AvaTrade Review 2025

Awards

- Best Mobile Trading Platform 2023 - Finance Derivative

- Best Educational 2023 - Global Business Magazine

- Best Overall Broker 2022 - DayTrading.com

- Best Trading App 2021 - DayTrading.com

- Best Forex Broker 2019 - DayTrading.com

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded further in 2025 as one of the first brokers to add CME’s Micro Grain Futures - financially settled contracts at 1/10th the size of standard contracts for key commodities like corn, wheat, and soybeans.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

AvaTrade Review

In this AvaTrade review, I’ve put the broker to the test, evaluating its accounts, markets, fees, platforms, regulations and support, to decide whether AvaTrade lives up to its motto: ‘Trade with Confidence’.

Regulation & Trust

4.8 / 5AvaTrade gets a very high trust score for several reasons, including:

- It holds licenses with 7 regulators including tier-one bodies like the ASIC and CySEC.

- It has over 15 years of experience with an excellent reputation and multiple industry awards.

- It is transparent about its trading conditions, including the costs you can expect to incur.

You can also see how AvaTrade’s regulatory credentials stack up against other brokers below.

| AvaTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Segregated Accounts | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

4.3 / 5AvaTrade offers a single account to retail investors. This keeps things simple for beginners, providing access to the full range of instruments and commission-free trading. The $100 minimum deposit is also accessible for new traders.

A Premium membership program is also available, offering priority support, interest on unused funds, exclusive events and a selection of other perks. The minimum account equity is $10,000 and traders will be automatically enrolled on the program the day after they meet the requirements.

In addition, Muslim traders can open a swap-free account. Alternatively, a professional account is available to qualifying traders with benefits including increased leverage.

I think AvaTrade could strengthen its account offering by providing specialized accounts to suit different styles.

For example, Vantage offers a standard, commission-free account alongside an ECN account with raw spreads and low commissions.

How To Open An Account

I can’t fault the account opening process – it took me less than 5 minutes. To get started:

- Add your email address and create a password in the application form, then select ‘Create Account’

- Complete the ‘Personal Details’ (name, date of birth, country of residency, address and phone number)

- Choose an account base currency (USD, EUR, GBP etc) and click ‘Continue’

- Answer the financial questions using the dropdown choices

- Fill in the trading experience and knowledge section

- Review and agree to the terms and conditions and select ‘Finish’

Deposits & Withdrawals

AvaTrade offers convenient account funding. There are no deposit or withdrawal fees – an advantage for active traders looking to move funds frequently.

As you can see from my analysis below, AvaTrade’s choice of payment methods also exceeds that of competitors, even if its choice of account currencies trails some alternatives.

| AvaTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Minimum Deposit | $100 | $0 | $100 |

| Payment Methods | Boleto, Credit Card, Debit Card, FasaPay, JCB Card, Mastercard, MoneyGram, Neteller, Perfect Money, Skrill, Swift, WebMoney, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | Apple Pay, Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Maestro, Mastercard, Neteller, Skrill, Visa, Wire Transfer |

| Account Currencies | USD, EUR, GBP, CAD, AUD | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, PLN, CZK, AED, SAR, HUF, MXN |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

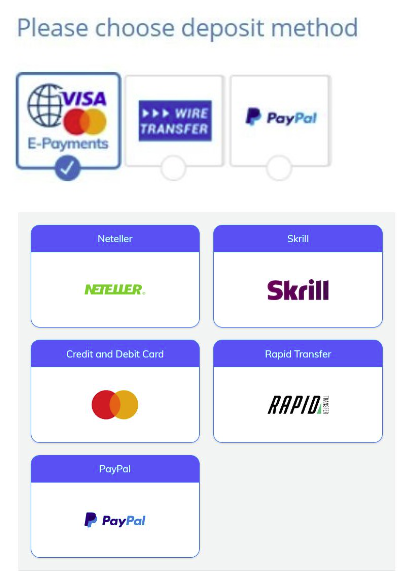

How To Deposit Funds

I find AvaTrade’s cashier portal user-friendly. Depositing funds only requires a handful of steps after logging in:

- Select the ‘Deposit’ icon from the menu on the left and then ‘Fund Your Account’

- Click on your chosen method using the logos

- Select the trading account you wish to add funds to

- Enter the amount to deposit and click ‘Next’

- Follow the on-screen instructions to complete the payment and click ‘Deposit’

AvaTrade also scores well when it comes to withdrawals, with near-instant processing for credit/debit cards and up to 24 hours for e-wallets. I would avoid wire transfers if you want your funds quickly – I found they can take several working days.

Minimum withdrawal limits vary but are low, starting at $1 for e-wallets and $100 for bank wire transfers.

