MCC Markets Review 2024

MCC Markets Review

MCC Markets is a relatively new forex and CFD broker offering a small product lineup. Day traders can invest on the MetaTrader 4 and MetaTrader 5 platforms with flexible leverage up to 1:500 and a welcome bonus. This MCC Markets review will cover minimum deposit requirements, account types, fees, payment methods, and more.

Key Takeaways

- Clients can trade through the popular MT4 and MT5 platforms

- Four live accounts are offered with commission-free trading

- An account manager and copy trading are available

- MCC Markets is new and unproven

- Cryptos and stocks are not available

Company History & Overview

MCC Markets was created by a team of financial experts in 2022. The broker-dealer offers a no-dealing desk (NDD) execution model with direct access to liquidity providers and 50+ financial instruments.

Asset classes are currently fairly limited (forex, indices and commodities only), though this may expand as the broker establishes its presence in the market.

Trading Platforms

Traders can open and close positions on MetaTrader 4 or MetaTrader 5. Developed with both experienced and novice traders in mind, the third-party platforms provide a range of superior tools for technical and fundamental analysis, as well as a simple process to open and close positions.

Users can fully amend chart layouts, timeframes, color schemes, and metrics to suit all trading styles and strategies. Preferred or custom-designed chart templates can also be saved so they can be used again.

Both platforms allow one-click trading execution plus a range of order types and risk-management settings such as stop-loss and take-profit. Automated trading systems are also permitted through Expert Advisors (EAs).

How To Place A Trade

- Log in to the MT4 or MT5 platform with your MCC Markets credentials

- Select the ‘New Order’ icon from the top menu (white page with green ‘+’ icon)

- Complete trade details, including size, execution type, risk management tools

- Add a comment (optional)

- Click ‘Buy’ or ‘Sell’

Assets & Instruments

The instrument list at MCC Markets is short compared to alternatives, with just over 50 assets available:

- Commodities – Trade gold, silver, natural gas, UK crude oil, and US crude oil

- Indices – Trade eight global indices such as the S&P 500, FTSE 100 and ESP 35

- Forex – Speculate on price movements across 40+ major, cross, and minor currency pairs including EUR/GBP, USD/SGD, and GBP/AUD

Unfortunately, stocks and cryptocurrency are not available.

MCC Markets Fees

MCC Markets is not particularly transparent when it comes to trading fees. The broker uses a floating spread model with commission fees ($2 per lot) on the ECN account. There are no commissions on the STD, STP or VIP accounts.

When we used MCC Markets, we were offered spreads of 0.9 pips on GBP/USD and 0.8 pips on USD/JPY which is competitive. However, spreads widen during periods of low liquidity and high volatility.

The broker does not charge any fees for deposits and withdrawals to a live trading account.

Leverage

MCC Markets provides day traders with up to 1:500 leverage. Maximum leverage values are reduced to 1:100 for ECN and VIP account holders. Still, this is high vs EU and UK-regulated brokers and increases the risk of online trading, especially for beginners.

Leverage ratios can be selected during account registration and amended following successful account sign-up.

All accounts have a 50% margin call and a 20% stop-out level.

Mobile App

The MetaTrader platforms have mobile-compatible apps. Download links are available via the client portal, connecting users directly to the relevant app store.

The mobile applications provide real-time price quotes, live financial news, forex charts, and all analysis tools. Our experts found that online trading via the apps is easy on both mobile and tablet devices, with simple navigation and an integrated toolbar menu.

Overall, the MT4 and MT5 apps will meet the needs of both new traders and experienced investors.

MCC Markets Payment Methods

Deposits

MCC Markets offers a good selection of payment methods, including bank cards, wire transfers, and e-wallets. The broker also doesn’t charge any payment fees, though third-party charges may apply.

When we made a deposit to MCC Markets, we were asked to send a screenshot of the transaction receipt to the broker’s customer service team for prompt processing. Bank wire transfers are subject to the longest processing time – allow up to five working days for money to be available.

Accepted deposit methods:

- Skrill

- Tether

- Neteller

- Help2pay

- Bank wire transfer

- Visa/Mastercard credit and debit cards

How To Make A Deposit

- Log in to the MCC Markets client portal

- Select ‘Deposit’ from the side menu

- Choose the payment method by selecting the relevant logo

- Complete the requested payment details

- Select ‘Make Payment’

- Upload transaction proof/receipt

Withdrawals

All withdrawals up to the deposit value must be returned to the original payment method, however, profits need to be returned via bank wire transfer.

