OspreyFX Review 2024

Pros

- Funded accounts up to $200k with 70/30 profit split

- MetaTrader 4 and MetaTrader 5 integration

- Full range of investments including cryptos

Cons

- Bank transfer deposit fee

- US clients not accepted

- Weak regulation

OspreyFX Review

OspreyFX offers two of the world’s most popular platforms for trading CFDs on forex, cryptos, stocks, and commodities. Though unregulated, the broker is a licensed business in St. Vincent and the Grenadines and offers competitive leverage rates and a range of payment options. This review delves into the benefits and drawbacks of signing up with OspreyFX, including account types, financial assets, scam security and more.

Assets & Markets

Despite its name, OspreyFX does not limit clients to speculating on the foreign exchange markets. While not the most extensive selection of assets compared to some alternatives, there are good trading opportunities in currencies, indices and cryptos, in particular.

The full range of financial assets offered by the broker includes:

- Stocks – shares in 10 EU and 27 US companies

- Forex – 57 major, minor and exotic currency pairs

- Cryptos – Over 20 of the biggest cryptocurrency tokens against the US dollar

- Indices – 13 global stock indices, including the Dow Jones US30 and FTSE 100

- Commodities – 9 hard and soft commodities including energies and metals

Fees & Spreads

OspreyFX follows an ECN pricing model with tight spreads alongside a low commission.

Typical live spreads on the Standard account are 0.8 pips with a $7 commission per lot, the PRO account offers typical spreads of 0.4 pips with an $8 commission, the VAR solution offers spreads from 1.2 pips with zero commission, and spreads on the Mini account start at 1.0 pip with a $1 commission per lot.

This makes the firm a good pick for traders deploying intraday strategies, including scalping and Expert Advisors.

Our experts were also pleased to see no inactivity fee and competitive swap fees for overnight positions.

On the downside, you have to pay a withdrawal fee, depending on the payment method.

Payment Methods

OspreyFX accounts can be funded and emptied using several popular payment methods, with varying fees and processing times. The options are:

- Bank wire transfer

- Credit/debit card

- VLoad

- Bitcoin

- UPay

On the negative side, bank transfers are charged a $25 fee, with an increased minimum deposit requirement of $100. All other payment methods have a minimum deposit of $10. When we used OspreyFX, we also liked that Bitcoin payments can be tracked on blockchain.info for added security.

The withdrawal time for any payment method is at least 24 hours, which is similar to other brokers. Withdrawals up to $5,000 made via bank transfer incur a $25 fee. Bitcoin withdrawals are free of charge, excluding third-party bank fees.

Importantly, deposits and withdrawals must be made from accounts under the same name that the trading account is registered with. Account transactions can be made easily from within the OspreyFX portal.

OspreyFX trading accounts can be opened in USD, EUR, GBP, CAD, AUD and BTC base currencies. The wide range helps keep fees to a minimum, with less need for currency conversion charges.

Note, PayPal payments are not currently accepted.

OspreyFX Accounts

OspreyFX offers four account types with a range of features and limits. This was a bonus for us, making it easy to find a profile that matched our trading style and strategy.

- Standard – spreads from 0.8 pips, $7.00 commission, $50 minimum deposit

- PRO – spreads from 0.4 pips, $8.00 commission, $500 minimum deposit

- VAR – spreads from 1.2 pips, $0 commission, $250 minimum deposit

- Mini – spreads from 1.0 pip, $1 commission, $25 minimum deposit

Swap-free MT4 and MT5 ECN accounts are also offered for Islamic traders.

Funded Accounts

OspreyFX also offers funded accounts via a three-step program.

Funded accounts essentially allow users to trade on behalf of a company. Profits are then divided between the individual and the company.

To open an OspreyFX funded account:

- Step 1: Purchase a challenge entry and familiarize yourself with the platform

- Step 2: Verify your strategy and prove your skills

- Step 3: Get funded and start trading with a real account

Importantly, to progress to the next step, traders cannot exceed a daily loss of 5% or a maximum overall loss of 12%. The minimum trading term is ten days. Traders must also adhere to the consistency rule that states that the best trading day must not exceed 30% of the total profit earned. Criteria must be met in full before a funded account is granted.

Once granted, funded accounts offer weekly payouts, tracking and analysis as well as a verification bonus. Funded accounts are also credited with 200k for which the account holder is not liable.

OspreyFX offers four funded account sizes. For a detailed breakdown visit the broker’s website.

Trading Platforms

OspreyFX offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular platforms for forex and CFD trading.

MetaTrader 4

We rated MetaTrader 4 for its intuitive interface, fully customizable dashboard and range of charting and analysis tools. MT4 offers 30 technical indicators, nine chart timeframes, market analysis tools, multiple order types and automated trading support. It also supports one-click trading, three execution modes and historical data is readily available.

