Just2Trade Review 2024

Awards

- Best Customer Service 2022 - Worldfinance.com

- The Best Partnership Program 2021 - Worldfinance.com

- The Best Multi-Asset Broker in Asia 2021 - Worldfinance.com

Current Promotions

Pros

- Try2BFunded trader development program with funded accounts for clients who reach profit benchmarks

- WhoTrades social network and copy trading through Novoadvisor

- Competitive fee schedule and high-quality trade executions

Cons

- Few standard educational resources compared to other brokers

- Cryptocurrency is only available in Asia

- Research tools such as stock screeners require third-party applications

Just2Trade Review

Just2Trade is an online broker offering stocks, options, forex and bonds through professional platforms and apps. Premium tools and innovative programs such as Try2BFunded make the offering fairly unique. Read our detailed website review and decide if Just2Trade is for you. Our experts assess minimum deposits, bonuses, demo accounts, spreads, and more.

Assets & Markets

Just2Trade offers a wide assortment of markets and instruments, including stocks (both US and international), ADRs, ETFs, futures, commodities, futures, options, forex, and bonds. IPO investing, robo-advisors, and individual investment portfolios are also available, as well as leveraged CFDs.

On the downside, to manage all of these from the same interface, a trader will need to use a third-party application.

Spreads & Commissions

Just2Trade offers a per-share plan starting at $0.012. This drops to as low as $0.0025 per share for accounts trading in volumes of at least 500k shares a month. To enrol, you must have a minimum balance of $3,000.

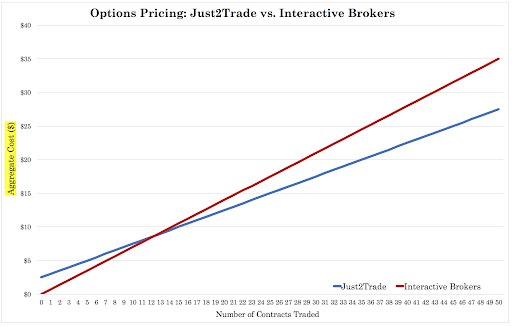

For options, Just2Trade charges a fee between $1.00 and $2.15, depending on the number of contracts. For investors trading options in non-trivial volumes (i.e., beyond 10 per month), Just2Trade offers competitive costs.

When comparing Just2Trade vs Interactive Brokers, for example, the broker comes out on top in terms of options pricing.

Commissions on futures vary from 0.00944% of daily turnover to 0.7% of the transaction amount, or a minimum of $0.5 – $37 per contract.

Spreads start at 0 pips on forex and CFDs.

Other Trading Fees

- $15 per quarter inactivity charge

- $0.003 per share is charged for placing a pre-market order

- Basic Market Data bundle for MT5 is free, but the Advanced package costs $1 per month or free for 1 trade each month

- Exchange and clearing fees are also taken varying between $0.000175 and 0.5%, with a minimum of $0.01 per order

- Requests from an official regulator for certain transactions may incur one-time fees: Blue Sheets are $5, whereas a Fed Reference Request is $10

- There is also a monthly fee if you are subscribe to exchange data, this is between $39 – $59 with an additional charge of up to $34.50

- The commission on dividend payments for UK, EU, and Asian shares is 3% of the dividend volume, with a minimum of $3 per issuer. The dividend payment commission rate for Russian stocks is 2.2% of the dividend volume for each issuer

- The structure of the fees for non-US markets is as follows: Canadian-listed stocks at 0.015 CAD per share, with a minimum 2.75 CAD per transaction; Europe and Mexico at 0.25% of the transaction value, with a minimum of 0.25 GBP/EUR/USD, plus any third-party expenses

Just2Trade Account Types

Just2Trade offers various accounts to fit traders’ unique personal financial needs:

Main Accounts

All primary accounts have automated trading, scalping, iOS and Android apps, 100% margin call, 50% stop out, phone and news investing, swaps, no re-quotes, metals (gold, silver, platinum, palladium), oil assets, CFDs on indices, access to Central News and Trading Central, $0.01 smallest transaction amount, and margin trading.

