KAB Review 2024

Pros

- Demo account

- Low minimum deposit

Cons

- No copy trading

- Few payment methods

- No MT4 integration

KAB Review

KAB Kuwait Group is a CMA-regulated broker based in the Middle East. It facilitates retail trading on global financial markets and investments including forex, indices and commodities. In this review, we deep dive into KAB’s services, from account types to trading platforms, instruments, and regulations. Find out whether you should register with KAB and start trading.

Key Takeaways

- KAB is a good option for traders based in the Middle East with low-cost local payment solutions and multiple account tiers

- KAB is not a good option for global traders due to the lack of internationally accepted deposit options and customer support

Company Details

KAB was established in 2002, and was named after its three founders: KC Chan, Alan Chan and Billie Lam. The company operates across Europe, Asia and the Middle East and has offices in Kuwait and Dubai.

With over 20 years of industry experience behind them, KAB has become a well-established online brokerage. Today, it offers a sleek 360 trading experience, boasting a broad range of tradeable assets, the advanced MT5 platform and a suite of additional tools and resources.

KAB is part of the KAB Kuwait Group. The Group is regulated and licensed by the Capital Markets Authority of Kuwait and the country’s Chamber of Commerce and Industry.

Trading Platform

KAB offers clients one of the industry’s leading trading platforms, MetaTrader 5 (MT5).

MetaTrader 5 is the successor to the hugely popular MetaTrader 4. The terminal is a good fit for experienced traders looking to conduct in-depth technical analysis.

On the downside, those new to trading may find the platform challenging to get to grips with. Alternative brokers often provide a beginner-friendly web-based platform with straightforward trading features.

MT5 functionality includes:

- Widget customization

- Multiple timeframes

- 38 technical indicators

- User-friendly interface

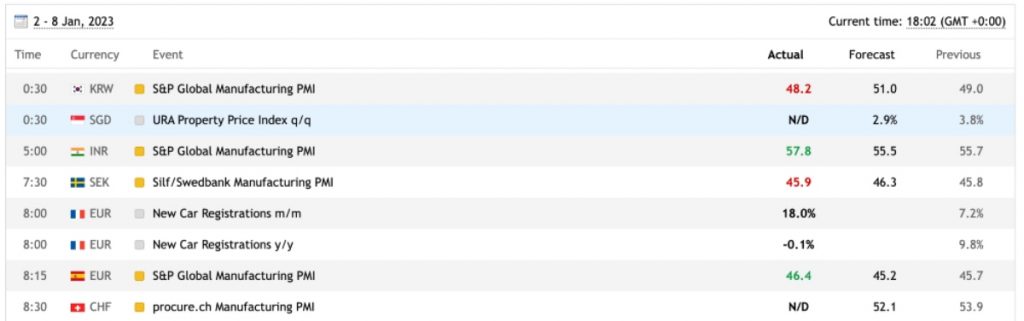

- Built-in economic calendar

- Advanced tools and analysis

- Compatibility with Autochartist and other third-party plugins

- Caters to a range of trading strategies including scalping and hedging.

MT5 is free to download onto any device. A download link can be found on the KAB website under the Platforms tab. Alternatively, the software can be downloaded directly from the Apple App Store or Google Play. MT5 is compatible with macOS and Windows devices.

How To Place A Trade

Once you have logged into your MT5 account, placing a trade can be done in a few simple steps:

- Select ‘Tools’ from the Menu bar and then ‘New Order’. Alternatively, from the Market Watch window, double-click on the asset you wish to trade.

- The Order screen will then pop up, you will need to enter the parameters of your trade including:

- Symbol

- Order type

- Volume

- Stop loss and take levels

Products & Markets

When we used KAB, there were 100+ instruments to choose from across five asset classes:

- Forex – trade major and minor currency pairs including EUR/USD, GBP/USD and EUR/AUD

- Shares – choose from hundreds of US, UK and European shares from leading companies

- Indices – popular indices including S&P 500, NASDAQ and Dow Jones

- Precious metals – spot gold and silver

- Energies – crude oil and natural gas

Whilst a relatively decent selection of trading assets, KAB does not offer cryptocurrency trading. This is a drawback vs competitors which are increasingly providing opportunities on digital assets.

Mobile App Review

KAB does not offer a proprietary trading app. This means the broker does not rank highly for mobile day trading compared to alternative firms.

However, clients can trade on the go with the MT5 mobile app. Simply download the application from the Apple App or Google Play and trade anytime, anywhere. Interactive charts, instant and pending orders, plus automated trading capabilities are available on the mobile and tablet app.

Deposits & Withdrawals

The payment methods supported by KAB are heavily tailored to Kuwait locals or residents of the Middle East. International clients may find them limited.

Deposits

To add funds to your trading account, the broker offers the following options:

- Knet Bank Card – only available to Kuwait locals

- My Fatoorah – Visa and MasterCard payments are supported for residents of UAE, Qatar and Saudi Arabia

- Scardu – accepted worldwide, Scardu is a direct payment solution that uses prepaid cards and gift cards

- BipiPay – a leading online payment service in Asian markets

Whilst there are some good options for local residents, global traders will be deterred by the lack of internationally accepted payment methods. This makes trading with KAB relatively inconvenient vs alternative firms.

