Vault Markets Review 2025

Awards

- Best Customer Service Africa 2022

- Fastest Growing Broker Nambia 2022

- Most Secure Broker South Africa 2022

- Most Innovative Broker South Africa 2022

- Fastest Withdrawals Africa 2021

- Best New Forex Broker Africa 2021

- Best MT4 Online Trading Solutions Provider Africa 2021

Pros

- A specialist broker for African traders

- MT4 and MT5 trading platforms

- Leverage up to 1:1000 is higher than most competitors

Cons

- No demo account makes it difficult for traders to test broker's services

- No top-tier regulatory oversight raises safety issues

- Trader reviews flag some scam concerns

Vault Markets Review

Vault Markets is a Namibian-based, online brokerage aimed at African traders. Clients can access various instruments on the MT4 terminal, from stocks and forex to precious metals and cryptos. Our review covers minimum deposit requirements, the registration process, account types, customer service operating hours, how to withdraw funds and more. Find out whether to sign up and start trading with Vault Markets.

Vault Markets Headlines

Vault Markets was established in July 2021 and is owned by 1st Fintech Capital (Pty) Ltd. The broker is regulated and authorized as a financial services provider by the Financial Sector Conduct Authority (FSCA) in South Africa. With that said, it is worth noting that 1st Fintech Capital is an intermediary between clients and Karibu FX Financial Consultant Services Pty Ltd. This company operates from the Republic of Namibia where it has various offices and does not hold a reputable financial license.

The founder and management team are made up of experienced international traders from the forex industry. Primarily aimed at African retail investors, the online brokerage is available in four countries, boasting over 10,000 registered users.

Vault Markets aims to provide a fully customizable trading environment, with several accounts, training courses and accessible investing tools.

The brand has been put forward for several awards, including the Most Secure Broker (Africa) and Most Innovative Broker (Africa) at the Investor Awards 2022, plus recognition from the World Business Outlook in 2021 as the Best New Forex Broker (Africa) and Best MT4 Online Trading Solutions Provider (Africa).

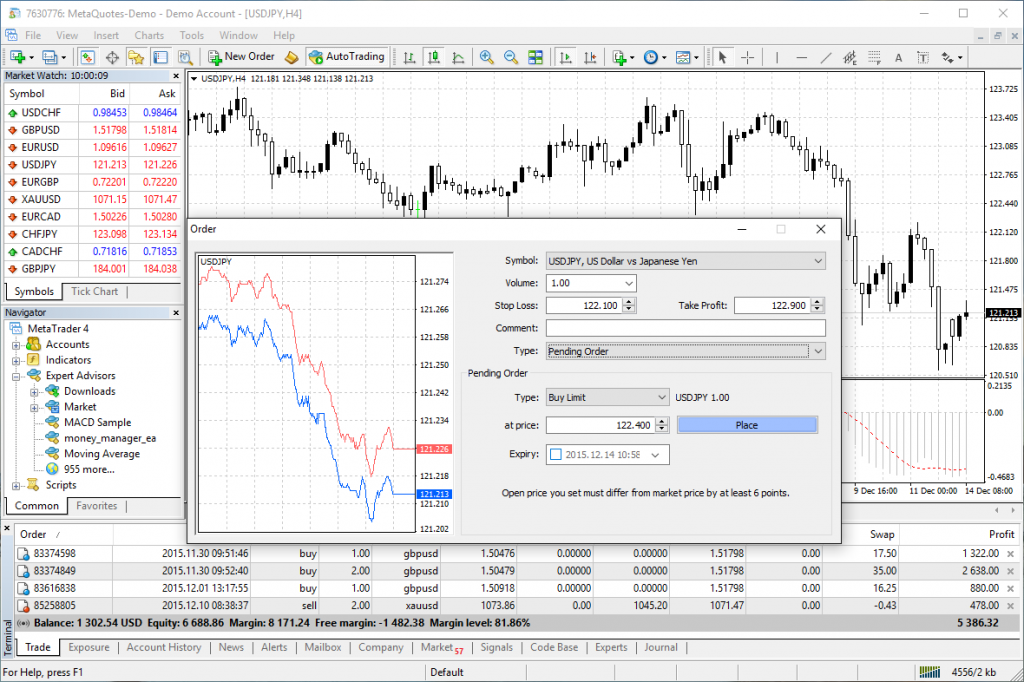

Trading Platforms

Vault Markets offers the MetaTrader 4 (MT4) terminal. The broker also offers MetaTrader 5 (MT5). On the negative side, there is no proprietary platform available.