MT5 Global

- MT5 platform

- Spreads from $0

- 50 forex instruments

- $2 per lot commission

- Cannot use position hedging

- Trade stocks, futures and bonds

- ≤ $3 per lot commission on CFDs

- $100 broker minimum deposit

Standard Account

- MT4 platform

- Spreads from $0.5

- Commission on CFDs

- 48 forex instruments

- $0 per lot commission

- Negative balance protection

- You can use position hedging

- $100 broker minimum deposit

This account type doesn’t offer stocks, futures and bonds.

ECN (Electronic Communication Network)

- MT4 platform

- Spreads from $0

- 47 forex instruments

- Commission on CFDs

- ≤ $2 per lot commission

- You can use position hedging

- No negative balance protection

- Trade stocks, futures and bonds

- $200 broker minimum deposit

With this live account, you cannot trade CFDs on shares, stocks, futures and bonds.

Variations

- Forex Islamic account

- Asset management

- Forex and CFD standard

- CQG – futures and options

- Professional trader solution

- ROX – US stocks and options

- Forex ECN & Forex ECN PRO

Just2Trade Asia also offers a couple of region-specific accounts: PAMM (percentage allocation management module) and Forex.

How To Open A Just2Trade Account

- Fill out the registration form with your name, email and telephone number

- Agree to the terms and conditions and submit requested KYC documents

- Activate your account using the link sent to the registered email address

- Sign in to the Just2Trade client area

- Open a platform and start trading online

Note, all clients must be 18 years of age or older to open an account.

Leverage

Just2Trade gives retail clients a leverage level of 1:30 by default. This is subject to the European Securities and Markets Authority’s (ESMA) limitation on the marketing, distribution, or sale of contracts for differences (CFDs). This is also in line with most competitors.

Professional clients are exempt from such limitations and alongside international clients, can access rates up to 1:500.

Note, leverage for spot crypto is up to 1:5 and up to 1:20 for futures and shares.

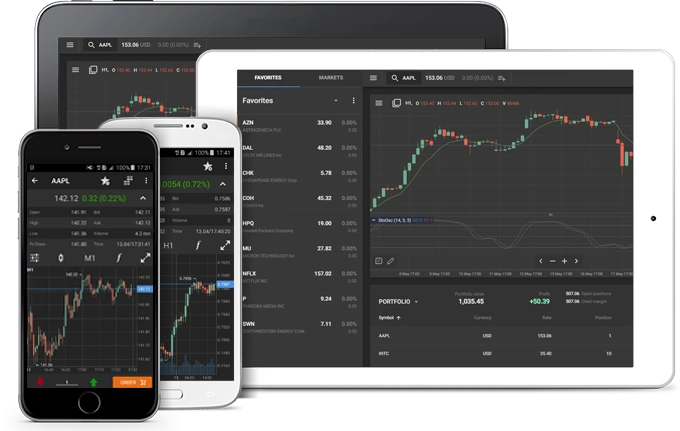

Trading Platforms

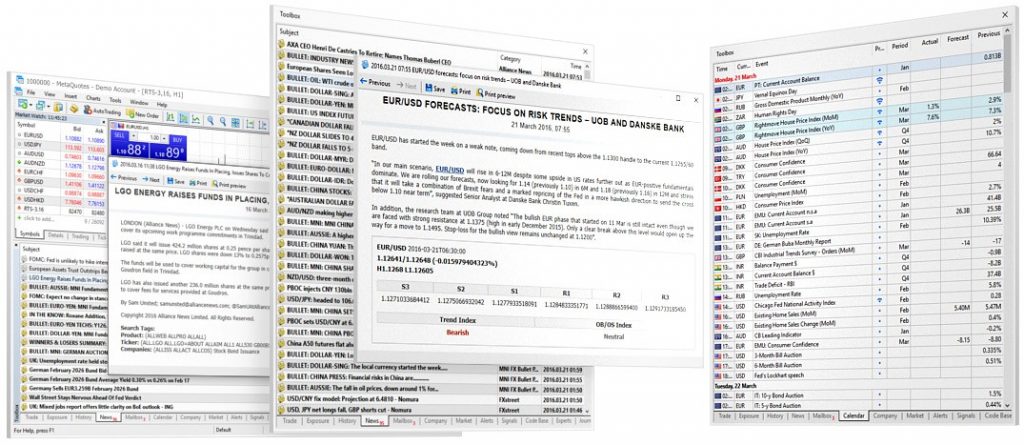

Just2Trade offers access to bonds, commodities, futures, CFDs, stocks, forex, ETFs, cryptocurrency and options on its main proprietary platform, alongside MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

The brokerage also provides access to several third-party platforms, including Sterling Trader Pro, CQG, ROX, and the iBroker mobile app, with access to demo versions.

