Bitcoin’s Correlation to Stocks, Bonds & Gold

Asset correlation is the degree to which different assets move together for the chief purposes of diversification value.

Bitcoin, since its introduction in 2009, has evolved from a speculative asset among a niche audience to an emerging macro asset.

For many individual traders, they’re more interested in the volatility and price movement. For institutions, they’re more interested in its potential as a return stream and its potential value in a portfolio. In short, its return, risk, and correlations with other assets.

We look at Bitcoin’s correlations with stocks, bonds, and gold.

Key Takeaways – Bitcoin’s Correlation to Stocks, Bonds & Gold

- The short answer (averages):

- BTC-SPY (stocks): 0.24

- BTC-TLT (Treasury bonds): 0.13

- BTC-GLD (gold): 0.10

- Correlation matters because real diversification comes from assets that respond to different economic forces.

- Statistical correlation (like the correlations we just provided) is a snapshot, not a guarantee. It shifts with liquidity, rates, and sentiment.

- Risk premiums are similar across assets after adjusting for risk, but environmental sensitivities are not.

- Build portfolios so those sensitivities offset, letting the risk premium drive returns.

- Bitcoin’s average correlations are modest, yet it often benefits from the same conditions as equities: abundant liquidity and low real yields.

- That overlap limits its diversification value during risk-on and stress periods.

- Bitcoin’s volatility is extreme, so position size should be small.

- Use Bitcoin as a nontraditional diversifier, not a hedge for equity risk.

- Focus on drivers first, correlations second.

Why Do We Care So Much About Correlation?

Correlation is fundamentally about diversifying.

Achieving reliable diversification is about balancing a portfolio based on assets’ relationships to their environmental drivers.

This is different than correlation assumptions, which are temporary numerical readings of these relationships.

All assets classes offer a risk premium that’s largely the same once adjusting for risk. But their sensitivities to various economic environments aren’t the same.

The goal then is to structure a portfolio of risk-adjusted asset classes such that their environmental sensitivities offset each other, so that the risk premium is the primary driver of returns.

And not whether, for example, growth is better than expected, inflation stays low, or interest rates stay modest – as is the bias of most portfolios.

For example, if inflation is higher than expected, we can expect that nominal bonds will underperform relative to its risk premium. This can nonetheless be offset with an asset class with the opposite sensitivity (like commodities).

This can leave the risk premium as the dominant driver of return and lead to more stable portfolio performance.

How Does Bitcoin Fit in This?

If it contains a similar environmental bias to other asset classes – even if its statistical correlation shows a lower reading – then its diversification value is more limited.

Adding in its volatility and overall risk, this pushes its allocation in a portfolio down.

Bitcoin’s Environmental Bias

Bitcoin’s environmental drivers are unlike any traditional asset.

Its performance tends to thrive when liquidity is abundant, real yields are low, and risk appetite is strong.

These are the same conditions that often favor equities and other growth assets.

When money is cheap and confidence is high, investors reach for risk, and Bitcoin’s price tends to surge.

That means Bitcoin’s environmental bias overlaps with stocks more than it might appear from its modest correlation figures (which we’ll get into more below).

Both benefit from loose monetary policy, expanding liquidity, and optimism about the future.

How This Differs from Equities

The difference lies in magnitude and sensitivity.

Equities are tied to earnings growth, while Bitcoin is tied to monetary liquidity and sentiment.

Stocks still have a claim on productive assets, while Bitcoin’s value is based on perceived scarcity and demand.

This makes it more reflexive, amplifying both gains and losses when conditions shift.

When liquidity tightens or real yields rise, equities might correct, but Bitcoin often collapses. Its reaction is sharper and faster.

So while the numerical correlation between Bitcoin and stocks may look modest, their environmental sensitivities point in the same direction: both are risk-on assets.

In other words, Bitcoin’s role in a portfolio isn’t necessarily as a hedge against equity risk, at least not most of the time, but can even be a levered expression of it.

Bitcoin vs Traditional Assets: An Overview

When people think about investing, they usually picture the familiar players: stocks, bonds, and maybe even a little gold or commodities if they want something of a nonfinancial character.

Then there’s Bitcoin, a digital wild card that doesn’t fit neatly into any of the old boxes.

Each of these assets has its own personality and purpose in a portfolio, and together they tell a story about how traders and investors try to balance risk, return, and the overall resilience of a portfolio.

