SushiSwap Review 2026

Pros

- The platform has received strong endorsements from multiple DeFi projects

- Some of the largest centralised exchanges in the world added the platform’s token, Sushi, days after it went live

- Sushi Academy with learning materials for beginners and technical users

Cons

- No demo account to test the firm

- Not as many tokens as other crypto exchanges

- No regulation bringing security concerns

SushiSwap Review

Sushi, otherwise known as SushiSwap, is a popular cryptocurrency platform in the evolving DeFi space. The exchange is one of the first Automated Market Makers (AMM) to send all profits back to the community that maintains and services it. This review explains how SushiSwap works, from farming and lending to available trading coins. We also cover fees, customer support and more. Find out how to get started today.

Headlines

SushiSwap is a crypto exchange built on the Ethereum blockchain. It allows users to buy and sell a long list of crypto assets, including emerging tokens. As one of the growing number of Decentralised Finance (DeFi) platforms, it facilitates crypto trading with minimal control from a central operator. Sushi holds over $3.99 billion in liquidity and over $69.32 billion in trading volume.

The Sushi token is a fork of Uniswap and grants control over the protocol to holders and pays a portion of fees to them.

History

SushiSwap was created in 2020 by a pseudonymous individual or group called Chef Nomi, along with co-founder 0xMaki. The team copied the open-source code used by Uniswap to create the building blocks for SushiSwap.

The company attracted users by promising Sushi token rewards if they locked up funds in a special pool on Uniswap. Once the code for SushiSwap was ready, the funds in that pool were transferred over.

How Sushi Works

The primary function of SushiSwap is to facilitate decentralised cryptocurrency trading. To do this, the exchange relies on Automated Market Makers (AMMs). These are smart contacts that create and manage liquidity pools of tokens or coins.

The Sushi token is what separates SushiSwap from Uniswap. The token has two functions. Firstly, it entitles holders to governance rights. Secondly, a portion of the fees is paid into the protocol. Sushi holders essentially own the protocol.

You can see the price of Sushi against the likes of USDT or BTC on a live chart at TradingView or DeFi Pulse. The price of Sushi can also be measured against popular fiat currencies such as the EUR, USD and GBP.

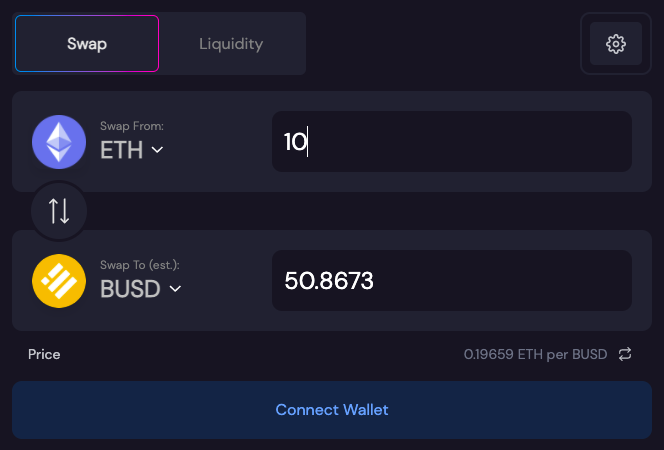

Using SushiSwap is simple. All you have to do is connect your wallet to the platform, select Swap in the left-hand side of the interface, select which tokens you’d like to swap, then set the amount and click Swap.

Products

A range of different services are available on the crypto trading website.

AMM

SushiSwap acts as an Automated Market Maker (AMM) which have seen a rise in popularity recently. This is because the protocols within an AMM improve a lot of the shortcomings seen in traditional exchanges. Unlike a centralised exchange, which relies on an order book to link traders and dictate pricing, AMMs utilise smart contracts to create markets for any two tokens. In this way, trading liquidity can be achieved between crypto assets. This also makes them one of the best places to go to acquire hard-to-find tokens.

The SushiSwap AMM offers some of the most competitive rates for DeFi blue-chips anywhere. Users can switch to other chains in just one click.

BentoBox Dapps

The BentoBox is a token vault for liquidity providers offering an innovative eco-system to use dapps gas-efficiently and to generate additional yield.

Users who deposit tokens into the BentoBox earn an annualised percentage yield (APY). This APY is generated by charging a fee to people who use the liquidity in the BentoBox to make flash loans, and by applying community-approved strategies to the liquidity in the vault.

BentoBox is designed to be scalable and serves as the future infrastructure for upcoming DeFi protocols on SushiSwap, the first of which is Kashi.

Kashi Lending

Kashi is a lending and margin trading platform built on BentoBox. It allows anyone to create customised and efficient markets for lending, borrowing and collateralising a variety of DeFi tokens, stable coins, and synthetic assets.