You can download the MetaTrader server platform for Windows devices or trade via major web browsers. The broker’s website provides a free download link.

Key functionality includes:

- Nine timeframes

- Two market orders

- Multilingual interface

- Fully customizable charts

- Available in 30 languages

- Four pending order types

- Three execution modes

- One-click order execution

- MQL4 programming language

- 30+ built-in technical indicators

- Two stop orders and a trailing stop

- Trade forex, indices, equities and CFDs

- Direct access to Expert Advisors and automated trading systems

Assets & Markets

3.4 / 5The broker offers a range of trading products for retail clients:

- Commodities – Take positions on precious metals plus oil

- Indices – Trade on 10+ of the world’s largest stock indices including NAS100 and US30

- Forex Pairs – Trade 200+ major and minor currency pairs including GBP/EUR and USD/GBP

- Stocks – Go long or short on big brands from financial services, manufacturing, technology and more

- Cryptocurrencies – Speculate on five established digital currency coins including Bitcoin and Ethereum

Spreads & Fees

Costs vary by account type, with spreads starting from 1 pip across most instruments. The Zero Spread Account features pips from 0.0 with a competitive commission. Rollover fees also apply if you hold positions overnight and there is a $10 monthly charge for accounts left dormant for a year. Overall, trading costs are in line with the industry.

Leverage

Leverage also varies by account type. But as an overseas company, the broker can offer substantial margin trading opportunities with limited regulatory restrictions. The maximum margin is available with the Leverage Account, offering up to 1:1000. This means a $10 deposit would provide traders with $10,000 in purchasing power.

Of course, highly leveraged trading can magnify losses as well as profits. With that in mind, make sure you take a careful approach to risk management.

Mobile App

Vault Markets offers a proprietary mobile app. Traders can download the app for iOS and Android (APK) devices directly from the broker’s website or via the relevant app store. Huawei compatibility and download options are also due to be available soon.

Clients can manage their account, check live pricing and view historical trading activity while on the go. MT4 and MT5 are also available as mobile applications. MT4 integrates various analytics tools, powerful forex trading functionality, interactive charts, full investment history and more. The MT5 features real-time quotes, financial news, customizable graphs and technical analysis.

Payment Methods

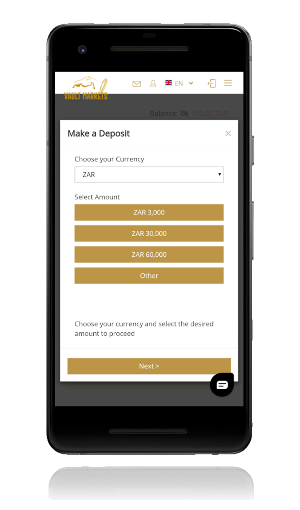

Deposits

Vault Market’s minimum deposit requirement varies by account type and payment method. The No Bonus Account, for example, requires the lowest initial funding of just $5. Other accounts are subject to a minimum funding value of $100. The broker accepts multiple deposit options with ZAR, USD and TZS available as account denominations.

Payment methods include:

- Bank Wire Transfer – Local transfers only

- Online Transfers – Perfect Money, MTN Mobile Money and M-Pesa

- Cryptocurrencies – Currently Bitcoin is the only accepted digital currency

- Credit/Debit Card – MasterCard or Visa. Typically provides instant fund processing

Third-party charges may apply when making deposits and withdrawing profits. Deposit times can also vary, particularly for wire transfers due to bank operating hours. Once processing is complete, Vault Markets aims to make funds available instantly. Simply select the deposit icon from the menu within the client/members area and choose your deposit method.

Withdrawals

Withdrawal payment options are limited to bank wire transfers. Vault Markets has a quick approval process, with payouts received by clients within several working hours. With that said, weekend dates and public holidays may cause delays. This review was pleased to see no minimum or maximum withdrawal limits.