MCC Markets does not charge a fee and will remit any bank charges. Bank wire transfers are liable for a two to five-day average processing time. Withdrawals made through other methods such as Neteller or credit/debit cards are typically settled within one working day.

To request a withdrawal, an online form must be completed. Select the ‘Withdrawal’ icon from the side menu.

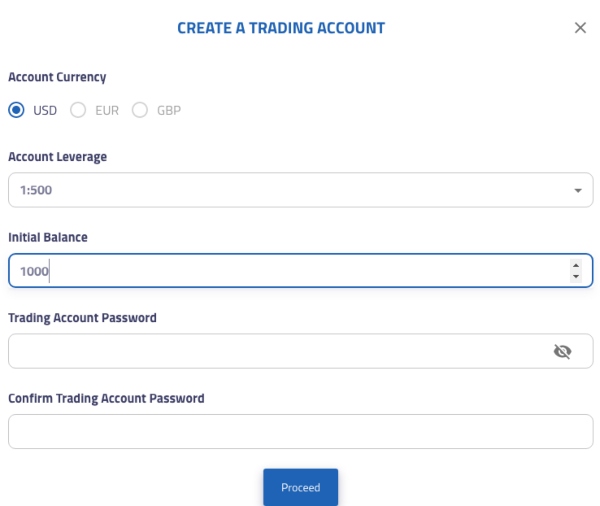

Demo Account

A free demo account is available to prospective MCC Markets traders. Users can choose an account base currency (USD, EUR, or GBP), the leverage amount and how much virtual funds they want to get started.

However, despite our profile and language settings being set to English, the demo platform was displayed in Mandarin so navigation was challenging. Fortunately, by selecting ‘WebTrader’ directly from the broker’s homepage and accessing the demo account that way, we were able to register for an English paper trading account.

How To Open A Demo Account

- Sign up for an MCC Markets account

- Log in to the client portal via the official website

- Select ‘Accounts’ and then ‘Demo Accounts’ from the menu on the left

- Choose ‘Open Demo Account’

- Complete the profile details and select ‘Proceed’

- Account details will be provided on the next screen

- Select ‘Download Platform’ or ‘Web Trader’ from the top menu to launch MT4/MT5

- Log in and start trading

Bonuses & Promotions

While using MCC Markets, we were offered a 50% welcome deposit bonus. This can be a good way to bolster your trading margin and purchasing power. However, bonus terms and conditions mean withdrawing promotional funds is not allowed.

Regulation & Licensing

MCC Markets claims to be a registered broker-dealer, regulated by the Securities Commission of the Bahamas, SCB SIA-F211. However we could not verify this license, which is seriously concerning from a safety perspective.

This is also not the most credible agency vs the Financial Conduct Authority (FCA) in the UK, for example. Fund protection and customer safety are not guaranteed when trading with an offshore brokerage. This includes access to third-party compensation schemes in the case of business failure.

Nonetheless, the broker does segregate client funds in custodian bank accounts.

Account Types

MCC Markets offers four account options for traders; STD, STP, ECN, or VIP.

All profiles permit the use of Expert Advisors, scalping, and hedging. There is a minimum trade size of 0.01 lots and a maximum trade size of 100 lots.

For beginners, we would recommend the STD account due to its low minimum deposit requirement and access to all the basic trading tools. The commission-free pricing model is also beneficial.

STD Account

- Commission-free

- $50 minimum deposit

- 1:500 maximum leverage

STP Account

- Commission-free

- $2000 minimum deposit

- 1:500 maximum leverage

ECN Account

- $2 commission per lot

- $5000 minimum deposit

- 1:100 maximum leverage

VIP Account

- Commission-free

- $20,000 minimum deposit

- 1:100 maximum leverage

How To Open A Live Account

New users can open an MCC Markets live trading account in five minutes:

- Select the green ‘Register’ icon on the top right of the broker’s website

- Complete the online registration form

- Fill in live profile details including employment status, profession, and source of funding

- Click ‘Submit’

- Deposit funds

- Start trading

Note, new clients will need to provide proof of identity before withdrawals are permitted. Documents can be uploaded via the ‘My Profile’ section of the client dashboard.

