OctaFX Review 2024

Awards

- Most Secure Broker Indonesia 2022- International Business Magazine

- Best Global Broker Asia 2022- International Business Magazine

- Best Forex Broker Pakistan 2022- Global Brands

- Best Forex Broker India 2022- World Finance

- Best Mobile Trading Platform 2022- FXDailyInfo

- Best In Class For Social Copy Trading 2022- Forexbrokers.com

- Best Trading Conditions Asia 2021- World Business Outlook

Pros

- Demo account with access to unlimited virtual funds

- Bonuses and contests available (non-EU)

- Negative balance protection (Within EU)

Cons

- No stock trading

- Few payment methods

- Zero pip spreads unavailable

OctaFX Review

OctaFX is a forex, CFD and copy trading broker offering the MT4 and MT5 platforms. In this 2024 broker review, our experts log in to the personal area and uncover the key features, including leverage, demo accounts, regulation and more. Read on to find out whether OctaFX is a good forex broker. Please note that the answer to this question might depend on where you live.

Quick Facts

| ? Available Account Currencies: | USD, EUR |

|---|---|

| ? Minimum deposit: | USD 100 |

| ?️ Max Leverage: | Up to 1:500, Up to 1:50 within EU |

| ? Spread: | From 0,6 pips |

| ⚖️ Regulator: | SVGFSA / CySEC |

| ? Bonus: | 10, 30 or 50% bonus on each deposit outside of the EU. No bonus is offered inside the EU. |

| ?️ Trading Platform: | MetaTrader4, MetaTrader5 |

| ???Free Demo Account: | ✔️ Yes |

| ? iOS App: | ✔️ Yes |

| ? Android App: | ✔️ Yes |

| ?Deposit money: | Mastercard & Visa debit/credit cards, Skrill, Neteller, FasaPay, wire transfer, Cryptocurrency |

Key takeaways

- OctaFX offers a promising service for beginners and experienced traders.

- The broker offers fee-free deposits and withdrawals, plus Islamic accounts

- They offer a free unlimited demo account.

- Trading through MetaTrader4 and Metatrader 5.

- Deposit money using VISA, Mastercard, Skrill, Neteller, FasaPay, wire transfer, Cryptocurrency

- Commissions free trading

- Offer high leverage. 1:50 EU, 1:500 rest of the world.

- Mobile app for Android and iOS.

- Regulated by the Financial Services Authority in St Vincent and the Grenadines (SVGFSA) and the Cyprus Securities and Exchange Commission (CySEC)

- OctaFX offers a deposit bonus on all deposit. (Non EU only)

Overview

Overall score

International

The overall score might seem lower than what each category’s score indicates. This is due to the fact that OctaFC forex trading is unregulated outside of Europe. We consider it to be very important that a broker is regulated by a regulator who offers strong trader protection. The overall score is therefore adjusted down due to the broker being unregulated. We do not recommend that you use this broker if you live outside the EU. Choose another regulated broker instead.

EU

This broker can be a good choice for you if you live within the EU and are satisfied with its limited selection of tradeable assets. It can also be a good choice if you are looking for a company that makes forex copy trading as easy as possible. If you prefer a broker that gives you access to a large selection of tradeable assets, then you are better off choosing another EU-regulated broker.

Score in each category

| Tradeable Assets & Markets: |

Score:

|

|---|---|

| Trading Platforms: |

Score:

|

| Spreads & Fees: |

Score:

|

| Leverage: |

Score: (Non-EU)

Score: (EU) |

| Mobile trading: |

Score:

|

| Payment methods |

Score:

|

| Demo account: |

Score:

|

| Deals: |

Score:

|

| Regulation: |

Score: (Non-EU)

Score: (EU) |

| Copy trading: |

Score:

|

| Account types: |

Score:

|

| Security: |

Score:

|

| Customer support: |

Score:

|

Can you trust OCTAFX?

