Why Do Companies Buy Back Shares?

Companies buy back shares for a number of reasons.

One key reason is to return value to shareholders. By reducing the number of shares outstanding, each remaining share becomes more valuable as earnings are spread over fewer shares.

By reducing the amount of outstanding common stock, companies can improve their return on equity (ROE), making them more attractive to potential investors.

Companies may also buy back their own shares if they believe that there is upside potential due to positive market conditions or upcoming announcements.

Companies may also be considered the most efficient way to return capital to shareholders instead of issuing a dividend, as dividends are taxed as income while share repurchases help boost the stock price (all else equal), which may eventually come in the form of a capital gain.

Buybacks can also be used in conjunction with other financial strategies such as debt reduction and financing expansion plans.

What Does a Stock Buyback Do?

A stock buyback, also known as a share repurchase, is when a company buys back its own shares from the open market.

The purpose of this strategy is to reduce the number of outstanding shares, boost shareholder value, and increase earnings per share (EPS).

When a company buys back its own stock, the total number of shares outstanding in the market decreases. This reduces the supply relative to the demand for the remaining shares outstanding on the market – which increases their price (again, all else equal).

With fewer outstanding shares on the market, each remaining share represents a greater fraction of the company’s total earnings – which can lead to an increase in EPS.

A stock buyback can also be used as a signal by management that it believes its stock is undervalued in the market.

Equity is also an expensive form of financing for a company (because it gives up ownership share). Debt is a cheaper form of financing (because the yield on it is lower and it doesn’t give up ownership share).

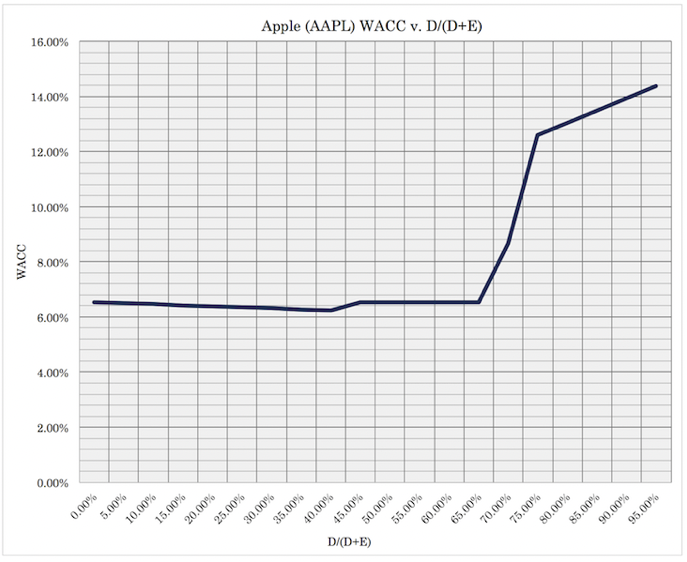

A company can plot out where its optimal debt-to-equity ratio is and perform a share buyback to lower its overall weighted average cost of capital (WACC).

For example, the below chart shows that Apple (AAPL) can handle more debt as a percentage of its overall capital structure.

In such a case, it could buy back shares to help achieve this.

In general, stock buybacks can be beneficial for shareholders, but not all companies use them as part of their strategy. Companies need to consider whether a buyback is the most efficient use of their funds and resources before deciding to move forward with one.

Who Benefits From a Stock Buyback?

Stock buybacks can be beneficial to both the company and its shareholders.

By buying back shares, the company reduces its outstanding share count, thus creating scarcity and increasing price, holding demand constant.

For companies with dividends, this increase in price can lead to higher dividend payments for shareholders since dividends are typically paid on a per-share basis, so fewer shares mean larger individual dividends for stockholders.

Furthermore, by reducing the number of outstanding shares through a buyback program, companies can help protect from dilution caused by future equity issuances such as employee options or convertible bonds.

Stock Buybacks (Share Repurchases) Explained in One Minute: Why Do Companies Buy Back Shares?

Buybacks vs. Dividends

When deciding how to allocate capital, companies have the choice between buybacks and dividends.

As mentioned, a buyback helps reduce the number of shares available for sale on the market and thus increasing their value.

Dividends are when a company declares a portion of its earnings as payments to shareholders. (Dividends can also be paid by issuing debt or a company’s savings, but this is less common for good reason as dividends are ultimately sustainable from the earnings of the company.)

Both options offer different benefits and drawbacks that should be taken into consideration before making any decisions.

Buybacks provide an immediate boost to shareholder value because they reduce the supply of shares on the market, thereby pushing up their prices (holding all else equal).

In contrast, dividend payments provide a more predictable and consistent stream of income for shareholders. This helps to boost investor confidence, as it allows them to plan ahead in terms of budgeting their gains from the company’s stock.

Moreover, dividends also act as an attractive incentive for potential investors since they tend to be associated with well-established companies that generate steady profits.

Dividends also tend to be “more visible” – that is, it’s a clear signal to the market whereas buybacks are less understood and less apparent.

It is up to each individual company to decide which option best suits its needs and objectives.

In the end, the choice should be based on the company’s goals, financial situation, and market conditions.

Each strategy has its own advantages and disadvantages that must be weighed carefully before making any decisions.

Why Apple, Warren Buffett, And Others Use Stock Buybacks

Is a Stock Buyback an Expense That Affects Earnings on the Income Statement?

No, stock buybacks are not considered an expense on the income statement.

A stock buyback is when a company repurchases its own stocks from investors to reduce the number of outstanding shares in the market.

This reduces the amount of equity available, thus increasing earnings per share (EPS).

As such, it doesn’t show up as an expense on the income statement because it simply redistributes existing assets.