Unlike traditional DeFi money markets where unstable assets can introduce risk to the entire protocol, in Kashi, each market is kept separate, meaning the risk from assets in one lending market does not affect the exposure of another market.

APIs

SushiSwap has an API that lets you aggregate liquidity from other platforms and swap tokens at the best price. Users need to contact Sushi directly to obtain an API Key. See the customer support section further below or head over to the broker’s website to get started.

Staking & Farming

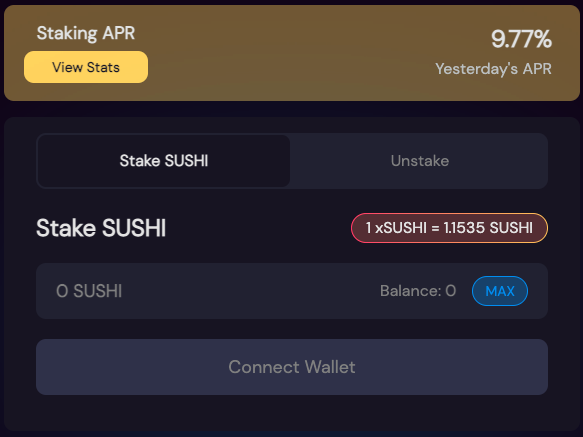

SushiSwap also offers crypto staking and farming. Many new users prefer staking over trading because it’s less labour-intensive and arguably provides more consistent ROIs. Additionally, the farming protocol means you don’t need to be a liquidity provider to earn rewards.

Through xSUSHI staking, users can earn governance rights and 0.05% of all swaps from chains in one place.

Fees

SushiSwap charges a 0.30% fee. Within this, 0.25% goes to liquidity providers in the selected pool and 0.05% to Sushi token holders who staked their coins in the SushiBar. These are competitive fees but it’s still important that traders factor in the costs before getting started.

Governance

SushiSwap is governed by its community. Users can vote on all vital upgrades and protocol changes. A percentage of all freshly issued Sushi tokens is set aside for the future development of the project. The community gets to vote directly on what projects deserve a financial boost.

Our review would like to see the crypto trading platform obtain a license from a reputable financial regulator in the future.

Customer Support

SushiSwap can be contacted via Twitter or email. The exchange also offers a range of tutorials and forums which can be accessed from the homepage. These guides can help with technical queries in addition to getting to grips with the platform and different services.

SushiSwap Verdict

SushiSwap is a serious contender in the growing DeFi market. The range of trading products and services, plus the ability to earn back money and robust community governance makes the platform a good choice for active crypto investors. It’s also an excellent alternative to competitor Uniswap.

FAQ

What Is SushiSwap?

SushiSwap incentivises a network of users to operate a platform where traders can buy and sell crypto assets. Similar to platforms like Uniswap and Balancer, SushiSwap uses a collection of liquidity pools and offers a competitive fee structure.

Is The Sushi Token A Good Investment?

Sushi has the potential to be a future leader in the crypto space. It offers a stable trading environment and ample liquidity exposure. Still, all crypto trading is risky with high levels of volatility versus traditional markets like stocks and commodities.

How Do I Use SushiSwap?

Unlike many crypto exchanges, users don’t need to create a live trading account. Instead, prospective clients can access the platform’s different applications straight from the main website. You will need to connect a digital wallet to start buying, selling and swapping cryptos.

Is SushiSwap Safe?

SushiSwap has not yet been hacked. But whilst run by a reputable team of developers, no crypto exchange is safe with security concerns common in the industry. As a result, we always recommend that our readers only invest what they can afford to lose.

Why Is SushiSwap Popular?

SushiSwap has attracted an active user base for its large selection of liquidity pools and community-focused setup. It is one of the few decentralised exchanges with enough liquidity to compete with centralised crypto trading platforms.

Best Alternatives to SushiSwap

Compare SushiSwap with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

SushiSwap Comparison Table

| SushiSwap | Interactive Brokers | World Forex | |

|---|---|---|---|

| Rating | 1.8 | 4.3 | 4 |

| Markets | Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $30 | $0 | $1 |

| Minimum Trade | Variable | $100 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | – | 100% Deposit Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | – | 1:50 | 1:1000 |

| Payment Methods | – | 6 | 7 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by SushiSwap and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| SushiSwap | Interactive Brokers | World Forex | |

|---|---|---|---|

| CFD | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Stocks | No | Yes | Yes |

| Commodities | No | Yes | Yes |

| Oil | No | No | Yes |

| Gold | No | Yes | Yes |

| Copper | No | No | No |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

SushiSwap vs Other Brokers

Compare SushiSwap with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of SushiSwap yet, will you be the first to help fellow traders decide if they should trade with SushiSwap or not?