Traders who live within the EU will have their accounts placed under Octa Markets Cyprus Ltd. Octa Markets Cyprus Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) and traders within EU can therefore trust OctaFX.

Traders living outside of EU will have their accounts placed under Octa Markets Incorporated. Octa Markets Incorporated does not have a license to offer forex trading and all trading is therefore unregulated. Traders outside EU can not trust OctaFX and should choose another forex broker instead.

How To Place A Trade

Once you have opened and verified your account profile, you can begin trading.

When we used OctaFX’s trading terminals, the new order process was similar and relatively straightforward. First, search for an asset using the navigation bar. You can utilize either market watch or one-click execution.

To open a position, complete the order form by selecting ‘buy’ or ‘sell’ and amend the volume in lots. You can also add stop-loss or take-profit risk management alerts too.

Full editorial review

Tradeable Assets & Markets

Score:

OctaFX offers trade in 80+ instruments:

- Forex – Trade 35 major and minor currency pairs, including EUR/USD and USD/JPY

- Indices – Speculate on 10 popular CFD indices such as US30, NAS100 and FTSE100

- Commodities – Invest in spot Gold and Silver contracts, plus Brent & Crude Oil and Natural Gas

- Cryptocurrencies – Trade 30 well-known digital currencies paired with the USD, including BTC/USD, ETH/USD and LTC/USD

Trading Platforms

Score:

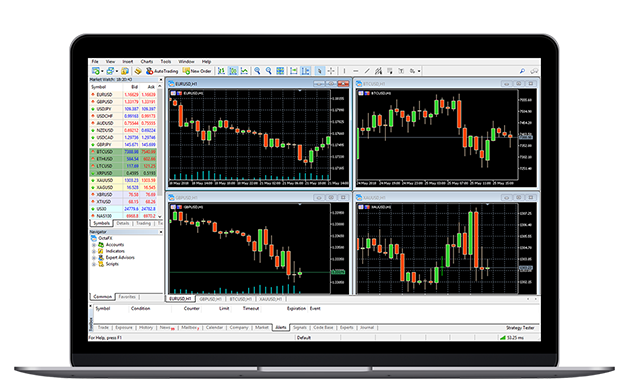

OctaFX offers two trading platforms; MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The award-winning terminals are available to download to Windows and Mac devices or can be used as web-based profiles. Useful download links and user guides are available on the broker’s website.

Both platforms are suitable for beginners, though our experts note that MT5 offers more advanced trading features.

MetaTrader 4

The MT4 platform is a trusted software used by both individual traders and institutions, due to its ease of use and flexibility.The terminal allows users to develop expert advisors (EAs) and technical indicators to suit individual trading styles. In addition to the 30 in-built technical indicators, advanced charting tools allow you to analyze price fluctuations and trends in the market, using three customizable chart and graph types. Additionally, MT4 offers nine timeframes, four pending order types and one-click trading.

Quick Facts MT4

Min Deposit $25

Min Position 0.01 lot

Spread Variable

Scalping ✅

Expert Advisors ✅

Hedging ✅

Trailing stop ✅

Pending orders ✅

One-click trading ✅

Automated trading ✅

Commission ❌

MetaTrader 5

MT5 is the next-generation platform that offers all the benefits of its predecessor but with additional speed, accuracy and more advanced features.Users can enjoy eight pending order types, 44 analytical objects including Gann and Fibonacci Retracement, plus additional technical indicators which are unique to MT5, such as Trend Oscillators and Bill Williams’ tools. There is also an integrated economic calendar as well as two major accounting modes for greater flexibility; hedging and netting.

Quick Facts MT5

Min Deposit $25

Min Position 0.01 lot

Spread Variable

Scalping ✅

Expert Advisors ✅

Hedging ✅

Trailing stop ✅

Pending orders ✅

One-click trading ✅

Automated trading ✅

Commission ❌

Both platforms are compatible with several languages, including English, Arabic and Hindi.

