Finance TikTok Report Card: 70% of Viral Investing Videos Misleading

TikTok has quietly become one of the most influential sources of financial information for young investors. Search hashtags like #StockTok or #FinTok, and you’ll find billions of views attached to short clips promising “hidden gems” and easy wealth strategies. For Gen Z in particular, TikTok is now the go-to place to learn about investing.

But worryingly, the content that racks up the most views can sometimes be misleading. The algorithm seems to reward confidence, brevity, and emotional triggers – not balance, context, or risk disclosures.

Regulators are starting to notice too: the SEC and FINRA in the US, as well as the FCA in the UK, have all warned about the rise of “finfluencers” making unqualified claims without suitable disclosures.

That led us to create the Finance TikTok Report Card. We collected viral investing TikToks in September 2025, analyzed their claims, and graded them for their accuracy, disclosures, oversimplification, and educational value.

Key Takeaways

- Scope:

- Reviewed viral finance and investing TikToks during September 2025.

- The videos combined had received 255,900+ views.

- Approach:

- Scored videos in 4 metrics: Accuracy, Disclosure, Oversimplification, Educational Value.

- Rated every video from A to F in each area, and awarded a final mark.

- Findings:

- 70% of viral finance TikToks didn’t clear a B grade, raising serious concerns.

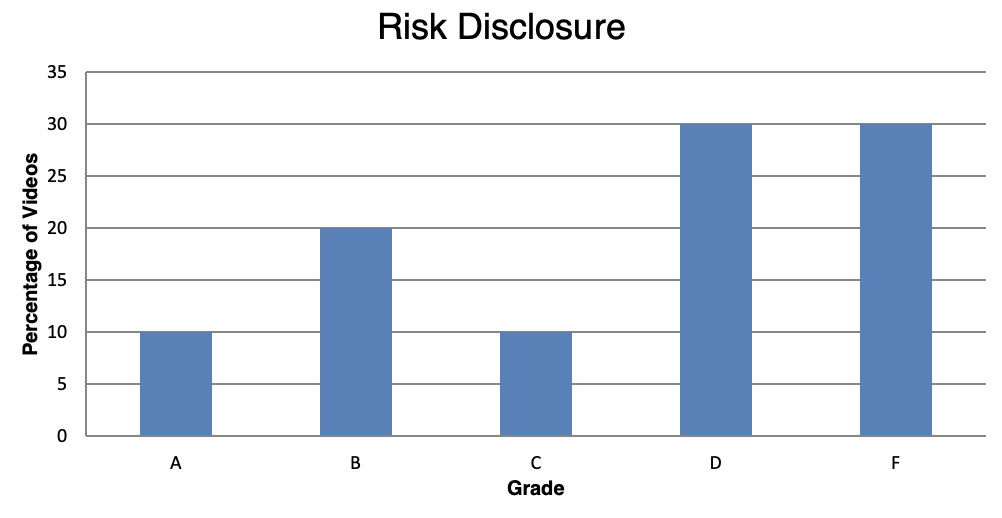

- Risk disclosure was the weakest area: 30% of videos scored F, and only 10% got A.

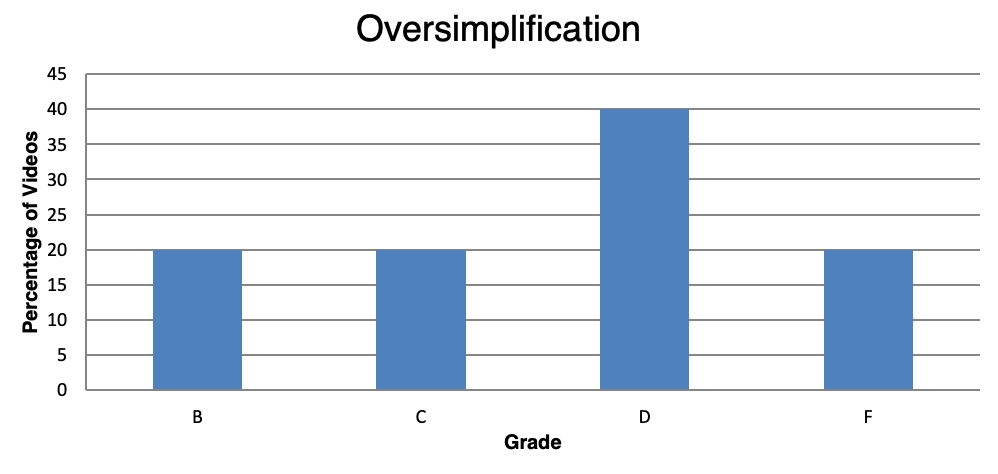

- Oversimplification was the most common flaw: 60% of videos were rated D or F.