Therefore, while stock buybacks often have an effect on a company’s overall financial performance, they don’t affect the bottom line.

Instead, companies should look to other factors such as operating expenses and revenue for guidance on what their profits might be at any given time.

Risks of Share Buybacks

Share repurchases can come with risks.

There is an opportunity cost associated with buying back shares. The cash used to repurchase shares could be invested in other ways, such as a new product line or research and development efforts.

Moreover, when companies are under pressure from shareholders to return capital through buybacks, they may take on more debt to finance the repurchases. This can increase their debt burden and lead to financial distress if they are unable to service the debt.

The success of a share buyback also depends on being able to accurately value its own shares. Overpaying for shares can be costly for shareholders because it won’t be an efficient use of resources.

FAQs – Why Do Companies Buy Back Shares?

Is it good if a company buys back stock?

Yes, companies buying back their own stock can be beneficial for shareholders.

When a company purchases its own shares, it reduces the total number of outstanding shares and increases the ownership stake that existing shareholders have in the business.

This typically leads to an increase in earnings per share (EPS). This is because the same amount of profits are spread over a smaller number of shares.

In addition, repurchasing shares can boost investor confidence by signaling management’s belief that their company’s stock is priced at attractive levels and its future outlook is healthy.

Finally, reducing outstanding shares through buybacks also helps counteract dilution from employee-driven share issuances such as option plans and vested restricted stock units (RSUs).

So overall, buybacks can be a good sign for existing shareholders and could potentially lead to an increase in the value of their shares.

However, it is important to note that buybacks do not always serve as a positive signal.

Large share repurchases often indicate that management does not have any better use for its cash at the moment or believes that alternatives such as making acquisitions or investing in research and development (R&D) may provide a lower rate of return.

Therefore, investors should still exercise caution when evaluating whether a stock buyback is a positive or negative signal.

Why do companies buy back shares instead of issuing dividends?

Companies may choose to buy back shares instead of paying dividends for a few reasons.

First, share repurchases are less costly than dividends in terms of taxes. Companies are not subject to double taxation on the profits they use to repurchase their own stock, but they must pay taxes on any dividend payments made.

Second, unlike dividends, which are paid out at regular intervals and can generate ongoing expenses for the company, share repurchases can provide a one-time boost to EPS without long-term commitments or liabilities.

In short, dividends are assumed to be a permanent commitment (when they’re not a share price is typically hit materially) while buybacks don’t carry such a permanent commitment.

Finally, while shareholders who receive dividends directly benefit from them, those who remain invested after a buyback could potentially have an increased ownership stake in the business due to the reduction in the total number of outstanding shares.

Overall, share repurchases can be a beneficial way for companies to return cash to shareholders while avoiding costly taxes and long-term liabilities.

However, investors should still consider the context in which these decisions are made and determine whether they truly reflect underlying fundamentals or are more likely part of a short-term strategy focused on boosting EPS temporarily.

What happens to the share price after a buyback?

The effect of a buyback on share price can vary depending on the current market conditions.

If investors believe that there are better opportunities elsewhere or have doubts about the company’s future outlook, repurchasing shares may not be enough to boost its stock price.

On the other hand, if management is seen as making a wise investment decision and signaling confidence in their own company, this could lead to an increase in investor confidence and potentially result in a higher share price.

Ultimately, what happens to the share price after a buyback will depend on how much investors value the company’s decision relative to other available options for deploying capital.

But generally speaking, reducing the total number of outstanding shares can have a positive impact on the stock price by increasing demand and reducing the supply of available shares.

In addition, repurchased shares may be retired or held as treasury stock, which can reduce the company’s overall cost of capital and potentially lead to higher earnings per share in the long run.

Do I lose my shares in a buyback?

No, you do not lose your shares in a buyback.

All else equal, it will increase the value of your shares as the company is essentially reducing the total number of outstanding shares, making each remaining share more valuable.

However, if you choose to sell your shares during or after a buyback, it is important to be aware that there can be tax implications depending on how long you have owned the stock and what type of account you hold it in.

It is always advisable to consult with a tax professional prior to making any decisions related to selling your shares.

Finally, keep in mind that while buybacks can be beneficial for existing shareholders, they are not guaranteed to increase the value of their investment.

What are the disadvantages of the buyback of shares?

One of the primary disadvantages of share repurchases is that they can signal a lack of confidence in the company’s ability to grow the company. In other words, it says that returning capital to shareholders by shrinking the equity base is the best idea.

Shareholders may perceive such decisions as an indication that management does not believe there are better opportunities for investors elsewhere, and this could lead to a decrease in investor confidence and potentially result in lower share prices.

Furthermore, buybacks may be seen as an effort by management to artificially boost EPS by reducing the total number of outstanding shares without necessarily improving underlying fundamentals. Such strategies can be detrimental if they fail to create lasting value and instead only serve as a short-term solution.

A company can also buy back shares when they are more than fully valued, which means it may not be the best use of capital.

Finally, companies who choose to deploy capital into buybacks must also consider the opportunity costs of not investing elsewhere and must do so in a way that is consistent with their overall business strategy.

Overall, while share repurchases can be beneficial for existing shareholders, they should only be undertaken if management believes it will create lasting value and not as a means to engage in short-term financial engineering.

Conclusion – Why Do Companies Buy Back Shares?

Overall, share buybacks can be an effective tool for companies to increase shareholder value and reduce volatility in their stock price.

However, it is important to remember that these programs are initiated at the discretion of management and should always be evaluated on a case-by-case basis.

In general, stock buybacks can help boost shareholder value, increase EPS, and signal confidence in the company’s stock by management. Companies need to weigh the pros and cons of such a strategy before deciding whether it is right for them.