UOB Kay Hian Review 2025

See the Top 3 Alternatives in your location.

UOB Kay Hian Review

UOB Kay Hian is a Malaysian broker that specialises in forex but has a wide range of markets that users can trade. This review will discuss details on the firm’s history, its focus on investor relations, the platforms and assets on offer, its pricing structure and more. Find out whether to start trading with UOB Kay Hain today.

UOB Kay Hian Headlines

UOB Kay Hian Holdings Ltd is an investment bank and brokerage firm based in Asia, though the company also has expanded to acquire branches across the globe in Toronto, Canada, London, the UK and New York, the USA. The seven main Asian offices are in Hong Kong (HK), Jakarta, Indonesia, Kuala Lumpur and Bukit Mertajam, Penang, Malaysia, Shanghai, China, Manila, the Philippines, Bangkok, Thailand and Singapore, where the UOB Kay Hian head office is.

The three UOB Kay Hian Holdings Ltd shareholders who have the largest number of ownership shares are Tye Hua Nominees Private Ltd, U.I.P Holdings Ltd and UOB Kay Hian Private Ltd.

The broker offers trading services on a range of assets, including stocks, bonds, futures and CFDs, for both retail and institutional clients, though the primary focus is on forex. UOB Kay Hian’s market cap is over $1 billion and the share/stock value and financial results can be checked on sites like TradingView. The broker is also one of the few Singaporean brokers that offer stop-limit orders on US stocks, allowing users to set a target price to limit losses.

Brief History

Launched at the beginning of the 20th century by Khoo Kay Hian, the then-called Kay Hian & Co (Pte) traded commodities and securities. The firm was one of the founding members of the Stock Exchange of Malaysia and Singapore. Kay Hian & Co (Pte) was incorporated as a private company in 1970 and became a member of the stock exchange following the splitting of the Stock Exchange of Malaysia and Singapore. In 1981, the current CEO Wee Ee-Chao joined the company as Managing Director and was later promoted to Chairman in 1996.

In 2001, Kay Hian & Co (Pte) was renamed UOB Kay Hian Holdings Ltd following a merger with UOB Securities Pte Ltd and The United Overseas Bank Group. During the years following the turn of the new millennium, UOB Kay Hian merged with the corporation United Mok Ying Kie Ltd and acquired sales bases of Credit Suisse First Boston and JM Sassoon, amongst others. Recently, in 2019, UOB Kay Hian bought and transferred the remisier base from DBS Vickers.

Platforms & Markets

UTRADE

UTRADE is UOB Kay Hian’s main platform, where users can trade ETFs, forex, stocks, CFDs, bonds, and Unit Trusts. UTRADE has a range of advanced features, including automated trading support, customisable indicators, charting tools, stock scanners, integrated screeners and graphical analysis objects. Creating an account with UOB Kay Hian on the UTRADE platform is free and there is no minimum deposit, making it highly accessible and competitive.

The assets supported by the UTRADE platform include:

- Stocks – Access to nine global markets such as the NASDAQ and London Stock Exchange, including IPOs.

- CFDs & ETFs – CFDs can be purchased on both equities and indices. Clients can trade as many as 500 assets, utilise up to 1:20 leverage on indices.

- Forex – Spreads as low as 0.8 pips for low-cost currency exchange. Over 30 currency pairs to choose from and leverage of up to 1:20.

- Bonds – Access to over 300 bonds made up of sovereign bonds, corporate bonds and dim sum bonds. Lower fees by placing bonds in custody with the Singapore Exchange’s Central Depository.

- Unit Trusts – Invest in funds that are managed by over 20 asset management companies with a range of different objectives and time horizons.

