Brokers With CZK Accounts

A Czech koruna (CZK) account is a trading account denominated in the Czech Republic’s currency. They are popular with Czech traders, allowing account holders to deposit, trade and withdraw in their local currency while helping to minimize conversion fees.

Discover the best brokers that offer accounts denominated in CZK following our extensive tests.

Best Brokers With CZK Accounts

Our findings show these are the 6 top trading platforms with CZK accounts:

-

1

Zacks Trade

Zacks Trade -

2

Plus50080% of retail CFD accounts lose money.

Plus50080% of retail CFD accounts lose money. -

3

Markets.com

Markets.com -

4

City Index

City Index -

5

IronFX

IronFX -

6

FXGiants

FXGiants

Here is a summary of why we recommend these brokers in February 2026:

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- Plus500 - Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

- Markets.com - Established in 2008, Markets.com is a long-standing, multi-regulated broker with oversight from the CySEC and FSCA. It offers unique features to track hedge fund moves and insider trades, while providing stock signals to alert traders to market opportunities. Its choice of accounts (Classic to Professional) caters to all levels of active trader. 72.3% of retail accounts lose money.

- City Index - Established in 1983 and now a part of the Nasdaq-listed StoneX Group, City Index is a renowned and award-winning broker specializing in forex, CFDs, and spread betting. Offering over 13,500 instruments, an evolving Web Trader platform, top-tier educational resources, and 24/5 customer support, City Index delivers a comprehensive trading experience.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

- FXGiants - FXGiants is a global CFD broker with FCA and ASIC regulation and hundreds of products available with STP or ECN execution. We like that the broker boasts several useful features, supporting always-on, ultra-fast automation via its dedicated fibre-optic VPS.

Brokers With CZK Accounts Comparison

| Broker | CZK Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Zacks Trade | ✔ | $2500 | Stocks, ETFs, Cryptos, Options, Bonds | FINRA |

| Plus500 | ✔ | $100 | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA |

| Markets.com | ✔ | $200 | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds | CySEC, FSCA, SVGFSA |

| City Index | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting | FCA, ASIC, CySEC, MAS |

| IronFX | ✔ | $100 | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) | CySEC, FCA, FSCA, BMA / Bermuda |

| FXGiants | ✔ | $100 | Forex, CFDs, indices, shares, commodities, futures | FCA, ASIC |

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- 20+ account denominations

- Regulated by FINRA with access to the Securities Investor Protection Corporation

- Demo account

Cons

- High minimum requirement of $2,500

- Shortcomings regarding platform loading times and technical glitches

- Withdrawal fees apply if removing funds more than once per month

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- In 2025 Plus500 added new share CFDs in emerging sectors like quantum computing and AI, offering opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- The customer support team continue to provide reliable 24/7 support via email, live chat and WhatsApp

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

Cons

- Educational resources are limited compared to best-in-class brokers like eToro, impacting the learning curve for beginners

- Algo trading and scalping are not supported, which may deter some day traders

- The absence of social trading means users can’t follow and replicate the trades of experienced traders

Markets.com

"Markets.com is best suited to retail investors who trade frequently but don’t want to calculate commissions, thanks to its spread-only pricing (EUR/USD around 1.3 pips). It especially appeals to short-term traders who value fast execution, flexible asset choice spanning 2,200+ instruments and proprietary tools like hedge fund confidence indices and insider trade alerts."

Christian Harris, Reviewer

Markets.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Crypto, ETFs, Bonds |

| Regulator | CySEC, FSCA, SVGFSA |

| Platforms | Web Platform, MT4, MT5, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK, CHF, PLN, CZK |

Pros

- Markets.com’s Hedge Fund Confidence and Insider Trading tools pulls SEC filings into the dashboard within 24 hours of disclosure, helping to spot fund moves and C-suite buys before most retail newsfeeds updated.

- Within the 2,200+ CFDs, Markets.com offers thematic baskets like the Warren Buffett Blend and Cannabis Blend, which behaved like ready-made mini-ETFs during testing, saving the work of balancing weights manually.