Demo Trading

There is no MT4 demo account option available to new or existing Vault Markets clients. This means no virtual funds to practice strategies risk-free and learn platform features and tools. This is disappointing as paper trading accounts are standard practice and benefit beginners, in particular. As an alternative, new starters may want to sign up for a low minimum deposit account.

Deals & Promotions

At the time of writing, the broker did not offer financial incentives beyond the standard account promotions outlined further below. This includes a welcome bonus and a no deposit bonus. Previous incentives have included R50, R100 and R1000 in no deposit credit.

The maximum bonus allowed within an account at any time is R300,000 on Vault 200 and Vault 100 or the equivalent currency per respective trading account.

Importantly, FSCA regulatory guidelines do not impose restrictions on bonus offerings. Nonetheless, always review the terms and conditions of financial incentives as unrealistic volume thresholds and requirements may be set.

A ‘refer a friend’ and affiliate program are available. The referral incentive permits a financial reward of up to 10% of the value deposited by your referee. Lifetime tradebacks are also available on trades executed by your referee.

Regulation & Licensing

Vault Markets is a product of 1st Fintech Capital (Pty) Ltd, South Africa. The owner company is an authorized financial services provider, licensed and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, FSP number 51478.

However, derivatives are issued by Karibu FX Financial Consultant Services Pty Ltd, a company established and operating in the Republic of Namibia, registered under company number 2019/0459. Essentially, the broker is trading offshore with limited customer protection measures or regulatory oversight.

Note, that Vault Markets does not offer services to US citizens/residents.

Additional Features

Vault Markets does offer some basic educational resources and content. This includes Spotify podcasts, an online forum, free PDF e-books and a weekly newsletter. These are helpful for new or inexperienced investors. Integrated YouTube video content is also available on the website. In addition, you can find broker-specific information on the official site, including typical execution speeds, understanding lot sizes, how to complete document uploads to the client portal, different account features and examples of successful trades. Finally, training courses are available.

Unfortunately, Vault Markets does not provide useful tools such as an economic calendar or pip calculator within the member’s area. These would be helpful additions for fundamental traders looking to stay up to date with market events and calculate margin, swaps, plus profit and loss.

Live Accounts

Vault Markets offers various types of accounts to retail investors. This includes bonus accounts, an Islamic account and a leveraged trading account. Minimum deposit requirements start from just $5 or equivalent currency. All accounts can be opened in USD, TZS or ZAR base currencies.

Bonus Account (50%, 100%, 200%)

- Spreads from 1 pip

- Instant withdrawals

- $5 minimum deposit

- Hedging not permitted

- Trade forex, shares, indices and cryptocurrency

Islamic Account

- Spreads from 1 pip

- Instant withdrawals

- Up to 1:500 leverage

- $100 minimum deposit

- Trade forex, shares, indices and cryptocurrency

No Bonus Account

- Spreads from 1 pip

- Instant withdrawals

- $5 minimum deposit

- Up to 1:500 leverage

- Trade forex, shares, indices and cryptocurrency

Weekend Trading Account (Coming Soon)

- Instant withdrawals

- $5 minimum deposit

- Trade VIX75, VIX100 and cryptocurrency

1:1000 Leverage Account (Limited Time Availability)

- Spreads from 1 pip

- Instant withdrawals

- $100 minimum deposit

- Maximum leverage 1:1000

- Trade forex, shares, indices and cryptocurrency

USD Cent Based Account

- Spreads from 1 pip

- Instant withdrawals

- $5 minimum deposit

- Maximum leverage 1:500

- Trade forex, shares, indices and cryptocurrency

Importantly, it is easy to open a new live trading account. All registration details must be completed via the Vault Markets website. This includes completing the online registration form, uploading identity verification documents such as a passport, and providing proof of residency. KYC and AML verification and protocols apply.

Note, that there is a minimum age limit of 18. Once personal details have been approved, you can log in with your unique profile number and start trading immediately.

Trading Hours

The published Vault Market trading hours are Sunday from 11 PM (GMT +2) to Friday 11 PM (GMT +2), however, this may vary by instrument. Typically, the forex market is available 24 hours per day between Sunday and Friday.

