Balancer Review 2025

Balancer Review

Balancer is a decentralised crypto exchange (DEX) platform that allows users to swap crypto tokens using dedicated pools. It provides opportunities for liquidity lroviders (LPs), portfolio managers and traders to earn rewards on their investments and profit from arbitrage opportunities across the exchange’s network. This review on the Balancer platform will look at its key features, how to begin trading, whether there is a mobile app, its fees and the risks associated with the platform.

Balancer Headlines

Balancer is a protocol created by Balancer Labs (albeit first developed by a company called BlockScience) and was officially launched in September 2019 by Mike McDonald and Fernando Martinelli, around five years after the Initial Coin Offering (ICO) that funded the Ethereum network. It has a total liquidity of $2.58b and 10,800 liquidity providers, making it a sizeable player in the DEX market.

Balancer is a DEX platform and automated market maker (AMM) that allows users to trade any combination of ERC-20 tokens, earn Balancer’s native governance token (BAL) from being an LP and also profit from following arbitrage opportunities. This crypto platform has already made significant progress to stand out from its rivals.

BAL

Those swapping eligible tokens can also earn BAL, which can be traded for fiat currencies on exchanges like Coinbase Exchange. The current BAL/USD and BAL/USDT price can be found online on sites like CoinGecko, Coinbase, Binance and Airdrop.

The token’s volatility makes prediction of the future value difficult, though Balancer sees the governance aspect of its crypto token as a key part of its decentralisation strategy.

Balancer users can also earn more funds from the BAL they receive or purchase by staking tokens as an LP. Moreover, BAL can be traded for a range of different tokens and cryptos inside and outside of the protocol, including XHDX, XEND, AAVE, YFI and KYL (a product of the Kylin network).

One of the features of BAL is that it is limited to a max supply of 100 million BAL. The cryptocurrency broker CoinBase allows Balancer users to earn BAL for free by correctly answering quiz questions about the currency.

LPs receive their yield (sometimes referred to as yield farming) in the form of BAL token liquidity mining distributions, which can be claimed weekly on Tuesdays. Additionally, BAL tokens holders have a voice in the governance of Balancer.

Decentralised Platform

The DEX platform allows permissionless and immutable trades, with the company enthusiastic in its pursuit of a trustless digital finance industry whereby investors retain control of their funds. In addition to Balancer’s rewards and opportunities available by trading on the Ethereum network, users can also trade on Polygon and Arbitrum. In April 2021, it was announced that the exchange will soon be available on the Algorand blockchain.