Just2Trade+ is a browser-based platform that requires no software download. It comes with a customizable interface, access to US exchanges, delayed market depth data, real-time news, and detailed stock information. Just2Trade+ allows you to review all your orders and shows your current portfolio and market performance.

The web-based platform also has a clean and intuitive interface that displays total profit and loss, plus charting functionality. Various setups are available, including simultaneous charts. You can also choose between dark and default themes.

Overall, when we used Just2Trade, our team found that it stood out for its wide selection of advanced trading tools.

MT4

This platform can be used with most live accounts, except MT5 Global. MetaTrader 4 offers real-time technical analysis on forex, CFD and futures markets. Advantages of MT4 include:

- Expert Advisors (EAs)

- MQL4 built-in programming language

- Invest from your mobile, laptop or computer

- Spot and futures investing in metals and forex

- Receive financial news and technical analysis from Trading Central

You can download MT4 from the broker’s website.

MT5

MT5 is ideal for experienced investors. The platform provides single-window trading on major stock and futures exchanges, as well as the forex market, currencies and CFDs. Benefits of the MT5 terminal include:

- Instant and pending order types

- MQL5 programming language for trade advisors and indicators

- 21 timeframes and an extensive collection of tools, including graphical objects and drawing features

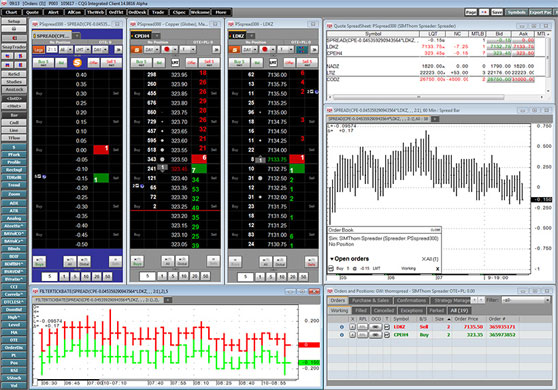

CQG

CQG gives direct access to over 40 global markets and products, including futures and options. CQG has been active for more than 35 years.

Platform fees vary between $25 and $595, though CQG Desktop is free. Investing in futures and options costs $1.50 per contract per side (buy or sell).

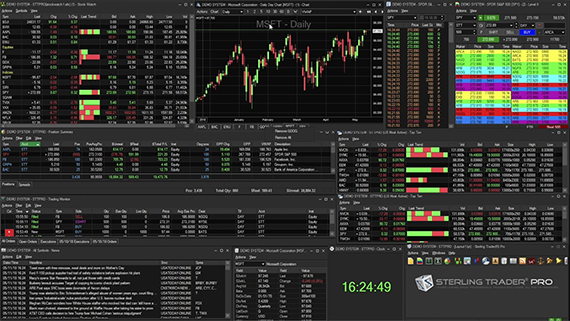

Sterling Trader Pro

Sterling Trader Pro is a direct-access platform for equities and options. Its options interface calculates Greeks and volatility. The options chain also highlights in-the-money options for faster decision-making.

In addition, the platform has 11 preconfigured options trade structures available, including butterflies, calendar spreads, covered calls, iron condors, and straddles.

ROX

You can use ROX to invest in securities on US stock and options exchanges. This includes direct access to NYSE, NASDAQ, CBOE, as well as stock markets in Canada, Mexico and Europe. Advantages include:

- Trade 7,000 securities

- Low commission from $0.0019 per share

- Access full liquidity of US stock exchanges

- Full version of ROX Premium provided, including options

Mobile App

Just2Trade offers one main mobile app: Just2Trade+ (Just2Trade Plus), available on iOS and Android. It broadly matches the web-based terminals. Instruments available in the browser-based client are also on the app, alongside interactive charting features.