- Switching between the proprietary web platform (great for alerts and quick analysis) and MT5 (strong for algorithmic EAs) was smooth in our tests; positions synced across desktop, web, and mobile without gaps or re-quotes.

Cons

- During sign-up, we hit unclear account type explanations and got stuck in an email verification loop that locked us out for an hour - way less streamlined than other brokers we’ve tested.

- The proprietary web platform felt a bit basic once we pushed into advanced charting with fewer drawing/indicator options than full TradingView or MetaTrader.

- Inactivity charges kick in after just 3 months, while variable spreads are wider than top ECN brokers during testing, which may deter day traders and high-frequency traders.

City Index

"City Index is a great match for active traders, with ultra-fast execution speeds averaging 20ms, a highly customizable web platform featuring 90+ technical indicators, and some of the best education we’ve seen."

Christian Harris, Reviewer

City Index Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Futures, Options, Bonds, Interest Rates,ETFs,Spread Betting |

| Regulator | FCA, ASIC, CySEC, MAS |

| Platforms | Web Trader, MT4, TradingView, TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:50 (Accredited Investor), 1:200 (Sophisticated Investor), 1:300 (Wholesale Investor), 1:400 (Professional Trader). Varies with jurisdiction. |

| Account Currencies | USD, EUR, GBP, AUD, PLN, CZK |

Pros

- City Index has made strides to enhance the trading experience, notably through its Performance Analytics in 2024 for insights into trades and discipline, plus an upgraded mobile app featuring in-built market research and news at a swipe.

- City Index is regulated by top-tier authorities like the FCA (UK), ASIC (Australia), and MAS (Singapore), while its ownership by StoneX Group Inc., a listed company, further reinforces its credibility.

- City Index boasts 13,500+ markets spanning forex, indices, shares, commodities, bonds, ETFs, and interest rates, with the platform's inclusion of niche markets like interest rates offering unique trading avenues not always found elsewhere.

Cons

- City Index lacks an Islamic account with swap-free trading conditions, making the broker less appealing to Muslim traders compared to providers like Eightcap and Pepperstone.

- Unlike brokers such as AvaTrade and BlackBull, City Index does not provide passive investment opportunities like social copy trading, or real stock or ETF ownership, making it less appealing for hands-off trading.

- While many brokers like eToro have expanded their crypto offerings, City Index only provides crypto CFDs, and the limited range may not satisfy traders looking for a broader selection of altcoins.

IronFX

"IronFX remains a good choice for experienced forex traders looking to trade with fixed or floating spreads. The range of 80+ currencies is more than many competitors and there are some excellent forex market research tools on offer."

Tobias Robinson, Reviewer

IronFX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) |

| Regulator | CySEC, FCA, FSCA, BMA / Bermuda |

| Platforms | MT4, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, PLN, CZK |

Pros

- Fixed and floating spread accounts are available, making IronFX a good choice for both beginners and experienced traders

- Alongside MT4, the broker continues to offer several additional services, including copy trading, a VPS solution, and PAMM/MAM accounts

- IronFX is an established firm and is regulated by several reputable bodies, including the CySEC, FCA and FSCA

Cons

- Commissions start from $13.50 per lot in the zero-spread accounts, nearly double the industry average

- Compared to the leading brokers, IronFX offers a relatively small selection of share CFDs

- It’s a shame that the broker doesn’t offer any additional software such as MT5 or TradingView to give experienced traders more choice

FXGiants

"We recommend FXGiants to retail investors looking to trade a wide range of stocks with the legitimacy that only comes from tier-one regulation."

William Berg, Reviewer

FXGiants Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities, futures |

| Regulator | FCA, ASIC |

| Platforms | MT4 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:300 (UK), 1:500 (Australia), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, SEK, CHF, PLN, CZK |

Pros

- Users can launch MetaTrader 4, PAMM management systems, automation developers and private servers

- FXGiants caters to all client types with both STP and ECN account choices and several hundred investment products

- Zero spreads on some account types

Cons

- Beyond automation functions, FXGiants does not offer any additional features to maximize the client experience

- There is a lack of educational material and helpful content, which would add value for new traders

- Traders seeking cryptocurrencies will need to look to other brokers

How Did We Choose The Best Brokers?

