Stake Review 2025

Pros

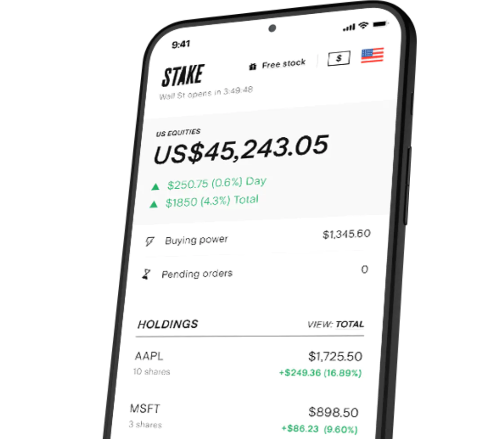

- Sleek and user-friendly mobile interface with price charts, a financial news stream and market data

- Clients can take advantage of free trades on Wall Street stocks and ETFs

- Excellent range of 6,000 US stocks and ETFs, plus a useful stock comparison tool

Cons

- UK investors are limited to bank transfers when making deposits and withdrawals

- The brokerage does not support trading using leverage or margin

- There are limited technical analysis tools in the app

Stake Review

Stake offers trading on over 6000 US stocks and ETFs with $0 brokerage fees. The user-friendly investing app is also regulated by tier-one financial authorities and provides deep insights into company financials.

Our experts tested Stake’s trading services, from platforms and minimum deposits to sign-up bonuses and customer support. This 2025 broker review also explains how to open a live account and start trading.

Company Details

Stake was launched in 2017 by co-founders Matt Leibowitz and Dan Silver, initially operating in America. The online broker is primarily app-based and aims to be an ASX and Wall Street brokerage that investors can access on the go.

After launching in 2017, Stake has expanded to operate in Australia, New Zealand, Brazil, and the UK. The brand boasts over 450,000 registered clients worldwide and low trading fees.

Shares and ETFs purchased through Stake are managed by DriveWealth, a popular finance platform also used by other investing apps such as Revolut.

Stake holds reputable regulatory licences in three jurisdictions. The broker is regulated by the FCA in the UK and ASIC in Australia. In addition, the company is a Registered Financial Services Provider in New Zealand.

Stake App

Stake operates a mobile-based trading platform, available as an app for iOS and Android devices.

Using the app, traders can view value charts and graphs of a stock or ETF, monitor their portfolio or place buy and sell orders on the go.

However when we used Stake’s app, we found it does not support helpful trading tools such as indicators, drawing tools, and complex order types. As a result, traders will need to conduct technical analysis on a third-party platform such as TradingView.

In addition to online trading, investors can access articles, market news and comprehensive company financial data through the app.

How To Buy Stocks

- Sign up for an investment account online

- Make a deposit or transfer money to your Stake account

- Use the asset navigation window to find a stock or ETF

- Select ‘Buy’ to purchase a stock or ETF

Note, you can review and sell your positions at any time through the app.

Assets & Markets

Stake is an online brokerage focussed on stock trading. Over 6,000 Wall Street stocks and ETFs are available, spanning an impressive range of equities from several top US exchanges. These shares make up the majority of the brand’s 8,000+ total investing products.

The rest of the list consists of 2,000+ shares and ETFs from the Australian ASX, including top national firms such as BHP Group and RIO Tinto Ltd.

The broker also offers fractional stocks, which will appeal to beginner investors and those with less capital.

Trading Fees

Stake makes much of its status as a $0 fee brokerage. There are no brokerage or forex fees on US stocks and ETFs, allowing traders to put all of their deposited funds into investments.

However, there is a one-off $5 fee for the broker to complete a US tax form on your behalf– a service other brokers offer for free.

The company charges a $3 fee on ASX stock purchases and sales. This said, if investors transfer ASX stocks from another brokerage worth $1,000 or more, these fees are waived for a year.

A Stake Black membership costs A$12 per month for the Wall Street package, A$12 per month for the ASX package and $17 per month for the comprehensive/combined package. However, these monthly rates are only available when the membership is paid annually and month-to-month billing rates are higher by A$2-3 per month.

Account Types

Stake offers a single brokerage account as standard. However, customers in Australia and New Zealand can purchase a Stake Black membership to use on either ASX or US markets or as a comprehensive package to cover all supported markets.

Stake Black costs between A$12 and A$20 per month, depending on features and billing preferences. Members receive a range of benefits over the standard offering, including:

- Market depth data

- Instant funds settlement after a sale

- Price targets from professional analysts

- Access to OTC-traded equities

- Full company metrics

Note, Stake does not offer ISAs.

How To Open An Account

New users can sign up in three steps:

- Register for an account on the official website

- Enter your contact details including citizenship, title, name, date of birth, and mobile number

- Complete several straightforward regulatory questions in the on-screen prompt

- Verify your tax jurisdiction and your identity

- Start trading

Note, the account opening process takes around three minutes, providing prompt access to trading markets.

Payment Methods

The payment methods available to clients vary based on their jurisdiction. For Australians and New Zealand residents, Stake supports:

- Bank Transfers

- POLi payments

- Debit and Credit cards

- Apple and Google Pay

Investors can also transfer an existing portfolio of US stocks held with another brokerage to their Stake account. While transfers via ACATS are free, portfolio transfers via DTC or DRS are subject to additional fees.

UK investors only have one option for making cash deposits: a bank transfer via an account that supports OpenBanking. Express deposits reach an account by US market open where applicable, while regular payments will credit an account the next working day during market hours. The minimum deposit is $50.

