M4Markets Broadens Asset Range With Share CFDs

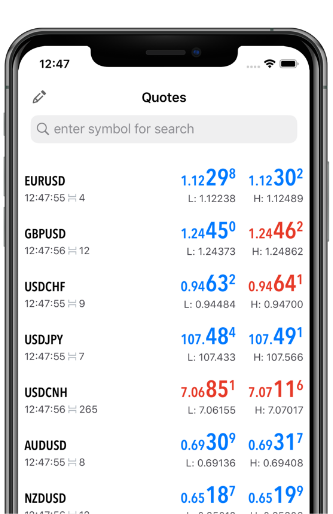

Emerging forex and CFD broker, M4Markets, has brought out share CFDs on its new MetaTrader 5 platform. The company has been quick to answer calls from its traders for leveraged stock CFDs. Clients can now trade a long list of EU and US shares on the industry-favourite MT5 solution.

Share CFDs

Some of the largest companies in Europe and the US can be traded, including Adidas, Apple, Coca-Cola, Tesla and Visa. The minimum spread is 0.01 while the pip value of 1 lot is €1. See the full list of available shares here.

Advanced price analysis is available through the MT5 platform, with 38 technical indicators, 44 graphical objects, 21 timeframes and an unlimited number of charts. This means both beginners and experienced investors can analyse the stock market and execute positions in a competitive trading environment.

Executive Director at M4Markets, Mr. Deepak Jassal, noted “Our goal is to increase our offering so that traders who come to M4Markets have a wide variety of products available to them. Our new asset class, Share CFDs, will be offered at the same exceptional conditions as our other products including ultra-fast execution, low-cost trading and a technologically advanced trading environment”

About M4Markets

Relatively new to the online trading scene having launched in 2019, M4Markets has been investing to give its clients a leading user experience. Customers benefit from low entry requirements with just a $5 minimum deposit, raw spreads from zero pips and 1000x leverage.

The broker offers over a dozen major indices, 50 currencies and a handful of precious metals and energies, including oil gold and silver. M4Markets also offers a sizeable 50% deposit bonus up to $5,000. And whilst no means a finished product, the broker is consistently refining its suite of products, making a name for itself in established trading jurisdictions.