Money Weighted Return vs. Time Weighted Return (MWR vs. TWR)

Money weighted return and time weighted return are two concepts in finance that are often confused.

Though both are used to measure returns, they differ in how they account for the timing of cash flows.

In this article, we’ll look at how MWR and TWR are different and how they’re calculated.

Money weighted return vs. Time weighted return (TWR vs. MWR)

Time weighted return (TWR) – sometimes called the time weighted rate of return (TWRR) – is the common method used by mutual fund companies to report performance.

It simply looks at the percentage change in value from one period to another.

All cash flows are assumed to have occurred at the beginning of the period.

This return is not influenced by when cash flows occur during the period, only the ending value.

Example

For example, imagine you invested $10,000 on January 1st and it was worth $11,000 on December 31st.

This would be a 10 percent time weighted return ($11,000 – $10,000 = $1,000. $1,000 / $10,000 = 10 percent).

Money weighted return (MWR) – sometimes called the money weighted rate of return (MWRR) – on the other hand, looks at the timing of cash flows and weighs them according to when they occurred.

This is the method used by most traders and investors to track their portfolios.

For example, continuing with the same scenario as above, but now let’s say you added an additional $5,000 to the portfolio on July 1st.

Your ending value would still be $11,000 and your time weighted return would still be 10 percent. However, your money weighted return would be different.

To calculate MWR, we first need to calculate the internal rate of return (IRR) of our cash flows. IRR is the discount rate that sets the present value of our cash flows to zero.

For our example, the IRR would be 11.11 percent. This means that if we had invested $15,000 at the beginning of the year at 11.11 percent, we would have exactly $11,000 at the end of the year.

Now that we know our IRR, we can calculate our MWR which is simply IRR minus the risk-free rate. The risk-free rate is the interest rate on an investment with no risk. For many traders and investors, this is commonly the 10-year Treasury note.

So in our example, MWR would be 11.11 – 3 percent (risk-free rate), or 8.11 percent.

As you can see, MWR will always be higher than TWR when cash is added to the investment during the year. This is because the additional cash flows increase the IRR and, in turn, the MWR.

Conversely, if we had withdrawn cash from our investment during the year, our MWR would have been lower than our TWR.

While time weighted return is a good measure of pure performance, money weighted return is a better measure of an investor’s personal performance. This is because it takes into account the timing of cash flows which can be just as important as the ending value.

For example, let’s say you invested $10,000 on January 1st and it was worth $11,000 on December 31st. This would be a 10 percent time weighted return ($11,000 – $10,000 = $1,000. $1,000 / $10,000 = 10 percent).

But what if you had actually invested $1,000 on December 31st to bring the account from $10,000 to $11,000?

Obviously the 10 percent return would not be accurate since it doesn’t take into account the length of time our money was actually invested.

This is where MWR comes in. By taking into account the timing of cash flows, MWR gives us a more accurate picture of our personal performance.

How to calculate money weighted return

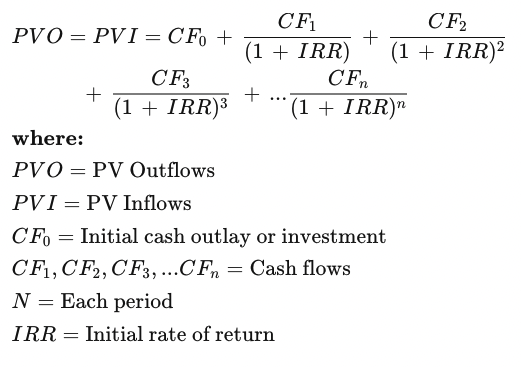

The formula for the MWR (MWRR) is:

To calculate the IRR using the MWR formula, set the net present value (NPV) equal to zero, then solve for the discount rate (r). This discount rate is the IRR.

This is hard to do analytically, so most solve is using software programmed to find the IRR.

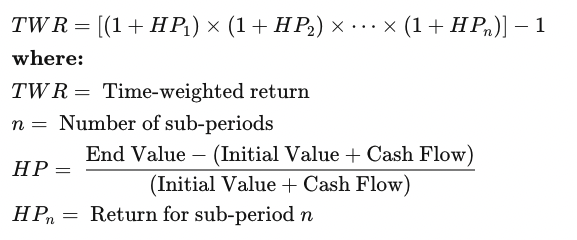

Calculate time weighted return

The formula for the TWR (TWRR) is:

1) Calculate the rate of return for each sub-period by subtracting the beginning balance of the period from the ending balance and dividing that by the beginning balance of the period.

2) Create a new sub-period for each period that there is a change in cash flow (deposit or withdrawal).

You’ll be left with multiple sub-periods wherever there is a deposit or withdrawal, each with a rate of return. Add 1 to each rate of return, which makes negative returns easier to calculate.

3) Multiply the rate of return for each sub-period by each other, then subtract what you get by 1 to find the TWR.

What does the Money Weighted Return (MWR) tell you?

The Money Weighted Return (MWR) is a measure of your investment performance that takes into account the timing and size of your cash flows.

It is considered to be a more accurate measure of your true investment return than the commonly used Time Weighted Return (TWR), which does not take into account the timing or size of your cash flows.

The MWR is calculated by first determining the Internal Rate of Return (IRR) for each individual investment period, and then taking the weighted average of these IRRs, where the weights are equal to the size of the cash flows.

For example, if you made two investments of $100 each, one at the beginning of the year and one at the end of the year, and your ending balance was $110, your MWR would be 10 percent.

If you made the same two investments, but your ending balance was $120, your MWR would be 11.11 percent.

The MWR is a good measure of your investment performance if you are constantly making deposits and withdrawals from your investment account.

