PayRedeem Brokers 2026

PayRedeem, formerly VLoad, is an online service that traders can use to transfer funds to online brokers. Owned by Global Primex Limited, it is a well-established payment method that makes it easy for investors to make fast and low-cost trading deposits. This guide will review PayRedeem by covering how it works, expected transaction times, plus transfer costs.

We have also compiled a list of the top trading brokers that accept PayRedeem deposits in 2026.

Best PayRedeem Brokers

Following our exhaustive tests, these are the best 3 brokers that support PayRedeem:

Here is a short overview of each broker's pros and cons

- M4Markets - M4Markets is an award-winning broker regulated by the CySEC, FSA and DFSA. Although relatively new, the broker continues to improve its offering with a range of innovative tools, platforms and accounts. Beginners can start with just $5, whilst experienced investors can access leverage up to 1:5000.

- LMFX - LMFX is an offshore CFD and forex broker with flexible account options that support trading with fixed or floating spreads, including a raw spread account with super tight pricing. The assets on offer include forex, stocks, indices and commodities, and very high leverage up to 1:1000 is available. The broker is based in Macedonia and was established in 2017.

- AdroFx - AdroFx is an offshore ECN/STP broker that has offered CFD trading since 2018. The firm supports 100+ tradable assets on the popular MetaTrader 4 platform as well as a web trader, Allpips. Eight live accounts are available with no restrictions on day trading strategies.

Compare The Best PayRedeem Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| M4Markets | $5 | Forex, CFDs, Indices, Shares, Commodities, Cryptos | MT4, MT5 | 1:1000 |

| LMFX | $50 | Forex, CFDs, indices, shares, commodities | MT4 | 1:1000 |

| AdroFx | $25 | Forex, CFDs, Indices, Shares, Metals, Cryptos | Allpips, MT4 | 1:500 |

M4Markets

"M4Markets will serve active investors looking for highly leveraged trading on powerful third-party platforms. Other investment opportunities are also available, including copy trading and MAM/PAMM accounts."

William Berg, Reviewer

M4Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Cryptos |

| Regulator | FSA, CySEC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, ZAR |

Pros

- M4Markets is a low-cost broker, offering spreads from 0.0 pips and $0 commissions, plus an accessible $5 minimum deposit

- M4Markets holds multiple global licenses, including the CySEC and DFSA

- Execution speeds are fast, averaging 30 ms (we consider anything below 100 ms as fast and suitable for active day traders)

Cons

- The educational resources trail the best brokers with only a small selection of eBooks and webinars offered

- M4Markets doesn't offer any rebate schemes or rewards for active traders

- The range of around 200 investments is slim compared to top brokers, who typically offer over 1000

LMFX

"Experienced traders who want highly leveraged CFDs and a choice between fixed and floating spreads should consider LMFX. On the downside, new clients should note the weak regulatory oversight."

William Berg, Reviewer

LMFX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, commodities |

| Platforms | MT4 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR |

Pros

- Zero deposit fees

- Bonuses, contests and awards

- High leverage up to 1:1000, 1:400 or 1:250 depending on the account

Cons

- No support on weekends

- No cryptocurrency and Bitcoin trading

- Limited educational resources for newer traders

AdroFx

"AdroFx will appeal to traders who want a quick and affordable way to speculate on currencies with high leverage via two reliable platforms, including MetaTrader 4. However, testing shows it trails the best day trading brokers in several areas, notably regulation and its investment offering."

Michael MacKenzie, Reviewer

AdroFx Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Metals, Cryptos |

| Regulator | VFSC, FSA, BSSLA |

| Platforms | Allpips, MT4 |

| Minimum Deposit | $25 |

| Minimum Trade | 0.0001 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP |

Pros

- Strong automated trading support with VPS access on MT4 offered free for Pro account holders and affordable access from $10 for other accounts

- Quick, responsive customer support from knowledgeable staff who provide personalized responses during testing

- 60+ currency pairs is a great range that beats out many rivals and provides plenty of opportunity for forex traders

Cons

- Only 100+ instruments are available, with a particularly weak stock and crypto offering, leaving little scope for diversification and reducing the broker's suitability for experienced traders

- Mediocre selection of research tools with limited insights into upcoming events that could help beginners identify opportunities, especially compared to alternatives like eToro

- Expensive withdrawals for most payment methods, including a 1.9% charge on cards, which can be avoided at most top day trading brokers

How Did We Choose The Best PayRedeem Brokers?