A session timetable is available on the broker’s website so you can stay up to date with upcoming public holidays, daily break sessions, market closures, and office operating hours.

Customer Service

Vault Markets offers several customer support options. This includes a phone number, email address and live chat. 24/7 availability is promoted for phone services and other methods are available within standard working hours.

It was disappointing to see no international contact options. Traders can, however, visit the FAQ section of the official website for self-help topics, including how to upload identification documents, the minimum amount to trade and general terms and conditions.

Contact details:

- Email Address – help@vaultmarkets.trade

- Online Contact Form – Located within the customer contact webpage

- Live Chat – Logo located in the bottom right of the website. Services hosted by WhatsApp via QR code

- Social Media – Accounts including Twitter and Instagram are refreshed with the latest broker news and responses to customer queries

- Helpline Contact Number – +27104496045 for South African clients, +255742297685 for Tanzanian clients and +264813682400 for Namibian clients

Security

The MT4 platform follows comprehensive safety protocols. Personal and financial data is exchanged between the broker and terminal using the latest encryption technology. We would also recommend implementing additional security features such as two-factor authentication (2FA) at the login stage. This added layer of security uses a verification code every time you log in to your online account via an authenticator app or email address prompt.

Vault Markets Verdict

Our VaultMarkets.com broker review has highlighted the pros and cons of trading with the organization. We were pleased with the low minimum deposit requirements, range of account types, MT4 trading terminal and customer contact options. However, some information was misleading, highlighting concerns around transparency and legitimacy.

Be careful when opening an account with overseas brokers – regulatory protections are limited and your capital may be at risk.

FAQs

Is Vault Markets Legit And Safe?

Our Vault Markets review raises some concerns around legitimacy. Peer review sites indicate poor customer service ratings, complaints, warnings of scams and a significant lack of regulatory and fee transparency.

Who Is The Owner Of Vault Markets And Are They Regulated?

Vault Markets was developed by 1st Fintech Capital. Karibu FX Financial Consultant Services Pty Ltd is the registered derivatives provider. This company operates from the Republic of Namibia with limited regulatory oversight.

Does Vault Markets Have A ZAR Account?

Yes, Vault Markets offers ZAR, USD and TZS account denominations.

Does Vault Markets Have A Demo Account?

Vault Markets does not currently offer a demo account, which is disappointing vs competitors like Trade245 and Veracity Markets.

What Is The Minimum Deposit Requirement For A Vault Markets Account?

Minimum deposit requirements vary by account type. Beginner accounts have initial funding requirements of just $5 or currency equivalent.

Is Vault Markets A Good Broker?

Vault Markets is an award-winning broker that has amassed thousands of registered users since it launched in 2021. Clients can trade on MT4 and MT5. Head to the official website or our review for the minimum deposit and amount to trade for the Nasdaq, how to change leverage trading levels, and for details on how long withdrawals take.

Can You Trade NAS100 With Vault Markets?

Yes – clients can trade on the US Nasdaq from within the broker’s MetaTrader 4 terminal. Spreads start at 1 pip and leverage up to 1:1000 is available.

How Long Does Vault Markets Withdrawal Take?

The online broker aims to process withdrawals within several working hours. Clients can withdraw profits using bank wire transfers.

Does Vault Markets Have A Bonus Offer?

Vault Markets offers a live trading account that provides staggered bonuses at 50%, 100% and 200%. Clients can create an account using the sign-up link below or by heading to the broker’s official website.

Who Owns Vault Markets?

Vault Markets is owned by 1st Fintech Capital. The firm is based in the Republic of Namibia.

Top 3 Alternatives to Vault Markets

Compare Vault Markets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Vault Markets Comparison Table

| Vault Markets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.3 | 3.6 | 4 |

| Markets | Forex, Stocks, Indices, Commodities, Cryptocurrencies | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $5 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FSCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | 200% Account Opening Bonus | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 6 | 6 | 11 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Vault Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Vault Markets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

Vault Markets vs Other Brokers

Compare Vault Markets with any other broker by selecting the other broker below.

The most popular Vault Markets comparisons:

Customer Reviews

There are no customer reviews of Vault Markets yet, will you be the first to help fellow traders decide if they should trade with Vault Markets or not?