Our experts found that more mobile applications are also available with their associated platforms, such as MT4 and MT5. In addition, you can find APIs online, like REST API, if you wish to integrate your Just2Trade account with other tools.

Just2Trade Payment Methods

Just2Trade offers an excellent range of deposit options to suit traders in different regions.

Accounts can be funded through wire transfer, Visa, Mastercard, UnionPay, 7-Eleven, Davivienda, SPEI, OXXO, PayPal, Alfa-bank, Klarna, Trustly, Neteller, P24, POLi, Nordea, Dankort, iDeal, Giropay, Skrill, or an account transfer.

For withdrawals, the following payment methods are accepted: FINAM Bank, bank wire transfers, Neteller, AstroPay, China UnionPay, Skrill, PayPal, and credit cards (Visa, Mastercard, etc).

The firm doesn’t accept deposits in cryptocurrencies, such as Bitcoin and Ethereum. Accounts also cannot be funded by credit card checks, traveler’s checks, money orders, or Western Union.

All deposits are free with the MT5 Global and Standard accounts, except Alph-bank which charges a 2.5% commission. ECN accounts incur a 2.25% to 3% commission; Trustly and UnionPay are free to use. As for speed, most transfers are instant, with bank wire taking 2-5 business days.

Commissions on withdrawals vary, with the highest coming in at 2.8%. FINAM Bank and China UnionPay are free, but only ECN accounts are able to use credit cards free of charge. Withdrawal times vary between 5-10 minutes and 2-3 days. Keep in mind that your bank may also charge fees for transactions.

Demo Account

Just2Trade offers a free demo account with up to $1 million in virtual funds on the online and mobile platforms. After you sign up, you can use the Just2Trade login page to start investing with simulated funds.

Importantly, the paper trading account lets you test the broker’s platforms and tools before committing real money.

Bonuses & Promotions

There may be a welcome bonus of up to $2,000 when signing up for a Just2Trade Online LTD pro account, depending on your location. This is a hefty account promotion though there may be withdrawal terms and conditions.

Keep an eye on the broker’s website to stay abreast of new deals.

Regulation & Licensing

Just2Trade is licensed by NFA, FINRA, Bank of Russia, and is a CySEC regulated broker-dealer. CySEC regulation is quite rigorous, requiring segregated funds, KYC checks, and financial compensation schemes.

Overall, the company is a trustworthy and reliable brand.

Additional Features

While using Just2Trade, our team were impressed with the breadth of trading tools and extra services.

The global social network, WhoTrades, allows traders to construct a personalized feed and discuss ideas, companies/securities, news, and strategies of interest. The service is also accessible to all, not just Just2Trade clients.

