LiteFinance Review 2025

See the Top 3 Alternatives in your location.

Pros

- Good range of forex pairs

- Decent suite of extra tools and features including a VPS

- Social trading service

Cons

- Not overseen by any top-tier regulator

- Some complaints online about difficulties withdrawing funds

- Does not accept US traders

LiteFinance Review

LiteFinance, formerly known as LiteForex, is an established ECN broker. Clients can trade currencies, commodities and stocks on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. In this broker review, we explore the complete LiteFinance trading experience, from the sign-up process to deposit and withdrawal options, contacting customer support, bonuses and leverage; helping you to make an informed choice.

LiteFinance Headlines

LiteFinance (ex LiteForex) was founded in 2005 by Aleksey Smirnov. Today, its brokerage services are used by 500,000 clients worldwide. It offers a range of assets, two of the most popular trading platforms and flexible account options with the aim of making the world of forex and CFD trading accessible to a global audience.

LiteFinance is owned by LiteFinance Global LLC. The group has offices in the Philippines, Kenya, Myanmar, Tanzania, Ghana, Nicaragua, India, Indonesia, Vietnam, Iran, and a recently opened office in Lagos, Nigeria. Services are available in English and 14 other languages.

Note, LiteForex (Europe) Ltd operates as a separate broker offering trading services to clients from Europe only.

Trading Platforms

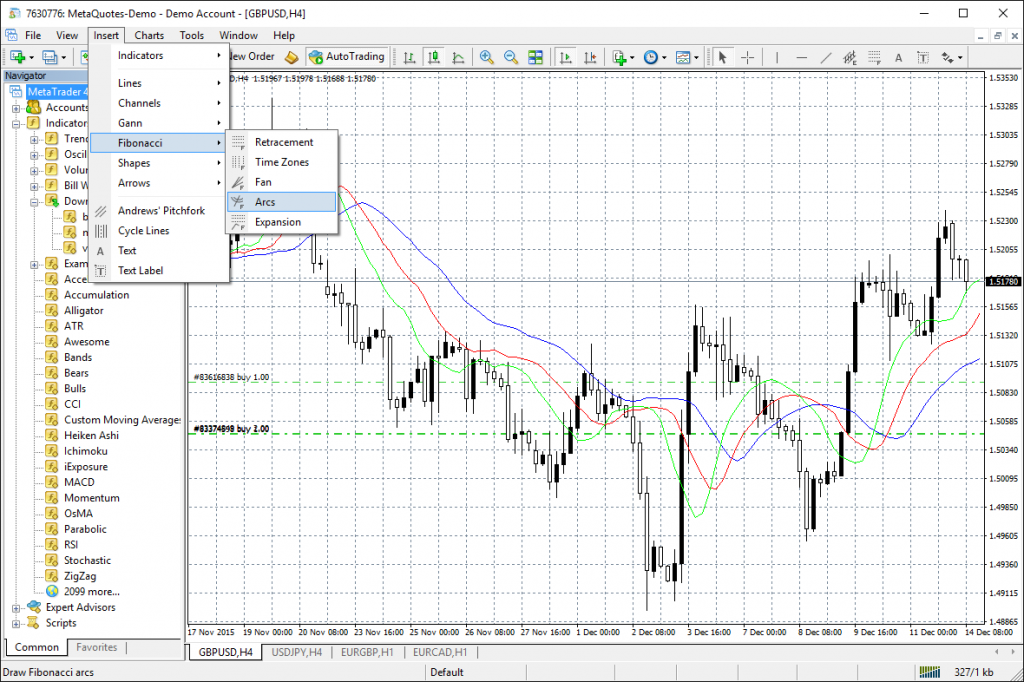

LiteFinance offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. Developed in 2005 and 2010 respectively, these systems have become the foremost platforms for online forex and CFD trading.

The terminals can be downloaded to Mac or PC devices. Alternatively, the WebTrader interface lets you trade directly from an online browser. The setup and verification process is quick and intuitive so users can start trading within minutes.

Both downloadable platforms are user-friendly while the web terminal offers a range of options for customization. They provide multiple chart types including, line, candlestick, and bar charts. MT5 offers more indicators and advanced analysis tools than MT4 including a built-in economic calendar, 21 timeframes, plus a Depth of Market feature. Still, MetaTrader 4 remains the most popular platform and has everything needed to implement successful trading strategies.

Assets & Markets

LiteFinance offers multiple asset classes which are available to all account holders:

- Currency – FX trading is available 24/5 on major, minor, and exotic pairs

- Commodities – Trade gold and oil 14/5 with consistent liquidity

- Global stock indexes – Trade CFDs on major global indices, including the US30 (Dow Jones)

- Stocks – Trade shares from US, UK and European stock markets with a raft of new equities added including Adobe

- Cryptocurrency – Popular crypto pairs, including BTX, XRP and XYZ, provide an alternative to traditional markets with fresh additions in 2024

Spreads & Commissions

The brokerage takes its fee from the spread. Spreads are specific to the account and asset being traded. The Classic account uses a spread-based system and the ECN account, a commission-based system.