Stake withdrawals can take up to four working days, with a minimum withdrawal amount of $10.

Deposit & Withdrawal Fees

While Stake’s offer of zero trading fees features heavily in their marketing, one fee that the platform does charge is for deposits and withdrawals.

In the UK, the brokerage charges a 0.5% ($2 minimum) flat fee on deposits as a forex fee, as GBP deposits are changed into USD trading funds by the broker. In addition, instant deposits are subject to an additional 0.5% fee ($2 minimum), adding up to a notable charge.

Withdrawals are subject to the same 0.5% (minimum $2) forex charge.

In other supported jurisdictions, Stake charges a 70 bps forex fee (minimum $2) and a 0.5% fee for instant deposits. Debit card funding costs an additional 0.5%, while credit card fees are 2.5%.

The same 70 bps ($2 minimum) forex fee is applied to withdrawals.

Regulation & Security

Investors are rightly concerned about the safety of their data and funds in the trading space. To this end, Stake is a stockbroker with multiple regulatory licences from reputable bodies such as the UK’s FCA and Australia’s ASIC.

Furthermore, client funds are insured for up to $500,000 each in case of the insolvency of DriveWealth, the company that holds the equities that Stake clients purchase.

In addition, login security is enhanced by support for Two-Factor Authentication (2FA). 2FA provides investors’ accounts with additional protection from fraud, and our experts recommend setting this feature up where possible.

Customer Service

While using Stake, our traders were disappointed with the customer support options. This may be an issue for investors who want to ask questions like how to buy stock on Stake.

While the brokerage has a small FAQ and help section on its website, there is only one avenue for investors to contact the support team– via email using a form on the company’s website.

Many brokers operate a live chat or phone line for fast help, so the lack of an instant contact method is disappointing. Furthermore, only registered clients can contact the broker, as traders need to use a “Stake account email” to submit this form.

Additional Features

While using Stake, we found several helpful additional tools.

The first of these is fractional investing. Clients can purchase fractions of Wall Street equities through the broker, meaning traders do not need to stump up large amounts to invest in high-cost shares such as Berkshire Hathaway and Tesla.

Another feature available to traders is stock lending. Participants can opt-in and lend their US equities to financial institutions that wish to cover short sales. In return, investors receive interest when their shares are borrowed. Share lending is an excellent way of earning passive income, especially for traders who own highly shorted stocks like GameStop.

Educational Content

When appealing to investors with a zero-fee mobile platform, brokers such as Stake are likely to attract new and inexperienced traders. Therefore, the company should provide a solid range of educational content.

Thankfully, Stake publishes plenty of educational content for its clients. This ranges from the explanatory articles of the Stake Academy to regular spotlights on recent market events and trending sectors.

Also included are articles on updates within the online brokerage, such as new features and special dividends, as well as pieces on the investment choices and portfolios of clients.

Trading Hours

Stake operates 24/7 through its app, enabling investors to access their portfolio anytime from their mobile devices. Investors can trade stocks within US market hours for Wall Street shares and within ASX exchange hours for Australian equities.

Stake Black members can trade stocks OTC, which gives access to out-of-hours trading on some US stocks.

Stake Verdict

This Stake review has shown the broker is a solid choice for on-the-go stock investing. With access to over 8,000 stocks and ETFs, clients can trade the most prominent US and ASX equities without trading fees. However, investors should beware of hidden costs such as deposit and withdrawal charges that can exceed 3.5%. We would also like to see improved customer support options through a live chat or phone helpline.

FAQs

Is Stake Trading Safe?

Stake is licensed by two of the most reputable regulators– the UK’s Financial Conduct Authority (FCA) and the Australian Securities & Investments Commission (ASIC). The online brokerage is also a Registered Financial Services Provider in New Zealand. This robust regulatory oversight suggests Stake is legitimate and not a scam.

Is Stake A Good Broker?

Stake is an excellent choice for investors that want to trade US and ASX stocks fee-free from a mobile app. Fractional stock trading is also available for investors on a budget.

Is Stake Good For Wall Street Investing?

With over 6,000 US stocks and ETFs to trade, Stake has plenty of options for US-focused investors. In-depth company data and market insights are also available to account holders.

Does Stake Have A US Brokerage?

Stake does not operate in the US. Supported regions are the UK, Brazil, Australia and New Zealand.

What Is The Stake Brokerage Fee For ASX Equities?

Stake charges $3 per trade on ASX stocks and ETFs. $0 fee trading is available on the majority of the brokerage’s trading assets.

Top 3 Alternatives to Stake

Compare Stake with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Zacks Trade – Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

Stake Comparison Table

| Stake | Interactive Brokers | Dukascopy | Zacks Trade | |

|---|---|---|---|---|

| Rating | 2.9 | 4.3 | 3.6 | 3.9 |

| Markets | Stocks, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, ETFs, Cryptos, Options, Bonds |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $100 | $2500 |

| Minimum Trade | Variable | $100 | 0.01 Lots | $3 |

| Regulators | FCA, ASIC, FMA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | FINRA |

| Bonus | Free Stock | – | 10% Equity Bonus | – |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | Own |

| Leverage | – | 1:50 | 1:200 | – |

| Payment Methods | 6 | 6 | 11 | 3 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Zacks Trade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Stake and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Stake | Interactive Brokers | Dukascopy | Zacks Trade | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Stake vs Other Brokers

Compare Stake with any other broker by selecting the other broker below.

The most popular Stake comparisons:

Customer Reviews

There are no customer reviews of Stake yet, will you be the first to help fellow traders decide if they should trade with Stake or not?