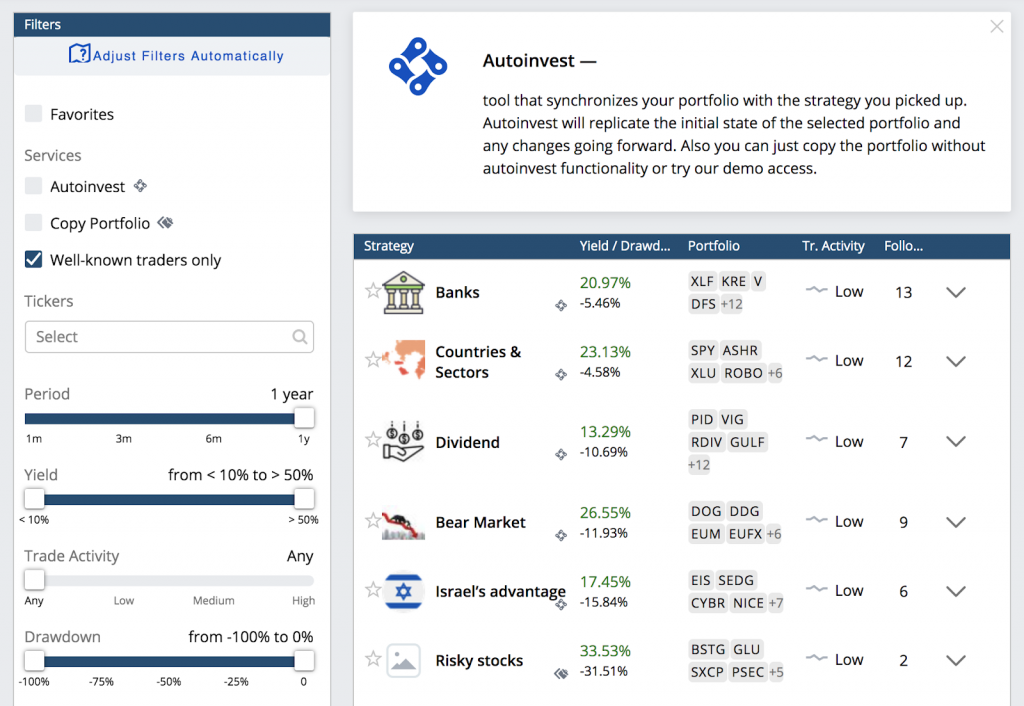

NovoAdvisor / Lime Financial

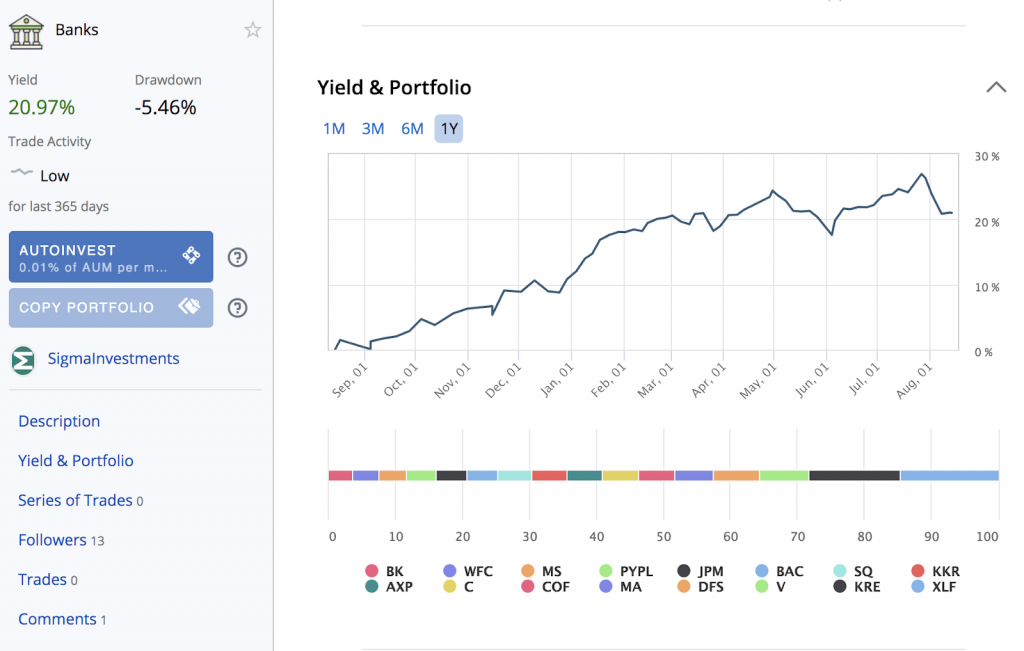

The proprietary platform, Novoadvisor (now known as Lime Financial), gives investors access to the top-performing traders and strategies on the Just2Trade network.

Each profile on Novoadvisor shows full transparency so investors can decide whether a strategy fits their personal needs and expectations. This includes returns, drawdowns, performance trends, portfolio holdings and percentage allocations, an AI- and/or user-generated synopsis of the investing style, popularity based on follower count, and any relevant time-stamped activity.

Note, Lime Financial is owned by Score Priority, which is part of Just2Trade.

Try2BFunded

Just2Trade also offers the Try2BFunded program for those looking to become professional traders. In the first two stages of the program, traders are placed on a demo/paper account and must meet a profit target while avoiding specific drawdowns and maximum daily loss amounts. If investors successfully pass both steps, they receive access to a funded real-money account and can trade on the firm’s capital (a monthly subscription fee applies).

