6 Best Day Trading Tips

Every day trader has different financial goals, varying levels of risk tolerance, and preferred strategies based on their personalities and skill sets. However, the most successful day traders follow a core set of tips and tricks and maintain them during their trading lives.

Here are our 6 best day trading tips that we think every trader should follow:

- Educate yourself

- Choose a broker wisely

- Make a plan…and stick to it

- Manage risk

- Diversify

- Watch out for fake breakouts

Recommended Brokers

No day trading tips will work if the broker you use does not deliver a good experience and can't execute trades quickly and affordably. Here are our top 4 recommended brokers .

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

1. Educate Yourself

In the case of day trading, the importance of education is huge. When you’re putting your hard-earned cash on the line you need to know you’re performing as effectively as you possibly can.

Financial markets are highly complicated and often move in unexpected directions. Past performance is no guarantee of what lies ahead, and even the most experienced traders, analysts and market commentators regularly get things wrong.

Intense and regular learning will also help day traders familiarize themselves with the broad range of financial instruments they can use to build wealth. Stocks, commodities, currencies, and derivatives like contracts for difference (CFDs) are among the most popular instruments day traders have available to them.

Critically, traders often need a firm grasp of technical analysis to get ahead. Individuals who use short-term strategies (like scalpers and day traders in particular) rely heavily on charts to identify trends and seize trading opportunities.

So, those who know their Bollinger Bands and Golden Crosses from their Stochastic Oscillators have a distinct advantage.

Charlie Munger, who was Warren Buffett’s right-hand man at Berkshire Hathaway until his recent passing, famously said that “those who keep learning, will keep rising in life.” The $2.6 billion fortune that the notorious bookworm built over his lifetime is testament to the benefits of constant learning.

2. Choose A Broker Wisely

Day traders tend to spend lots of time on technical analysis but unfortunately, many fail to put in nearly enough legwork to find the best broker that suits their needs. That’s why one of our best day trading tips is to choose a brokerage carefully.

Not all day trading brokers are the same. The fees and charges that these platforms charge can differ greatly, as can the range of assets and financial products they allow customers to trade.

But these are not the only key considerations. Other important questions to ask include:

- Is their trading platform easy to use, and does it offer sophisticated features like charting tools and filtering options? CMC Markets offers an easy-to-use platform for active traders with a modern design and superb user experience.

- Does the firm offer an app that allows me to trade ‘on the go’? AvaTrade continues to offer a first-class app for mobile day traders. It’s also easy to learn for beginners.

