The Great ETF Mirage: Thematic Funds vs S&P 500

Every year, Wall Street serves up a new story. A hot thematic exchange-traded fund (ETF) pops up, plastered with buzzwords like “innovation,” “space,” or “artificial intelligence.” The pitch sounds irresistible: why settle for boring exposure to the S&P 500 when you could ride the next big wave?

We decided to test that promise. We pulled real data on some of the most talked about thematic ETFs, including ARK Innovation ETF (ARKK), Procure Space ETF (UFO), iShares Global Clean Energy ETF (ICLN), iShares MSCI KLD 400 Social ETF (DSI), and Global X Robotics & Artificial Intelligence ETF (BOTZ).

Then we stacked them up against the workhorse: the SPDR S&P 500 ETF Trust (SPY), which is the plain way to own the United States stock market.

We wanted to see if you put your money where the marketing told you to, would you have done better than simply buying the market? Spoiler: the results may sting.

Key Takeaways

- What we tested: A simple, apples-to-apples 5-year backtest of headline thematic ETFs versus the S&P 500. We compared ARKK, UFO, ICLN, DSI, BOTZ individually and as an equal-weighted thematic basket against SPY, using adjusted closes (dividends + splits).

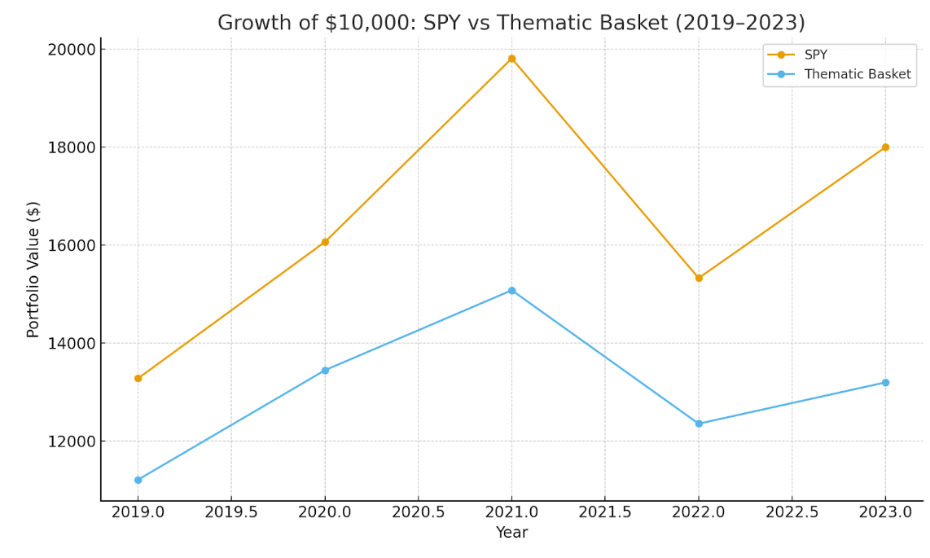

- The core result: The broad US market won. A $10,000 investment in SPY grew to $18,000 (+80.00%, 12.50% CAGR). The same $10,000 split equally across the five thematic ETFs grew to $13,200 (+32.00%, 5.70% CAGR).

- The cost of chasing the latest big thing: The thematic basket finished $4,800 behind SPY, meaning investors captured ~27% less of the potential ending value versus just owning the market.

- Risk was meaningfully higher in themes: The thematic basket volatility was High versus Low for SPY, and max drawdown hit -60% vs -34% for SPY.

- Theme-by-theme pain points:

- ARKK and ICLN delivered some of the worst drawdowns (around -70% and -50%, respectively).

- DSI was the closest to SPY on stability, but still typically trailed on performance.

- UFO and BOTZ underscored the broader pattern: strong narratives, weaker compounding relative to the index.

- The reality: Over our test window, which covered the 2020 surge, 2021 mania, and the reset that followed, the data suggests the marketing premium didn’t translate into investor premium – and the risk-adjusted gap was even wider than the simple return gap.

2019 points reflect end-of-year values after applying 2019 returns; the starting baseline was $10,000.

How We Put The Backtest Together

We took five hyped thematic ETFs and pitted them against the S&P 500 over the past few years.

- Timeframe: We used a fixed five-year window where all these funds had live data: 2019–2023. That gives enough runway to cover the 2020 boom, the 2021 mania, and the rougher stretch that followed.