To list the top PayRedeem brokers, we:

- Searched our directory of 139 online brokers, removing all those that don’t support PayRedeem payments

- Ensured that the remaining brokers support PayRedeem deposits and withdrawals for day trading

- Sorted them by their total rating, derived from over 100 data points and first-hand observations

What Is PayRedeem?

PayRedeem is a voucher card payment system available to users around the world. It was launched in 2007 with the aim of facilitating secure transactions between customers and merchants, such as day traders and online brokers.

All cards are given a ‘ribbon’ which is a classification of what the card can be used for. If you are using a card to transfer funds to and from a broker, the card will be given a ‘brokerage’ ribbon.

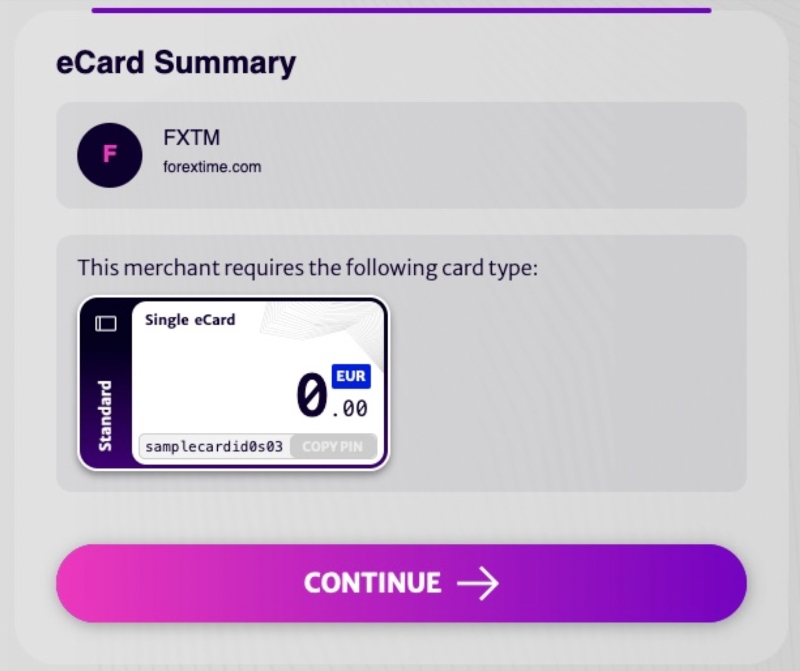

The firm makes use of three types of eCard to process payments. These are called Standard, Subscription and Payout and can be bought on the main dashboard after you login.

- Standard cards work in a similar way to vouchers in that you purchase a card with a pre-determined amount and once it has been used, it must be replaced. Standard cards must be used within 96 hours of purchase. Any funds left on the card after the 96-hour period expires will be returned to your account balance sheet. Deposits to a Standard card can be made via Mastercard and Visa debit/credit cards, bank transfers and Bitcoin.

- Payout cards can be used to withdraw funds from PayRedeem brokers. If you want to cash out on your trading returns, you can use the details on the Payout card linked to your investing account. Once your funds have been withdrawn, the card will work in the same way as a Standard card.

- Subscription cards can be used to make recurring payments. As these cards do not expire, they offer a viable alternative to purchasing a Standard card every week, month or year, depending on your membership period. This could be a good option for active traders looking for brokers that accept PayRedeem deposits.

Importantly, when you purchase an eCard, you have to specify the merchant it will be used for. An example can be seen below where the chosen merchant is the online trading broker, FXTM.

Payment Speed

Brokers that accept PayRedeem deposits usually process payments instantly, making it one of the best methods for fast access to the financial markets. Alpari, for example, processes PayRedeem deposits immediately.

On the other hand, withdrawals generally take longer. At most trading brokers, PayRedeem withdrawals take a full business day, though this can vary.

Overall, most PayRedeem brokers offer fast deposits and withdrawals versus alternative payment methods, such as wire transfers.

Fees & Limits

Transactions tend to be free but you may find that certain PayRedeem brokers impose a fee. Fortunately, there is a decent list of brokers that accept PayRedeem deposits, such as M4Markets, that do not charge.

It is worth noting that there are caps on the minimum amount you can transfer using PayRedeem.