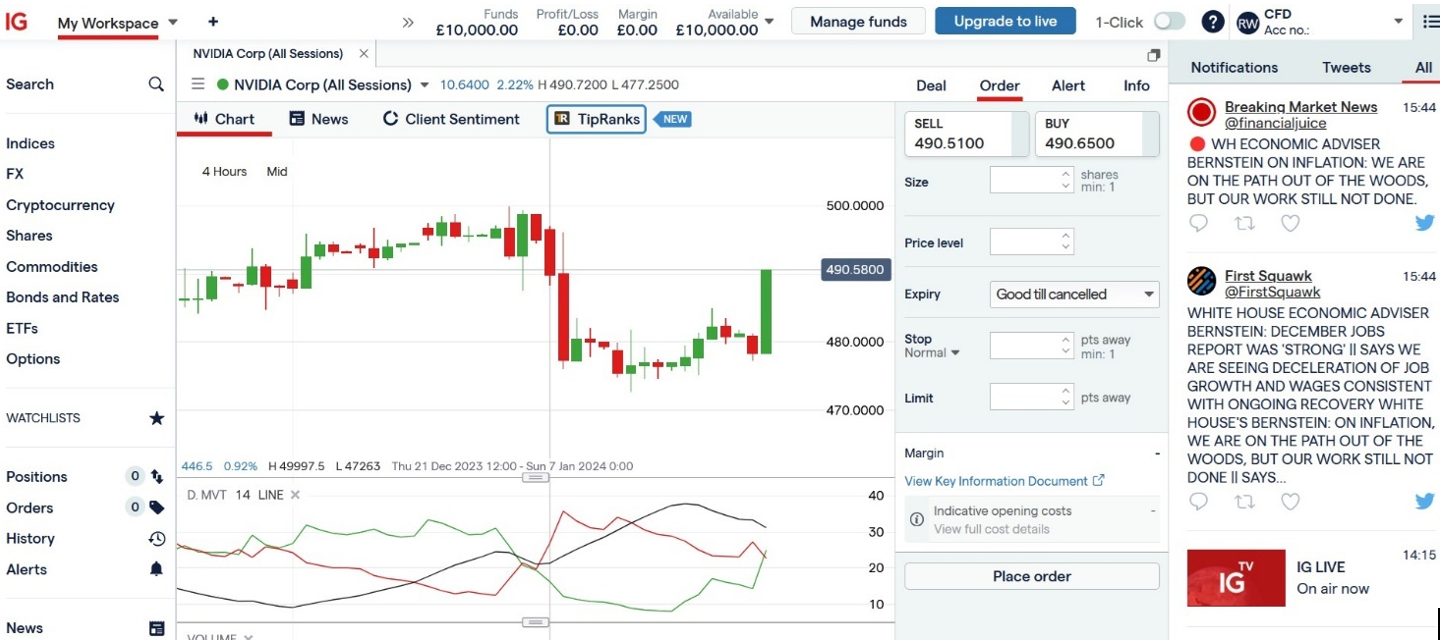

- Can I access research and analysis tools? IG offers best-in-class daily research and advanced technical analysis tools to help day traders find opportunities.

- Does the brokerage offer a demo account? Plus500 is one of a limited number of day trading brokers to offer an unlimited demo account so you can keep practising intraday strategies. This is a great perk for beginners especially.

- Are their trading fees low? IC Markets stands out as a low-cost broker for day traders with spreads from near zero that can help active traders keep costs down.