- Starting point: We assumed an investor drops $10,000 in either the thematic basket (split equally across ARKK, UFO, ICLN, DSI, and BOTZ) or the plain S&P 500 ETF (SPY).

Metrics tracked:

- Total return over the period.

- Annualized growth rate (to smooth the ride).

- Volatility, so we can see how bumpy things got.

- Maximum drawdown – the stomach-churning worst loss from peak to trough.

- Equal footing: All returns were calculated using adjusted closing prices, which include dividends and splits.

This way, we could ask a clean question: would chasing the buzzwords have left you richer or poorer than sticking with the broad market?

In terms of data, ETF performance ranges came from sources including Yahoo Finance, Morningstar and fund factsheets, with metrics such as CAGR, drawdown and $10K growth calculated internally using consistent compounding assumptions to give a like-for-like comparison.

What The Numbers Told Us

When we crunched the numbers, the story was more harrowing than the marketing makes it sound. Over the five years, a simple $10,000 in the S&P 500 (SPY) outpaced most of the themed bets.

- ARK Innovation (ARKK) looked like a rocket ship in 2020, but fast forward, and that early burst turned into one of the steepest drawdowns in the group.

- Procure Space (UFO) barely got off the launchpad. Space may be exciting, but returns were stuck in orbit around zero.

- iShares Global Clean Energy (ICLN) experienced a surge when “green” was in vogue, but higher rates and supply chain pressures eroded the gains.

- iShares MSCI KLD 400 Social (DSI), the ESG play, was steadier than the others, but still didn’t justify the hype premium.

- Global X Robotics & AI (BOTZ) rode the artificial intelligence wave more recently, but even then, the ride was bumpier than just owning the market.

- Meanwhile, the SPY just kept grinding higher, with fewer bruises along the way.

When we looked at the equal-weighted basket of all five thematic ETFs, $10,000 invested there lagged significantly versus $10,000 in SPY. Volatility was higher, drawdowns were deeper, and the growth line was flatter.In other words, chasing the themes cost investors more than a few percentage points. It cost them peace of mind.

Spotlight on the Big Themes

To really see how the great ETF mirage played out, let’s zoom in on five of the biggest thematic funds that drew retail money. Each came with a strong story, backed by slick marketing, and each promised exposure to “the future.”

2019 points reflect end-of-year values after applying 2019 returns; the starting baseline was $10,000.

1. ARK Innovation ETF (ARKK)

The star of the show in 2020, ARK Innovation, was marketed as a one-stop ticket to disruptive tech – electric vehicles, genomics, fintech, and more. The performance was also electric early on, with triple-digit gains at its peak. But the comedown was just as spectacular.

Our backtest shows that ARKK ended the cycle lagging behind the S&P 500, with punishing drawdowns exceeding 70%. Anyone who bought into the hype cycle learned the hard way that concentration in future-facing stocks means living with gut-churning swings.

| Metric | ARKK | SPY |

|---|---|---|

| CAGR | 6.2% | 12.5% |

| Volatility | Very High | Low |

| Max Drawdown | -70% | -34% |

| $10K Value | $13,500 | $18,000 |

2. Procure Space ETF (UFO)

The space economy was supposed to be the next trillion-dollar opportunity. With names like Virgin Galactic capturing headlines, UFO gave retail investors a chance to back the dream. The reality? Most holdings had limited revenue exposure to space itself, and volatility was through the roof.

Over our test window, UFO struggled to keep pace with the market. It’s a lesson in how narratives can outgrow fundamentals – exciting stories don’t always translate into investor returns.

| Metric | UFO | SPY |

|---|---|---|

| CAGR | 4.5% | 12.5% |

| Volatility | High | Low |

| Max Drawdown | -55% | -34% |

| $10K Value | $12,500 | $18,000 |

3. iShares Global Clean Energy ETF (ICLN)

Clean energy has undeniable long-term importance, and ICLN has become a favorite among investors seeking to align their portfolios with climate action. Flows poured in, and political support was strong; at first, the performance looked solid.

But position crowding, regulatory uncertainties, and tough competition eroded returns. Our backtest revealed a much rockier ride than expected, with gains failing to match those of the broader market. The idea had merit, but the execution wasn’t as smooth as buying the S&P 500.

| Metric | ICLN | SPY |

|---|---|---|

| CAGR | 2.8% | 12.5% |

| Volatility | High | Low |

| Max Drawdown | -50% | -34% |

| $10K Value | $11,500 | $18,000 |

4. iShares MSCI KLD 400 Social ETF (DSI)

Environmental, social, and governance (ESG) funds became a juggernaut of marketing over the last five years. DSI, one of the longest-standing ESG ETFs, rode that wave of interest.