Spreads & Fees

Score:

Trading fees vary depending on the account type and instrument, though when we used OctaFX, it was good to see no commissions. Instead, costs are integrated into the bid-ask spreads. These are floating rather than a fixed rate spread, therefore they may fluctuate during periods of high liquidity.

The average spread for the EUR/USD currency pair is 0.7 pips, while the USD/CAD is offered at 0.8 pips. Major indices, including the NASQAQ, are offered at an average 0.6 points, which is competitive. Spot gold and silver were offered at an average of 1.8 pips.

In June 2022, OctaFX also removed swap fees. This is a significant advantage for investors using mid-term and long-term strategies as charges will not be applied for any positions held overnight.

There is also no inactivity fee for dormant accounts or commission charges for deposits, withdrawals or currency exchange.

Trading fees

| Fee | Charged by OctaFX |

| Spreads | ✅ Yes, between 0.6 pips to 1.0 pips on majors |

| Commission | ❌ No put markups on raw spreads |

| Overnight fees | ❌ No. |

| Live Price Feed / Stamp Duty/ Settlement Fee | ❌ No. Does not offer trading on financial instruments with this type of fee. |

| Currency Conversion Fee | ✅ Might be added on certain spreads. |

None trading fees/ account fees

| Fee | Charged by OctaFX |

| Deposit Fee | ❌ No, Your payment processor might charge a fee. |

| Withdrawal Fee | ❌ No, Your payment processor might charge a fee. |

| Inactivity Fee | ❌ No. OctaFX does not charge inactivity fees and does not try to pressure you to trade, |

|

Account Fee

|

❌ No, all accounts are free |

OctaFX Leverage

Score: (Non-EU)

Score: (EU)

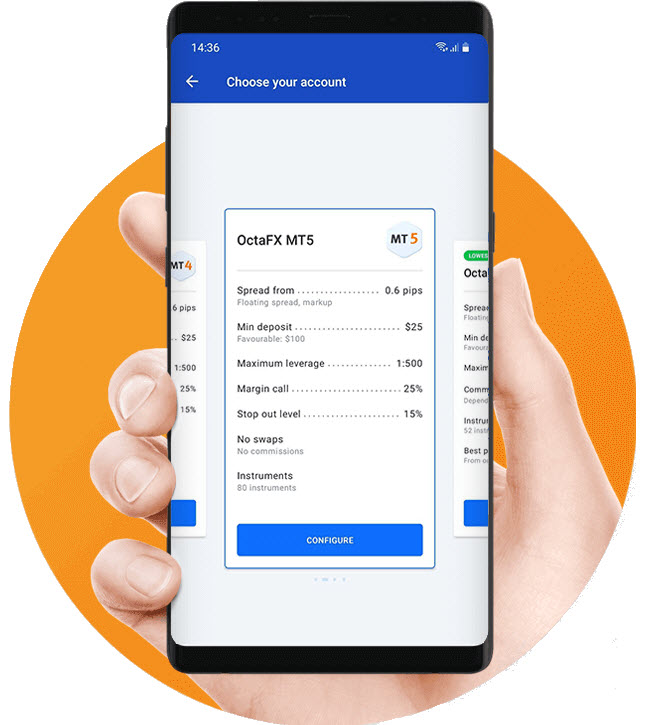

When using the OctaFX platform, our experts were offered generous leverage limits up to 1:500. This means a $50 deposit would provide $50,000 in purchasing power. Although trading with significant leverage can increase profit prospects, it can also increase losses. Ensure you apply appropriate risk management strategies. The margin call/stop-out level is 25/15%.

Note that EU clients will be subject to ESMA leverage capping introduced in 2018. Investors can access maximum leverage of 1:30.

Internationale traders can enjoy the following leverages.