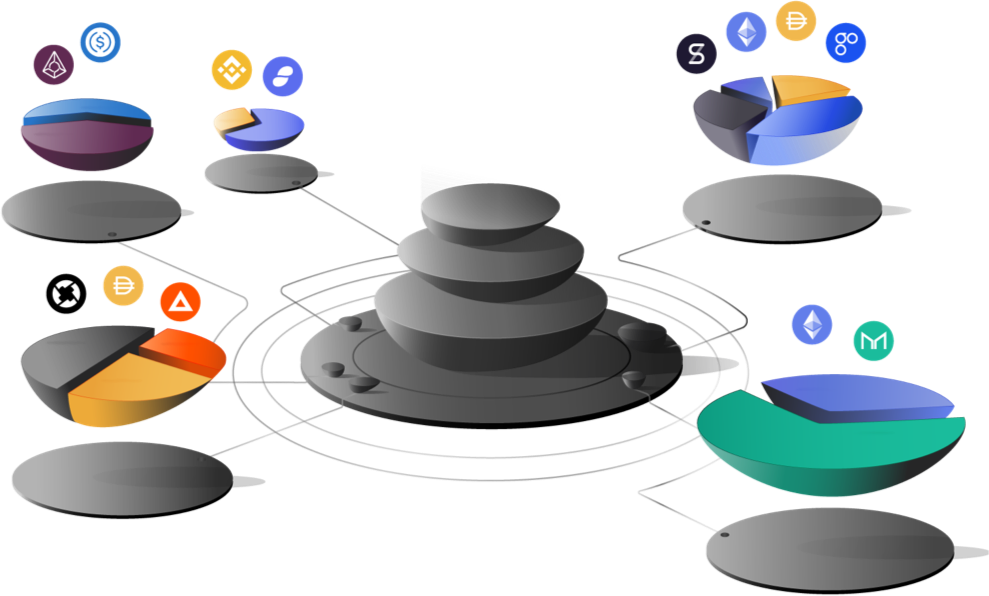

Weighted Pools

Balancer has an extensive range of pools that facilitate token swaps for a network of exchanges. Pools are simply smart contracts that implement the Balancer Protocol to provide enhanced liquidity for exchanges. The creators of these pools control the number of token types within them (up to eight) and the ratio between the tokens (e.g 80:20).

Balancer incentivises users to invest their liquidity in larger pools because, when pools do not have enough liquidity, price slippage is increased.

There are different types of pools – public, private and smart – and there are thousands of cryptocurrencies that can be traded (e.g DAI, USDC, USDT, WETH). Smart pools on Balancer are those controlled by a smart contract and include a Liquidity Bootstrapping Pool (LBP), which updates weights within the pool to implement a particular market strategy.

Getting Started With Balancer

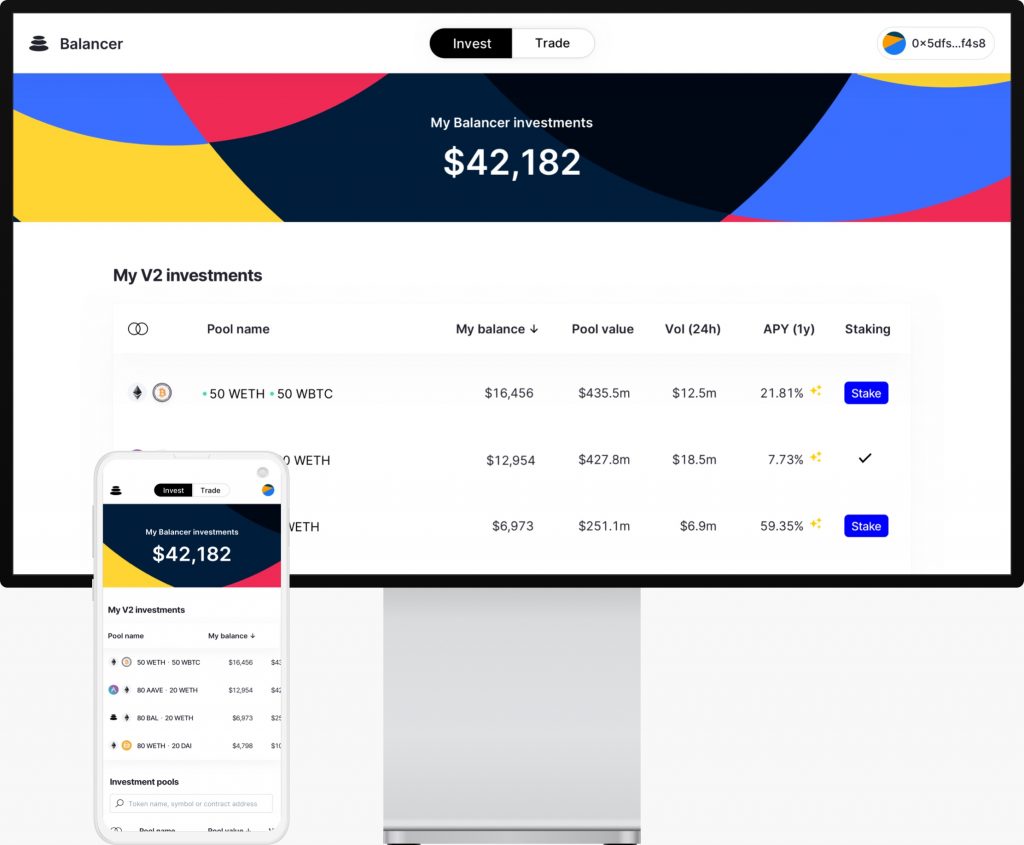

The Balancer platform is designed for desktop and web-based use via its online Invest and Trade apps. If new to the Ethereum blockchain, users will need to set up an ETH wallet before they can start trading. Having a Wallet means traders can store crypto, view their balance and transaction history, execute transactions and connect to applications.