With the latter, commission is charged at $0.5 per lot alongside spreads from 0.0 pips. Spreads on the Classic account are relatively high, starting at 1.8 pips but with no commission.

Leverage

Leverage up to 1:500 is available. When signing up, users can select the leverage they want. Details of the margin call process can be found in the FAQ section of the broker’s website. Make sure you have a sensible money management plan when trading with high leverage.

Crypto leverage goes up to 1:50.

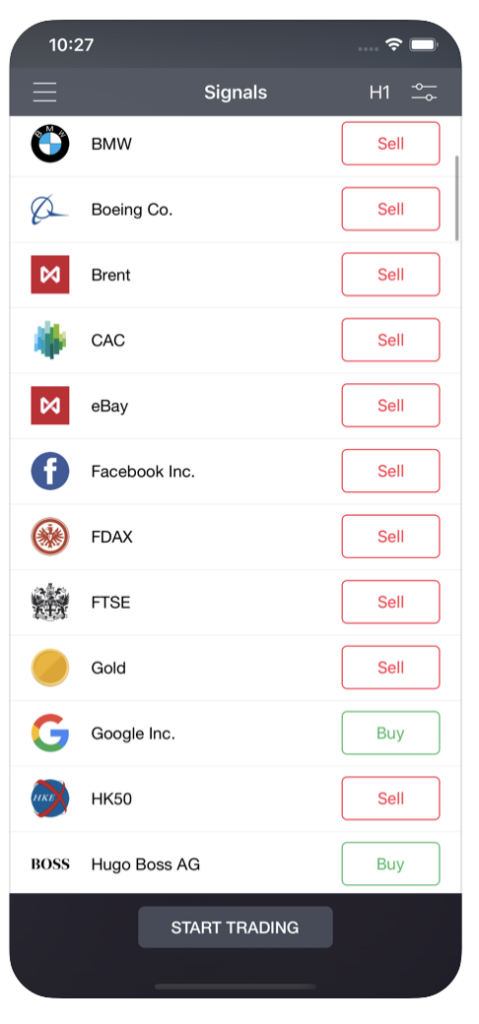

Mobile App

LiteFinance offers its own mobile trading application, available from Google Play and the App Store. The application offers access to 190 instruments, over 100 graphical tools, and 75 indicators. Users also benefit from signals and copy trading, plus automatic withdrawals up to $3000. In addition, the app was updated in 2022 to provide a more stable and reliable trading experience.

Mobile trading is also available through the MT4 and MT5 platforms. The apps are available to download free of charge on both Android (APK) and Apple (iOS) devices. Users get signals, news alerts, and a range of price analysis features for different trading strategies. The mobile applications are also easy to navigate and available in eight different languages.

Mobile trading offers greater flexibility than desktop trading but for data-intensive tasks, the desktop solution is easier to navigate.

Deposits & Withdrawals

Traders can deposit directly into their LiteFinance account via:

- Credit/debit card (Visa & Mastercard)

- Bank transfer

- WebMoney

- AliPay

The minimum deposit for all accounts is $50 and payments are usually processed on the same day. Clients can also fund their accounts with cryptocurrencies, such as Bitcoin.

LiteFinance offers an automatic withdrawal feature that enables traders to withdraw funds up to $100 per day within 24 hours and is available on Perfect Money and M-Pesa. Withdrawal charges are specific to the provider.

Note, PayPal is not available.

Demo Account

LiteFinance offers a free demo account which is a great way to get to grips with the broker, and its platforms, risk-free. The sign-up process is straightforward and an account can be opened in under a minute. Demo accounts are useful for traders of all experience levels.

Bonuses & Promotions

At the time of writing, LiteFinance does not offer a welcome bonus or any promo codes. However, there is a promotional offer to get a rebate on deposit fees, so payments are essentially free.

Also, the brand runs a ‘Dream Draw’ with a prize fund of $350,000 and a Video Blogger contest with a prize pool of $1,000. The broker also runs trading contests with cash prizes up to $4,000.

Visit the broker’s website for the latest no deposit bonuses and promo codes in 2025.

Regulations

LiteFinance is owned by LiteFinance Global LLC. LiteFinance Global LLC is incorporated in St. Vincent & the Grenadines under registration number 931 LLC 2021.

LiteForex (Europe) Limited is registered by the Cyprus Securities and Exchange Commission (CySEC) under license number 093/08 in accordance with Markets in Financial Instruments Directive (MiFID). All retail clients are insured by the Investor Compensation Fund.

Additional Features

LiteFinance has a cabinet of tools to facilitate successful trading including; an economic calendar, a world market news blog, and both a margin and Fibonacci calculator all accessible via the homepage.

Additional support is supplied in the form of Claws&Horns’ expertise; an analytical agency providing comprehensive analytical tools.