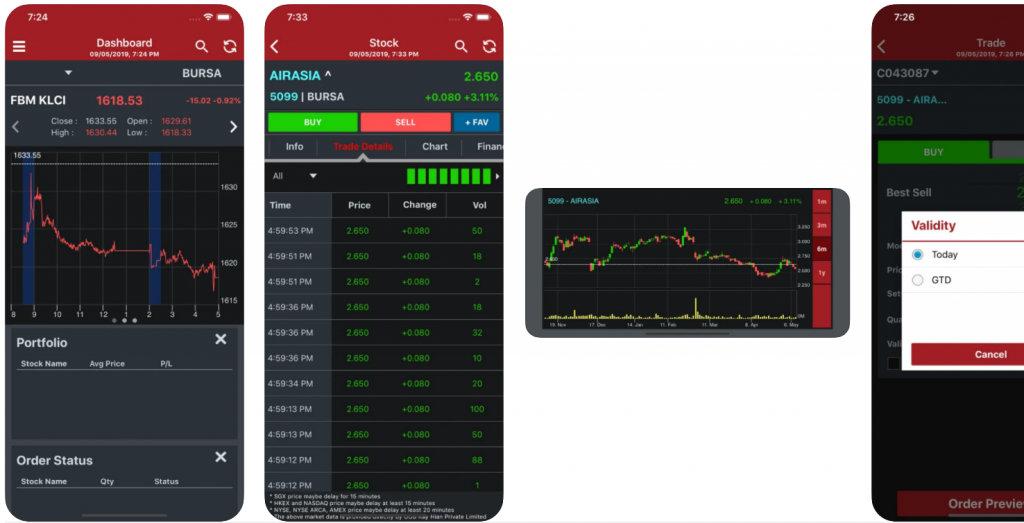

Mobile App

There is a UTRADE mobile trading app available on both Apple iOS and Android APK devices. The app can be downloaded by either scanning QR code links on the UOB Kay Hian website or searching application stores.

The UTRADE mobile app has a simple interface with real-time market information, account management, trading charts and integration with the ChartGenie, ShareXplorer and Stock Screener tools.

Accounts

There are several account options on UOB Kay Hian that provide different benefits and serve different purposes. The client onboarding process involves filling out a form to specify the account type and whether it is a joint account or not.

Securities Trading

The most basic trading account provides users access to equities, bonds, unit trusts, ETFs and other products in any of the Singapore, Hong Kong, Malaysia and US markets

UTRADE Edge

This UOB Kay Hian account offers lower commission and fees than the Securities Trading account. Users with a UTRADE Edge account have access to markets in Singapore, Hong Kong, Malaysia and the USA.

UTRADE PLUS

This is similar to the UTRADE Edge account, users must pay cash up front before making any trades. The key difference is that the fees and commission are lower than the Edge account and that users may only trade in SGX.

Payment Methods

To make a deposit in Singaporean dollars (SGD), users have several options. Options include cheques, GIRO form, EPS, bank transfers and internet banking bill payments, though the most convenient is through the PayNow system. This is a quick and easy way to make deposits as the funds are transferred almost instantly and at no extra cost. The process is simple as you can either type in UOB Kay Hian’s UEN into your mobile banking app or simply scan the QR code on their website. It is important to note that not all banks will allow you to use PayNow, so you should check to see the list of participating banks on UOB Kay Hian’s website.

If you are making a payment in CAD, GBP, CNY or EUR then you can only use a Telegraphic Transfer. Payments in USD can be made either through Telegraphic Transfer or by cheque.

Trading Fees

UOB Kay Hian clients are charged various online trading fees depending on location, account type, trading form and instrument. For example, the brokerage fee structure for Singapore is as follows:

Margin Account

- Positions less than 50,000 SGD – 0.275% commission

- Positions between 50,000 & 100,000 SGD – 0.22% commission

- Positions greater than 100,000 SGD – 0.1% commission

- All positions – minimum commission of 25 SGD

Edge Account

- Flat 0.18% commission, minimum 18 SGD

Plus Account

- Flat 0.12$ commission, minimum 10 SGD

Promotions

UOB Kay Hian has a number of promotions running. For example, clients can get ETF cashback thanks to a partnership with Bursa Malaysia and another bonus with Endowus Cash Smart provides users with up to 2% additional earnings per annum.

Customer Support

There is an extensive customer support service in place with teams of experienced traders and staff that users can contact either via hotline phone call or email between 08:30 and 17:30 SST during the day or between 22:00 and 02:00 SST for the night desk, Monday to Friday.

For all users, there is a personalised service with dedicated training teams that give one on one consultations and strategy advice as well as recommendations for alpha stock and share picks for trading. This is at the advice of business analysts like David Tay and Vincent Khoo.

