Stash Review 2024

Pros

- Recurring and automated investments with generated portfolios based on risk profile and goals

- Very low minimum investment from 1¢ or $0.05 for fractional shares

- Simple fee structure with tier-based subscription from $3 per month and the first month free

Cons

- Available to customers in the US only

- Human financial advisors are not available

- No automated IRA management

Stash Review

Stash is an established personal finance app offering tailored investment plans on stocks and ETF instruments. The firm is regulated and also provides portfolio diversification systems, financial advice, savings tools and debit cards to US residents. This 2024 Stash review will cover membership plans, minimum deposit requirements, customer service, security features and more.

This review has no affiliation with Stash Financial UK Limited based in London.

Stash Headlines

Stash is a personal finance app that was established in 2015. It was developed to simplify investing for everyone, meaning that getting started with the somewhat challenging enterprise financial speculation is made easier. The app and financial wallet were built with a modest philosophy: everyone should have access to investing. The service aims to help everyday clients build wealth and achieve their financial goals.

Today, the service has over 5 million users. Crunchbase reports 20+ employee profiles working behind the scenes, contributing to bespoke plans. Stash investing and saving tools can be utilised on the go thanks to the broker’s mobile app. The firm is a registered investment advisor with the US Securities and Exchange Commission (SEC).

Investment Services

There are various online facilities offered by Stash, all developed to enhance users’ financial investment journeys. Below, we outline some of the main services that can be utilised.

Stash Banking Account

Our review found that the Stash banking account is a digital service that can be accessed via a tile on the home feed. This service can help users track expenditure, spend wisely and save more to invest more.

Auto-Stash

Auto-stash is a set of unique tools that can help clients to invest as if it were a part of everyday life. This includes a set schedule (investments repeated every week, two weeks or month) and round-ups (saving spare change from purchases). Smart-Stash is the auto-version of saving. The team of experts will invest funds in relevant assets when savings hit a set threshold.

Stock-Back

Stock-back rewards let users invest where they shop. The Stock-Back rewards scheme allows users to gain a fractional share of stock when spending on qualifying purchases with the Stash debit card. Wherever you spend with your stock-back card, you will be rewarded with a diversified fund, if the merchant is registered on the platform. Clients can earn up to a 5% bonus and fractional shares can be earned from over 11 million places across the US and globally; subject to foreign transaction fees. The debit card works in over 125 countries across the world.

Smart Portfolios

The Stash team uses individual risk profiles to create bespoke investment plans. These cannot be amended by investors without changing initial sign-up details. All Smart Portfolios use targeted exchange-traded funds (ETFs) so that clients have exposure to a diverse set of investment environments. These portfolios are monitored regularly and updated to balance allocations based on specific personal targets. Trades are executed by the ‘experts’ once deposited funds clear, which typically takes 1-2 working days.

Assets

Our Stash review found thousands of investment opportunities, grouped into two categories:

- Stocks – invest in 3,800+ global corporations across diverse industries including Amazon, Apple and Coca-Cola

- ETFs – 93 exchange-traded funds, baskets of investments traded on the stock exchange. These include Public Works, Clean & Green and Match the Market

Users also have the opportunity to invest in fractional shares, ideal for new traders. These are great for portfolio diversification.

Fees

All Stash investments are commission-free, though investors are required to subscribe to monthly plans with transparent charges. These vary from $1 per month to $9 per month based on the plan. The associated fees are to provide access to all money needs, such as unlimited financial advice, fractional share investing and a debit card that earns stock when you spend. Remember, investment accounts are subject to taxes, which is the responsibility of investors.

All clients are responsible for paying third-party charges. Apex Clearing custodian maintenance and bank transfer fees may apply. Incoming and outgoing bank transfers (ACH) do not have a fee.