This popular forex trading platform is widely used around the world and despite the fact that MT5 has been around for over a decade, MT4 still supports a greater trading volume than its successor.

MetaTrader 5

MetaTrader 5, the latest platform from MetaQuotes, boasts 38 built-in technical indicators, 21 timeframes, 10 order types and 44 graphical analysis tools.

MT5 is better suited for multi-asset trading, leverages more sophisticated software, and is more efficient. MT5 also supports the MQL5 programming language and real-time market review and analysis. As such, our team recommend MT5 for more experienced traders.

Both trading platforms are compatible with Windows and Mac computers, iOS and Android (APK) mobile devices and most browsers for web-based order execution.

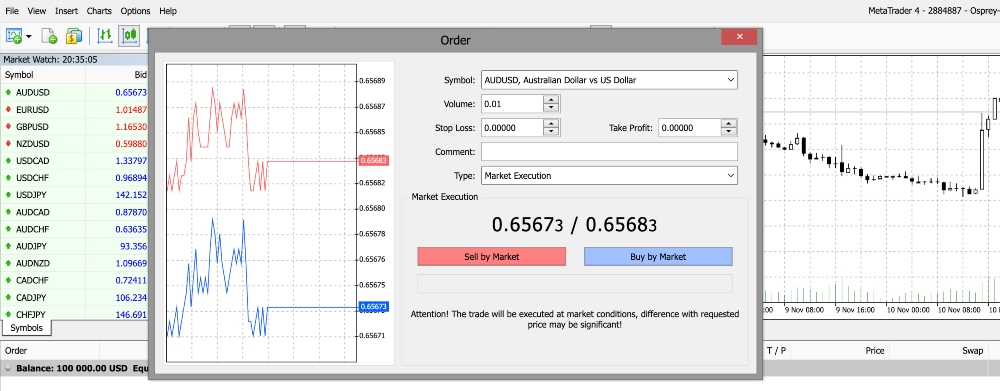

How To Place A Trade

I found that trading with OspreyFX is quick and easy. To make a trade:

- Login to your trading portal and select the platform you wish to trade through

- Search for your desired asset using the navigation bar and once found, double click

- A new order window will appear

- Choose between instant execution and pending order

- Complete the remaining order details, including the parameters of your trade such as volume in lots, stop-loss and take-profit

- Hit the ‘buy’ or ‘sell’ button to confirm the trade

Note that once verified, you will need to add funds before you can start trading.

Mobile Apps

OspreyFX clients are not tied to their desks if they want to access their accounts or execute trade orders. Both MT4 and MT5 mobile applications can be downloaded for free on the App Store or Google Play Store, facilitating on-the-move trading and position monitoring.

However, we found that mobile trading does have its limitations, with fewer advanced features and analysis capabilities than are supported on the desktop and web-based platforms.

Leverage Review

One benefit of not falling within the jurisdiction of a regulatory agency is that OspreyFX can offer leverage up to 1:500 across its range of assets.

While this may be attractive to many thanks to the opportunity for greater market exposure and profit, margin trading should be carried out with care. Leverage can also magnify losses, with the possibility of losing more money than you have capital in your account.

Demo Account

OspreyFX offers a well-equipped free demo account for those who wish to try before they buy. The account is credited with as much virtual funds as desired and supports all forms of trading that are possible on the main account, with the same 1:500 maximum leverage rate.

Practice accounts are a brilliant way to get a feel for a broker, platform or asset range before committing real capital. They can also be used to test new strategies and ideas risk-free.

That being said, spreads, liquidity and slippage may not always match those seen in live accounts.

OspreyFX Bonuses

OspreyFX regularly runs trading competitions with a variety of rules and goals, often with monetary prizes. For the latest live offers, visit the broker’s website.

The broker also offers a referral bonus scheme.

For a 20% discount off all trading competitions, follow any of our visit buttons, or go direct to OspreyFX.

Regulation & Licensing

OspreyFX is headquartered in St. Vincent and the Grenadines, where it is a legally licensed business. That being said, it is not a regulated forex broker, which may put some investors off.

Regulated brokers typically have several protective measures in place, such as segregated bank accounts, negative balance protection and legal recourse opportunities. We generally recommend selecting a regulated broker for these reasons.

That being said, being unregulated affords OspreyFX some opportunities. For example, leverage rates are not capped, the broker can provide crypto derivatives to traders in certain countries, and client anonymity can be preserved to a greater level.

Additional Features

OspreyFX offers its clients more than just brokerage services, the website is home to a range of financial news and insights articles, a suite of topical content such as myth debunking, and online calculators.

For traders new to forex or for those that want to brush up on their skills, OspreyFX offers the Forex Squad app. It is a free education tool offering training and resources on a range of topics, including fundamental analysis, forex strategy and trading psychology. While using OspreyFX, we particularly rated that the app is free to download and available to all.