Bonus Offers

AvaTrade occasionally offers a welcome bonus, though availability will vary depending on your jurisdiction. For example, I was offered a 20% deposit bonus when I signed up with a $200 deposit required to qualify.

On the downside, AvaTrade does not offer any rebates for high-volume traders. I consider this a more attractive incentive, especially for active traders. If this is important to you, I recommend Forex.com.

I never recommend choosing a broker based solely on their trading promotions. There are more important factors to consider, including safety, trading conditions and investing tools.

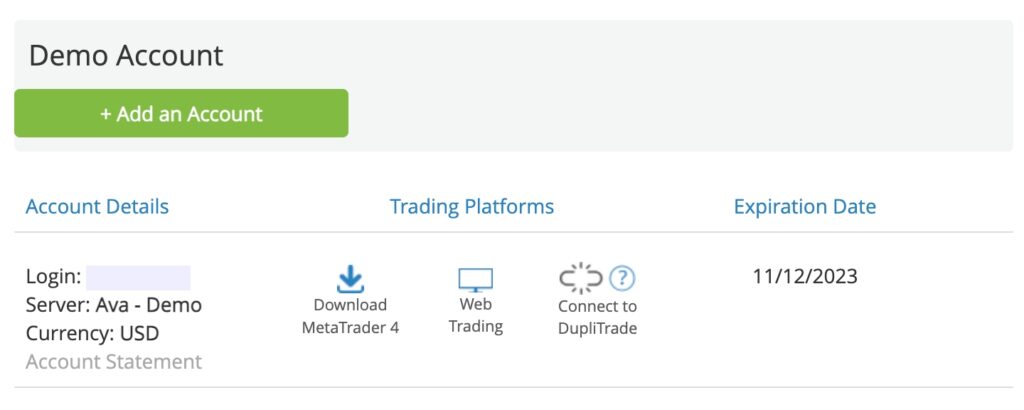

Demo Account

AvaTrade offers a free demo account. I opened a paper trading profile and found that you can test the MT4, MT5, WebTrader, and AvaTradeGO platforms in a risk-free setting. $100,000 in virtual funds is available, with access to real-time pricing.

However, the biggest advantage is that there is no time limit – making it an excellent tool for beginners looking to continue testing strategies after opening a live account. Demo trading accounts at most competitors I have reviewed automatically close after 30-90 days.

Assets & Markets

4.5 / 5AvaTrade has a relatively strong investment offering, with 1,250+ instruments spanning popular asset classes like stocks, forex and commodities. It trails alternatives like CMC Markets with its 12,000 instruments, but still offers enough for most retail traders.

The selection of indices and ETFs is particularly strong, providing opportunities to build a diverse portfolio.

The majority of products are available via CFDs, however spread betting and options are also available in some locations.

I logged into AvaTrade’s platforms to check the assets available. You can speculate on:

- ETFs: 60+ exchange-traded funds with 1:5 leverage including the Vanguard Real Estate ETF, SPDR Gold Trust, Invesco QQQ, and the S&P 500 VIX short-term futures ETN

- Stocks: 650+ shares including General Electric, Netflix, Amazon, JP Morgan Chase and Procter & Gamble

- Forex: 50+ currency pairs including majors, minors, and exotics such as EUR/USD, GBP/USD, and AUD/CAD

- Indices: 45+ index funds and custom baskets such as Green Energy and Airlines

- Commodities: 18 soft and hard commodity products including gold, silver, crude oil, natural gas, and wheat

- Cryptocurrencies: 9 popular cryptos including Bitcoin, Bitcoin Cash, Litecoin, Ripple and Ethereum

- Bonds: Euro-Bund or Japan Government Bond

AvaTrade also bolstered its offering in 2024 by introducing AvaFutures. Traders can bet on future market prices, hedge against volatility and build diverse portfolios spanning over 35 markets, including oil, S&P 500, EUR/USD and Bitcoin.

In 2025 it went further. AvaTrade was among the first brokers to offer CME’s Micro Grain Futures from their launch – financially settled contracts at just one-tenth the size of standard grain futures – providing traders with early, cost-efficient access to key agricultural markets like corn, wheat, and soybeans.

