NordFX Review 2025

Awards

- Best Social Trading Network 2021 - Forex Awards

- Best Affiliate Program 2021 - Forex Awards

- Best Customer Support 2021 - Forex Traders Association

- The Most Transparent Broker 2021 - World Forex Award

Pros

- NordFX has bolstered its charting tools for advanced traders, adding MT5 to its existing MT4 integration, with faster, multi-threaded processing.

- The straightforward copy trading service may appeal to beginners or improving traders, with just a $100 minimum deposit to get started.

- There's an impressive range of 25+ payment methods, including local bank transfers, with zero fees and near-instant processing, making for a convenient account funding experience.

Cons

- With only around 100 instruments, NordFX’s market coverage is lacklustre at best, with a particularly poor selection of around 20 shares.

- Although NordFX offers competitive pricing in its Zero accounts, it still trails the cheapest brokers like IC Markets, while the Pro accounts feature industry-high spreads from 10 pips.

- The lack of regulatory oversight is a significant concern as clients of NordFX may receive limited safeguards, notably no negative balance protection or segregated accounts.

NordFX Review

NordFX is a global forex trading firm. The brand offers a range of accounts to suit different trader needs, as well as low minimum deposits, a demo account, plus MT4 and MT5 integration. The MetaTrader platforms also provide automated trading and market signals. Read our detailed review to find out if NordFX is good or not.

NordFX Headlines

NordFX is an online brokerage with a history dating back to 2008. The founder wanted to create a reliable investing service, and it looks like they succeeded. If you are wondering how trustworthy NordFX is, then know that over 1.7 million accounts across 190 countries have been opened on the site since it launched.

The brand enables its clients to speculate on cryptocurrencies, forex pairs, indices, and stocks. Unlike many competitors, it also offers the option of managed investment services.

Since it operates globally, NordFX locations include the following support centers: LATAM, Europe, Bangladesh, China, Thailand, India, and Sri Lanka.

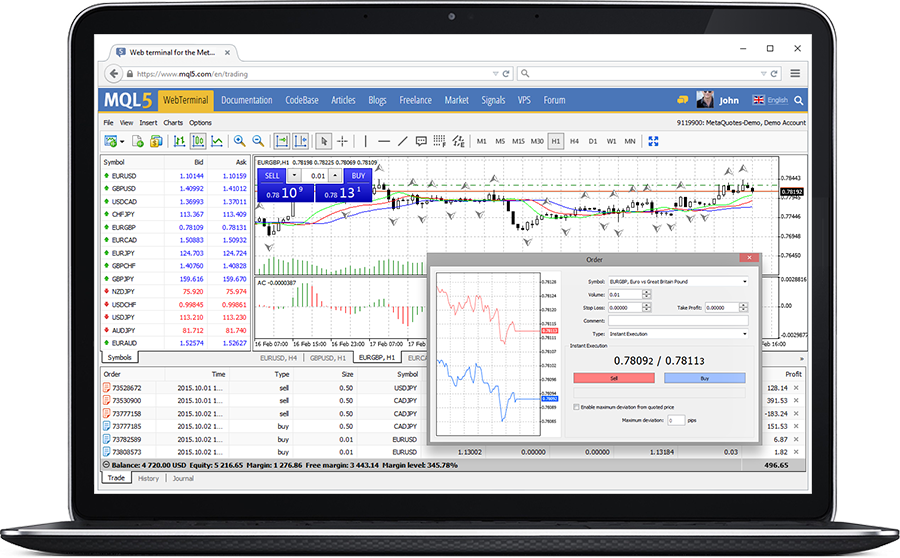

Trading Platforms

NordFX uses the popular MetaTrader 4 solution, alongside MetaTrader 5, which it added in 2024.

After hours testing both platforms, MT4 is best suited to day traders looking for essential charting tools and order types, while MT5 is a better fit for advanced traders, sporting additional indicators, timeframes, orders, plus a built-in newsfeed.

The options of either managed funds or automated investments are also clearly accessible and require limited customization to deploy.

Both platforms also offer enhanced levels of functionality to dig down into and a wide range of data and charts available for analysis if users want more control and insight over their investment decisions.

MT4 MultiTerminal

The broker also offers the MT4 MultiTerminal. This is suitable for investors using multiple accounts at the same time. The terminal maintains the same functionality as the original MT4 platform, while also providing manual or automatic distribution of trading volume for each account individually.