You should also be aware that PayRedeem imposes its own transfer limits. These limits cap how much can be sent over a period and are linked to the account tier:

- Tier 0 – Up to €150 with a maximum of two successful payments per month. When you first join up, your account is automatically set to tier 0

- Tier 1 – Once you have provided a valid ID and proof of residence, your account is upgraded to tier 1. The new maximum is €25,000 per year

- Tier 2 – This is the final tier and the transaction cap is increased to €100,000 per annum. To reach tier 2, traders must submit a passport-style photo, verify their phone number and sign a Declaration of Money Origin form

Note that PayRedeem charges €20 to make a withdrawal from your payment account to your bank.

Security

To help protect client accounts, the company restricts card payments to their specified merchant, such as a named trading broker. This way, even if someone were to gain access to your eCard information, they could not send money to their own bank account.

Furthermore, Standard accounts expire after three days, so there is only a limited amount of time where you are vulnerable.

It’s also worth making sure that you sign up with trusted brokers that accept PayRedeem. Avoid unregulated trading platforms with negative user reviews. See our list of recommended PayRedeem brokers here.

Customer Support

There are several ways to seek help if you encounter an issue trading with PayRedeem. Clients can use any of the following methods to contact the 24/7 customer service team:

- FAQ help centre

- Live chat via the official website

- Email to support@payredeem.com

- Call either the +1 912 800 0083 or +44 162 820 0487 phone number

Note, PayRedeem brokers may also be able to help with deposit and withdrawal delays.

Benefits Of PayRedeem For Traders

- Safe and secure payment method

- Instant deposits at most PayRedeem brokers

- Easy to increase maximum transfer limits

- 24/7 customer support

Drawbacks Of PayRedeem For Traders

- Limited deposit size and frequency with tier 0

- Withdrawals are only permitted for tier 1 and tier 2 accounts

- A limited number of brokers accept PayRedeem deposits

How To Deposit Using PayRedeem

The exact process will depend on the broker, but will generally involve logging into your client area, selecting PayRedeem from the list of deposit methods and confirming the transaction in the secure portal. At M4Markets, for example, you would need to follow these steps:

Deposits

- In your trading account, go to the funding area and select ‘Deposit

- From the list of available methods, choose PayRedeem

- Enter your eCard’s PIN and the amount you wish to deposit

- If you have not yet set up an eCard for your broker, select the ‘Buy Voucher’ option. This will redirect you to PayRedeem’s website where you can purchase an eCard

- Confirm the deposit

Withdrawals

- Login to your trading brokerage and go to the finance section

- Click ‘withdrawal’ and select PayRedeem from the drop-down list

- Complete the fund withdrawal form and input your PayRedeem account details

- Your broker may use 2FA to validate the withdrawal. If so, complete the verification process

- Wait for your funds to be deposited into your PayRedeem account

Is PayRedeem Good For Day Trading?

PayRedeem is a cost-effective and reliable method for sending funds to and withdrawing profits from your trading broker. There are some restrictions if you hold a tier o account, however, fast and secure payments make it an attractive option.

Use our list of the best brokers that accept PayRedeem deposits to start trading.

FAQ

Can I Make Deposits To PayRedeem Brokers Through A Mobile App?

At the time of writing, there was no PayRedeem mobile app, meaning the only way to access your account is through a web browser. However, there are plans to introduce an app available for download on Apple and Android devices in the future. Until then, users will need to make trading deposits from their desktop computer or laptop.

Is PayRedeem A Trustworthy Way To Fund Online Trading?

PayRedeem is a secure and trustworthy payments company. It is a genuine transfer system and there are several regulated brokers that accept PayRedeem deposits and withdrawals. For an added layer of security, traders can only make a deposit with the payment solution if they named the online brokerage as a specified merchant.

Can I Use PayRedeem Discount Codes When Making Deposits To My Trading Account?

You may be able to find PayRedeem bonus codes online, though there is no referral scheme. Some trading brokers that accept PayRedeem deposits also offer welcome bonuses, such as no deposit offers. Importantly though, always check terms and conditions before using a trading offer, as there may be volume requirements to meet before profits can be withdrawn.

Is PayRedeem Available To Traders In The USA?

PayRedeem is available in many key countries around the world, including the US, the UK, India, Canada and the EU. However, if you are a trader based in Russia, South Africa, or Albania, for example, you must use alternative payment methods. You can see the full list of countries where PayRedeem is unavailable on the website.

How Do I Make Trading Deposits With PayRedeem?

To make payments using PayRedeem, you need to purchase either a Standard or Subscription eCard. These can be bought using credit and debit cards, bank transfers or Bitcoin. Brokers that accept PayRedeem deposits can be found on the official website on the merchant list page. Alternatively, we have reviewed and ranked the best PayRedeem brokers here.