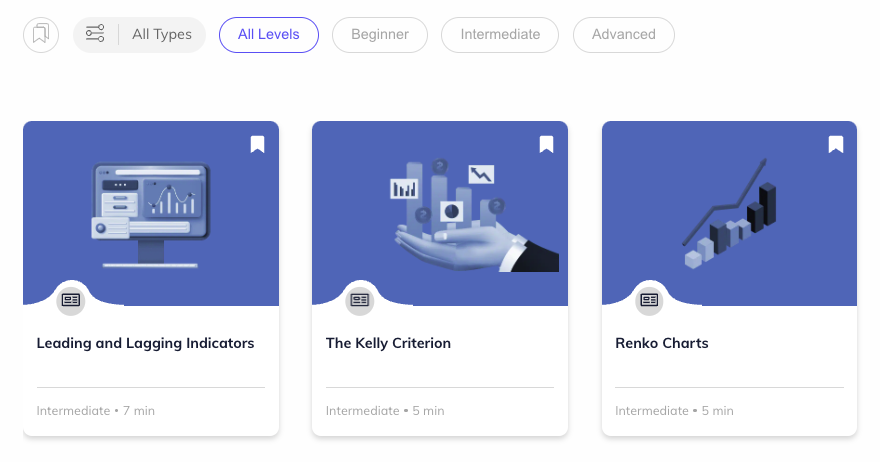

Futures trading is supported on the MetaTrader 5 platform, while the broker has teamed up with the CME Group to up-skill newer futures traders, providing well-presented courses that you can filter by experience level (beginner, intermediate, advanced).

| AvaTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Leverage

Leverage at AvaTrade varies depending on the instrument, location and your status as a retail or professional investor.

Retail traders in the EU, for instance, can trade with leverage up to 1:30, while pro traders can access leverage up to 1:400.

As you can from my comparison below, AvaTrade offers leveraged trading opportunities in line with competitors.

| AvaTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Leverage | 1:30 (Retail) 1:400 (Pro) | 1:50 | 1:200 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

3.8 / 5AvaTrade offers a straightforward fee structure, with spread-only pricing.

The broker’s in-house dealing desk model means that whilst you don’t pay commissions, spreads are a little wider than at non-dealing desk brokers.

Trading Fees

I recorded spreads during the most liquid times of the day and found that AvaTrade’s fees stand up reasonably well against competitors, but as you can see from my analysis below, it isn’t the cheapest broker.

Major forex pairs like the EUR/USD were available at 0.9 pips and the USD/JPY at 1 pip. Popular stocks, including Apple and Microsoft, were offered at 0.13%.

Pricing is also competitive on futures products, with a 0.75 charge per trade on Micro contracts and 1.75 on E-Mini and Standard contracts. There are also zero deposit fees, account fees, plus you get free access to level 2 market data.

| AvaTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| EUR/USD Spread | 0.9 | 0.08-0.20 bps x trade value | 0.1 |

| FTSE Spread | 0.5 | 0.005% (£1 Min) | 100 |

| Oil Spread | 0.02 | 0.25-0.85 | 0.1 |

| Stock Spread | 0.13 | 0.003 | 0.1 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Non-Trading Fees

I have marked AvaTrade down slightly for its non-trading fees.

Casual investors should bear in mind that a $50 inactivity fee applies after three months of zero activity, with an additional $100 charge after 12 months. While not a major drawback, this is higher than the $10 monthly charge at Plus500 and $15 charge at FxPro.

Swap fees apply for positions held overnight. These are industry standard, though Islamic profiles are exempt from this charge.

Platforms & Tools

4.3 / 5AvaTrade excels in its choice of high-quality trading platforms. There is something for all experience levels, from beginners to seasoned traders. You can use the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as the broker’s WebTrader, AvaTradeGO, and AvaOptions.

I explain how each platform measures up in terms of design, ease of use and functionality below, but the headlines:

- AvaTrade’s WebTrader is good for beginners looking for a smooth trading experience with a user-friendly interface.

- MT4 and MT5 are better options for more experienced traders looking for advanced tools and automated trading features.

On the negative side, AvaTrade doesn’t offer the widest range of third-party platforms, as you can see from my comparison with other brokers below.

| AvaTrade | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| MetaTrader 4 | Yes | No | Yes |

| MetaTrader 5 | Yes | No | Yes |

| cTrader | No | No | No |

| TradingView | No | Yes | No |

| Auto Trading | Expert Advisors (EAs) on MetaTrader | Capitalise.ai & TWS API | Yes (EAs & FIX APIs) |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

