Valutrades Review 2024

Pros

- Excellent pricing from zero pips and lightning-fast execution

- No minimum deposit will appeal to traders on a budget

- Strong selection of forex pairs with over 80 assets

Cons

- Only one account type restricts flexibility

- Subpar market research and analyst insights

- Narrow range of non-forex assets especially commodities

Valutrades Review

Valutrades.com is a UK-based forex broker offering multi-asset trading on the MT4 and MT5 platforms. Continue reading for a review of spreads, leverage, and minimum deposits. Find out whether you should start trading with Valutrades.

Valutrades Company Overview

Valutrades Limited was established in 2012. As well as its London headquarters, the broker has a registered office in Seychelles.

Valutrades is regulated by the Financial Conduct Authority (FCA) in the United Kingdom and the Financial Services Authority (FSA) in Seychelles.

The company offers online trading in forex, commodities, and index CFDs to thousands of clients from over 70 countries. The core team, including CEO Graeme Watkins and Advisor Gavin Foster, are based in London.

Trading Platforms

MetaTrader 4

Valutrades offers the award-winning platform – MetaTrader 4, suitable for both beginners and expert traders. With MT4, traders can analyse markets and price dynamics using a host of advanced tools and algorithmic trading strategies.

Features include:

- 30 built-in technical indicators & 24 graphical objects

- 9 time-frames, from one minute to one month

- Multiple order types and execution modes

- Automated investing Expert Advisors (EAs)

- Real-time pricing in Market Watch

- Historical market data

- One-click trading

- 3 types of charts

MT4 is compatible with Windows 7 operating systems and above and is available to download directly from the broker’s website.

MetaTrader 5

As the successor to MT4, the MT5 platform offers a powerful, all-in-one trading experience with a host of advanced features. Traders can open over 100 charts simultaneously for seamless market forecasting on top of other tools, including:

- 38 technical indicators, 44 graphical objects, & unlimited charts

- 21 time-frames with additional minute and hour charts

- Access to Expert Advisors (EAs)

- Historical price data

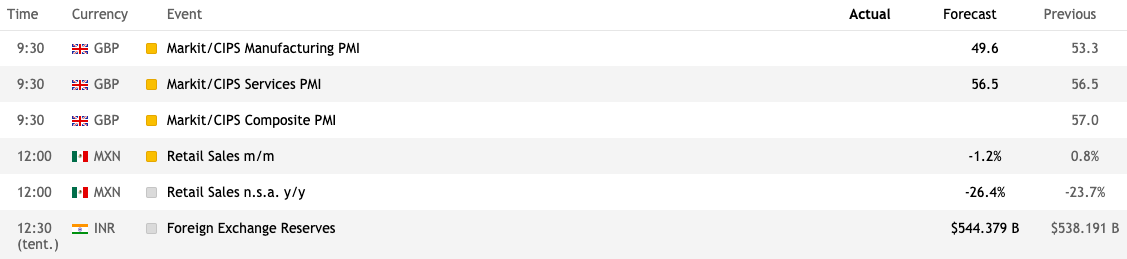

- Economic calendar

- One-click trading

- Market Depth

MT5 can be downloaded from the ‘Platforms’ page on the broker’s website.

MetaTrader WebTrader

The MetaTrader platforms are also available in web-based versions, meaning users have easy access to trades without needing to download any applications. WebTrader offers access to all the same features as the desktop platform, including three types of charts; bars, candlesticks, and lines, as well as a variety of indicators and graphical objects for advanced analysis.

WebTrader is compatible with all major internet browsers and can be accessed from the broker’s website.

FIX API

FIX 4.4 API uses the Fix Protocol method of trading which allows clients to trade directly on Valutrades’ ECN matching engine. Users are given direct market access to forex, CFDs, and commodities. Fix Protocol is suitable for anyone with API knowledge.

Traders will need to contact customer support and submit their email address to set up their FIX API account.

Markets

Valutrades offers trading across three main markets:

- Forex – Trade over 80 majors, minors, and exotics, including EUR/USD, USD/JPY, and GBP/EUR

- Commodities – Trade on precious metals and oils, such as gold and crude oil

- Index CFDs – Trade on global indices such as the FTSE 100 and S&P 500

Spreads & Commission

Spreads at Valutrades are competitive, starting from 0.2 pips for major pairs such as the EUR/USD. Typical crude oil spreads are around 0.018 and for the FTSE 100, spreads are approximately 0.7.

A forex commission is charged at $3 per side with the standard ECN account. Details of other charges such as swaps, dividends, rollovers, end of day rates, and margin rates, can all be found on the ‘Trading Products’ page of the broker’s website.

Leverage

At Valutrades UK, leverage is offered at a maximum of 1:30. The 1:30 leverage cap is a result of European regulations that regulated brokers must follow to limit client risk exposure. At Valutrades Seychelles, the maximum leverage is 1:500.

Mobile Apps

The MT4 and MT5 mobile apps allow users to analyse market information 24 hours a day, wherever they are, with complete control over accounts. Technical analysis tools, one-click trading, and market depth are available, as well as mobile-friendly features such as live mobile chat and push notifications.