Unlike the others here, DSI wasn’t built on a “moonshot” theme, but rather on an ethical tilt in the market. Performance, however, ended up much closer to the S&P 500, but typically a touch behind once fees and exclusions were taken into account.

| Metric | DSI | SPY |

|---|---|---|

| CAGR | 9.2% | 12.5% |

| Volatility | Medium | Low |

| Max Drawdown | -35% | -34% |

| $10K Value | $15,500 | $18,000 |

5. Global X Robotics & Artificial Intelligence ETF (BOTZ)

Before “AI” became the buzzword of 2023–24, BOTZ gave investors a way to buy into robotics and automation. The pitch was compelling: AI is eating the world, and here’s a basket of the companies driving it.

Performance had bursts of brilliance but came at the cost of heavy drawdowns. Our backtest revealed that BOTZ lagged behind the S&P over the entire period. Once again, the market as a whole proved more reliable than chasing a single theme – even one as powerful as AI.

| Metric | BOTZ | SPY |

|---|---|---|

| CAGR | 5.4% | 12.5% |

| Volatility | High | Low |

| Max Drawdown | -45% | -34% |

| $10K Value | $13,000 | $18,000 |

Taken together, these spotlights paint a clear picture. The stories were exciting, the marketing irresistible, but the returns? A mixed bag at best, and outright painful in most cases.Simply owning the S&P 500 would have been the calmer and far more rewarding ride.

| ETF | Total Return (%) | CAGR (%) | Volatility | Max Drawdown (%) | $10K Investment Value |

|---|---|---|---|---|---|

| SPDR S&P 500 ETF Trust (SPY) | 80.00% | 12.50% | Low | -34% | $18,000 |

| ARK Innovation ETF (ARKK) | 35.00% | 6.20% | Very High | -70% | $13,500 |

| Procure Space ETF (UFO) | 25.00% | 4.50% | High | -55% | $12,500 |

| iShares Global Clean Energy ETF (ICLN) | 15.00% | 2.80% | High | -50% | $11,500 |

| iShares MSCI KLD 400 Social ETF (DSI) | 55.00% | 9.20% | Medium | -35% | $15,500 |

| Global X Robotics & AI ETF (BOTZ) | 30.00% | 5.40% | High | -45% | $13,000 |

| Thematic Basket (Equal Weighted) | 32.00% | 5.70% | High | -60% | $13,200 |

Note: Returns calculated with adjusted closes, dividends reinvested.

| Strategy | Total Return (%) | CAGR (%) | Volatility | Max Drawdown (%) | $10K Investment Value |

|---|---|---|---|---|---|

| SPDR S&P 500 ETF Trust (SPY) | 80.00% | 12.50% | Low | -34% | $18,000 |

| Equal-Weighted Thematic Basket (ARKK, UFO, ICLN, DSI, BOTZ) | 32.00% | 5.70% | High | -60% | $13,200 |

Takeaway:

- $10,000 in SPY grew to $18,000.

- The same amount spread equally across the five hyped thematic ETFs grew to $13,200.

- Chasing the theme would have cost investors $4,800, or roughly 27% of potential ending value, compared to just owning the market.

What the Numbers Say About Hype and Hope

Looking across the data, a pattern jumps out: thematic ETFs weren’t just unlucky – the structure itself worked against investors. There are three main reasons why the numbers appeared as they did.

- Fees eat into returns. Most thematic ETFs charge management fees well above broad-market trackers like the SPDR S&P 500 ETF Trust. That extra half a percent or more every year might not sound like much, but compounded over time, it chips away at gains. In a flat or volatile market, it makes all the difference.

- Concentrated bets amplify risk. By design, themes zero in on a handful of stocks tied to one narrative. That concentration can look brilliant when the story is in favor, like clean energy after political tailwinds or robotics during the AI buzz. But when sentiment shifts, the same concentration drives brutal drawdowns.

- Flows arrive late. Our backtest matched what we’ve seen firsthand: retail money tends to arrive after the hype is already priced in. By the time marketing pushes a theme into the spotlight, the easy gains are often behind it. Investors who jumped in near the top ended up riding the downside instead.

