nextmarkets Review 2025

Pros

- There is a wealth of educational resources suitable for new traders including articles and video content

- Regulated in the EU with adherence to MiFID and membership with the ICF

- Easy to use mobile app packed with market alerts, customizable charts and straightforward order placement

Cons

- Commission-free trading is only available on volumes over €500

- Limited funding methods with no Paypal, Skrill or Neteller

- No third-party platform such as MetaTrader 4

nextmarkets Review

nextmarkets Trading Ltd is an online broker that offers clients access to a wide range of assets, including stocks, forex, ETFs and CFDs. The brand is recognisable by its n3 logo and boasts competitive leverage rates alongside more than 800 instruments. This 2025 nextmarkets review will cover everything you need to know, including fees and spreads, customer support channels, payment methods and more.

nextmarkets Headlines

nextmarkets Trading Ltd is a neobroker founded in 2016 and registered in Malta. It is a subsidiary of nextmarkets AG GmbH, a company founded in 2014 and headquartered in Cologne, Germany. The company was established by co-founders Dom and Manuel Heyden, two brothers that have had esteemed careers in the financial and technological sectors. The broker has received funding from a range of well-known investors including Peter Thiel, the co-founder of PayPal.

The firm is regulated by the Malta Financial Services Authority (MFSA). While no specific valuation is available on sites like Crunchbase, the company has received over $43 million in funding through various investment rounds. Customers are accepted from a range of European countries, including Belgium, France, Germany, Spain and the United Kingdom. Over 1 million trades are completed every year through the platform.

Trading Platform

nextmarkets has developed its online trading platform, called Gettex. The platform runs on almost any browser and does not need to be downloaded to the desktop. Placing orders is simple, easy and can be done in units or in selected amounts. Leverage and margin can be scaled to whichever value the user desires. There is also a mass of charts and technical indicators to assist in research and analysis. Moreover, clients can implement risk management strategies such as stop-loss orders through the platform.

Assets

There are over 5000 different assets and trading instruments available for nextmarkets customers. The broker covers a variety of classes, including forex, stocks, CFDs and cryptocurrencies.

Users can purchase real stocks through the broker’s platform, which provides access to the Munich Stock Exchange. Alternatively, clients can purchase stock CFDs, whereby they do not own the underlying asset.

Instruments available include:

- Cryptos: Including Bitcoin (BTC) & Dogecoin (DOGE)

- Indices: Global equity indices from across the world

- Forex: 21+ major, minor and exotic currency pairs

- Commodities: 5+ energies and metals

- Stocks: 5000+ company shares

- Bonds

- CFDs

- ETF

Spreads & Commission

nextmarkets average spreads are around 0.8 pips. Comparing this vs competitors such as Smartbroker, eToro, Degiro and Trade Republic, nextmarkets orders have a lower average spread, indicating that they are a cheaper broker to trade with. The typical spread for the EUR/USD currency pair is 0.6 pips, lower than the industry norm.

Additionally, the broker offers commission-free trading, though this is only applicable to orders over EUR 500, any orders below this amount will be charged a EUR 1 commission.

The broker does not charge any inactivity fees.

Leverage

nextmarkets used to offer a maximum leverage rate of 1:200, however, this has now been lowered to 1:30. This is in line with EU law, which dictates that leverage rates above this cannot be offered to retail traders. The leverage is scalable, if you wanted to trade with 1:5 or 1:25, you can as you have full control. Trading with a leverage of 1:30 means users can put down EUR 100 and trade with EUR 3,000. While this may increase winnings, it also magnifies losses, so caution must be taken.

Mobile Apps

nextmarkets provides its mobile trading app. The app is available for download on both iOS and Android and has positive reviews on both stores with average ratings of 4.7 out of 5. The app is almost fully featured. All order types are available and placing orders is simple. The layout is intuitive and easy to use. The only thing the app is lacking is some of the chart analysis functions that are available on the web trading platform.

Payment Methods

There is no minimum deposit with nextmarkets. Equally, there are no deposit or withdrawal fees. Deposits are processed over different timeframes depending on the method (credit cards and debit cards are instant while bank transfers can take up to three days). Withdrawals take approximately one to two days to process. Deposits and withdrawals can be made via the following methods:

- Trustly

- Fast Bank Transfer

- Manual Bank Transfer

- Debit Dard (Visa & Mastercard)

- Credit Card (Visa & Mastercard)

Demo Account

nextmarkets does offer a free demo account for users. The brokers’ customers can use this account to test their trading skills and get used to the platform. All clients should use the demo account first to support the platform learning process, it will also give great insights into your potential earnings. If you were thinking of quitting your careers and jobs to trade full time, the demo account will help you learn your potential before you start risking your hard-earned capital from the bank.