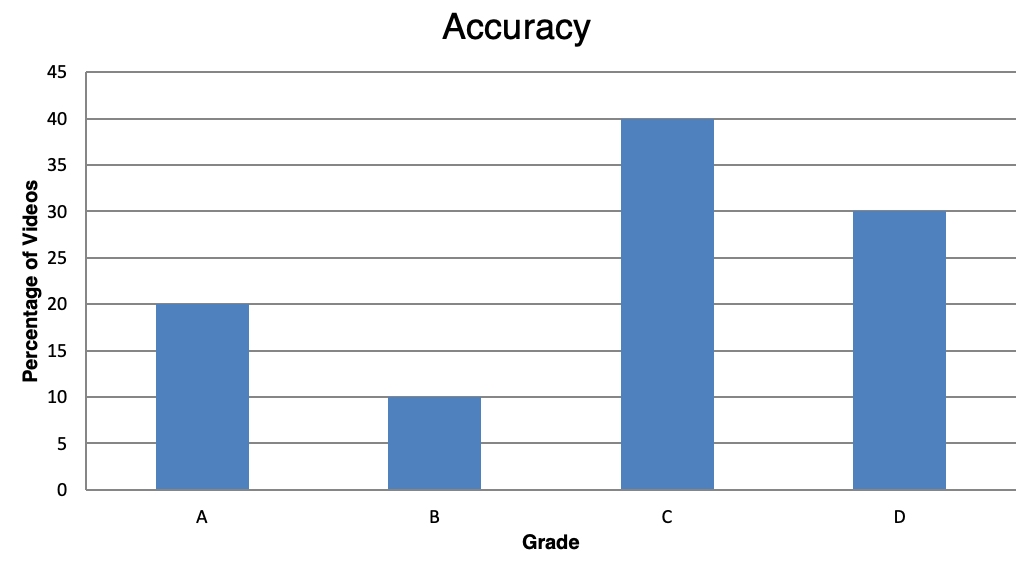

- Accuracy scores clustered in the middle: 40% at C, 30% at D, and just 20% at A.

- Only 20% got A for educational value, and focused on compounding and salaries.

- Themes:

- Oversimplification sells, accuracy and context doesn’t.

- Risk-free narratives around finance dominate the TikTok feed.

- Viewers are still hooked on crypto content, similar to other social channels.

- Some genuine educators are producing thoughtful content, but they’re the exception.

- Implications:

- Viewers risk mistaking entertainment for financial education; regulators face enforcement challenges; financial services firms have an opportunity to step in with credible content.

- This isn’t just about TikTok. It’s about how a generation learns to handle money and invest in an environment where the loudest voice is rewarded, not the most accurate one.

This report analyzes themes across viral finance content on TikTok. We do not name specific accounts. Examples are anonymized and intended to illustrate patterns in content messaging, not to criticise particular creators.

Methodology

Step 1: Selection of TikToks

We started by scanning TikTok for the hashtags #StockTok, #FinTok, #FinanceTok, and #CryptoTok over the course of September 2025. From this pool, we shortlisted 10 top clips that met three criteria:

- High View Count: We targeted viral content, not niche videos. Our focus is on what’s most influential to audiences.

- Clear Financial Claim: Videos needed to make a point about investing, saving, or trading, rather than pure entertainment.

- Diversity of Themes: We included stock picks, crypto hype, trading tips, and basic education to reflect the variety on Finance TikTok.

Step 2: Scoring Framework

We then applied a four-part scoring system:

- Accuracy: Is the content factually correct based on current market data, established financial principles, and regulatory standards?