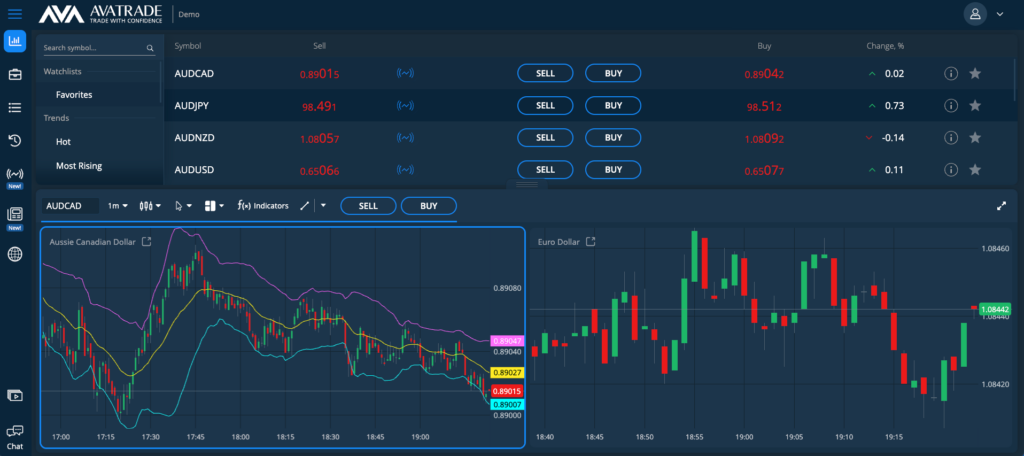

WebTrader

Design & Usability

I find AvaTrade’s WebTrader easy to use with a sleek design and straightforward navigation. It offers a more user-friendly feel than the MetaTrader platforms, making it a good option for new traders.

The asset search function is easy to locate and I had no issues navigating the market watch window. You can click on the information icon next to each asset to pull out the order window and instrument details.

I also like that you can switch between 6 chart layouts, with the option to view up to 4 charts on the same window.

One thing that could be improved is the overall customizability. For example, the market watch and watchlist widgets are fixed and I’m not able to hide, move or resize them, which is frustrating.

AvaTrade could improve the user experience by ensuring the whole workspace can be adjusted to the trader’s preferences.

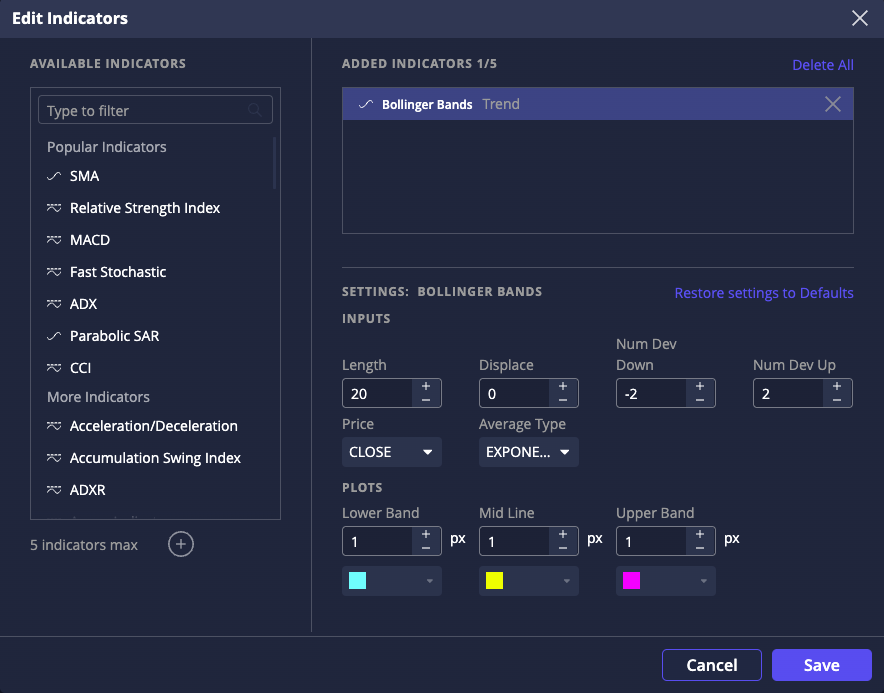

Charting Tools

WebTrader still provides sophisticated trading tools, including 10 chart timeframes and 14 drawing tools such as Fibonacci Retracements and Trend Line.

There are also 60+ technical indicators like RSI, Bollinger Bands, and Fast Stochastic – more than MetaTrader.

Order Types

I was able to initiate market and pending orders, with the option to set take profit and stop loss orders. Market orders are executed at the prevailing market rate, whilst pending orders are executed at a predetermined point above or below the prevailing market rate.

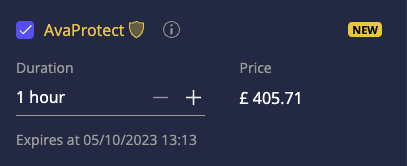

However, the stand-out feature for me is the AvaProtect risk management tool. This is fairly unique and offers protection against losses of up to one million dollars.

