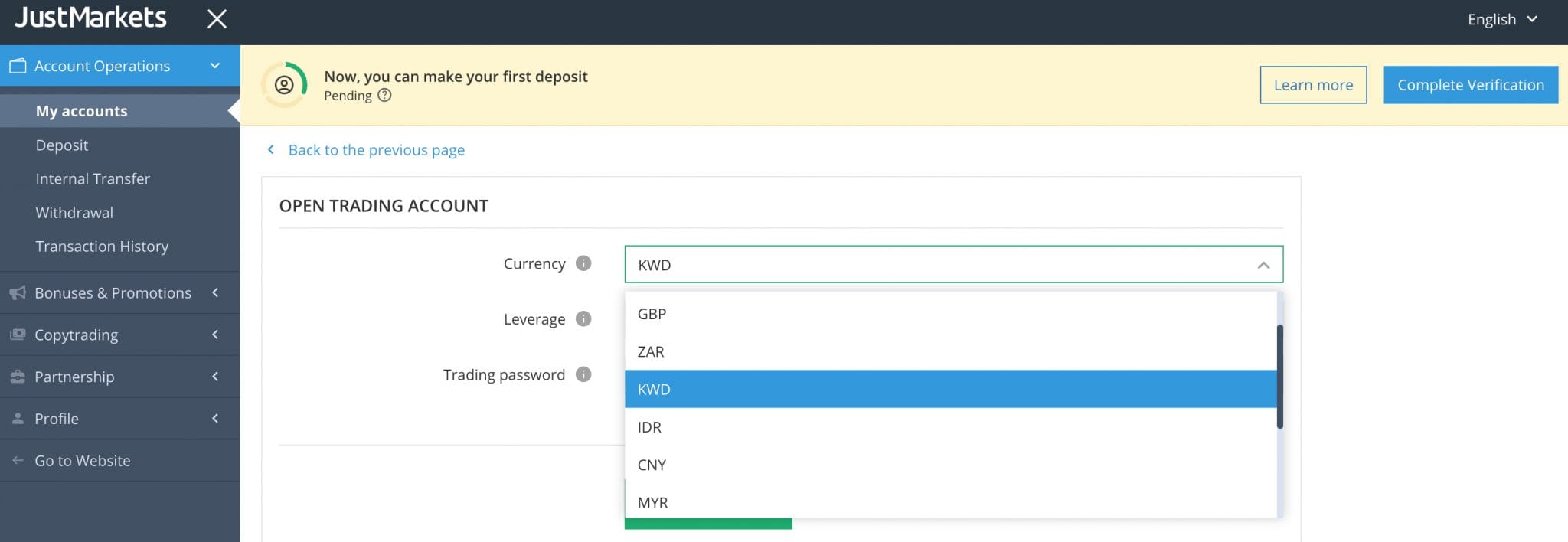

Below you can see a KWD trading account I opened with JustMarkets.

Do I Need A KWD Trading Account?

A KWD-based account may be right if:

- You live in Kuwait and earn or save in KWD as running a trading account in the same currency is cost-effective.

- You trade Middle Eastern securities, for example stocks in local oil and gas companies, as the KWD is a key currency in the region.

- You are an overseas trader looking to diversify your currency exposure by holding some of your cash in a relatively strong currency.

How Can I Check If A Broker Offers An Account In Kuwaiti Dinars?

Simply follow these steps, which our experts used to check our recommended trading platforms offer a KWD account:

- Find the accounts page on the broker’s site to find the choice of ‘account currencies’.

- Check that ‘KWD’ is available as an accepted account currency in your location.

- Register for a trading account and click on ‘KWD’ as the base currency.

Sometimes an advertised base currency isn’t immediately available when you register for an account, which happened when I signed up with JustMarkets.I recommend speaking to the support team who can help you set up an account with the right base currency, in this case KWD.

Pros & Cons Of KWD Trading Accounts

Pros

- For active traders in Kuwait, they provide a smooth trading experience, ensuring you can manage your account and trades in your local currency without worrying about various exchange rates.

- Given the Kuwaiti Dinar’s position as a relatively stable currency, holding your balance in a KWD account may offer a degree of protection against volatile FX rates and inflationary pressures.

- They can minimize conversion costs when trading in Kuwaiti Dinars. This is especially important for active investors like day traders, who otherwise may have to pay frequent transaction costs.

Cons

- KWD accounts remain extremely rare (less than 2% of all the brokers we’ve evaluated), so you have limited choice when selecting a trading platform, especially when compared to the hundreds of brokers with USD accounts.

- Although it’s a fairly strong currency, Kuwait’s economy is heavily reliant on oil, accounting for around 90% of government export revenue according to the International Trade Administration, so changes in oil prices could impact the value of your KWD account balance.

- As the Kuwaiti Dinar is not widely traded, it can be harder to get competitive exchange rates when converting to or from the Kuwaiti Dinar for other activities.

FAQ

Which Is The Best Broker With A KWD Account?

We’ve evaluated the top trading platforms with KWD accounts. Use our selection to find the best broker for you.

How Much Does It Cost To Open A Trading Account Based In Kuwaiti Dinars?

While you often need up to 250 USD, around 77 KWD, to open a general trading account, our analysis of the narrow number of brokers with KWD accounts shows you normally require much less – up to 10 USD, or around 3 KWD.

JustMarkets has the lowest minimum deposit of 1 USD, or 0.3 KWD, making it a stand-out option for budget traders.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com