- Risk Disclosure: Does the video acknowledge the risks or downsides of the strategy/product being recommended?

- Context: Does it explain key assumptions (time horizon, costs, volatility), or does it strip away nuance to make the claim go viral?

- Credibility: Does the creator present sources, experience, or disclaimers that establish trust?

Each factor was rated on a simple A to F scale, along with an overall grade that reflects the seriousness of any weaknesses identified. For example, a video with accurate information but no risk disclosure could still score poorly because it can mislead viewers in practice.

Step 3: Independent Verification

Where possible, we cross-checked claims against reliable sources: regulatory websites (SEC, FINRA, FCA), reputable finance outlets, and official company filings.

If a video claimed “X stock is guaranteed to rise,” we looked at the fundamentals, volatility, and analyst consensus to assess whether that statement was defensible.

Why This Matters

Our process isn’t about nitpicking or being biased against creators. It’s about testing how viral finance content stacks up against responsible investing principles.

The Report Card format makes it simple: we’re not labelling anyone a “scammer,” but we are highlighting when viral advice could be misleading by omission, overconfidence, or lack of context.

Report Card

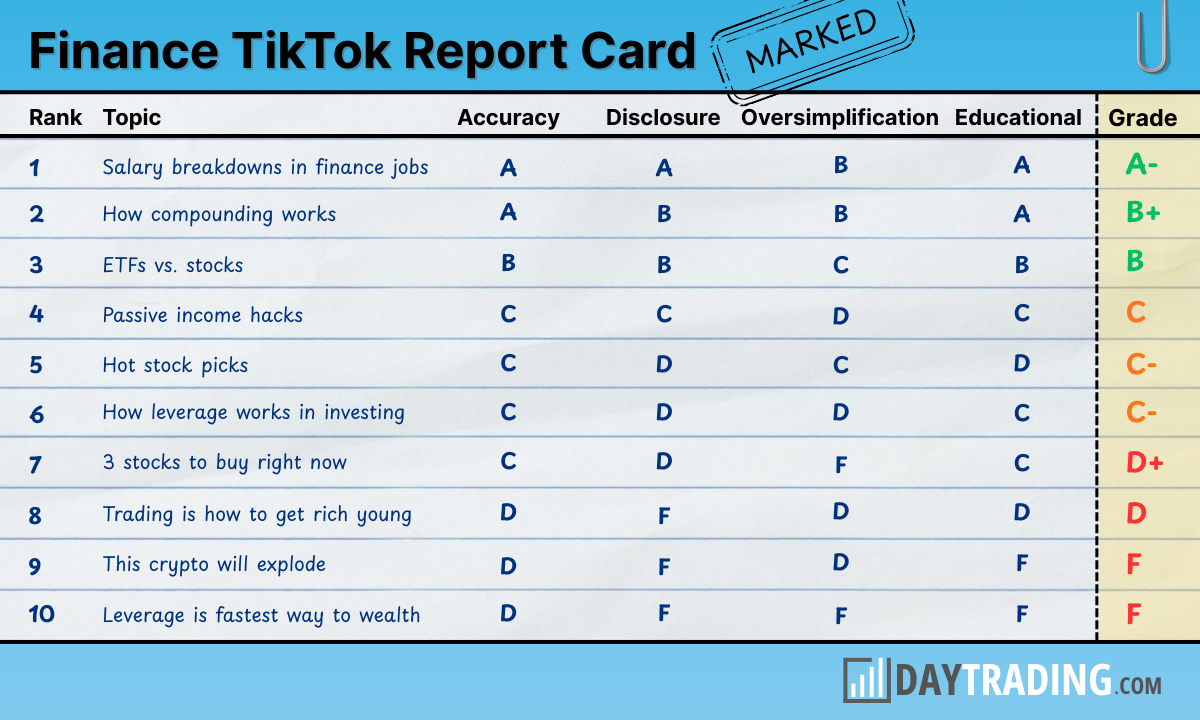

Here is the final report card with a breakdown by scoring category and overall grade:

Accuracy

Here is the distribution of grades awarded in the Accuracy category.

30% scored a D for content accuracy, with just 20% earning an A.