How To Place A Trade

It’s quick and easy to make a trade in WebTrader:

- Search for a symbol in the watchlist menu on the top left side or filter by category

- Select ‘Sell’ or ‘Buy’ in the asset window to open the new order screen

- In the order entry window, use the toggles to increase/decrease the amount to invest or lot size

- Review the spread, leverage, and margin details

- Select ‘More Options’ to view the risk parameters available

- Use the tickbox icon to select a risk tool and use the toggles to amend the trigger price

- Select ‘Sell’ or ‘Buy’ at the bottom to confirm the order

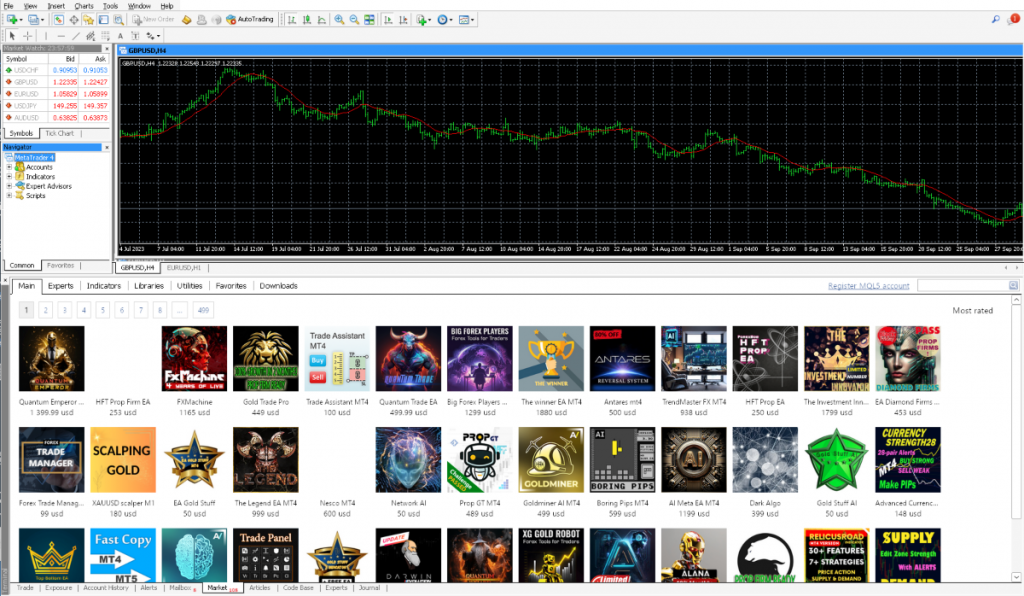

MetaTrader 4 & 5

For those looking for powerful, third-party platforms, MT4 and MT5 are good options. They both offer flexible charting views, advanced technical analysis tools and customizable workspaces.

They are particularly good for automated traders, with support for Expert Advisors (EAs).

Design & Usability

MT4 and MT5 are very similar when it comes to the design and layout of the interface. The traditional look and feel of the platforms may feel a little outdated to some, but the good news is that they are easy to navigate.

The customization options are also good. The main windows, including the Market Watch and Terminal features, can be expanded or hidden altogether, allowing you to tailor your workspace easily.

In terms of accessibility, you can access both MT4 and MT5 from web, desktop or mobile applications.

Charting Tools

MT4 and MT5 both offer an extensive range of technical analysis tools.

With MT4, you get 30 technical indicators and 31 graphical objects. There are 9 time frames, from one minute up to one month. You also get access to Expert Advisors (EAs) in the integrated marketplace, as well as single-threaded strategy testing.

I think MT5 is the best option for multi-asset trading. It is the latest iteration from MetaQuotes with faster processing than MT4 plus a wider suite of trading tools, including:

- 21 chart timeframes

- Multi-thread strategy testing and integrated economic calendar

- 38 technical indicators including MACD and Stochastic Oscillator

- 44 graphical objects such as Elliott Wave and Fibonacci Retracement

Order Types

Both platforms feature the same 4 order types:

- Market Orders

- Pending Orders (buy limit, buy stop, sell limit, sell stop)

- Stop Loss

- Take Profit

With MT5, you get an additional 2 pending order types: buy stop limit and sell stop limit. These are useful if you plan to trade very volatile markets.