- Forex: 1:500

- Gold & silver: 1:200

- Indexes: 1:50

- Energies: 1:100

- Crypto: 1:25

Mobile Apps

Score:

Both MetaTrader platforms are available as mobile apps, with a free download to iOS and Android (APK) devices. When using the MT4 and MT5 interfaces on mobile, you can be assured of platform stability, with fast execution speeds.

You can access all the tools, features and functionality found on the web terminals including one-click trading, chart customization and full order management.

Additionally, the broker also offers a proprietary mobile app. When we used the OctaFX app, it was easy to integrate an existing MetaTrader profile into the branded app. You can set SMS price alerts and app notifications of market movers. The application also permits full account management including live deposits and withdrawals and copy trading services.

Payment Methods

Score:

Deposits

OctaFX does not have a deposit fee for any payment methods. Additionally, the broker covers any third-party charges that may be incurred from some services. Retail clients can deposit in all currencies, though account denominations are available in EUR and USD only. Live market currency conversion fees apply. Available deposit methods:

Deposit methods:

| Payment Method | Fee | Minimum Amount | Execution Time |

| Bitcoin | Free | 0.00037000 BTC | 3 – 30 minutes |

| Skrill | Free | 50.00 USD | Instant |

| Neteller | Free | 50.00 EUR | Instant |

| Ethereum | Free | 0.020ETH | 3 – 30 minutes |

| VISA / MasterCard | Free | 50.00 EUR | Instant |

| Tether TRC-20 | Free | 50 USDTT | 3 – 30 minutes |

| Tether ERC-20 | Free | 50 USDTE | 3 – 30 minutes |

| Dogecoin | Free | 230 DOGE | 3 – 30 minutes |

| Litecoin | Free | 0.30 LTC | 3 – 30 minutes |

Note, some local payment methods may also be offered depending on your country of residency. This includes international bank wire transfers for citizens of Thailand, India and Nigeria, for example.

All bank transfers are processed within 1-3 hours of a request. Other payment methods offer instant funding.

There is no maximum deposit limit.

Withdrawals

Our experts were pleased to see no withdrawal fees at OctaFX. There are, however, minimum withdrawal limits for all payment methods, though these are minimal, including $5 for Skrill and Neteller.

All withdrawal requests are processed within 1-3 hours during business hours, though the time taken for funds to clear back to the original payment method may vary.

Withdrawal Methods

| Withdrawal Method | Minimum Amount | Fee | Execution Time |

| Bitcoin | 0.00009000 BTC | Free | 1-4 hours |

| Skrill | 5.00 USD | Free | 1-4 hours |

| Neteller | 5.00 USD | Free | 1-4 hours |

| Ethereum | 0.00500000 ETH | Free | 1-4 hours |

| Tether TRC-20 | 10.00000000 USDTT | Free | 1-4 hours |

| Tether ERC-20 | 10.00000000 USDTE | Free | 1-4 hours |

| Dogecoin | 75.00000000 DOGE | Free | 1-4 hours |

| Litecoin | 0.11000000 LTC | Free | 1-4 hours |

Withdrawal Usually require 1-3 hours for the withdrawal to be approved and then up to 30 minutes for the funds to be transfered

Demo Account

Score:

A free demo account is available to OctaFX day traders on both MT4 and MT5. Clients can register and switch to a demo profile via the client portal.

When we used the OctaFX demo account, it was good to see emulated live market conditions and real-time prices. Paper trading accounts are a great way to practice investment strategies risk-free and learn platform terminal features and tools. Users can access unlimited virtual equity with flexible leverage.

Our experts were also offered the chance to win real funds by participating in the OctaFX Champion demo contest. Upcoming competitions, duration and rules can be found on the broker’s website.

Note, demo accounts are deactivated after 30 days of inactivity.

OctaFX Deals & Promotions

Score:

OctaFX (non-EU) offers several deposit bonus deals, including a 10, 30 or 50% bonus on each deposit. In addition, there are occasional Trade & Win promotions where traders can win gifts such as OctaFX t-shirts or gadgets. There are also contest opportunities, including the OctaFX 16 Cars contest where traders are entered into a car prize draw every three months, as well as the Champion Demo Contest for MT4 users.