Ethereum has many different types of wallets available but those that can be used on Balancer are Metamask, WalletConnect, Coinbase and Portis. An Ethereum wallet is all that is required to begin trading and investing, no sign-up is required.

If you have already begun trading on Balancer within V1 pools, you can migrate your liquidity to V2 pools easily online.

Fees

Fees are charged for token swaps with the funds then used to reward the LPs. Fees vary depending on which pool one is trading or investing in and are customisable by the pool creator. The fees are charged as a percentage of the input trade. However, swap fees must be between 0.0001% and 10%. In V2 Balancer, a small protocol fee is also charged, which is a percentage of the swap fee.

V2 Balancer has also created dynamic fee pools that maximise returns for LPs. Dynamic swap fees are controlled by governance and are set by the exchange’s commercial partner, Gauntlet.

A generous perk of using the Balancer platform is that traders are paid back up to 90% of their gas fees (charges to compensate for the computing energy required to process the transaction on the Ethereum blockchain). Trading against both standard and stable pools will cost just over 100k, which is at the same level as Uniswap V2. It will cost even less if internal balances are used.

There are withdrawal fees when removing tokens from the Protocol entirely and a fee for flash loans (loans that are repaid with interest in the same transaction).

How To Trade With Balancer

Just like its logo, Balancer’s website is simple. The tools to invest, withdraw and trade tokens are easy to locate and switch between.

Traders, LPs and portfolio managers can either use the exchange front-end or invest through Balancer’s smart contracts on Ethereum Mainnet.

Users can also select a slippage tolerance on Balancer, which is the maximum change in price that they are willing to accept between the order being submitted and the time it is executed.

Amateur traders and those not familiar with DEXs may wish to better understand the exchange by watching various clips on YouTube.

Withdrawals

Withdrawals are simple to execute on Balancer, users simply need to connect their Ethereum wallet and confirm the amount they wish to withdraw from a specific pool (see below). Most of the exit fees, as explained in the white paper, are returned to the LPs that remain in the pool, with the rest of them going to an account controlled by Balancer Labs, Inc. to develop future releases.

Mobile App

Balancer does not have a mobile app available on iOS or Android. The platform can only be run on the exchange’s website or desktop client.

Security & Risks

The core protocol code has been reviewed by ConsenSys Diligence and formally audited by Trail of Bits and OpenZeppelin. However, there is always a risk that bugs may be found in the future. Balancer Pools are not upgradeable, which helps prevent their immutability from being undermined (although other third-party smart pool implementations may be upgradeable).

V2 Balancer has introduced an emergency pause mechanism (only within the first three months of Mainnet operation) to prevent a serious vulnerability putting user funds at risk. During the pause, funds can no longer be added to the vault, although liquidity can always be removed. Full details of Balancer V2’s risks can be found in its docs on GitBook.

There is also the risk of impermanent loss inherent in DEXs and Balancer is no different. However, the benefit of Balancer being a DEX is that there is no login or sign up, which reduces the risk of personal data being stolen and you remain in control of your assets at all times, so there is no need to trust a third party.

Benefits

Weighted Pools Of Up To 8 Token Types

Balancer is a market leader with its innovative multi-token pools. These increase the opportunities available to traders and liquidity investors alike.

Decentralised

One of the main benefits of decentralisation is that it makes it simple for day traders to get started – there is no need for users to sign up for a Balancer account and no custodial risk over one’s funds. All that is needed is an Ethereum wallet.