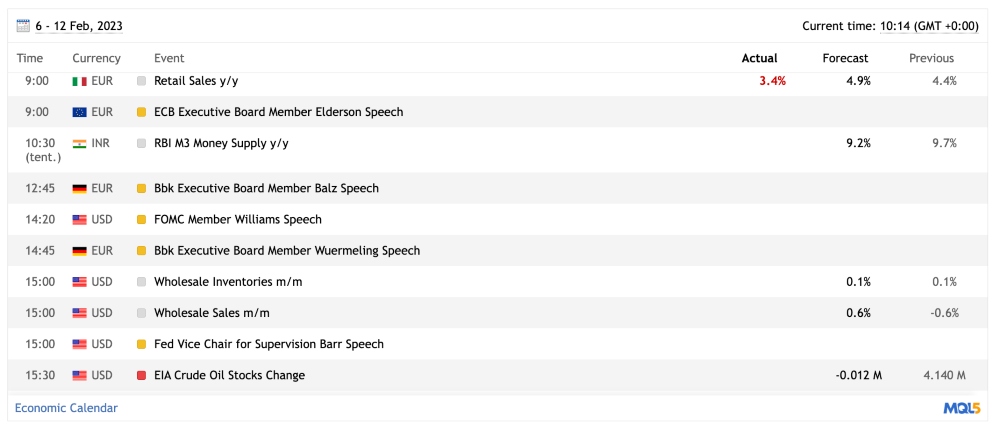

Additional Tools

Our experts were disappointed with the lack of educational content and additional trading tools offered by MCC Markets.

The link to the economic calendar was broken on multiple occassions. Our traders also tried to gain access to ‘Investor’ status through the broker’s copy trading service. This was never approved and we were unable to make any automated trades or view registered signal providers.

This is a significant downside vs major brokers. Many brands today have introduced proprietary tools as well as providing access to third-party services, such as Autochartist.

Opening Hours

Trading hours vary by asset class. The forex market, for example, is available 24 hours a day, 5 days a week due to the four global trading sessions. Release dates and closing times are visible in the broker’s trading platforms.

On the downside, MCC Markets does not offer out-of-hours or weekend trading opportunities.

Customer Support

MCC Markets offers 24/5 customer service. Contact methods are limited, with no telephone number. However, the live chat was responsive – we received a response to queries within a couple of minutes. Additionally, new clients benefit from a dedicated account manager with support on using the platforms and account verification.

- Live Chat – Blue icon available at the bottom right of each webpage

- Email – contact@mcc-markets.com or cs@mcc-markets.com

- Office Address – 201 Church Street, Sandyport, Nassau, Bahamas and 3007, Westbury Business Tower, Business Bay, Dubai

Company news, upcoming events and market trends are posted on the broker’s social media channels, including Twitter and Facebook.

Security & Safety

MCC Markets uses data encryption technology and third-party fraud monitoring. Additionally, the MetaTrader brand is top-tier when it comes to security features. All data transmissions are fully encrypted and IP addresses are hidden when investments are executed from a computer or mobile device.

Apply two-factor authentication (2FA) and one-time passwords (OTP) for additional account protection.

MCC Markets Verdict

As a relatively new broker, MCC Markets is still lacking some of the basic features of a top-rated brokerage. The range of tradable assets is narrow while the broker’s copy trading service and economic calendar aren’t fully functioning. In addition, MCC Markets does not offer negative balance protection and there is limited regulatory oversight. The company will need to address these challenges to improve its rating.

FAQs

Is MCC Markets A Good Broker?

MCC Markets is not yet a leading trading broker. The company is missing some key features, including pricing transparency, robust regulatory oversight, copy trading and negative balance protection. The firm also offers just 50 financial instruments with no stocks or cryptos.

Is MCC Markets Legit Or A Scam?

MCC Markets appears to be a legitimate forex and CFD broker. The company was established in 2022 and says it is regulated by the Securities Commission of the Bahamas. However, it doesn’t have a proven track record and our experts could not find an active registration with the regulator.

Does MCC Markets Offer A Wide Range Of Financial Instruments?

Just 50 instruments are available at MCC Markets, spanning forex, indices, and commodities. However, neither cryptocurrencies nor stocks and shares are available.

Is My Money Safe With MCC Markets?

MCC Markets uses segregated accounts, meaning customers’ deposits are held separately from business money. However, the broker does not provide negative balance protection or access to compensation schemes. The company is also relatively new with limited user reviews and ratings.

Is MCC Markets Suitable For Beginners?

MCC Markets does not offer any educational content or training materials for new traders. There is a copy trading solution, however, when we used MCC Markets, it did not work properly.

Top 3 Alternatives to MCC Markets

Compare MCC Markets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

MCC Markets Comparison Table

| MCC Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 0.8 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Indices, Metals, Energies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 50% Deposit Bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by MCC Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| MCC Markets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

MCC Markets vs Other Brokers

Compare MCC Markets with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of MCC Markets yet, will you be the first to help fellow traders decide if they should trade with MCC Markets or not?