Make sure to check all bonus terms and conditions before participating. When we used OctaFX’s deposit bonus scheme, we were only permitted to withdraw a reward after completing the minimum volume requirement. This is calculated as; bonus amount/2 standard lots. So, if you claim the 50% bonus on a $100 deposit, the minimum volume requirement will be 25 standard lots.

Regulation & Licensing

Score: (Non-EU)

Score: (EU)

Octa Markets Incorporated is registered in St Vincent and the Grenadines. The online broker is licensed and regulated by the Financial Services Authority (SVGFSA). Our experts confirmed incorporation on 15th September 2011 and found an active regulatory registration under the trading name. It is important to note that SVGFSA does not regulated Forex trading nor binary options trading.[1] This means that all Forex trading done through OctaFX.com is unregulated.

Octa Markets Cyprus Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 372/18.[2] Octafx.eu, octamarkets.eu and their subdomains are regulated to offer forex trading.

OctaFX acts in full compliance with international legislation and regulation standards. With this, the broker guarantees segregated client funds and negative balance protection.

The broker accepts clients in 150+ countries, though it is worth checking which entity you will receive services from.

Additional Features

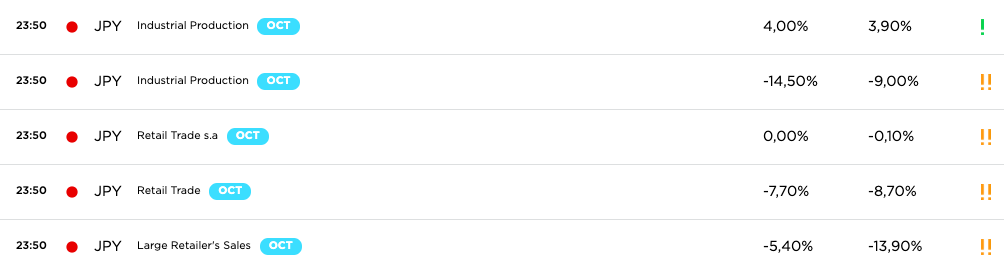

Traders benefit from a range of additional educational features and trading tools at OctaFX, including video tutorials and webinars, plus regular forex market insights and news. The brokerage also offers profit and margin calculators, as well as a forex signal service with the Autochartist plugin and live quotes.

After using the educational resources offered by OctaFX, we are confident that there is plenty of information for both beginners and experienced investors.

Copy Trading

Score:

OctaFX also offers a copy trading service, available via an Android (APK) compatible mobile app or integrated into the MetaTrader platform. Users can benefit from stable earnings from a diversified portfolio by copying the most profitable traders.

The bespoke software enables users to track master traders and their live performance, control portfolios on the go, view how their funds are invested and manage risk in real-time.

- No commissions are charged by the broker

- Execute orders in less than five minutes after the copy master

- Simple tool to use, click ‘copy’ and use the deposit percentage setting

- Retail traders are permitted to stop copying, unsubscribe, or close a trade anytime

- View detailed trading statistics for master traders including their individual commission fee

How to use OctaFX mobile copy trading

- Download the OctaFX copy trading app: Download the app for Android from the Google Play Store.

- Launch the app on your mobile device: You will be prompted to sign up. Important: If you already have an account with OctaFX for manual trading, you can use that for copy trading as well. Simply enter your email and password, or sign in using Google or Facebook.

- Log in to the start screen; (When you have begun using OctaFX for copy trading, your present and past copy trading subscriptions will be displayed there.)

- Deposit money to your account: to begin copy trading for real money, you must have enough money in your copy trading OctaFX account. If you already have money in your standard OctaFX account, you can quickly transfer it to your copy trading account within OctaFX. The other option is to make a deposit using any of the available deposit methods. You press the menu icon on the top left of the screen and tap “Deposit”. Select a deposit method and follow the on-screen instructions.