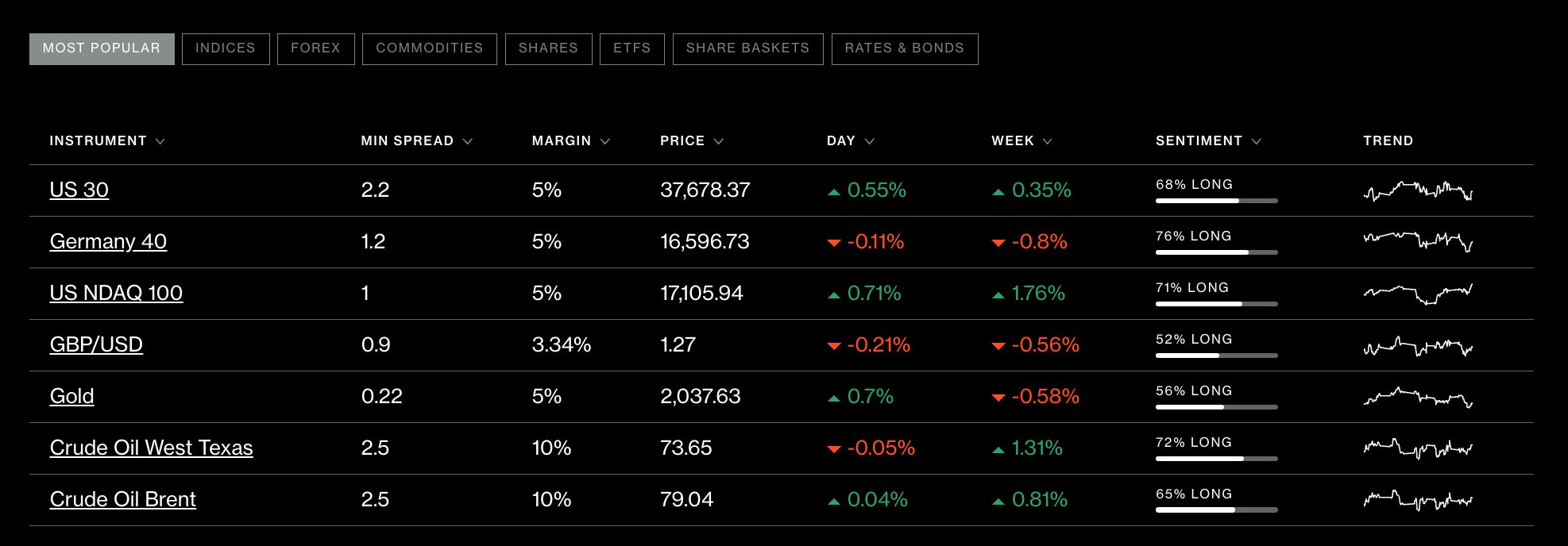

The amount of leverage that a day trader can use to potentially amplify their returns can also differ greatly from broker to broker. So traders whose trading strategies lean on using borrowed funds, which is common with intraday trading, should carefully consider the levels of gearing available on different financial instruments.

Most importantly, traders need to check that the brokerage they select is recognized and regulated by an industry body (such as the Financial Conduct Authority (FCA) in the UK). Failure to do so could leave your funds at risk and expose you to unscrupulous business practices, and even scams.

3. Make A Plan… And Stick To It

Following a trading plan that sets out your objectives and strategy is essential for day traders of all levels. Trading financial markets is a complex pursuit, and trading plans provide structure, discipline, and a systematic approach to help you navigate them.

These roadmaps tend to contain the following key elements:

- Your financial objectives and goals

- How much you wish to trade

- Entry and exit criteria

- Position sizes

- Time horizons for trades

- Your risk tolerance

- Trade evaluation procedures

However, having a trading plan and a firm bank of knowledge to use won’t on their own help you trade successfully if you buy and sell assets based on impulse.

Ensuring that all your dealing decisions are backed up by data is one of our most important day trading tips. Humans are emotional creatures, and it is easy to get overexcited when things go very right or wrong.

After a big win today you might feel uncharacteristically brave when the markets open tomorrow and pull the trigger on a trade too hastily. Alternatively, a large loss could cause you to miss an excellent trading opportunity if you retreat into your shell.

Sticking to the entry and exit parameters in your trading plan is critical. Riding a rising market for too long, or refusing to cut your losses when an asset is sinking, can be expensive mistakes.

Be disciplined – your bottom line will thank you for it.

Something that can really help here is maintaining a trading journal so you can keep a record of your dealings. Historical data is hugely useful in helping you to identify problems, amend your day trading strategy, and ultimately make more intelligent decisions in future. You never meet a trader who regrets keeping a trading journal!

The software from TradeMetria is particularly strong and links with over 140 brokers making recording and analyzing trades a breeze. It even has a specific ‘Daytrader’ report.

4. Manage Risk

Taking on too much risk can be fatal. So it is vital that new and experienced day traders sit down and outline a risk management strategy. Without a strategy in place, your career as a speculator could be short-lived.

Warren Buffett said it best with his assertion that “the first rule of investment is don’t lose [money]. The second rule of investment is don’t forget the first rule.”

A day trading strategy built on excessive risk often puts the primary trading principle of capital preservation in severe danger.

The ‘right amount of risk’ depends on an individual’s financial goals, personal circumstances, and personality traits.

I think online risk tolerance assessments (like this one from the University of Missouri) can be a useful tool in helping traders decide how much risk to take on.

The tried-and-tested “1% rule” is a popular risk management tool among day traders. It dictates that an individual invests no more than, you guessed it, 1% of their account on any one trade.

The volatile nature of day trading means that you should also make use of stop-loss and take-profit orders when placing a trade.

The former is designed to limit your loss by automatically selling when an asset’s price falls to a certain level. The latter instructs a sale to occur when a security rises to a pre-set target, thus enabling a trader to lock in their desired profit.