It is also a good measure to use when comparing different investment options, as it takes into account the timing and size of cash flows.

What does the Time Weighted Return (TWR) tell you?

It can be hard to know the true percentage gain or loss on a portfolio when there are multiple deposits and withdrawals made over time.

The time weighted return (TWR) is a common metric used to assess performance that adjusts for the timing of cash flows in and out of the portfolio.

The calculation for TWR starts with the internal rate of return (IRR) and then further modifies it to account for cash flows.

The result is a more accurate picture of true investment performance, which can be useful when comparing different investments or analyzing your own performance over time.

There are some drawbacks to using TWR as well, such as its reliance on historical data and its sensitivity to small changes in cash flow timing.

But overall, it remains a popular metric for investors and financial professionals alike.

What is Internal Rate of Return (IRR)?

Internal rate of return (IRR) is a metric used to measure the profitability of an investment.

It is the rate of return that makes the net present value (NPV) of all cash flows from the investment equal to zero.

- To calculate IRR, you need to know the following:

- The initial investment amount

- The cash flows from the investment over time

- The discount rate

The discount rate is usually the same as the investor’s required rate of return. This is the minimum return that an investor would accept for making an investment in the first place.

The formula for IRR is as follows:

IRR = r*((CF1/(1+r)) + (CF2/(1+r)^2) + … + (CFn/(1+r)^n))

Where:

- r = discount rate

- CF1 through CFn = cash flows from the investment over time

- n = the number of periods (usually years)

The idea behind using IRR is that it tells you what annualized return you would need to earn on an investment in order to breakeven after taking into account all cash flows associated with the investment.

The IRR is also used heavily in private equity and when considering investment or project hurdle rates, such as the weighted average cost of capital (WACC).

Difference Between MWR, TWR, and ROR

The ROR is the rate of return. The TWR is the time-weighted rate of return. The MWR is the money-weighted rate of return.

The ROR tells you nothing about cash flows.

The TWR gives equal weight to each dollar, regardless when it was invested.

The MWR factors in when cash was deposited or withdrawn, giving greater weight to more recent investments.

The ROR ignores the timing of cash flows. The TWR considers the timing of cash flows, but not the size. The MWR considers both the timing and size of cash flows.

Compounding factors

All three rates of return are affected by compounding. However, the way compounding is factored into each calculation is different.

The ROR is simply the rate at which your investment grows.

The TWR is the rate at which your investment would grow if all cash flows were reinvested at the same time.

The MWR is the rate at which your investment would grow if all cash flows were reinvested at the same time and in the same proportion.

The ROR assumes you have one lump sum to invest. The TWR and MWR both allow for multiple deposits and withdrawals over time.

Differences in calculating ROR, TWR, and MWR

To calculate the ROR, you need to know two things: the initial investment amount and the ending value of the investment.

To calculate TWR, you need to know three things: the initial investment amount, the ending value of the investment, and all cash flows in and out of the investment over time.

To calculate MWR, you need to know four things: the initial investment amount, the ending value of the investment, all cash flows in and out of the investment over time, and the timing of those cash flows.

The ROR is the simplest rate of return to calculate, but it is also the least informative.

The TWR is more informative than the ROR, but it can be difficult to calculate.

The MWR is the most informative rate of return, but it is also the most difficult to calculate.

TWR vs MWR – FAQs

What does MWR stand for?

MWR stands for money-weighted return.

What does TWR stand for?

TWR stands for time-weighted return.

How do I calculate MWR?

To calculate MWR, you need to know the following: the initial investment amount, the ending value of the investment, all cash flows in and out of the investment over time, and the timing of those cash flows.

How do I calculate TWR?

To calculate TWR, you need to know three things: the initial investment amount, the ending value of the investment, and all cash flows in and out of the investment over time.

What is the difference between TWR and MWR?

The TWR is the time-weighted rate of return. The MWR is the money-weighted rate of return.

The TWR tells you nothing about cash flows. The MWR factors in when cash was deposited or withdrawn, giving greater weight to more recent investments.

The TWR gives equal weight to each dollar, regardless when it was invested. The MWR factors in when cash was deposited or withdrawn, giving greater weight to more recent investments.

To calculate the TWR, you need to know three things: the initial investment amount, the ending value of the investment, and all cash flows in and out of the investment over time.

To calculate MWR, you need to know four things: the initial investment amount, the ending value of the investment, all cash flows in and out of the investment over time, and the timing of those cash flows.

What is a better measure of performance – TWR or MWR?

There is no definitive answer to this question. It depends on your individual circumstances and what you are trying to measure.

If you want to know how your investment has performed over time, without taking into account when you made deposits or withdrawals, then the TWR is a good choice.

If you want to know how your investment has performed taking into account when you made deposits or withdrawals, then the MWR is a better choice.

The TWR is more informative than the ROR, but it can be difficult to calculate. The MWR is the most informative rate of return, but it can be difficult to calculate.

Why is the MWR more accurate than the TWR?

The MWR is more accurate than the TWR because it takes into account the timing of cash flows. The TWR only takes into account the amount of each cash flow, not when it occurred.

The MWR, unlike the TWR, factors in when cash was deposited or withdrawn, giving greater weight to more recent investments. The TWR gives equal weight to each dollar, regardless when it was invested.

Summary – Money weighted vs. Time weighted return

So which return should you focus on?

TWR is a good measure of pure performance, but MWR is a better measure of your personal performance.

If you’re tracking your own investment portfolio, MWR is the way to go.

However, calculating MWR can be difficult to determine unless your broker has it built in or you’re using software to calculate it. If you’re working with a financial advisor, they can help you calculate your MWR.

The bottom line is that both TWR and MWR have their own merits. It’s up to you to decide which one is more important to you.