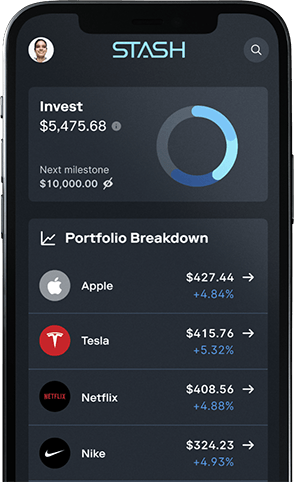

Mobile Apps

The Stash investment platform is a mobile application only. The app is available for free download and is compatible with Apple (iOS) and Android (APK) devices. The terminal is user-friendly, with an intuitive design that is great for new investors. The process of investing in stocks and ETFs can be made with the click of a button. Features include:

- Portfolio analysis

- Simple and intuitive design

- Automated investment tools

- Budgeting and spending analysis

- Investment recommendation view

- Anticipated investment returns tool

- Access to fractional shares investing

Payment Methods

Deposits

Minimum deposit requirements are just $1. Deposits from an external banking account can be invested almost instantly. It can take up to five business days for funds to transfer out of an external bank account. Processing times vary with ACH transfers. Cash may also be deposited via participating retailers, though clients will require a stash stock-back debit card to do so. Processing times:

- Stash Invest Transfers – within 5 working days

- Direct Deposits – available within 1 working day

- Cash Deposits – available on the first business day after receiving the deposit

Withdrawals

Withdrawals can take up to five working days to be processed back to an external account. Investments must be sold before a withdrawal can be requested and the SEC holding period must be closed. Maximum limits apply for both withdrawals and deposits. These include a single outbound transfer limit of $3,000.

Demo Account

Stash does not provide a demo account. This is similar to primary competitors Robinhood and Acorns. Trial accounts are beneficial for new investors, particularly to apply trading strategies risk-free. Nevertheless, the broker’s minimum deposit requirements and initial funding amounts mean that you can get started with a live account with no significant risk of losing large amounts of capital.

Deals & Promotions

It is not uncommon for Stash to implement financial rewards for customers. The Stash investment platform has previously run various trading tournaments.

As an investment service, users can also benefit from a rewards programme. The Stock-Back rewards scheme allows users to gain a fractional share of stock when spending on qualifying purchases with the Stash debit card. You will need to sign up for a bank account to start earning on qualifying purchases. Bonuses can vary between 1% and 5% of your purchase. Companies included in the scheme include Netflix and Starbucks.

Regulation & Licensing

Stash is a registered investment advisor with the US Securities and Exchange Commission (SEC). This requires the company to comply with federal regulations to protect investors and provide advice that is in the best interest of all clients. Investments are held in a third-party custodian company; Apex Clearing Corporation. Apex is a registered broker-dealer with the SEC and has a membership to FINRA and SIPC. This means investments to personal accounts are protected for up to $500,000 compensation. Banking accounts with Stash are insured to the maximum regulatory limits by the Federal Deposit Insurance Corporation (FDIC).

Additional Features

The Stash investment service provides an extensive educational platform free of charge; Stash Learn. The learning centre on the website provides plenty of articles, money news, help with understanding industries, guides for beginners and more. ‘Teach me’ topics include the basics of saving, credit, insurance and investing. Users can then drill into specific categories, such as applying the topics to retirement, parenting, career and travel. The latest broker-specific news is also posted here for clients to follow upcoming updates, important dates and recently published education.

Several how-to posts can also be found via the FAQs section of the website. All content is digestible and easy to follow, with supporting YouTube video content applicable for some topics.

Account Types

Stash has three investment plans available; Beginner, Growth and Stash+. Users can switch between subscriptions or cancel at any time. It is simple to open an account online, simply register with personal details via the app to sign-up. You may be required to provide personal details to comply with know-your-customer (KYC) protocols. The process takes just two minutes with an initial $1 minimum deposit required. The company works by asking questions to determine your current financial picture and risk adversity. Investments are recommended and curated from this information via a tailored plan.

Stash Beginner

Designed for newer investors.