The mobile apps are compatible with iOS and Android smart devices and can be downloaded from the App Store or Google Play store.

Payment Methods

Deposits

Accounts can be funded using a number of fast and fee-free payment methods. These include bank wire transfer, credit and debit cards, as well as e-wallets, such as Skrill and Neteller. There is no minimum deposit requirement, making Valuetrades an accessible option for beginners.

Bank wire transfers tend to take 3 – 5 business days while credit and debit card payments are usually credited the same day.

Withdrawals

Withdrawals can be made via the same methods at a minimum of 50 in the chosen currency. The broker aims to process all withdrawals within 24 hours.

Valutrades offer all of their clients three free withdrawals per month, which renews on the 1st of each month. A 5% processing fee is then charged from the fourth withdrawal, however, clients can always choose to defer the fourth payment to the following month to avoid the fee.

Demo Account

Available on desktop, mobile, and web, the MetaTrader demo accounts offer a variety of analytical indicators, EAs, economic calendars, and more. Users can set their own limit in terms of virtual funds, but note the account will expire if not used within a month.

Deals & Bonuses

As per regulatory restrictions, Valutrades does not offer any deposit bonus deals or rebate promotions.

Regulation

Valutrades Limited (UK) is licensed and regulated by the Financial Conduct Authority (FCA) with registration number 586541. Valutrades (Seychelles) Limited is authorised and regulated by the Financial Services Authority of Seychelles, with Securities Dealer License number SD028.

Under both sets of regulatory frameworks, Valutrades holds client money in segregated accounts with reputable banking institutions. Guaranteed negative balance protection is also provided. For Valutrades UK, investor protection is also provided under the Financial Services Compensation Scheme (FSCS) up to £85,000 per person.

Additional Features

Valutrades offers additional resources for beginners who wish to learn the basics and for experts who wish to expand their knowledge. The education centre contains training resources on economic indicators, forex trading strategies, webinars, and blogs, as well as useful tools such as an economic calendar and custom indicators for MT4.

For those who trade at least 10 lots per month, Valutrades also offers two high-performance VPS (Virtual Private Server) options.

Accounts

The standard account offered at Valutrades is their ECN account. The account is designed for active traders, offering scalping opportunities, EAs, news trading, and no limits on the number of open orders.

FX commission is charged at $3 per side and there is no minimum deposit, although traders should bear in mind margin requirements.

Traders can also apply for professional status and gain access to higher leverage. Details of this are provided by the customer support team.

Trading Hours

Trading hours for forex run from 01:00 to 23:59 UK time. For precious metals, the server opens at 01:01 and closes at 23:59 UK time. UK oil markets run from 03:00 to 00:00 and US oil markets run from 01:00 to 00:00. For indices, operating times vary and can be found on the ‘Trading Products’ page on the website.

Customer Support

There are several ways of getting in touch with Valutrades:

- Email – sales@valutrades.com

- Telephone – +44 (0) 202 3141 0888

- Online contact form – Contact Us page

- Live chat – Located in the bottom right-hand corner of the website

On testing the live chat service, responses were helpful and received quickly.

Valutrades Limited is headquartered at 51 Eastcheap, London, EC3M 1JP, United Kingdom.

Client Security

Valutrades ensure client data is fully encrypted on both the trading platforms and within the client portal. The MetaTrader platforms use industry-standard Secure Sockets Layer (SSL) encryption as well as the option to enable Two-Factor Authentication (2FA) upon login. The broker is also PCI-compliant (Payment Cards Industry Data Security Standard).

Valutrades Verdict

Whilst non-forex products may be slightly limited, Valutrades offers low spreads and advanced trading on the MT4 and MT5 platforms. The FCA regulation also ensures a safe trading environment while the no minimum deposit makes it an accessible broker for beginners.

Top 3 Alternatives to Valutrades

Compare Valutrades with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

Valutrades Comparison Table

| Valutrades | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 4.3 | 3.5 |

| Markets | Forex, CFDs, indices, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | – | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Valutrades and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Valutrades | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

Valutrades vs Other Brokers

Compare Valutrades with any other broker by selecting the other broker below.

FAQ

Where is Valutrades based?

Valutrades is headquartered at 51 Eastcheap, London, EC3M 1JP, United Kingdom, with an additional office in Seychelles.

What leverage is offered at Valutrades?

At Valutrades UK, leverage is offered up to 1:30 and at Valutrades Seychelles, leverage is offered up to 1:500.

How can I open a Valutrades account?

You can open either a demo account or a live account from the top right-hand corner of the website. You will need to fill in an online registration form which asks for your details, background, and initial requirements.

What is the minimum deposit at Valutrades?

There is no set minimum deposit amount at Valutrades, but bear in mind the margin requirements of the instruments that you wish to trade.

Is Valutrades regulated?

Yes, Valutrades UK is licensed by top-tier regulator, the Financial Conduct Authority (FCA). The broker is also regulated by the Financial Services Authority (FSA) in Seychelles.

Customer Reviews

There are no customer reviews of Valutrades yet, will you be the first to help fellow traders decide if they should trade with Valutrades or not?