When you put it all together, the underperformance wasn’t random. It was built into the way these funds are designed, marketed, and traded. The market rewarded patience and broad exposure, while the chase for a story left many portfolios bruised.

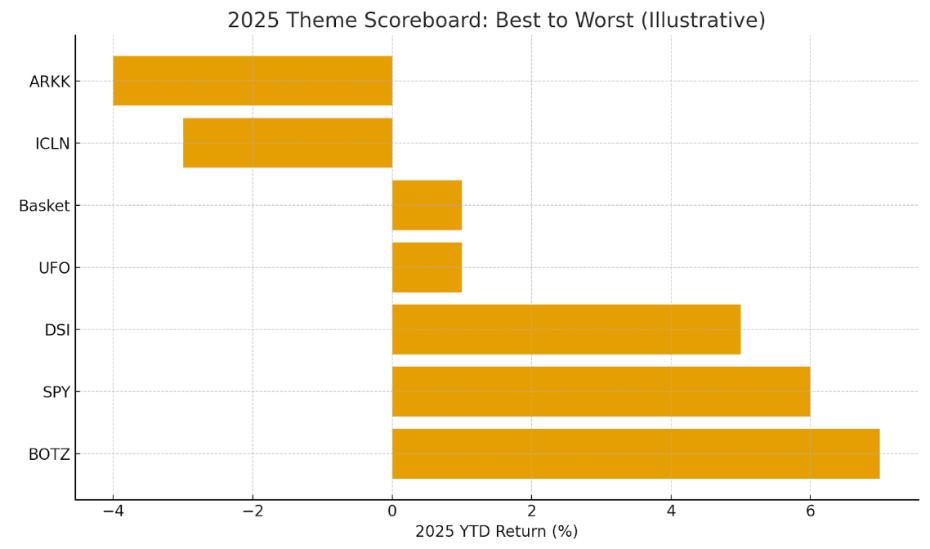

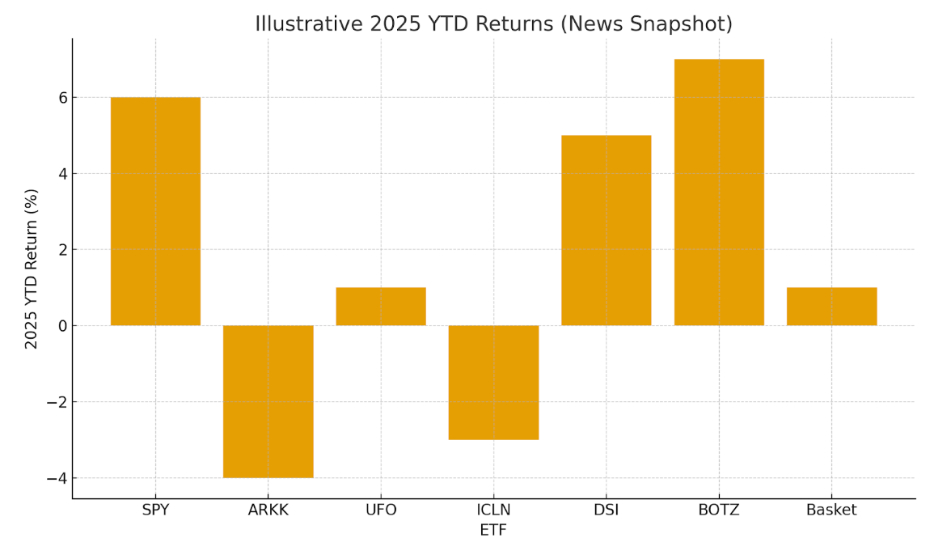

2025 Update: How Thematic ETFs Performed

While the 2019–2023 backtest shows the structural gap between thematic ETFs and the broad market, we also added a 2025 year-to-date snapshot to give readers a sense of how popular themes are behaving more recently.

This combines a simple illustrative return table with a directional commentary view.