Regulation

nextmarkets Trading Ltd is regulated by the Malta Financial Services Authority (MFSA). This is an EU-based regulatory body and, as such, the broker complies with all EU laws and rules.

Additional Features

Education

nextmarkets provides a wealth of educational resources on its website. These include tutorials, YouTube videos and a range of learning articles. These resources are designed to teach customers everything they need to know about trading on the platform and in general, from how the markets work to what contracts for difference (CFDs) do. With so many resources, it is almost a trading school.

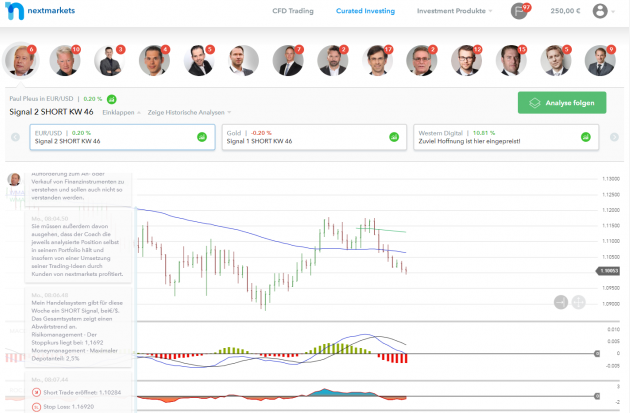

Coaches

nextmarkets has a team of pro coaches that analyse up to 100 different assets per month. There are 17 different coaches available, including Andre Stagge and Gerry Celeya. They will research the market for you and recommend different products for you to purchase so that you can save time.

Account Types

nextmarkets provides a single one-size-fits-all account for its customers. There is no minimum deposit and anyone can open this account, providing they are of legal age. The benefit of only providing one account type is that the best spreads are not hidden behind paywalls and high minimum deposits.

Trading Hours

nextmarkets assets vary according to the markets they are listed on. For example, forex currency pairs can be traded during the standard forex session, 24/5 on weekdays with breaks on weekends. Stocks are available to trade when the Munich Stock Exchange is open for business.

Customer Support

nextmarkets customer support can be reached Monday to Friday between 09:00 and 18:00 CET. The team is available to help in all scenarios, whether you have forgotten your login details or have another issue that needs resolving. The broker can be contacted via the following methods:

- Phone: +49 221 98259 007

- Live chat: available on website

- Support form

Additionally, nextmarkets GmbH can be found on a range of social media platforms, including Facebook, Twitter, Instagram and LinkedIn.

Security

nextmarkets use a two-factor authentication (2FA) system for logins to add a layer of protection to accounts. Once activated, an SMS or push notification will be sent to the registered phone when someone tries to sign in.

The broker is also part of the Investor Compensation Scheme, which ensures that, should the broker go bankrupt, clients will be paid at least 90% of their funds. Moreover, your deposit and funds are held in a separate account from the broker’s funds, so they cannot be used for company business.

nextmarkets Verdict

nextmarkets is an exciting broker out of Malta and Germany, Recent news articles are pegging them as the up-and-coming broker in Europe who could rival the established names. With a range of forex, ETF and CFD instruments to trade, users will be able to find whatever they are looking for on nextmarkets.

FAQs

Is nextmarkets Legit?

Yes, nextmarkets is a legitimate, regulated broker. The firm has received many positive reviews on both Trustpilot and Reddit and complies with European legislation.

How Much Capital Do I Need To Trade On nextmarkets?

There is no minimum deposit limit on nextmarkets accounts. Therefore, you can start trading with any amount of money, which is great for beginners or casual traders.

Where Is nextmarkets Regulated?

nextmarkets is regulated by the Malta Financial Services Authority (MFSA). This is an EU body and, therefore, the broker complies with all EU laws.

Does nextmarkets Run Promotions?

No, nextmarkets does not run promotional events and financial incentives. These are prohibited under EU regulation, with firms instead needing to rely on differentiation through competitive services.

Does nextmarkets Offer A Demo Account?

Yes, nextmarkets offers a demo account, which is a great place to get used to the platform and practise strategies. These provide virtual funds in a simulated trading environment for risk-free practice.

Top 3 Alternatives to nextmarkets

Compare nextmarkets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

nextmarkets Comparison Table

| nextmarkets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 2.7 | 4.3 | 3.6 | 4 |

| Markets | CFDs, Forex, Stocks, ETFs, Cryptos, Commodities | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $1 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | MFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | – | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:30 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 6 | 6 | 11 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by nextmarkets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| nextmarkets | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

nextmarkets vs Other Brokers

Compare nextmarkets with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of nextmarkets yet, will you be the first to help fellow traders decide if they should trade with nextmarkets or not?