For purposes of this article, we look at Bitcoin via GBTC, stocks through SPY, bonds via TLT, and gold through GLD.

Bitcoin (GBTC): Something New

Bitcoin doesn’t generate cash flow, pay dividends, or represent ownership in a company.

Instead, it’s a bet on technology, scarcity, and belief in a more decentralized future.

If anything, it’s just something different. If it has finite supply (though it competes with other cryptocurrencies) and has demand that could increase over time, there could be something there.

Over the past decade, it’s delivered massive returns; but with lots of volatility.

The volatility makes it hard to have in any kind of sizable way for those who need/want stability.

Stocks (SPY): The Growth Engine

Stocks are the core growth driver.

Through SPY, investors own a slice of corporate America (plus their international exposure, which is 28%-41% of their sales and earnings). It’s the innovation, productivity, and profit that fuel long-term wealth.

But stocks can be finicky. Their strength lies not necessarily over short time horizons, but in time and the compounding power of earnings.

Bonds (TLT): Income + Stability

Bonds are the calm presence in the mix.

They generate income and help cushion the ride when markets get rough.

TLT, which holds long-term Treasuries, tends to move opposite stocks when changes in discounted growth is the main macro driver of asset moves.

This offers a kind of financial gravity when everything else floats too high.

Gold (GLD): The Timeless, Alternative Currency Hedge

Gold throughout history has been considered money that transcends borders.

It doesn’t yield or innovate, but it endures because most people agree that it has intrinsic value.

In uncertain times, traders/investors turn to it as protection against inflation, currency weakness, or political risks.

The Numbers: How Correlated Is Bitcoin Really?

Bitcoin is often thought of as an “excess liquidity” asset, so if stocks fall then Bitcoin is often assumed to have fallen as well.

But the story isn’t nearly that simple.

The Data: What the Numbers Say

Let’s start with the basics. Over the long run:

- BTC-SPY: 0.24 (mildly positive)

- BTC-TLT: 0.13 (weakly positive)

- BTC-GLD: 0.10 (essentially uncorrelated)

A correlation of 1 means two assets move in perfect sync. A correlation of -1 means they move in opposite directions. Zero means they largely do their own thing – at least on average.

So Bitcoin’s numbers (hovering near zero) tell us something important: it’s reasonably independent of traditional assets, but only on average.

It’s also important to differentiate correlation as a mathematical/statistical concept and correlation in terms of the underlying drivers of an asset.

The mathematical concept is purely about the numerical relationship between variables, as described above. But the underlying drivers have to do with the actual reasons or mechanisms causing the relationship.

Correlation in the Tails

Correlation has a habit of rising when traders least want it to.

In normal times, many asset classes seem independent, giving the illusion of safety through diversification.

But during market stress (the “tails” of the distribution), there’s the risk that everything starts moving together.

They may sell stocks, Bitcoin, crypto, and other stuff together.

Fear drives selling across all asset classes as liquidity vanishes and people want cash. This is when traditional correlations break down and diversification benefits fade.

It’s a reminder that correlation is dynamic, and often weakest exactly when true diversification matters most.

Bitcoin and Stocks: A Loose Connection (Especially with Growth/Long-Duration Tech Stocks)

A 0.24 correlation with the S&P 500 (SPY) means Bitcoin often moves with stocks, but only loosely.

When markets are benefiting from liquidity flowing, Bitcoin often does well in addition.

But when a sell-off hits, it doesn’t always dance to the same tune.

Its volatility exaggerates moves, but the underlying rhythm isn’t tightly linked to corporate earnings or macro data the way stocks are.

Bitcoin and Bonds: Barely Acquainted

The BTC-TLT relationship at 0.13 is barely noticeable.

Bonds move on interest rates, inflation expectations, and central bank policy.

Bitcoin moves on sentiment, risk appetite, and liquidity.

Bitcoin and Gold: Kindred Spirits, Different Stories

Gold and Bitcoin are often cast as digital and physical prototypes of the “store of value” concept.

Essentially the idea that both could be hedges against currency debasement.

Yet the numbers show a 0.10 correlation.

Gold reacts to real interest rates and central bank demand, while Bitcoin responds to technology adoption and speculative momentum.

The Volatility Factor

Bitcoin stands apart because it can be a rather intense ride.

Measured by annualized standard deviation, Bitcoin sits around 120%.

Compare that to stocks at 15%, long-term bonds at 14%, and gold also near 14%.