As an added bonus, advanced security ensures data transfer safety.

Assets & Markets

2.8 / 5NordFX offers a wide array of financial instruments, asset types, and markets. These are comprised of 33 currency pairs, 11 cryptos (including Bitcoin), gold, silver, and oil. In addition, you can trade CFDs in the form of 5 indices and 68 stocks.

Unlike many other brokers, NordFX also offers managed investment services under its PAMM (Percent Allocation Management Module) account. The PAMM manager deposits their own money alongside those of investors’, providing an added layer of trust for the customer.

Note, the company doesn’t provide binary options.

Spreads & Commission

The spreads offered on NordFX are tight, starting from just 0.0 pips. They remain competitive by outsourcing trades to a third-party liquidity provider, which helps keep costs low due to the large trading volumes.

No commissions are charged except for the Zero account (starting at 0.0035% per trade for each side) and on crypto at 0.06%. The Savings account has a yearly loan interest fee of 3% on average.

An issue to remain aware of is withdrawal fees – the specific amount depends on the money transfer method (for example, online payment systems, digital wallets, or bank transfers).

Leverage

NordFX isn’t regulated by the FCA or the ESMA, like many popular brokers. Therefore, the amount of leverage offered is high, with a rating of up to 1:1000.

Though many experienced traders will welcome this high leverage limit, for new investors, it is important to manage risk. A common reason many newbies lose money is by overextending positions.

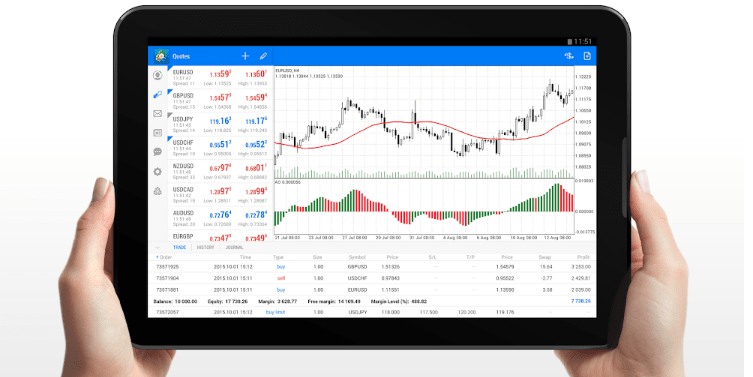

Mobile Apps

NordFX uses the MetaTrader platforms, which are widely employed in the industry. These are comprehensive, cross-purpose, and multifunctional tools that requires specific software to be downloaded.

For mobile users, there is an app version available called MT4 and MT5. These are available to download on both iOS and Android, although functionality is somewhat reduced compared to the desktop version.

Clients can also use the broker’s bespoke mobile APK trading software. Available as a free download from respective app stores, it offers complete account management, instant executions, and a selection of order types.

Mobile traders can still conduct technical analysis and set up price alerts. The application is an excellent solution for those looking to stay tuned into the financial markets while on the go.

NordFX Payment Methods

Various payment options are available at NordFX. Users on the platform are able to wire funds directly into their accounts, use credit or debit cards, or various other online payment methods.

As part of our withdrawal review, we found the same options available for deposits. However, depending on which you choose will impact how long it takes before the money is available in your bank account, though it is typically between 1 and 6 business days.

Note, money laundering regulations may dictate that withdrawals are made back to the same funding source used for deposits.

Demo Account

Before committing to opening a live account, users can create a demo account with $10,000 worth of virtual currency. The free paper trading account can help investors get used to the interface, explore the platform and get a taste of which markets they’re interested in. Setup is a simple process, taking less than a minute.

The account offers 24/7 support and the DemoCup contest, where users compete for a $42,000 prize pool.

Bonuses & Promotions

NordFX has a variety of offers. Customers also have the option of guaranteed stop-losses, limit orders, plus automated trading. In addition, NordFX is running a ‘refer a friend’ promotion deal. Where users refer a friend that goes on to make a deposit, the referrer receives 10% of that deposit as a cash bonus.

100,000 USD Super Lottery

NordFX has a mega lottery draw with $100,000 up for grabs split across 200 prizes in varying values of $250-$1,250 and two higher-ranking super prizes of $10,000 each.