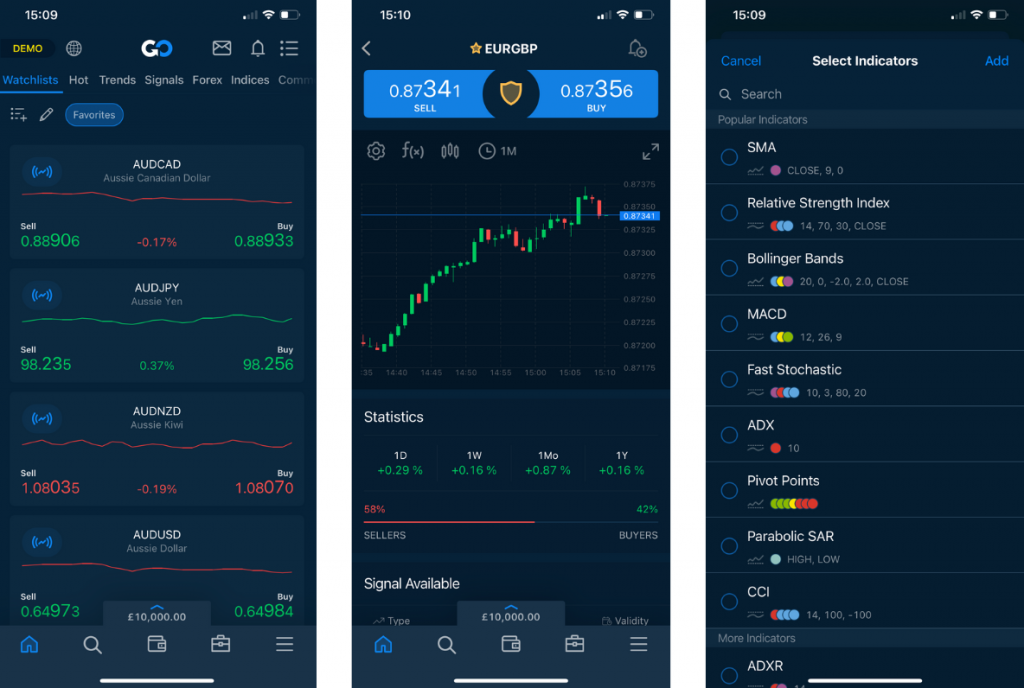

Mobile App

AvaTrade also offers an intuitive mobile app, AvaTradeGO, which is free to download on Android and Apple devices. The application performed well during my tests, with a clean look and feel, dynamic charting and market sentiment data.

I was impressed with the functionality of the charts, which have been well-optimized. I could access 9 time frames and over 90 customizable indicators.

The app is also packed with other useful features, including an economic calendar, market research, a Trading Central news feed, and education videos.

In summary, I think the AvaTradeGo app is a great tool for beginners who are already familiar with the WebTrader platform and want to switch seamlessly between devices.

Additionally, the quality of market research tools should be valuable for anyone looking to stay ahead of market movements whilst on the go.

Additional Tools

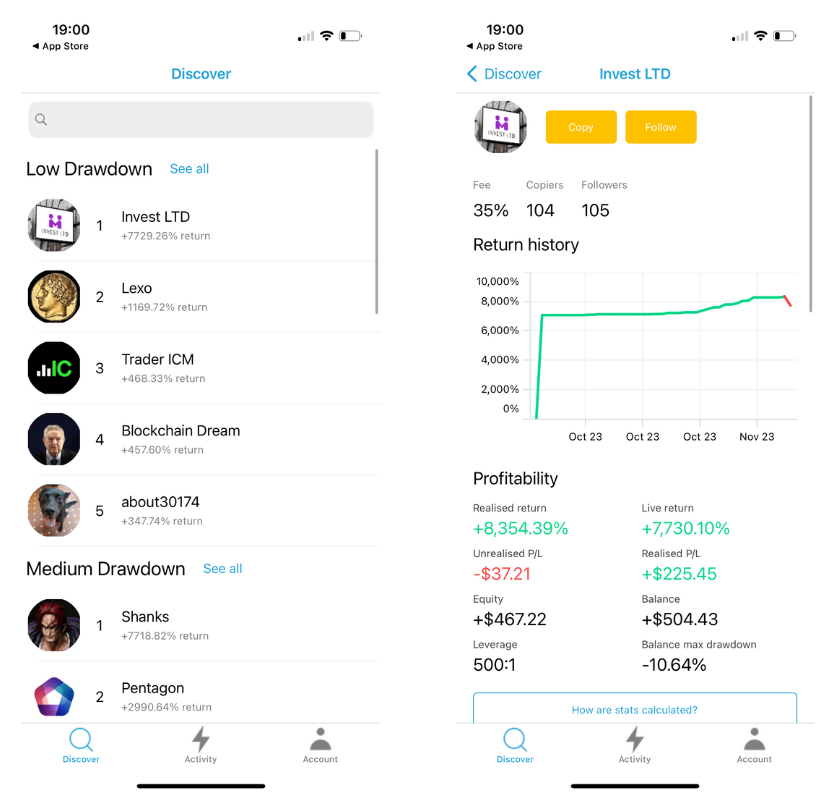

AvaTrade also stands out for its selection of extra tools to enhance the trading experience. The choice of copy trading solutions is particularly strong and makes the broker a good pick for aspiring traders and hands-off investors.

AvaSocial

The broker’s copy trading platform, AvaSocial, lets you replicate the positions of successful investors, either manually or through the automated service.

Available for iOS and Android devices, clients can interact with other traders via community channels to ask questions on specific strategies or seek out a trading mentor.