So as far as volatility, Bitcoin is miles apart from the others.

Its volatility has come down over time with greater institutional adoption, but it’s still high.

Why Volatility Skews the Picture

This extreme volatility makes short-term correlations tricky.

When something moves up or down 10% in a day, it can look connected to whatever else is moving at the time.

That’s why Bitcoin’s modest correlations (0.24 with stocks, 0.13 with bonds, 0.10 with gold) shouldn’t be misread as stability. They’re low because Bitcoin’s price behavior is chaotic, not calm.

Low Correlation ≠ Low Risk

It’s tempting to see low correlation and think “great diversifier.”

But correlation just shows direction, not magnitude. Bitcoin may move differently from stocks or gold, but when it moves, it tends to move hard.

For traders and investors, that means it can still dominate portfolio behavior even in small doses.

For those who care about limiting tail risk and drawdowns over long time horizons, Bticoin in even ~5% allocations can push drawdown figures higher than you’d be comfortable with.

Bitcoin’s Relationship to Stocks

Bitcoin’s connection to stocks is complicated.

Most of the time, the correlation isn’t as high as many think, but in moments of market stress or euphoria, it often goes the same way as equities.

This shifting behavior has everything to do with liquidity and sentiment.

When Markets Cheer, Bitcoin Joins In

During bullish periods, like the 2020-2021 rally, Bitcoin’s correlation with stocks climbed sharply.

Investors were flush with cash, central banks were flooding markets with liquidity, and risk appetite was sky-high.

In that environment, everything that hinted at growth or innovation surged together.

Bitcoin traded like a high-octane version of the NASDAQ, rising faster when optimism took over.

When Liquidity Tightens, the Link Weakens

The connection tends to break when liquidity dries up. In times of tightening financial conditions or sudden fear, it’s common for market participants to rush to sell whatever they can.

The Takeaway

Bitcoin behaves like a high-beta tech or growth asset when risk is in favor.

But when confidence fades, it more closely reflects an asset driven by liquidity, sentiment, and conviction.

It explains why some traders see it as both a complement to and a challenge for traditional equities.

Bitcoin and Bonds

Bitcoin and bonds couldn’t be more different.

The correlation between Bitcoin and long-duration Treasuries (TLT) is just 0.13. They move on mostly separate forces.

Different Drivers, Different Worlds

Bonds live and breathe interest rates.

Their prices rise when yields fall, and they fall when rates rise.

They’re tied to central bank policy, inflation expectations, and the rhythm of the economy.

Bitcoin, on the other hand, is driven by liquidity, sentiment, and speculative appetite.

It reacts to how much risk traders/investors are willing to take, not to the yield curve or the Federal Reserve’s dot plot.

When Low Real Yields Help Both

There are moments when they move in the same direction. Falling real yields can lift both, but for very different reasons.

Bonds rally because lower yields make their future payments more valuable. Bitcoin rises because easy money and cheap borrowing fuel demand for riskier assets.

In short, Bitcoin and bonds may occasionally align, but their relationship is more coincidence than connection.

Buyers of Bonds and Bitcoin Are Very Different

They each tend to have different buyers.

There’s a correlation between those who buy Bitcoin and growth stocks.

There’s much less correlation between those who buy Bitcoin (no dividends/coupon payments + speculative returns) and bonds (income + lower returns).

Bitcoin and Gold

Few comparisons in finance spark more debate than Bitcoin versus gold.

Both are often described as stores of value, as assets that exist outside traditional systems and might provide protection from inflation or currency debasement.

Yet when you look closely, they behave very differently.

The Myth of the Perfect Pair

Their correlation sits at 0.10. So while people talk about Bitcoin and gold as cousins, they rarely move together – a good thing for those searching for diversification.

The overlap in narrative is strong, but the connection in price action is weak. In reality, their drivers are miles apart.

Different Forces at Work

Gold reacts to real interest rates and currency movements. When real yields fall or the dollar weakens, gold tends to rise as investors look for safety in something tangible and time-tested.

Bitcoin, on the other hand, responds to liquidity, technology adoption, and investor risk tolerance. It thrives in periods when markets are confident and money feels easy.

Complementary, Not Competitive

Rather than seeing Bitcoin as gold’s digital replacement, it may be wiser to view it as a complement.

Gold offers historical trust and lower volatility, while Bitcoin provides growth potential and independence from the traditional financial system.