Risk Disclosure

Here is the distribution of grades awarded in the Risk Disclosure category.

30% scored an F for the suitability of risk disclosures, with just 10% earning an A.

Oversimplification

Here is the distribution of grades awarded in the Oversimplification category.

20% scored an F for the level of oversimplification in messaging, with 0% earning an A.

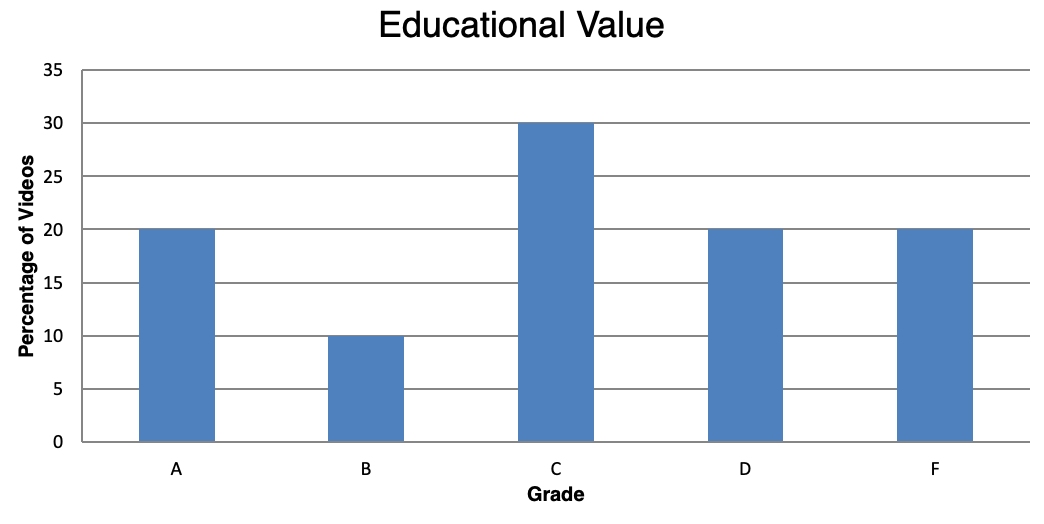

Educational Value

Here is the distribution of grades awarded in the Educational Value category.

20% scored an F for the degree of educational value provided, with just 20% earning an A.

Snapshot of 10 TikToks

A-: Offered a clear, fact-based breakdown of banking salaries. Educational, though slightly simplified.

A: A strong example of responsible FinTok – explained compounding clearly, encouraging long-term thinking.

B+: Explained ETFs vs. individual stocks. Good accuracy, though oversimplified portfolio construction.

C: Dividend strategy explained fairly, but glossed over downsides like tax and concentration risk.

C-: Showed conviction in specific stocks but framed as near-certainties, which risks misleading beginners.

C-: Promoted aggressive trading with leverage as a wealth shortcut, without acknowledging the huge risks.

D+: A classic “hot stock tips” video with no data or rationale; pure hype for clicks.

D: Aspirational “rich in your 20s” trading story; more motivational than practical, with risky undertones.

D: A one-sided “crypto will change everything” pitch, ignoring volatility, hacks, and regulation.

F: Urgent “buy this stock now” messaging. High engagement, but little context or balance.

Analysis & Themes

Our grades make one thing clear: Most viral finance TikToks aren’t designed to educate – they’re designed to grab attention. A few stand out as genuinely helpful, but the dominant trends are hype, shortcuts, and half-truths.

Five major themes emerged:

1. Oversimplification Sells, Accuracy Doesn’t

Three of the most viral videos reduced investing to a handful of “stocks to buy now.” The problem is not just the speculation – it’s the framing.

Complex questions like “Should I own equities, bonds, or ETFs?” get boiled down to “Buy these three tickers.” That oversimplification makes for a sticky 30-second video, but it strips away context and risk.

Contrast this with another video, which earned a B+ by carefully explaining ETFs vs. stocks. This video still simplified, but at least it taught a real concept.

The trade-off is clear: the more accurate a video is, the less viral it tends to be.

