Kyber Network Review 2024

Pros

- The decentralized network operates with no intermedaries, no registration requirements and no trading limits or restrictions

- A range of crypto activities supported including token swaps, reward farming, and governance proposals

- Compatible with 10+ crypto wallets including MetaMask, Krystal, Coinbase and WalletConnect

Cons

- No app for mobile investors

- Below-average customer support with no live chat, email or telephone help

- Low trust score due to weak regulatory status

Kyber Network Review

Kyber Network is a decentralised cryptocurrency exchange and DeFi platform supporting token swaps for more than 1,500 crypto coins, as well as staking, farming and dapp production solutions. The blockchain-run exchange has a native token, KNC, which is used for governance, fees and support for the range of decentralised services offered. This 2024 Kyber Network review will explore how it works and delve into the various functions of the project, including its staking system, liquidity provision and security procedures.

How It Works

Kyber Network is a decentralised finance (DeFi) project that was announced in 2017 and looks to evolve the perception and capabilities of decentralised cryptocurrency exchanges (DEXs). While it still works as an effective exchange tool, with thousands of cryptocurrencies that can be swapped through an anonymous network of traders, exchanges, dapps and aggregators, there is much more to it.

Kyber Network hopes to lay the foundations required for developers to create convenient payment streams, apps and blockchain tools. The platform as it stands can be used to develop wallets, token swap services, NFTs, e-commerce payment systems, exchanges, trading integrations and DeFi systems.

Kyber Network also supports a range of other decentralised tools and functions, including passive income streams like staking, alongside liquidity provision, crypto analytics, governance overhauls and crypto farming. The exchange is also an automated market maker, utilising internal and external tokens to improve liquidity and reduce slippage, keeping prices low and spreads tight.

Features

The Kyber Network is not only an efficient Ethereum-based exchange system but is also built as a transfer mechanism for different crypto coins. On this system, the coins sent do not have to match those received, cutting the time to make trades and offering a great way for more businesses to accept crypto as payment.

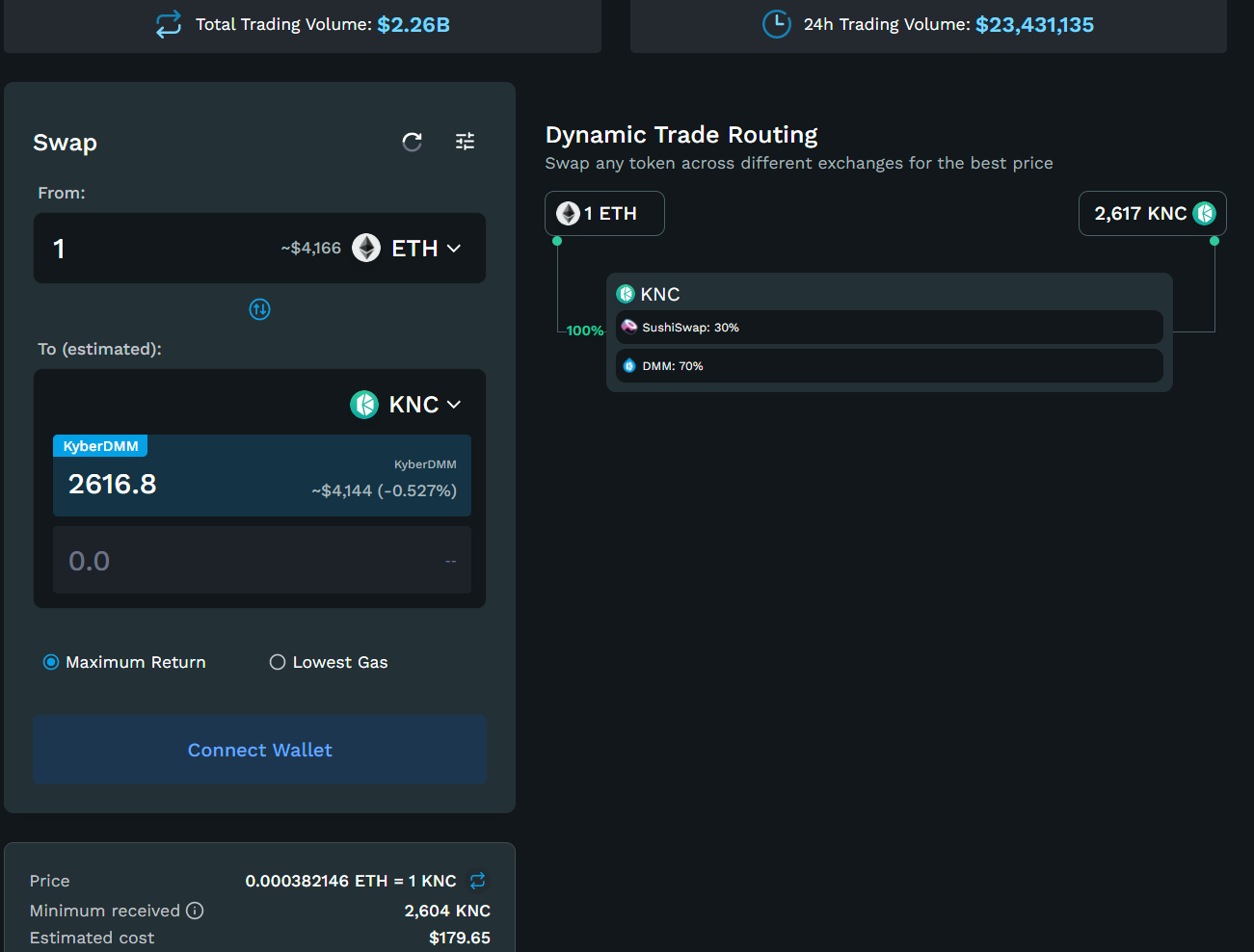

Kyber Swap

Kyber swap is a feature of the platform that allows for the immediate trade of different cryptocurrencies without any order books, deposits or wrapping. The exchange actuates trades by dynamically routing requests through several centralised exchanges and liquidity pools to find the best prices. Clients can also choose to optimise their swaps for either the lowest gas prices or maximum returns. Additional features include variable slippage tolerance and key pre-trade information like minimum returns and estimated USD value.