Example

Let’s put this all together and say that I wish to trade shares in Tom’s Tent Warehouse. The company is currently trading at $20 per share.

I have $10,000 sitting in my trading account. So applying the 1% rule gives me $100 to use for this trade. With Tom’s Tents trading at $20 a share, I have an opportunity to buy five shares.

The placing of my stop-loss and take-profit levels on this trade would depend on my attitude to risk and how much I am willing to potentially lose, as well as my overall trading strategy.

I also need to carefully other factors like technical analysis, fundamental factors (like scheduled trading news and economic data), and broader market conditions.

In the case of trading Tom’s Tents shares, setting a stop-loss point of $99 and a take-profit level of $103 could be an appropriate risk management strategy for me.

5. Diversify

Another one of my key day trading tips is to build a diversified portfolio. By not putting all of my eggs in one basket I can avoid getting washed out by one or two disappointing trades.

Sir John Templeton – creator of the famous Templeton Growth Fund in the 1950s – once declared that “the only investors who shouldn’t diversify are those who are right 100% of the time.”

I know that not all of my trades will be profitable. Accepting this, and spreading my net wide as a result, helps to reduce the risk to my overall portfolio.

Multiple Benefits

But diversification brings more benefits than simple risk reduction. Spreading your capital far gives you the chance to exploit opportunities in different sectors or asset classes. It can also allow you to make multiple trades at the same time.

Diversification can also reduce overall volatility in a portfolio; may make it easier to generate a profit as market conditions change; and can make it easier for traders to do their thing thanks to better liquidity.

There are many ways that day traders can choose to diversify their portfolios. You can do this by getting exposure to different:

- Asset classes (like stocks, currencies, bonds, commodities)

- Sectors (such as consumer staples, healthcare, banking and real estate)

- Geographies (like individual countries or specific regional classifications (like emerging markets))

- Market capitalizations (from FTSE 100 and S&P 500 shares through to small caps)

- Risk profiles (from fixed-income bonds to volatile cryptocurrencies)

CMC Markets stands out for its huge selection of more than 12,000 day trading markets that span many asset classes.

6. Learn to Spot Fake Breakouts

To spot fake breakouts early in the day, which can really hit day traders, treat the open as a danger zone, not a green light.

Mark premarket highs/lows and key support/resistance before the bell, then wait for the first 5–15 minutes of chaos to pass. When price “breaks out”, check the fuel: strong, rising volume, a clean hold or retest of the level, and alignment with the broader market.

If it rips through a level on weak volume and immediately slips back under, that’s classic fake-out behaviour.

If you have good access to market data, watch Level 2 and time & sales: big orders vanishing from the book or heavy selling smashing the bid right after a breakout are major red flags.

Combine that with tight, well-placed stops just beyond your level, and you may be able to turn those early-session traps from painful surprises into managed scratches.

Bottom Line

The top day trading tips discussed in this guide can be used by both beginners and more advanced traders. They provide a broad framework that could help those pursuing short-term trading strategies.

Trading on financial markets can be an effective way to create wealth. But remember that success is not guaranteed, and that a careful and disciplined approach is essential to minimize the risk to your capital.

FAQ

What Is The Top Tip For Day Traders?

A key hint is to spend time in the beginning developing an effective risk management strategy. This can help minimize losses, keep you in the day trading game for longer, plus it develops a disciplined mindset.

What Is The Best Day Trading Tip For Beginners?

For beginner day traders, the best tip is to start with a demo account. These simulators let you develop, test and refine intraday trading strategies with virtual money.

Article Sources

- Guide To Financial Markets 7th Edition: Why They Exist And How They Work – The Economist, Mark Levinson

- Guide To Investment Strategy: How To Understand Markets, Risk, Rewards And Behaviour – The Economist, Peter Stanyer And Stephen Satchell

- The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management – Alexander Elder

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com