2. The Rise of Risk-Free Framing

Several TikToks we investigated leaned on “guaranteed wealth” narratives. Leverage was pitched as a shortcut, trading was positioned as the path to getting rich young, and downside risk was glossed over.

This is one of FinTok’s most worrying features for us. It gives the illusion of certainty in a world where nothing is guaranteed. Worse, it often borrows the language of authority, i.e. urgent calls to action, or claims of insider knowledge, to mask speculation as fact.

We spoke to another finance professional who’s seen the dangers of acting on FinTok information up close. Olivier Wagner, Founder of 1040 Abroad, which helps individuals navigate complex tax and financial regulations, told us:

“I had a case not too long ago involving a group of young professionals who followed a TikTok video that promoted setting up offshore accounts as a “tax loophole” for U.S. citizens. In reality, it presented tax compliance issues and hefty IRS penalties for the advice because the creator omitted all of the disclosure rules surrounding it (like FBAR and FATCA).”

This theme also aligns with findings from the CFA Institute that found only around 20% of finance-related TikTok content containing recommendations included any form of disclosure – a startlingly low figure considering the stakes.

3. Crypto and Trend Chasing Are Still the Hooks

One video had a bullish crypto pitch that is a textbook case of FinTok’s attention economy: Lean into a divisive, exciting narrative that creates instant debate.

We noticed crypto content tends to attract higher engagement than dull but reliable topics like bonds or retirement accounts.

The trade-off is familiar. Audiences click, creators grow, but the message often leaves viewers with a skewed sense of risk/reward.

4. Bright Spots Exist – Education Can Win

Not every video we went through was bleak. Two TikToks earned high marks for content that was clear, accurate, and balanced. Salary breakdowns and compounding examples may not sound viral, but both proved there’s a place for straightforward education.

It’s worth noting, however, that these videos had lower engagement velocity compared with hype-driven ones. The audience rewards excitement more than nuance.

Still, the success of these clips shows that good financial education can cut through, especially when paired with clean visuals and simple metaphors.

5. The Pattern: Hype First, Accuracy Later

Taken together, these TikToks show us a platform where the loudest voices aren’t usually the most accurate ones. If the message fits into a viral-friendly frame – “hot picks,” “get rich quick,” “the next big thing” – it spreads. If it requires context, nuance, or disclaimers, it struggles.

That imbalance explains why 70% of videos failed our accuracy test. It’s not that creators don’t know better – it’s that the algorithm rewards virality over responsibility.

If you’re watching Finance TikTok, remember that hype beats accuracy in the algorithm. Treat bold claims with caution, and tune in to creators who focus on education over engagement.

Case Study Deep Dives

Numbers and grades tell one story, but nothing illustrates the dynamics of Finance TikTok better than looking at individual clips in detail.

Here we break down three examples – one misleading, one dangerously risky, and one genuinely useful – to show how content style shapes perception as much as substance.

Case Study 1: “Leverage is the Fastest Way to Wealth” (Grade: F)

In this viral clip, the creator enthusiastically promotes margin trading as the ultimate wealth hack. The video uses fast cuts, bold on-screen captions like “Double Your Money Instantly”, and a confident, upbeat delivery.

Why it hooked viewers:

- The message was compressed into a single bold claim – leverage = riches.

- The idea of multiplying money instantly appeals directly to FOMO and impatience.

- Luxury cars and a neon backdrop reinforced the wealth narrative.

What was missing:

- No mention of margin calls, liquidation risk, or debt obligations.

- No discussion of suitability – leverage is appropriate for experienced traders with strict risk management.

- No disclosure of personal bias (e.g., if the creator benefits from broker referrals).

Case Study 2: “3 Stocks That Will Explode This Month” (Grade: D+)

Here, the video presented a rapid-fire list of stock picks with bold claims of near-term upside. The video had a strong hook – “Don’t miss these gains” – paired with fast-moving graphics and ticker symbols.

Why it hooked viewers:

- Language like “this month” creates immediacy.

- Green arrows and upward-trending charts suggested inevitability.

- Three picks, one minute, no complexity – perfect for TikTok’s format.

What was missing:

- No explanation of underlying fundamentals (earnings, market position, risks).

- No time horizon beyond “this month.”