Kyber Reserve

This reserve function is a form of local liquidity provision, helping optimise the transactions across the blockchain. The system pools tokens contributed by users with liquidity provided by third parties. This allows for lower slippage and gas fees across more of the token types. The transparent fund management model secures the reserve fund ensuring all trades that are completed by reserves are recorded.

Kyber Developer

This interface provides developers with the tools necessary to bring new apps, wallets, exchanges and platform alterations to the decentralised Kyber Network exchange. This means that the platform is continuously growing and becoming better for its users.

Kyber Network Crystal

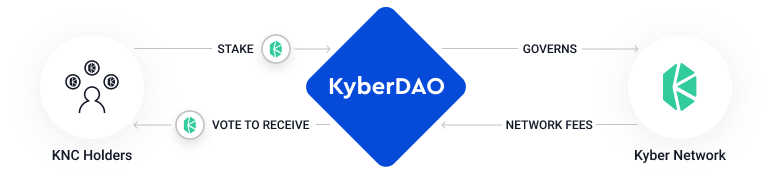

Kyber Network Crystal (KNC) is the native token of the exchange’s blockchain, facilitating the recording of any information or transactions through the network. The token connects liquidity providers and pools to those in need, whether for trading, dapps, wallets or aggregators, also providing referral bonuses for any users or transactions directed through the network. KNC is also used to collect transaction fees, though some of each charge is burned to ensure the coin remains deflationary. Another use is to maintain the smooth running of the reserve system as third parties must purchase KNC for their operations on the Kyber Network. Finally, the token can be used both as a staking tool, used to generate passive reserve income, and a governance tool, so users can vote on the future of the blockchain.

Security

Kyber Network is a decentralised finance (DeFi) exchange and so does not store any funds or private data. This means there is minimal risk of personal data and information being stolen. Moreover, the platform is non-custodian, so the security of your tokens is entirely down to you and your wallet system.

Trading Fees

The only costs incurred when using Kyber Network for trading is a flat fee of 0.1%, which is competitive compared to other centralised and decentralised exchange platforms.

Customer Support

Kyber Network’s customer service team can be contacted via email only:

- Email Address: support@kyber.network

Verdict

Kyber Network is a decentralised crypto exchange with a range of additional services suited to investors and traders as well as institutions and developers. Alongside simply swapping tokens, users can stake crypto for passive income liquidity provision rewards, farm tokens or pool resources. With low fees and a simplistic platform, Kyber Network is a solid competitor in the DEX market and its non-custodian, anonymous structure will be appealing to many. However, newcomers to crypto trading will need to purchase some tokens from an entry-level exchange before they can make use of this platform.

FAQs

How Can I Contact Kyber Network?

You can contact Kyber Network customer support via email at support@kyber.network. There is no telephone or live chat service.

What Is The Kyber Network Crystal Token?

KNC has several uses as the blockchain’s native token. Besides simply collecting transaction fees, the coin can also be staked for passive income rewards, used for governance of the platform and support the smooth operation of the Kyber Network Reserve system.

Is The Kyber Network Safe?

As Kyber Network is a non-custodian, decentralised exchange, users need simply to connect a wallet address and begin trading, maintaining full control of their cryptocurrency capital and providing no identification.

What Is The Kyber Reserve?

This liquidity pool stores tokens from third party contributors and allows Kyber Network to work as an automated market maker ensuring that token swaps can be completed quickly and with minimal slippage.

Does Kyber Network Have A Blog?

Yes. The Kyber Network’s blog is an informative place to find out the latest news to enhance your crypto trading experience. The blog also touches on live price predictions for coins and KNC. You can access the blog through the exchange’s official website.

Top 3 Alternatives to Kyber Network

Compare Kyber Network with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Kraken – Kraken is a leading cryptocurrency exchange with a proprietary trading terminal and a list of 220+ tradeable crypto tokens. Up to 1:5 leverage is available with stable rollover fees on spot crypto trading and up to 1:50 on futures. The exchange also supports crypto staking and has an interactive NFT marketplace.

Kyber Network Comparison Table

| Kyber Network | IG | Interactive Brokers | Kraken | |

|---|---|---|---|---|

| Rating | 1.9 | 4.4 | 4.3 | 3.9 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Cryptos |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $10 |

| Minimum Trade | $0 | 0.01 Lots | $100 | Variable |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, FinCEN, FINTRAC, AUSTRAC, FSA |

| Bonus | – | – | – | Lower fees when trading volume exceeds $50,000 in 30 days |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | AlgoTrader |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | – |

| Payment Methods | 1 | 6 | 6 | 6 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

Kraken Review |

Compare Trading Instruments

Compare the markets and instruments offered by Kyber Network and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Kyber Network | IG | Interactive Brokers | Kraken | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | No | Yes | Yes | No |

| Commodities | No | Yes | Yes | No |

| Oil | No | Yes | No | No |

| Gold | No | Yes | Yes | No |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | Yes |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Kyber Network vs Other Brokers

Compare Kyber Network with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Kyber Network yet, will you be the first to help fellow traders decide if they should trade with Kyber Network or not?