To take part, existing Pro account holders simply need to carry on depositing funds and trading. New users will need to open an account, deposit at least $200, and trade 2 lots. Virtual lottery tickets are automatically awarded when volumes are met, and cash prizes can be withdrawn.

The lucky winners will be announced across 3 draws scheduled on the 4th of July 2022, the 4th of October 2022, and the 4th of January 2023, with the two $10,000 prizes awarded in the final draw. Sign-up today for your chance to win big.

Regulation & Licensing

NordFX is currently unregulated. However, that doesn’t mean NordFX is an unsafe or unreliable platform – orders can be executed in under half a second with full security.

Additional Features

NordFX offers a variety of additional features to entice potential users. These include a comprehensive ‘Education’ section on their website, with a Learning Centre and Glossary so investors can gain knowledge of how the financial markets work and make better investment decisions.

The brand also provides an economic calendar, a currency converter, a profit calculator, plus various other tools for in-depth analysis. One excellent forecast feature is the weekly analysis of various financial markets conducted by an experienced in-house analyst.

A VPS service is also available through Fozzy with a 24/7 uptime. This solution offers a stable, fast, and uninterruptible connection to NordFX.

Copy Trading

NordFX also offers a copy trading signals service. Experienced investors with profitable accounts can sell their tips to subscribers using the NordFX Pro account.

The experts set their own subscription price, and all the revenue adds to their bottom line, increasing profit margins for those willing to put in the time. Plus, there are no restrictions on strategies. You can hedge, use scalping, and EAs.

For traders who are looking to save time and effort on their research, there is the opportunity to purchase signals.

Select from the top signal providers by reviewing their profitability over the last month, day, or all-time. The price is paid purely on the profits of a trade, starting from 10%. So, if the trade is not successful, you pay nothing for the signal.

Execution is also automatic, meaning that even while you’re not logged in to the MetaTrader platforms, you will be placing trades. However, note that while this can result in passive profits, it means that your capital is at risk even while you’re not at the trading desk. The good news is that you can stop copying at any time.

Account Types

NordFX offers Zero and Pro accounts for its MT4 or MT5 platforms, catering to different needs:

- Pro: Best for traditional spread-only pricing with no commissions or strategy restrictions

- Zero: Best for low-spreads, starting from 0, with a 0,0035% per trade (each side) forex commission, featuring ECN execution

Both types of accounts offer high leverage up to 1:1000 and 3% free margin interest annually.

Benefits

NordFX has an extensive record of delivering optimal performance for its users, dating back to 2008. The platform is easy to pick up yet complex enough for experienced traders. There is a solid range of additional features, competitive spreads, and high leverage. Plus, the copy trading functionality allows both experts and beginners to profit from one another through signal sharing.

The MT4 and more recently MT5 integration, is a significant step for NordFX and illustrates their approach to professional trading. Implementing the ‘de facto’ pro trader tool set sets the brand apart from other competitors of similar standing and moves the firm up the pecking order of online brokers.

All in all, NordFX is a good choice for either new or experienced investors, giving easy access to a wide range of financial instruments. The inclusion of VPS and managed accounts are also two differentiating factors.

Drawbacks

Some investors may prefer to use online brokers regulated by more rigorous financial conduct authorities, with stricter adherence to international leverage limits and greater levels of consumer protection. High leverage rates could mean NordFX is ultimately too risky for many potential investors.

Trading Hours

The platform is available to use 24/7 for cryptos, though markets for different asset classes are open at various times. For example, the forex market is traded across four time zones varying upon which exchange is open:

- Tokyo – 7 PM to 4 AM EST

- Sydney – 5 PM to 2 AM EST

- London – 3 AM to 12 PM EST

- New York – 8 AM to 5 PM EST

Customer Support

3.5 / 5NordFX has a responsive, knowledgeable customer support team, with 7 specific centers employing dozens of staff to help with inquiries. Users can choose to contact NordFX through a webchat (logo located at the top of the page), via various social channels, or by email at support@nordfx.com. However, if you wish to get hold of support via a phone number, here are a few region-specific options:

- India – +972559662836

- Europe – +357-25030262

- China – +86 108 4053677

- Thailand – +66600035101

- Sri Lanka – +972559661848

- LATAM – +593-9-80-909032

- Bangladesh – +447458197795

Customer support is available 24/5 and a small FAQ section is also present on the broker’s website. They can help with any questions you may have, including country-specific complaints (like India), demo account login, user agreement issues, and more.