I don’t think AvaSocial rivals best-in-class copy trading app, eToro.

One drawback for me is the interface, which feels somewhat dated and bland in comparison. I think the broker could modernize the design of the app and improve the navigation between features.

DupliTrade

Alternatively, there is a third-party copy trading solution, DupliTrade, which enables investors to follow signals and strategies in real-time. I found that the tool can be linked directly to an MT4 account for simplicity. Master traders are also thoroughly vetted.

One major downside, though, is that a $2000 minimum deposit is required, which will put it out of reach for most beginners.

Trading Central

AvaTrade has also partnered with Trading Central to offer powerful technical analysis and market insights. I find this useful for informing trading decisions, with trading plans developed by professional analysts.

Also available through the solution is a daily strategy newsletter, intuitive pattern recognition technology, plus a host of advanced indicators on over 115 forex charts. Trading Central also tracks 7000 media sources for investors interested in fundamental analysis.

Guardian Angel

One of the stand-out features for me is the Guardian Angel risk management feature, which can be installed on the MT4 platform.

This add-on essentially provides performance data for current and future trades and makes suggestions about prevailing market volatility. It is especially useful for improving trading behaviors.

Research

4.3 / 5AvaTrade excels when it comes to research tools. Within the Discovery tab of the web platform or mobile app, you can access a wealth of high-quality resources, including market signals, a news feed, and an economic calendar.

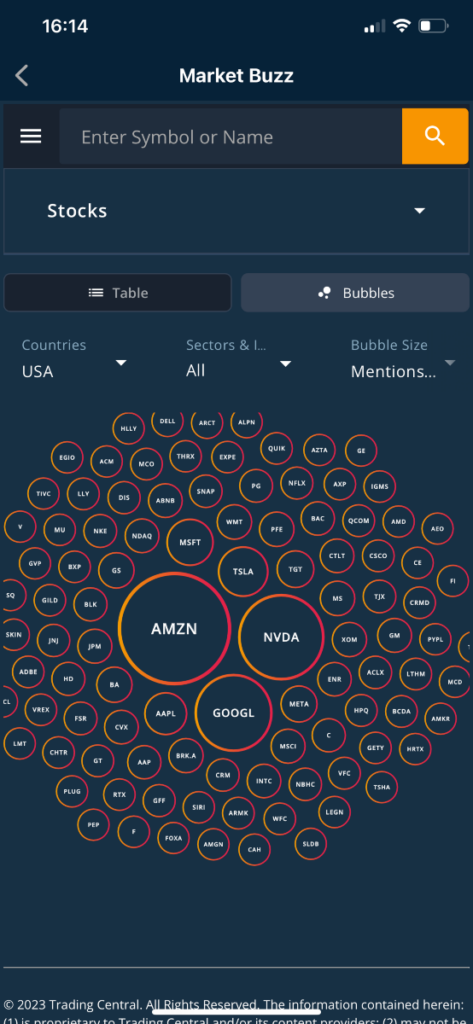

My favorite features are the Analyst Views tool which gives actionable forex trade ideas, and the Market Buzz tool which collates market sentiment data from top global news sources.

Tip: You can switch to the ‘Bubbles’ view in the Market Buzz tool for a more visual representation of market sentiment. You can also narrow down your search using the Countries, Sectors and Bubble Size filters.

Education

4.5 / 5AvaTrade also has an excellent education center, complete with videos, eBooks, tutorials, glossaries, and more. Additionally, whilst there is a dedicated section for trading education, I think the whole site in general is very informative for online traders.

I particularly rate the trading platform tutorials, with step-by-step video guidance and informative articles. Advanced strategy guides are also available.

Customer Support

4.3 / 5I have no complaints about the customer support at AvaTrade. You can reach the multilingual team 24/5 via multiple channels, including live chat, email, and WhatsApp. I’m glad to find local telephone numbers, ensuring customer service agents can respond to country-specific questions.

Response times are also fast based on my tests. I got through to an agent on live chat within 3 minutes each time I tested the customer service.

There’s also a comprehensive help center, with FAQs and useful articles which are accessible via a search function.

You can also find AvaTrade on social media sites including Facebook, Twitter and LinkedIn.

Should You Trade With AvaTrade?

After rigorously testing AvaTrade’s platforms, apps and tools, I’m happy to recommend this broker to traders looking for a tightly regulated broker with competitive trading conditions.

Beginners will appreciate the low $100 starting deposit, simple pricing model and beginner-friendly apps. There’s also a free demo account, an excellent suite of educational resources and the AvaProtect risk management feature.

For experienced traders, there’s a good range of sophisticated third-party platforms, including MetaTrader 5, plus a large suite of assets and research tools.

FAQ

Is AvaTrade Legit?