To list the top trading platforms with CZK accounts we:

- Used our database comprising 139 brokers and trading platforms

- Identified all those providing an account denominated in Czech koruna

- Sorted them by their rating, blending 100+ data entries with the direct experiences of our experts

What Is A CZK Account?

A CZK account is a trading account where the base currency is denominated in the Czech koruna.

All trades (opening and closing positions) and non-trading transactions (deposits and withdrawals) are conducted in CZK.

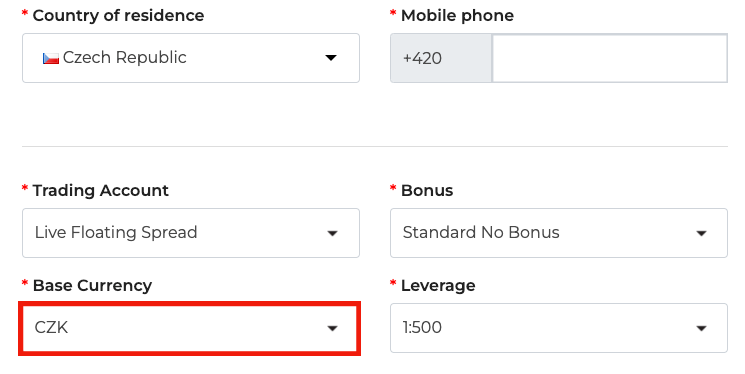

Below you can see an example where I opened a CZK-based trading account at IronFX.

Do I Need A CZK Trading Account?

This type of account may be suitable if:

- You live in the Czech Republic and earn or save in the CZK because it’s cost-effective to have a trading account in the same currency.

- You trade currency pairs with a CZK component, for example, the EUR/CZK and USD/CZK, because it simplifies calculating profits and losses.

- You trade Czech stocks listed on the Prague Stock Exchange because they could help you avoid frequent conversion costs.

How Can I Check If A Broker Offers An Account In Czech Koruna?

Follow these simple steps, which we used to verify that every one of our recommended brokers offers a CZK account:

- Navigate to the account options page on the broker’s website to see if there’s a list of ‘base currencies’ or similar.

- Check that ‘CZK’ is listed as a supported account currency for your location.

- Sign up for a live or demo account and click ‘CZK’ as your preferred currency.

Pros & Cons Of CZK Trading Accounts

Pros

- Brokers with koruna accounts are more likely to tailor their trading services to Czech traders in other ways, for example, providing stocks listed on the Prague Stock Exchange (PSE) and forex pairs containing the CZK, such as EUR/CZK.

- They reduce/eliminate currency conversion fees on koruna deposits, whereas if you deposited koruna into an IG trading account based in US Dollars, for example, you would be charged a 0.8% FX conversion fee in addition to the current exchange rate from multiple banks.

- Our analysis shows brokers with CZK accounts are often authorized by a European regulator that complies with the EU MiFID directive, providing excellent safeguards for retail traders across Europe, including the Czech Republic, notably negative balance protection.

- For Czech traders, especially day traders, being able to manage many trades and navigate frequent costs is more convenient when everything is based in the currency you are familiar with.

Cons

- Despite a rising number of platforms supporting CZK accounts, they remain relatively rare (less than 10% of the brokers we’ve tested), reducing the pool of high-quality brokers to choose from.

- Although the CZK is a relatively stable currency, in part because of its strong economic ties with Europe, holding funds in the currency may expose you to any fluctuations in the koruna following geopolitical pressures in the Czech Republic.

- The Czech koruna exhibits lower trading volumes than major currencies like the USD and EUR, so investors trading CZK with other currencies may incur higher spreads.

- Active traders dealing in overseas assets, such as US stocks, may need to pay a conversion fee if depositing and managing trades in the koruna.

FAQ

Which Is The Best Broker With A CZK Account?

Use our list of the top brokers with CZK accounts to find the platform that best meets your needs.

How Much Does It Cost To Open A Trading Account Based In Czech Koruna?

Our analysis of 139 brokers, including over 10 that offer a CZK account, shows you normally need up to 250 USD (or CZK equivalent).

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com