The broker’s owner is NFX Capital VU Ltd. If you need to contact their headquarters, the office location is Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay Gros-Islet, Saint Lucia.

Security

NordFX is a relatively safe broker from an operational angle, with trades executed in under half a second. The MetaTrader interface also means users can invest on the go, while the servers are robust and efficient, providing a reliable service for professional, frequent traders.

NordFX Verdict

NordFX is a great choice for potential investors looking into online brokering platforms. They have a proven track record and offer the chance to trade on a broad array of asset types, a fully functional demo account, and extensive customer support. The extra features (such as in-depth market analysis and investor education) mean NordFX has several differentiating factors. Commission rates are competitive too.

FAQs

What Is The Minimum Deposit At NordFX?

The minimum deposit for the Fix account in $10. This is low versus competitors and makes NordFX popular with new investors.

Is NordFX Genuine?

Yes – NordFX is a genuine broker which was founded in 2008.

What Is The Highest Leverage At NordFX?

The highest leverage traders can access is 1:1000. This is because the brokerage is not regulated by a European, UK or Australian authority.

Does NordFX Have A Savings Account?

Yes, the broker has a DeFi savings account with a minimum deposit of $500. The account generates a passive income of up to 30% per annum.

Who Regulates NordFX?

NordFX are, at present, unregulated.

What Can I Trade On NordFX?

You can invest in 33 FX pairs, 11 cryptocurrencies, 4 commodities, 5 indices, and 68 stocks.

Is NordFX Legit?

Though unregulated, NordFX are a legitimate forex and CFD broker.

Does NordFX Accept US Clients?

At the time of writing, the broker doesn’t accept clients from the US.

Is NordFX Legal In India?

The firm provides trading services that are legal in India. However, make sure you check with your local authority if this is still valid when you decide to invest.

How Do I Withdraw Money From NordFX?

Withdrawing from NordFX is simple. Log in to your account, go to Trader’s Cabinet, select Withdrawal, then click on the payment method you wish to use and process your request.

Is NordFX A Scammer?

No – NordFX is a trusted international broker with 1.7 million accounts opened across 190 countries.

How Do I Close My NordFX Account?

You need to contact the support team by email at support@nordfx.com or by phone (country-specific helplines can be found on the broker’s website) and request your account to be closed.

Is NordFX A Market Maker?

No, the online broker is not a market maker.

Top 3 Alternatives to NordFX

Compare NordFX with the top 3 similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

NordFX Comparison Table

| NordFX | World Forex | Interactive Brokers | Dukascopy | |

|---|---|---|---|---|

| Rating | 3.5 | 4 | 4.3 | 3.6 |

| Markets | Forex, CFDs, indices, commodities, cryptos, stocks | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $1 | $0 | $100 |

| Minimum Trade | $1 | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | Pro accounts can participate in the 100,000 USD Super Lottery | 100% Deposit Bonus | – | 10% Equity Bonus |

| Education | Yes | No | Yes | Yes |

| Platforms | MT4, MT5 | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:1000 | 1:1000 | 1:50 | 1:200 |

| Payment Methods | 10 | 10 | 6 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | World Forex Review |

Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by NordFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| NordFX | World Forex | Interactive Brokers | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | No | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

NordFX vs Other Brokers

Compare NordFX with any other broker by selecting the other broker below.

Customer Reviews

4.7 / 5This average customer rating is based on 3 NordFX customer reviews submitted by our visitors.

If you have traded with NordFX we would really like to know about your experience - please submit your own review. Thank you.

I agree with the stuff in here about the analysis at NordFX. I trade major FX pairs like EUR/USD and the weekly analysis these guys shoot out is the exact level of detail for me – just the key takeaways supported by broader macroeconomic insights, with charts that are NOT caked in indicators and drawings so you can actually see when price i approaching key support and resistence levels. I read em every week to help support with my day and swing trade setups.

I’ve been trading with NordFX for over a year now. Their platform is intuitive, and I’ve never faced any issues with deposits or withdrawals. Customer support is always prompt and helpful.

I really like NordFX. It’s easy to use, and they’ve been around since 2008, which is cool. I feel safe using it because they follow the rules. I trade cryptocurrencies, and it’s simple on NordFX. Customer support is great – they help me when I need it. With the awards they’ve won, it’s clear they’re doing a good job. If you’re in Finland and want to trade, NordFX is a good pick.