Balancer’s Swap Feature

This allows arbitrage traders to easily profit from rebalancing pools, with yields sent directly to the user and there is no need for any tokens to be spent. Simply spot the arbitrage opportunity and reap the rewards.

Protocol Vault

The Protocol Vault reduces gas costs by reducing the number of transfers required between the individual pools to complete a transaction.

Drawbacks Of Balancer

Risk Of Impermanent Loss

If the proportional values of the assets in an LP change, there is the risk of some loss due to the actions of arbitrageurs, who rebalance the pools. This does not always result in meaningful loss, as trading fees can still make it profitable, though it may result that you withdraw less than you would have earned from simply HODLing the cryptos. Balancer does provide a useful impermanent loss calculator on its website.

Risk Of Hacks

Balancer was subject to a major hack in June 2020, resulting in $500,000 worth of tokens being stolen. While this may seem scary, it should be noted that hacks are a threat to all DeFi platforms.

No Mobile App

This may be disappointing for those who like to trade and invest on the move and with ease using their mobile. However, Balancer users can build their own decentralised application (dApp) with open-source code from GitHub or the Balancer V2 API.

Trading Hours

The decentralised nature of cryptos means that they can be traded 24/7, though you may find it best to trade at times of greater activity and, therefore, liquidity.

Contact Details

Inside the Balancer Invest and Trade app, there is a chat function so that users can easily send a message to the exchange’s customer support team. Live chat response times are usually within five minutes. The platform can also be contacted through Twitter and LinkedIn, or via the email address below.

- Email Address: contact@balancer.finance.

There is also a community of Balancer users that discuss the exchange on Reddit and websites such as Coinbase provide a range of tutorials. GitHub can be used to learn more about cryptocurrency in general or more complex concepts such as the Kovan Testnet.

Balancer Verdict

Balance provides an array of opportunities for DeFi investors, including token trading, liquidity pooling, staking services and arbitrage. Of note, Balancer allows more than one token type in each pool, beating out its main competitors. If you want to open an account with the exchange, click the button below.

FAQs

What Is BAL?

BAL is a token issued by the Balancer platform that allows holders to influence the governance affairs of the platform. It can also be traded for other currencies.

What Is A Decentralised Exchange (DEX)?

A crypto trading platform upon which users retain control of their capital at all times. There is no third party acting as a medium, which helps create a more (but not entirely) trustless environment.

What Makes Balancer Stand Out Vs Competitors Like Uniswap And Curve?

One of the key aspects of Balancer is its multi-token pools, which can house up to 8 different tokens. On Balancer, the creator of the pool decides the ratio between the different tokens.

What Is An Automated Market Maker?

Automated Market Makers are the mechanism by which trades take place on a decentralised exchange. Liquidity pools and complex algorithms are used to price assets and allow trades to take place without requiring centralised permission.

What Is Tokenomics?

Tokenomics is about understanding the value and supply of cryptocurrency (e.g Balancer’s own token, BAL), in order to make informed decisions about a particular asset’s future trajectory.

Best Alternatives to Balancer

Compare Balancer with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Kraken – Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

Balancer Comparison Table

| Balancer | Interactive Brokers | Kraken | |

|---|---|---|---|

| Rating | 2.5 | 4.3 | 3.9 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $1 | $0 | $10 |

| Minimum Trade | $1 | $100 | Variable |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Bonus | – | – | Lower fees when trading volume exceeds $50,000 in 30 days |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | AlgoTrader, Quantower |

| Leverage | – | 1:50 | – |

| Payment Methods | 1 | 6 | 6 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Kraken Review |

Compare Trading Instruments

Compare the markets and instruments offered by Balancer and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Balancer | Interactive Brokers | Kraken | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | No | Yes | No |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | Yes |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Balancer vs Other Brokers

Compare Balancer with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Balancer yet, will you be the first to help fellow traders decide if they should trade with Balancer or not?