Additionally, there are regular webinars and training sessions that provide a great opportunity for traders of all experience levels to learn more about different markets and hone their craft. There are also user guides for UTRADE, CFDs and LFX (leveraged foreign exchange) accessible through the FAQs section of the website.

To keep up to date with any news, such as quarterly and annual reports, announcements, financial reports and statements, annual dividend yields (including 2021) or other information, you can follow websites and social media channels like YouTube and Facebook or financial forums like Lowyat.

Regulation, Safety & Security

UOB Kay Hian is a legitimate broker that is licenced with the Monetary Authority of Singapore, which guarantees insurance and protection for users and their capital. Regulation by the MAS means that UOB Kay Hian is required to have certain protective measures in place, such as firewalls with safety checks, data encryption, an intrusion detection system and unique user IDs and passwords.

Traders can be assured that their investments are safe as their funds are placed in segregated trust accounts and there are account security features like 2FA for login attempts and transactions in addition to a system similar to ‘know-your-customer’, whereby users must submit personal ID documentation when opening an account.

If you believe your account may be compromised then you should contact UOB Kay Hian and reset your password. Additionally, users should try to avoid scams and phishing attempts by checking that any contact they receive from the broker has the correct credentials, such as the logo and email address. It is also important that you never give out your trading pin and, if you need to log into your account, go through the correct UOB Kay Hian webmail and website.

Benefits

- Low spreads

- Mobile trading

- MAS regulation

- Good asset variety

- Decent leverage rates

- Range of trading tools

- Access to several stock exchanges

Drawbacks

- No demo account

- No crypto trading

- Limited payment options

- Long registration process

UOB Kay Hian Verdict

UOB Kay Hian boasts a wide range of platforms, resources and trading instruments that provide its customers with competitive access to global financial markets.With many asset types, relatively cheap pricing, mobile trading support and several avenues of educational content and market analysis, the broker is a good choice for all levels of experience.

FAQs

What Are The Malaysian UOB Kay Hian Offices Near Me?

As well as the offices in Kuala Lumpur and Penang, there are additional branches in Kuala Terengganu, Kota Bharu, Kota Kinabalu, Johor Jaya, Kulai and Ipoh. If you wish to only trade online in Malaysia, then you can simply login to your account on the Utrade platform.

How To Withdraw Money?

The withdrawal process on UOB Kay Hian is very simple, you just log in to your account on the UTRADE platform, go to the ‘account’ tab, then to ‘trust’ and finally ‘withdrawal’ – ensure you have the correct bank account number and details for the money to withdraw to. Another option is to contact your local dealer directly.

What Are The Other UOB Group Subsidiaries?

Under the UOB Group umbrella, there is also the UOB Kay Hian Credit (m) Sdn Bhd, UOB Kay Hian Securities (m) Sdn Bhd, UOB Kay Hian Research (Pte) Ltd, UOB Kay Hian Wealth Advisors Sdn Bhd, UOB Kay Hian Nominees (Asing) Sdn Bhd, UOB Kay Hian (U.K.) Limited, UOB Kay Hian (U.S.) Inc. and UOB Kay H ian (HK) Ltd.

Where Can I Find Information About The UOB Board Of Directors?

Look at the broker’s website for UOB Kay Hian directors and management team info. You can also see LinkedIn profiles with employment history for directors such as Desmond Yeo or executive director Lim Seng Bee.

Can I Read UOB Kay Hian Glove Research Reports?

You can read glove analyst reports commissions by UOB Kay Hian on SGinvestors.io.

Best Alternatives to UOB Kay Hian

Compare UOB Kay Hian with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

UOB Kay Hian Comparison Table

| UOB Kay Hian | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 2.5 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, ETFs, Futures | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $3000 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | MAS | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:20 | 1:50 | 1:200 |

| Payment Methods | 1 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by UOB Kay Hian and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| UOB Kay Hian | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | Yes |

| Oil | No | No | Yes |

| Gold | No | Yes | Yes |

| Copper | No | No | Yes |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

UOB Kay Hian vs Other Brokers

Compare UOB Kay Hian with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of UOB Kay Hian yet, will you be the first to help fellow traders decide if they should trade with UOB Kay Hian or not?