If a prospect successfully passes through the qualifying stages of Try2BFunded, initial capital balances are $30,000 ($100 monthly subscription fee), $50,000 ($150/mo), and $100,000 ($300/mo).

Importantly, profits are split 60% to the trader and 40% to Just2Trade.

Company History

Just2Trade is a discount brokerage founded in 2007 and headquartered in Limassol, Cyprus. The brand was acquired in 2015 by WhoTrades Inc, a company that promotes social trading services.

Just2Trade caters to active traders with competitive pricing for those who trade in high volumes. The company is a FINRA registered broker-dealer and a member of the SIPC and NFA.

Trading Hours

Opening hours run from 9:30am to 4:00pm EST, Monday through Friday, excluding holidays. Just2Trade also offers extended hours (i.e., pre-market and post-market) running from 8:00am to 9:30am, EST, and 4:00pm to 7:00pm EST.

Customer Support

Customer service can be reached using the telephone number, email, and live chat on the website. The service is available during business hours 24/5. This is a drawback versus some competitors who offer around the clock customer support.

Security & Safety

All personal information is secure and safeguarded when processed on the website. Just2Trade’s mobile applications also offer a PIN or fingerprint authentication. In addition, the company uses an external account verification system, alongside Plaid to authenticate a client’s bank and brokerage accounts.

Finally two-factor authentication is enabled while the desktop platform requires user credentials (username, password) as well as a security phrase/image and pin.

Just2Trade Verdict

In our just2trade.online review, we have covered how it works, alongside the pros and cons. The broker is most likely to appeal to independent day traders and active swing traders looking to keep costs down while accessing advanced technology and analysis tools. Algorithmic traders may also have an interest in Just2Trade given the ease with which APIs and custom automated trading applications can be connected.

Yet given that Just2Trade is aimed at higher-volume traders, it lacks some the traditional analysis tools and filters (stock/bond screeners) and conventional education resources that other brokers provide.

FAQs

What Is Just2Trade Online LTD Cyprus?

Just2Trade Online Ltd is a broker based in Cyprus and regulated by the CySEC. The brand offers forex, commodities, stocks, ETFs, CFDs, crypto, bonds, futures, and options.

Is Just2Trade Trustworthy?

Yes – Just2Trade is a legitimate brokerage registered with several respectable regulators and financial authorities, including the CySEC, NFA, FINRA, and Bank of Russia. Over 155,000 traders from more than 130 countries have registered an account with the firm.

Is Just2Trade Good For Day Trading?

Just2Trade offers ultra-fast trade executions, low fees and powerful platforms, making it a good pick for day traders. It provides a competitive environment for active day traders.

Where Can I Read Just2Trade User Reviews?

Our website provides detailed reviews and ratings on trading brands. Alternatively, you can head to forums and sites like Trustpilot for other user reviews.

How Can I Check To See Just2Trade’s Licence?

Type “Just2Trade online LTD CySEC” into Google, and the broker’s accreditation will appear. You can also search for the broker’s name in the respective regulator’s digital register.

Can You Use Just2Trade In Malaysia?

Yes – Just2Trade accepts traders based in Malaysia. You can select your base country when you sign up for a new account.

Can You Trade On Just2Trade From The USA?

No – Just2Trade does not accept clients from the United States. This is due to regulatory restrictions and additional requirements.

Is Just2Trade A Good Broker?

Just2Trade offers an array of trading accounts and platforms, plus low spreads and commission charges. The brand is also available in various countries around the world. Its thousands of instruments and leading tools also separate it from competitors.

Top 3 Alternatives to Just2Trade

Compare Just2Trade with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Just2Trade Comparison Table

| Just2Trade | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4.3 | 4.5 |

| Markets | Stocks, ADRs, ETFs, Futures, Options, Commodities, Bonds | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, NFA, FINRA, Bank of Russia | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | NFA, CFTC |

| Bonus | Up to $2,000 for professional accounts | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:20 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:50 |

| Payment Methods | 20 | 6 | 6 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Just2Trade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Just2Trade | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Just2Trade vs Other Brokers

Compare Just2Trade with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Just2Trade yet, will you be the first to help fellow traders decide if they should trade with Just2Trade or not?