- Choose a trader to copy: It is up to you to decide which Master Traders to follow (copy). Go to the left-hand menu, then to “Copier Area” → “Go to Master Traders” Rating. You will now see a selection of available Master Traders and their respective ratings. They are sorted by risk score, but the filter feature allows you to sort them based on other factors, such as popularity or gain.To find out more about a Master Trader, simply tap on their name. You will now see information such as gain, profit and loss, order history, risk score, number of followers (copiers), and commission. Please note that the minimum permitted investment amount differs between the various Master Traders, so make sure you select Master Traders that are suitable for your bankroll and preferences.

- Start copy trading: When you are ready to begin investing, tap “Set up copying” at the top of the screen. Adjust the settings in accordance with your preferences, and then press Start Copying.

Account Types

Score:

There are two account types available at OctaFX, which are determined by the trading platform you are using; Micro (MT4) and Pro (MT5). Accounts are available in USD or EUR denominations. The minimum trade volume across all accounts is 0.01 lots and both profiles benefit from market execution in under 0.1 seconds.

The minimum deposit is USD100, regardless of what type pf account you choose to open.

Below you can compare the brokers two accounts:

Micro

- $100 recommended deposit

- Maximum trade size of 200 lots

- Floating spreads, no commissions

- Access to most trading instruments

Pro

- $100 recommended deposit

- Maximum trade size of 500 lots

- Floating spreads, no commissions

- Access to all trading instruments

There is also an Islamic swap-free account for those worried about whether trading is haram or halal.

Trading Hours

Trading times in the MT4 and MT5 platforms are 24/5, from 00:00 on Monday to 23:59 on Friday server time (EET/EST time zone). Cryptocurrency can be traded 24 hours per day, 365 days a year.

It could also be worth viewing the published session timetable via the broker’s terminal interface. This is particularly useful to stay up to date with upcoming market closures such as public holidays.

Security & Safety

Score:

OctaFX uses 128-bit SSL encryption and PIN codes in the personal area and trading platforms, which is the industry-standard security requirement for protecting personal data.

The broker also applies 3D secure Visa authorization when processing credit and debit card transactions. Also ensure you add additional security settings such as two-factor authentication (2FA) when using OctaFX platforms.

Customer Support

Score:

When using the services of OctaFX, day traders can be assured of 24/7 customer support. Contact methods include:

- Online contact form – available via the broker’s ‘contact us’ page

- Social media – you can find updates on the broker’s social media pages, as well as the OctaFX YouTube channel

- Telephone helpline – +44 20 3322 1059, between 00:00 and 24:00, Monday to Friday (EET). For EU clients, the number to call is +357 25 251 973 between 09:00 and 18:00, Monday to Friday (EET)

- Head office addresses – OctaFX, Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, St Vincent and the Grenadines or Octa Markets Cyprus Ltd, 1 Agias Zonis and Thessalonikis Corner, Nicolau Pentadromos Center, Block: B’, Office: 201, 3026, Limassol, Cyprus

- Live chat – available via the broker’s ‘contact us’ page. It is the fastest way to get in touch with the broker, via the chat logo on the bottom right of each web page. This is the best method for quick queries including if you need to know your withdrawal pin, any platform problems, VPS questions, or you want to delete an account

Note, the OctaFX website is available in a number of languages for clients from Indonesia, Malaysia, Pakistan and India.

How To Sign Up

The account opening process is simple and fast. ID documentation must be submitted in line with KYC requirements. In most cases, if your documents are submitted correctly, verification should only take up to three hours.

Note clients from the United States or the UK are not accepted at OctaFX or Octa Markets Cyprus Ltd.