Together, they can serve different purposes in a portfolio; gold as more of an anchor that’s tried and true, and Bitcoin as an experiment that is a call option on a long-term store of value.

What This Means for Portfolio Construction

Bitcoin’s relationship with traditional assets makes it a fascinating, yet tricky, ingredient in a portfolio.

It offers something a bit different in terms of correlation for the most part, but its volatility can easily dominate everything else if not handled carefully.

Building around Bitcoin takes both curiosity and discipline.

Start Small, Stay Smart

The math is clear: a little Bitcoin goes a long way.

Because of its 120% annualized volatility, even a 1-5% allocation can have a noticeable impact on returns and overall diversification.

We look at backtests toward the end of this article.

Small positions capture potential upside without turning the portfolio into a rollercoaster. This approach lets investors benefit from Bitcoin’s independence without being overexposed to its swings.

Diversification Still Matters

Bitcoin’s low average correlation to stocks, bonds, and gold makes it an intriguing diversifier.

It doesn’t move in perfect sync with anything else, which helps smooth long-term returns when combined thoughtfully.

But diversification isn’t about owning things that look different; it’s about owning assets that behave differently under stress.

Bitcoin sometimes aligns with risk assets during rallies, so it’s a very imperfect diversifier

Manage Risk, Don’t Chase Hype

Bitcoin’s history is filled with large rallies followed by brutal drawdowns. That cycle will likely continue.

The idea is not to time the market but to size the position properly.

Traders who treat Bitcoin like any other high-risk, high-reward asset tend to make better decisions.

Correlations Can Change Fast

Market relationships change.

When liquidity floods the system, Bitcoin often behaves like a tech stock.

When liquidity tightens, it’s likely to perform quite differently.

Traders will need to view correlation as a moving target, not a constant rule.

Focus on the environmental drivers of assets, and not basic statistical properties.

Balance Innovation with Prudence

Bitcoin has earned a place in the conversation, but not necessarily at the center of the table.

Stocks, bonds, and gold/commodities remain the foundation of most portfolios.

The strategy most institutional allocators will choose will be heavily skewed toward traditional assets, but potentially a very small amount in Bitcoin for optionality.

Used wisely, Bitcoin can potentially make a portfolio more resilient, not simply gambling on price movement.

Backtests

Let’s say we have the following portfolios, where we have allocations to stocks, bonds, gold, and Bitcoin.

And let’s say we change things up by moving the allocation between bonds and Bitcoin (i.e., other allocations stay the same).

Portfolio 1

| Ticker | Name | Allocation |

|---|---|---|

| VTSMX | Vanguard Total Stock Mkt Idx Inv | 25.00% |

| VGTSX | Vanguard Total Intl Stock Index Inv | 10.00% |

| VBMFX | Vanguard Total Bond Market Index Inv | 30.00% |

| ^BTC | Bitcoin Market Price USD | 20.00% |

| GLD | SPDR Gold Shares | 15.00% |

Portfolio 2

| Ticker | Name | Allocation |

|---|---|---|

| VTSMX | Vanguard Total Stock Mkt Idx Inv | 25.00% |

| VGTSX | Vanguard Total Intl Stock Index Inv | 10.00% |

| VBMFX | Vanguard Total Bond Market Index Inv | 45.00% |

| ^BTC | Bitcoin Market Price USD | 5.00% |

| GLD | SPDR Gold Shares | 15.00% |

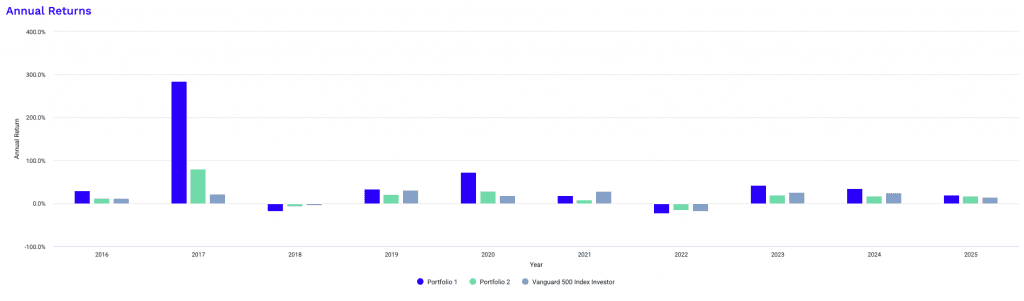

Our results over a 10-year testing period:

Performance Summary

| Metric | Portfolio 1 | Portfolio 2 | Vanguard 500 Index Investor |

|---|---|---|---|

| Start Balance | $10,000 | $10,000 | $10,000 |

| End Balance | $197,809 | $44,126 | $38,286 |

| Annualized Return (CAGR) | 35.82% | 16.45% | 14.76% |

| Standard Deviation | 26.08% | 11.95% | 15.30% |

| Best Year | 284.74% | 79.93% | 31.33% |

| Worst Year | -23.45% | -15.80% | -18.23% |

| Maximum Drawdown | -31.77% | -21.02% | -23.95% |

| Sharpe Ratio | 1.22 | 1.16 | 0.84 |

| Sortino Ratio | 3.37 | 2.55 | 1.31 |

| Benchmark Correlation | 0.44 | 0.64 | 1.00 |

Returns

Portfolio 1 crushed it:

- CAGR: 35.82%

- End balance: $197,809

Portfolio 2 still performed well, but far less explosively:

- CAGR: 16.45%

- End balance: $44,126

That 15% shift from Bitcoin to bonds nearly cut returns in half. Bitcoin’s extreme upside over this period fueled Portfolio 1’s massive growth.

Portfolio 1’s outperformance was heavily a result of the 2017 gains in Bitcoin.

Volatility and Risk

But that performance came with turbulence:

- Portfolio 1 had a 26.1% standard deviation, more than double Portfolio 2’s 11.9%.

- Its maximum drawdown was deeper too (-31.8% vs. -21%).

So, Portfolio 2 was smoother and steadier.

Risk-Adjusted Returns

Interestingly, Portfolio 1 still wins on efficiency:

- Sharpe ratio: 1.22 vs. 1.16

- Sortino ratio: 3.37 vs. 2.55

Even though it was riskier, the reward per unit of risk was slightly higher thanks to Bitcoin’s outsized performance.

The heavier Bitcoin portfolio also gave a lower correlation to the overall stock market.

The Big Takeaway

Shifting money from Bitcoin to bonds makes the portfolio more stable and predictable but much less explosive.

Bonds lower volatility, cushion drawdowns, and align the portfolio more closely with traditional benchmarks (note the higher benchmark correlation of 0.64 vs. 0.44).

Bitcoin adds asymmetry, massive upside potential with emotional swings. Bonds add ballast, the kind that better smooths price movements.

In short:

- Portfolio 1 = higher returns, higher chaos

- Portfolio 2 = lower returns, smoother ride

Which is better depends entirely on your risk tolerance, and how much excitement you’re willing to live with.

For those who need to keep drawdowns in check, the lower Bitcoin and cryptocurrency will be in a portfolio.

Caveats

Bitcoin’s returns look good looking backward, but that’s no guarantee of future performance.

A lot of adoption has occurred and that may make its performance more muted going forward. We’ve also seen its volatility come down.

The main risk is that even if cryptocurrency as an asset class grows long-term, there may be other “coins” that come up to supplant Bitcoin in popularity, similar to how companies come up to supplant market leaders, leading to their decline long-term.

Takeaway: Bitcoin’s Unique Role

Bitcoin is still figuring out who it wants to be. Some days it behaves like a hyperactive tech stock, other days like a more staid asset.

Most of the time, it lives in a category of its own, moving to rhythms that reflect its unique participants (i.e., retail, momentum, increasing institutional).

A New Kind of Asset

Unlike stocks or bonds, Bitcoin isn’t tied to earnings, interest rates, or government policy.

There are no dividends or interest payments.

It exists outside the financial system, which gives it a kind of independence that can be hard to find elsewhere.

That separation and lack of income-producing benefits is also what makes it so volatile.

Semi-Correlated, Yet Still Useful

Bitcoin’s correlations with stocks, bonds, and gold remain modest on average.

That gives it genuine diversification potential, especially in small doses.

It can add a different return stream to a traditional mix.

This can reduce dependence on any single economic outcome.

At the same time, its correlation in the tails of distributions is something to consider.

It tends to correlate strongly with growth equities in both the left and right tails of distributions.

High Potential, High Risk

Its independence comes with a price.

Bitcoin can strengthen a portfolio, but it can also destabilize it if position sizes are too large or expectations too high.

The best approach is to treat Bitcoin as a nontraditional diversifier, something that rewards patience, discipline, and humility in the face of uncertainty.