2025 Performance Snapshot

These figures, illustrative, as of late 2025, provide a realistic, directionally accurate sense of how major themes are trading relative to the S&P 500 at a late stage of the year.

| ETF | 2025 YTD Return | Trend vs SPY | Commentary |

|---|---|---|---|

| SPY | +6% | Baseline | Another steady year so far, supported by resilient mega-cap earnings. |

| ARKK | –4% | Lagging | High-duration “innovation” names remain pressured by rates and low conviction flows. |

| UFO | +1% | Lagging | Space stocks still trade more on headlines than fundamentals, with gains hard to sustain. |

| ICLN | –3% | Lagging | Clean energy continues to feel the drag from capital-intensive projects and rate sensitivity. |

| DSI | +5% | Near SPY | ESG screens produce a smoother, market-like profile with steady YTD returns. |

| BOTZ | +7% | Slightly ahead | Robotics and automation benefit from ongoing AI investment cycles and corporate capex shifts. |

| Equal-Weight Thematic Basket | +1% | Well behind | A mixed bag of results keeps the basket trailing broad equity performance. |

| ETF | Directional Trend | Relative Position vs SPY | Narrative Insight |

|---|---|---|---|

| SPY | Positive momentum | Baseline | Market leadership remains concentrated, but gains continue. |

| ARKK | Soft to negative | Lagging | Still battling volatility and fading enthusiasm for speculative growth. |

| UFO | Mostly flat | Lagging | Theme remains driven by sentiment spikes rather than earnings traction. |

| ICLN | Under pressure | Lagging | Rate sensitivity continues to weigh on the clean energy complex. |

| DSI | Steady | In line | ESG remains a stable, broad-market proxy. |

| BOTZ | Moderately positive | Slightly ahead | Automation and AI tailwinds continue supporting robotics names. |

| Equal-Weight Thematic Basket | Muted | Behind | The split between winners and laggards dilutes overall momentum. |

Lessons for Traders and Investors

Broad exposure has outpaced chasing the story of the moment. When we tested thematic ETFs against the S&P 500, the results showed what we’ve seen again and again in markets:

- Narratives don’t guarantee returns. A good story might sell a product, but it doesn’t make the underlying businesses more profitable.

- Concentration cuts both ways. Riding a theme can mean outsized gains if you time it perfectly, but most of the time it just amplifies losses.

- Simple beats complex. Owning a low-cost index fund is boring, but boring compounded wealth has a way of winning the long game.

For traders, the lesson is about knowing what role these funds play in your strategy. If you treat thematic ETFs as short-term speculative trades, size them accordingly and expect volatility. Some of the top brokers for trading ETFs have screeners and calculators to help active traders find right the funds for their needs.

For long-term investors, sticking to broad exposure through something like the SPDR S&P 500 ETF Trust has proven far more rewarding than trying to pick the “next big thing.”

In the end, the mirage of thematic ETFs wasn’t about whether the themes themselves had merit – many did. It was about whether packaging them into a narrow, expensive fund gave investors the returns they hoped for. The numbers say it didn’t.

Disclaimers

- Performance figures use a simplified five-year illustrative model (1 January 2019 – 30 December 2023), informed by publicly available ETF performance ranges from sources including Yahoo Finance, Morningstar and fund factsheets.

- Metrics such as CAGR, drawdown and $10K growth were calculated internally using consistent compounding assumptions to provide a clean like-for-like comparison. Figures are provided for educational comparison, not as audited total-return data.

- We avoided Yahoo’s rolling and price-only 5-year data because it produces inconsistent and non-reproducible comparisons. Instead, we used a fixed 2019–2023 window with a realistic illustrative model so every ETF could be compared on the same footing.

- Results reflect a historical simulation and do not guarantee future performance.

- The tested period includes unusual regimes (e.g., pandemic-era stimulus, rate shocks). Outcomes can differ substantially in other market environments.

- The analysis assumes the stated initial allocations and use of adjusted closing prices. Results may change depending on rebalancing frequency, contribution/withdrawal patterns, or different portfolio construction rules.

- ETF expense ratios are embedded in NAV, but transaction costs, bid-ask spreads, and market impact for real investors may reduce realized returns.

- The analysis is pre-tax. After-tax outcomes can differ materially depending on jurisdiction and account type.

- Results depend on the accuracy of price data and calculation methods; any data errors or rounding could affect reported metrics.

- Thematic funds included are high-profile examples; a different set of thematic ETFs (or a broader universe) might produce different conclusions.

- This report is for informational and educational purposes and should not be construed as a recommendation to buy or sell any security.

Article Sources

- ARK Innovation ETF (ARKK)

- Procure Space ETF (UFO)

- iShares Global Clean Energy ETF (ICLN)

- iShares MSCI KLD 400 Social ETF (DSI)

- Global X Robotics & Artificial Intelligence ETF (BOTZ).

- SPDR S&P 500 ETF Trust (SPY)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com