OctaFX company details

OctaFX was established in 2011. The company’s mission is to provide outstanding forex and CFD trading services, via cost-effective, transparent conditions on a worldwide scale. The broker offers 80+ trading instruments including currency pairs, commodities, indices and cryptocurrencies.

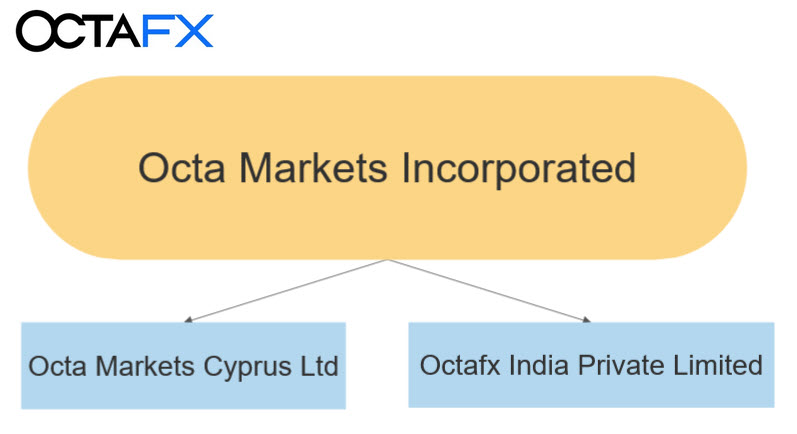

The broker operates under three subsidiaries:

Octa Markets Incorporated

Octa Markets Incorporated is the international branch of the broker. The company was established in St. Vincent and the Grenadines and is regulated with licensing from the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). OctaFX uses this company to operate in 185 countries. The Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) offer weak trader protection. Opening an account from one of the 185 countries where this license is used is considered high risk.

Octa Markets Cyprus Ltd

Octa Markets Cyprus Ltd is a Cyprus-based company regulated with licensing from the Cyprus Securities and Exchange Commission (CySEC). This is the company that OctaFX uses to offer forex trading within the European Union. Accounts belonging to traders who reside within the European Union will be placed within this company and will see their accounts regulated by CySEC. CySEC offers much better legal protection, and your legal protection is, therefore, a lot stronger if you open an account with Octa Markets Cyprus Ltd.

Octafx India Private Limited:

Octafx India Private Limited is an Indian company that Octa Markets incorporated and opened in 2019. The company is not licensed, and traders who open an account on Octafx India will see their accounts regulated under the license from the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA)

Market position

OctaFX has achieved a solid position in the financial trading markets, executing an impressive 1+ billion trades from over 10 million live customer accounts. The founder and owner have ensured the brand has amassed a global reach, with trading services now spanning 185+ countries. Most of the traders who use this broker are located in Indonesia, India or Malaysia.

Ownership

Octa Markets Cyprus Ltd and Octafx India Private Limited are owned by Octa markets incorporated. Octa markets incorporated is a privately owned company and the exact owner and ownership structure are unknown.

FAQs

Is OctaFX A Legit Company And Regulated Broker?

OctaFX is a legitimate company registered in Saint Vincent and the Grenadines and regulated by the Saint Vincent and the Grenadines Financial Services Authority (SVGFSA). The EU entity is registered in Limassol, Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC). If you’re unsure whether a broker is a scam or a legit company, read our guide and check out customer reviews online.

Is OctaFX A Market Maker?

OctaFX is a No Dealing Desk (NDD) broker and therefore acts as an intermediary between the trader and the market. OctaFX receives commissions from its liquidity providers for each transaction.

How Do I Delete My OctaFX Trading Account?

To delete your OctaFX trading account, you will need to get in touch with the customer support team. Note, accounts are automatically deactivated if you never deposit or sign in to them.

How Do I Open A Copy Trading Account At OctaFX?

You can sign up and login to the OctaFX copy trading service in a few easy steps. Once you login to your personal area, you can set up your copy trading profile and deposit to your wallet. You can also sign in to your new account using the Android app.