- $1 subscription fee per month

- Banking access with a stock-back card

- Investing access via a personal portfolio

- Insurance access with $1,000 life insurance

Stash Growth

Targeted at investors wanting to grow their finances.

- $3 subscription fee per month

- Banking access with a stock-back card

- Insurance access with $1,000 life insurance

- Investing access via a personal portfolio, smart portfolio and retirement portfolio

Stash+

Aimed towards family finance advice with market insights.

- $9 subscription fee per month

- Insurance access with $10,000 life insurance

- Banking access for 2x stock with the stock-back card

- Investing access with two kids portfolios (custodial accounts)

- Investing access via a personal portfolio, smart portfolio and retirement portfolio

Stash lients must be 18 years or over and hold US citizenship, a green card or a relevant visa to open an account. Investors must also be registered with a US bank account and have a social security number.

Trading Hours

Stash utilises four trading windows per day; two in the morning and two during the afternoon. The investment windows operate during normal trading hours, Monday to Friday, excluding public holidays.

Customer Support

Stash provides the below 24-hour customer service options:

- Live Chat

- Email – support@stash.com

- Telephone – (800) 205-5164 (weekdays only)

A comprehensive FAQ and query page is also available on the Stash website. Topics include what to do if the app download is not working, repository lists and understanding an investment valuation. You can also interact with the Stash brand on social media channels like LinkedIn.

Safety & Security

Financial data with Stash is compliant with PCI DSS, meaning the company has applied steps to secure critical systems and align controls to protect payment card data. The service utilises 256-bit encryption to protect personal information including transaction history. The mobile and web pages use the latest Transport Layer Security (TLS) when communicating with the broker. Additional security features that can be added to every account include two-factor authentication (2FA) and biometric recognition such as facial or fingerprint access. Session end-timers and maximum login attempts also provide an additional security layer.

Stash Verdict

Stash is an exciting investment application and savings platform that helps bring the world of financial speculation to a much wider audience. The company is licensed by the SEC and supports investments into thousands of company stocks and ETFs. It is great to see simple navigation and low minimum deposit requirements, particularly with the fractional shares stock-back opportunity. The education forum is very competitive, with tutorials, investment tips and ideas, plus strategy information on personalised plans. It is a shame the service is available only for US residents.

FAQs

Is Stash Regulated?

Yes, Stash is regulated and registered as an investment advisor with the US Securities and Exchange Commission (SEC).

What Assets Can I Invest In With Stash?

Stash groups thousands of investment choices into two categories; Stocks and ETFs. This includes 3,800+ global corporations including Amazon and Apple and 93 exchange-traded funds including S&P 500 trackers. Users also have the opportunity to invest in fractional shares, which is ideal for new traders

Does Stash Have A Minimum Deposit Requirement?

Stash minimum deposit requirements are just $1 to open a live account. Monthly subscription plans are available for $1, $3 or $9 per month.

Does Stash Offer A Trial Account?

No, Stash does not offer a demo account, though the low minimum deposit requirements and initial funding amounts mean that you can get started with a live account with no significant risk of losing large amounts of capital.

How Can I Contact Stash With An App Query?

Stash offers 24/7 customer service options including email and telephone. Additionally, there is a live chat service on the mobile application.

Top 3 Alternatives to Stash

Compare Stash with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular online brokerage. It is also quick and easy to open a new account.

Stash Comparison Table

| Stash | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| Rating | 2.9 | 4.3 | 4.4 | 4 |

| Markets | Stocks, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | No | Yes | Yes | No |

| Minimum Deposit | $1 | $0 | $0 | $0 |

| Minimum Trade | $1 | $100 | 0.01 Lots | $1 |

| Regulators | SEC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SEC, FINRA |

| Bonus | – | – | – | Deposit Bonus Up To $4000 |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Own |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 4 | 6 | 6 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Stash and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Stash | Interactive Brokers | IG | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

Stash vs Other Brokers

Compare Stash with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Stash yet, will you be the first to help fellow traders decide if they should trade with Stash or not?