AvaTrade is a legitimate broker. The firm has hundreds of thousands of traders, multiple industry awards and licenses from reputable regulators. Importantly, I didn’t uncover any reports of scams during my research, and most other user reviews are generally positive.

Is AvaTrade Trustworthy?

Yes, AvaTrade is a trustworthy broker. The broker is regulated by multiple bodies, including the ASIC and CySEC. The firm also uses important safeguards, including segregating client funds and negative balance protection.

Does AvaTrade Offer Low Fees?

While not the cheapest broker I have tested, AvaTrade offers competitive fees. Most instruments can also be traded commission-free. I was offered average spreads of 0.9 pips on major forex pairs while the spread to trade gold was $0.29 over market.

Is AvaTrade Suitable For Beginner Traders?

Yes, AvaTrade is a good broker for beginners based on my assessment. The starting deposit is low, there is a free demo account, comprehensive educational materials, and copy trading solutions. I also found the web platform easy to learn with a user-friendly interface.

Is AvaTrade A Market Maker Broker?

Yes, AvaTrade is a market maker broker. This means the brokerage takes its cut from bid-ask spreads, which are typically wider than ECN brokers. It also means AvaTrade can provide liquidity and help traders get orders filled promptly.

Does AvaTrade Offer A Good App?

Yes, the AvaTradeGo mobile app is reliable and offers access to all the investing tools and account management features needed to trade on the go. You can also access helpful services such as Market Trends which provides useful data based on other users’ trading behaviours and sentiment.

Is AvaTrade Good For Day Trading?

Yes, AvaTrade will serve day traders. It offers a secure trading environment with transparent fees, powerful trading tools and reliable order execution. Both MT4 and MT5 are also available, catering to active day traders and automated trading strategies.

Top 3 Alternatives to AvaTrade

Compare AvaTrade with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

AvaTrade Comparison Table

| AvaTrade | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| Rating | 4.9 | 4.3 | 3.6 | 4.4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, Stock CFDs, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | ASIC, CySEC, FSCA, ISA, CBI, FSA, FSRA, BVI, ADGM, CIRO, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | NFA, CFTC |

| Bonus | 20% Welcome Bonus up to $10,000 | – | 10% Equity Bonus | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Education | Yes | Yes | Yes | Yes |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingCentral, DupliTrade | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:30 (Retail) 1:400 (Pro) | 1:50 | 1:200 | 1:50 |

| Payment Methods | 13 | 6 | 11 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by AvaTrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| AvaTrade | Interactive Brokers | Dukascopy | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | No | Yes |

| Options | Yes | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | Yes | No | Yes | No |

AvaTrade vs Other Brokers

Compare AvaTrade with any other broker by selecting the other broker below.

The most popular AvaTrade comparisons:

- Expert Option vs AvaTrade

- AvaTrade vs Exness

- XM vs AvaTrade

- AvaTrade vs eToro

- IC Markets vs Avatrade

- Binance vs AvaTrade

- Fusion Markets vs AvaTrade

- Pepperstone vs AvaTrade

- FOREX.com vs AvaTrade

Customer Reviews

4.4 / 5This average customer rating is based on 5 AvaTrade customer reviews submitted by our visitors.

If you have traded with AvaTrade we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of AvaTrade

Article Sources

- AvaTrade Website

- Ava Capital Markets Australia Pty Ltd - ASIC License

- Ava Trade Middle East Limited - ADGM License

- DT Direct Investment Hub Ltd - CySEC License

- Ava Trade Markets Ltd - BVIFSC License

- Ava Capital Markets Pty - FSCA License

- AvaTrade Japan K.K. - FSA License

- AvaTrade EU Ltd - CBI License

- ATrade Ltd - ISA License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

I’ve used AvaTrade, and I really like its smooth interface and variety of trading options. The spreads are decent, and having multiple platforms like MT4 and AvaTradeGO makes it flexible. I also appreciate the strong regulations, which add a sense of security. The only downside I noticed is that withdrawals can take a bit longer than expected, but overall, it’s been a solid experience.

Super reliable broker with a user-friendly trading platform. I find the Analyst Views especially useful for helping discover opportunities.

I’m new to online trading and have found AvaTrade a great place to start. It’s got loads of helpful trading guides and customer support are always reachable when I need them.

I have been trading with an AvaTrade STP account for over a year, and I have had nothing but positive experiences. They are very easy to use, and it feels like the support actually cares when I contact them. I have made several withdrawals without any problems. I did have to verify my identity before my first withdrawal, but the process to do so was quick and painless.

I’ve been happily using AvaTrade for months. The web platform is easy to learn and the mobile app is great for trading on the go. Customer support is also available whenever I need them. If I had one complaint it’s that the spreads aren’t the lowest.