Why Was My OctaFX Withdrawal Rejected?

If you encounter a withdrawal problem when using the OctaFX trading platform, you will receive a notification in an email explaining the issue. Alternatively, if you need to cancel a withdrawal, you can do this within your personal area.

Does OctaFX Offer Any Free Bonus Deals?

OctaFX offers a 10%, 30% or 50% deposit bonus deal. No other promo codes or no-deposit bonus deals are currently available. Check out the bonus terms and conditions before participating.

Is OctaFX Legal In India And Pakistan?

No. OctaFX does not have authorization from the Reserve Bank of India (RBI). They are not authorized to offer forex trading in India. In September 2022, the Indian Enforcement Directorate (ED) froze several bank accounts belonging to OctaFX India and related companies for illegal forex trading. It is not illegal for you to use OctaFX to trade forex, but it is illegal for them to offer forex trading, and this causes extra risk for you as a trader as you risk losing money due to the Indian Enforcement Directorate (ED) freezing more of the brokers’ accounts.

Similarly, the State Bank of Pakistan has declared forex trading platforms illegal in Pakistan.

Resources

- Financial Services Authority, St Vincent & The Grenadines. (February 3, 2022). UNLICENSED FOREX/BINARY OPTIONS – Financial Services Authority. https://svgfsa.com/unlicensed-forex-binary-options/

- Cyprus Securities and Exchange Commission. (n.d.) Octa Markets Cyprus Ltd. Retrieved December 14, 2022, from https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/81668/

Top 3 Alternatives to OctaFX

Compare OctaFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

OctaFX Comparison Table

| OctaFX | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 2.3 | 4.4 | 4 | 4.3 |

| Markets | Forex, CFDs, indices, commodities, cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $1 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | SVGFSA, CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Bonus | Up to 50% deposit bonus | – | 100% Deposit Bonus | – |

| Education | Yes | Yes | No | Yes |

| Platforms | MT4, MT5, AutoChartist | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:30 (Retail), 1:250 (Pro) | 1:1000 | 1:50 |

| Payment Methods | 8 | 6 | 10 | 6 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

World Forex Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by OctaFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| OctaFX | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

OctaFX vs Other Brokers

Compare OctaFX with any other broker by selecting the other broker below.

The most popular OctaFX comparisons:

- Wahed Invest vs OctaFX

- OctaFX vs Binomo

- FBS vs OctaFX

- OctaFX vs Luno

- OctaFX vs Binance

- OctaFX vs Olymp Trade

- OctaFX vs Expert Option

- IC Markets vs OctaFX

- OctaFX vs DeltaStock

- OctaFX vs eToro

- OctaFX vs Oanda

- OctaFX vs AvaTrade

- OctaFX vs XM

- OctaFX vs VantageFX

- Quotex vs OctaFX

- OctaFX vs Pepperstone

- OctaFX vs IQ Option

- OctaFX vs FXTM

- Moomoo vs OctaFX

- OctaFX vs Exness

Customer Reviews

4.6 / 5This average customer rating is based on 5 OctaFX customer reviews submitted by our visitors.

If you have traded with OctaFX we would really like to know about your experience - please submit your own review. Thank you.

I respect Octa SO MUCH! They might not have completely figured out the part of keeping their costs low, but they know how to keep clients safe. And the broker is also regulated by multiple bodies.

I’m just copytrading here, its still SO fun! BUT slowly learning to trade from their lessons, webinars and tutorials. I like how they structure it in lessons, its so easy to breese through!

I trade here every day. Moreover, I open from 3 to 10 orders daily. Therefore, I am well aware of broker’s trading conditions.

Orders are executed smoothly and without slippage

I’m not one hundred percent sure, but it seems to me that conditions of this broker are really favorable

OctaFX never disappoints when it comes to deposits, withdraws and spreads best broker i use.

market execution, leverage and bonuses , customer care services operating 24/7 with highly professional , different accounts to choose from .