Withdrawals

To make a withdrawal, clients will need to complete an online form. The form requests some basic client information as well as the total sum you would like to withdraw and bank details.

Once complete, it will need to be sent to Backoffice@kabkg.com for processing.

Withdrawals are processed within 48 hours. All charges imposed by a bank or third party are transferred to the customer.

KAB also offers internal transfers for clients that wish to move funds between live trading accounts. To process an internal transfer request, clients are required to fill out a transfer request form. And once complete, send it to Accounts@kabkg.com.

Leverage Review

The broker offers leverage up to 1:400. This is much higher than many retail brokers, so will appeal to investors looking to increase their positions and purchasing power.

Leverage essentially gives the trader the opportunity to earn greater sums by boosting their initial capital investment. However, whilst leverage can increase profits it can also amplify losses. As a result, it should be used with a suitable risk management strategy.

Account Types

KAB offers three account types that cater to a range of experience levels:

- Standard – the basic account offers trading on 100+ financial instruments and permits a range of trading styles and strategies. Standard account holders will typically see higher spreads vs the premium profiles below.

- Elite – caters to large volume traders looking to capitalize on competitive rates. This is the most premium account that KAB offers.

- Corporate– suitable for corporate traders only. For more information on Corporate account requirements, contact the customer support team (details provided below).

KAB Demo Account

Our experts found that the brokerage offers prospective clients the chance to try before they buy with the demo account.

The paper trading account is credited with $100,000 in virtual funds and supports the full range of trading assets and tools. Clients can trade real live prices in a simulated trading environment. All strategies are allowed.

The demo account is available for 30 days.

Deals & Promotions

KAB does not offer any deals or promotional offers.

This is another drawback vs other popular brokers which typically offer welcome deposit bonuses and loyalty schemes for active traders.

Additional Features

KAB has a News Centre where they offer a number of resources including an economic calendar and chart analysis tools. There is also an insights tab where you can view the latest industry updates.

For those interested in commodity trading, there are also weekly oil and gas inventory reports to review.

Further education opportunities can be accessed through the Continuous Training Programs. Programs are free and cater to a range of experience levels.

In terms of additional tools and features, KAB offers a fairly average selection. Useful extras that can be found at competitors and which are particularly useful for newer traders include copy trading.

Customer Service

The customer support team can be reached at:

- Email: info@kabky.com

- Phone: +965 229 1186

- Address: KAB Kuwait Group for Financial Brokerage Co. Al-Shuhada St, KUW-13127, Kuwait

There is also the option to submit a ticket to the team. The enquiry form can be found under the ‘Contact Us’ tab on the broker’s website.

And finally, there is a live chat feature which offers round-the-clock support.

KAB are active on social media. Follow them on Facebook, LinkedIn, Twitter or Instagram for the latest updates.

Regulation

The KAB Kuwait Group is regulated and licensed by the Capital Markets Authority of Kuwait under license number AP/ 2017/ 004 and Commercial registration number AP/ 2000/ 0062.

The group is also licensed by the Kuwait Chamber of Commerce and Industry under licence number MM/673/200 and Commercial registration number 82259.

Safety & Security

All client funds are held in segregated accounts. However, there is very little information regarding any additional security measures in place.

Whilst it is reassuring that KAB is regulated, we would expect to see more information from the broker in regard to security processes. As it stands, the lack of transparency lends itself to the risk of weak safety protocols, unexpected fees and higher spreads.

KAB Verdict

KAB is an established, regulated broker operating from the Middle East. It offers one of the leading multi-asset platforms, a good range of tradeable assets and a suite of educational resources. For experienced traders that are based locally, KAB could be worth considering.

However, due to limited payment options and acceptance in countries further afield, KAB doesn’t cater to global traders. Instead, see our list of recommended alternatives below.

FAQs

Is KAB A Good Broker?

KAB is a reputable broker offering a good range of tradeable assets, flexible account options and an advanced trading platform. If you are a trader based in the Middle East, they could be worth considering.

However, traders based in the West will find other firms offer a better range of payment methods, localized customer support, and trading instruments.

How Can I Set Up A KAB Live Account?

To register for a KAB live account, use the ‘Visit’ button above. In the top right corner of the broker’s, you will see an option for Account Creation. You will then be required to enter your contact information as well as some personal details and an overview of your trading knowledge.

Can I Trade Forex With KAB?

Yes, KAB offer seven major currency pairs as well as a thirteen minor pairs. EUR/USD, USD/YEN and EUR/GBP are offered plus many more.

Does KAB Offer MetaTrader 4?

No, KAB does not offer MT4. It does, however, offers its successor, MT5 which offers a range of advanced tools and features. It is available to download for free from the KAB website or the Apple App Store or Google Play.

Does KAB Accept US Clients?

No, KAB does not currently accept clients from the US, UK, Singapore, the Netherlands or Hong Kong.

Top 3 Alternatives to KAB

Compare KAB with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

KAB Comparison Table

| KAB | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Metals, Energies, Shares, Indices | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5, AutoChartist | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:400 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 4 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by KAB and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| KAB | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

KAB vs Other Brokers

Compare KAB with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of KAB yet, will you be the first to help fellow traders decide if they should trade with KAB or not?