Account Types

LiteFinance offers two primary live accounts; the ECN account and a Classic account.

ECN Account

For professional traders and investors, LiteFinance recommends the real-trading ECN (Electronic Communications Network) account. The account offers an interest rate of 2.5% on surplus funds, an unlimited number of transactions and trades are delivered directly to liquidity providers.

Note, only the MT4 platform is available to ECN account holders.

Classic Account

The Classic account is available to experienced traders. No interest is paid on surplus funds and no commissions are charged. Both the MT4 and MT5 trading platforms are available.

To sign up for an account, select ‘Registration’ which you will find in the top right-hand corner of each page.

ECN vs Classic accounts? Both have their merits, so ensure you do your research. As accounts correspond to different servers, it is not possible to change the account type once opened, to do so you will need to delete the account.

A Forex Islamic account is a halal trading account and is available to investors prohibited from conducting trades involving interest rates, owing to religious beliefs.

Trading Hours

Trading platforms are open and usable 24/7, however certain markets only permit trading between specified hours. This is something to consider when trading stocks at the weekend, as it is likely margins will be lower and profitability reduced.

Any changes to standard trade hours are reliably communicated by the LiteFinance news blog. Also check for the respective server time where you’re based.

Customer Support

Access to advice can be found via the live chat feature available from the logo on the LiteFinance website. Once users are passed the login page, the live chat icon will appear in the bottom right-hand corner of the screen. Alternatively, traders can contact customer service representatives via:

- Email – clients@litefinance.com

Customer support can help with most queries, including internal transfers and admin issues.

Community forums can also be found on:

The broker’s headquarters office address: First Floor, First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

Safety & Security

LiteFinance offers a safe and secure platform and the site is protected with firewalls and isolated servers. LiteFinance recommends a VPS to manage trades whilst users’ gadgets are switched off. It is not reliant on an internet connection or power supply and offers a degree of security to web traders.

In 2021, the broker also introduced two-factor authentication to enhance the security of operations.

LiteFinance Verdict

LiteFinance is a legitimate broker with a lot to offer. There is a good range of tradeable forex and CFD assets, plus the MT4 and MT5 platforms.

The website is easy to navigate, support is easily accessible and there are multiple free analysis tools. The LiteFinance brand is largely inclusive and despite its international presence, remains tailored to individual markets.

FAQs

Is LiteFinance A Trusted & Good Broker?

LiteFinance is a legitimate, established broker. All activity is monitored and clients should feel reassured that their funds are held safely.

What Is The Minimum Deposit For A LiteFinance Account?

LiteFinance has a minimum deposit of $50. This is in line with industry requirements. Payments are usually processed the same day. As an alternative, clients can also fund their accounts using cryptocurrencies.

Who Is The Owner Of LiteFinance?

Aleksey Smirnov is the CEO and owner of LiteFinance. Smirnov founded LiteForex in 2005 and has been at the helm ever since.

Is LiteFinance Available In The USA?

No, LiteFinance is not available to residents of EEA, Russia, USA, Japan or Israel.

Is LiteForex The Same As LiteFinance?

LiteFinance was formerly LiteForex. The company rebranded in 2021 ahead of its global expansion.

Best Alternatives to LiteFinance

Compare LiteFinance with the best similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

LiteFinance Comparison Table

| LiteFinance | World Forex | Dukascopy | |

|---|---|---|---|

| Rating | 4 | 4 | 3.6 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $1 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | CySEC | SVGFSA | FINMA, JFSA, FCMC |

| Bonus | Rebate on payment fees | 100% Deposit Bonus | 10% Equity Bonus |

| Platforms | MT4, MT5 | MT4, MT5 | JForex, MT4, MT5 |

| Leverage | 1:500 (Crypto 1:50) | 1:1000 | 1:200 |

| Payment Methods | 10 | 10 | 11 |

| Visit | – | Visit | Visit |

| Review | – | World Forex Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by LiteFinance and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| LiteFinance | World Forex | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | Yes | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | No |

| Options | No | No | No |

| ETFs | No | No | Yes |

| Bonds | No | No | Yes |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

LiteFinance vs Other Brokers

Compare LiteFinance with any other broker by selecting the other broker below.

The most popular LiteFinance comparisons:

- IC Markets vs LiteFinance

- LiteFinance vs FOREX.com

- LiteFinance vs Markets.com

- Libertex vs LiteFinance

Customer Reviews

5 / 5This average customer rating is based on 1 LiteFinance customer reviews submitted by our visitors.

If you have traded with LiteFinance we would really like to know about your experience - please submit your own review. Thank you.

I use LiteFinance for trading FX. It’s been a gfreat broker for me because it has fast ECN execution, tight spreads on USD pairs (even during fed announcements) and a solid VPS service for running algo strategies. Their site and tools use to be clunky and a minefield but they’ve made strides to imrpvoe that over the years. Now LiteFinance is a solid option for day trading FX in my experience.