- No suggestion of diversification or position sizing.

Case Study 3: “The Magic of Compounding” (Grade: B+)

In stark contrast, this educational nonprofit used TikTok-native storytelling to explain how small, consistent investments can grow over time. The video utilized animated charts, simple metaphors (such as a snowball rolling downhill), and upbeat narration.

Why it hooked viewers:

- Animated growth curves made abstract math tangible.

- Targeted at Gen Z, the example used relatable scenarios like saving $5 a day from coffee.

- Encouraging but not overpromising.

What it got right:

- Clear explanation of both the potential and the limits of compounding.

- Acknowledgement that results depend on time horizon and market conditions.

- Practical takeaway: that small steps matter, rather than promising instant riches.

Lessons from the Case Studies

Together, these examples highlight the tension at the heart of Finance TikTok:

- Destructive content spreads because it’s bold and simple.

- Good content spreads when it’s engaging without cutting corners.

The implication is not that TikTok is inherently hostile to financial education, but that the default incentives push creators toward attention-grabbing narratives.

For viewers, that means sharpening their ability to distinguish entertainment from advice. For the industry, it’s a wake-up call that credible voices must learn the platform’s language if they want to compete.

What This Means for Viewers

So what should you take away from all this if you’re one of the millions of people consuming finance TikTok? The lesson isn’t “avoid it altogether.” Social media has lowered the barrier to entry for financial knowledge – that’s a net positive. But the way you use TikTok matters.

Here are the key insights from our analysis and how to apply them as a viewer.

1. Recognize the Algorithm, Not Just the Message

If a video pops up on your feed, remember it’s there because TikTok’s algorithm thinks it will steal your attention, not because it’s the most accurate or trustworthy.

Hype spreads faster than nuance. That means you should always add a mental filter: “Is this showing up because it’s helpful, or because it’s exciting?”

2. Treat “Guaranteed” Claims as Red Flags

Any TikTok that promises certainty – “this stock will double,” “this coin can’t fail,” “use leverage to retire early” – should trigger immediate skepticism. Real investing involves probabilities, not guarantees.

Even professional fund managers with decades of experience are wrong a significant portion of the time. If a video is skipping risk disclosures, it’s usually because risk undermines the sales pitch.

3. Learn to Spot Oversimplification

Simplification isn’t always bad – it can make finance more accessible. But oversimplification becomes dangerous when it cuts out the information you need to make an informed decision.

If a video gives you “the answer” in under 30 seconds without covering context like time horizon, fees, or downside, consider it entertainment, not education.

4. Balance Inspiration With Education

It’s fine to use TikTok for inspiration – maybe you discover a new investing term, hear about an asset class, or get curious about budgeting. But that’s where the platform should stop.

Use it as a spark to do your own research elsewhere. Podcasts, blogs, long-form YouTube explainers, or even good old-fashioned books can give you the detail TikTok leaves out.

5. Curate Your Feed Deliberately

One of the overlooked powers of TikTok is that you can shape your algorithm. By following accounts that prioritize literacy over hype, you can increase the chances of seeing genuinely useful content.

Likewise, be conscious of who you engage with. Every like, save, or comment is a vote for more of the same.

6. Remember: You’re the Product

Finally, it’s worth remembering that for most viral creators, Finance TikTok is a business model. The goal isn’t just to educate you – it’s to capture your attention and funnel you into courses, paid communities, or broker affiliate links.

That doesn’t make all monetization bad, but it does mean you should always ask: “Why is this person giving me this advice for free?”

Bottom Line

Our Finance TikTok Report Card set out to answer a simple question: how reliable is the investing and financial content that goes viral on TikTok?

After reviewing the most-watched clips of September 2025, the answer is clear – not very. 70% of the top videos contained misleading, incomplete, or oversimplified information.

That doesn’t mean every video isn’t worth your time. The best-performing videos show that accuracy and engagement can co-exist. But they are the exception, not the rule.

The overwhelming trend is toward content that prioritizes virality over accuracy, entertainment over education.

Article Sources

- TikTok (#StockTok, #FinTok, #FinanceTok, and #CryptoTok)

- How TikTok is transforming financial advice - CFA Institute

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com