Trading Hours

Forex trading opens at 21:00 GMT on a Sunday and closes at 10:00 GMT on a Friday. Despite being open throughout this window, different currency pairs are best traded at times when their respective exchanges are open.

For example, the GBP/USD pair is most liquid when both the London Stock Exchange (LSE) and New York Stock Exchange (NYSE) are open, between 13:00 GMT and 16:00 GMT. The main global trading sessions are:

- Sydney – 22:00 – 07:00 GMT

- Tokyo – 01:00 – 10:00 GMT

- London – 08:00 to 16:00 GMT

- New York – 13:00 – 22:00 GMT

Other financial instruments have different market times. Stocks are only tradeable while their local exchanges are open, commodities have a range of trading times and cryptos are available 24/7.

Company Details & History

Founded in 2019, OspreyFX is an online brokerage operating from St. Vincent and the Grenadines. Clients can trade a range of instruments spanning multiple asset classes via the two latest MetaQuotes trading platforms. Its services are best suited to day traders, offering good technical analysis, variable account options and high leverage rates.

As an ECN broker, OspreyFX does not pass order flow to market makers. Instead, it electronically matches trade participants and passes orders through to liquidity providers. ECN brokers typically provide more transparent market data, deeper liquidity and tighter spreads than dealing desk brokers, though often with additional commissions.

OspreyFX is unregulated, meaning that its activities are not necessarily compliant with standard regulatory practices. Clients should be aware that trading with an unregulated broker carries greater risk.

Customer Support

If you find yourself in need of help, perhaps your account is locked or you have received a margin call, OspreyFX’s customer service team are contactable 24/7 via a range of standard methods.

We found that the quickest way to get in contact is using the live chat feature in the lower right corner of their website. Our only criticism is that the automated chatbot can take some navigation to get to the support you need.

You can also provide your email address or phone number to submit a ticket request for the broker to contact you back.

OspreyFX is also active across social platforms including Facebook, Twitter, Instagram and LinkedIn.

Security & Safety

Despite no legislative requirement to do so, OspreyFX segregates client funds from its own capital using reputable banking institutions.

OspreyFX also implements KYC protocols and a two-factor authentication process to sign in to your account, using a QR code to verify your identity.

While unregulated, OspreyFX clearly takes the safety of its client funds seriously, demonstrating transparency. That being said, policies such as negative balance protection and insurance are not offered.

OspreyFX Verdict

OspreyFX is an offshore ECN broker offering a reasonable range of trading instruments alongside access to both MT4 and MT5. While using OspreyFX, our experts found that the broker has good levels of accessibility and customer service, with mobile trading support and a competitive fee structure, including a zero-commission account. The funded account is also a plus for us.

However, the lack of educational resources, payment options and regulation may deter some users.

FAQs

Is OspreyFX A Legit And Safe Broker?

OspreyFX is not regulated by any financial watchdog, creating a level of risk for anyone that opens an account. Unregulated brokers are not required to implement protective measures or abide by legislative limits that are put in place to protect retail investors. However, OspreyFX maintains a good level of site and account security, segregates its client funds and uses two-factor login authentication.

Who Owns OspreyFX?

The owner of OspreyFX is OspreyFX Limited, a holding company also registered in St Vincent and the Grenadines. The broker has been operating since 2019.

Does OspreyFX Offer A Demo Account?

Yes, OspreyFX provides prospective users with a demo account on both its trading platforms. Users can fund their practice accounts with as much virtual money as they want and trade with all the same instruments, leverage rates and functionalities available with live trading.

Where Is OspreyFX Located?

OspreyFX’s headquarters are in St. Vincent and the Grenadines, where it has been operating since 2019 and holds a local business license.

Is OspreyFX On MT5?

OspreyFX offers both MT4 and MT5, appealing to traders that have grown fond of MT4 and supporting more advanced traders and new investors with the sleeker, more sophisticated MT5.

Does OspreyFX Allow US Investors?

No, OspreyFX does not accept US clients, whether citizens or residents of the country. Other restricted countries and locations include the UK, Japan, Malta and North Korea.

Top 3 Alternatives to OspreyFX

Compare OspreyFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

OspreyFX Comparison Table

| OspreyFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3 | 4.4 | 4.3 | 4 |

| Markets | Forex, Cryptos, Indices, Stocks, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 20% Discount [DayTrading.com Exclusive] | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by OspreyFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| OspreyFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

OspreyFX vs Other Brokers

Compare OspreyFX with any other broker by selecting the other broker below.

The most popular OspreyFX comparisons:

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Customer Reviews

There are no customer reviews of OspreyFX yet, will you be the first to help fellow traders decide if they should trade with OspreyFX or not?