JCB Card Brokers 2026

A JCB card is becoming an increasingly popular payment solution for day traders. The transfer network, formed by the Japan Credit Bureau (JCB), is a major player in the payment card industry. This review will explain the benefits and drawbacks of using a JCB Card for online trading. We also discuss the company’s fee structure, security protocols and customer support, before listing the best brokers that accept JCB Card deposits.

Best JCB Card Brokers

Our rigorous tests have revealed that these are the best 6 brokers that accept JCB payments:

Here is a summary of why we recommend these brokers in January 2026:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- FBS - Founded in 2009, FBS is an award-winning CFD broker operating in over 150 countries with a client base exceeding 27 million traders. Traders are supported at every stage of their journey with 24/7 assistance, market analytics, trading calculators, and competitive pricing with zero commissions.

- Vantage - Founded in 2009, Vantage offers trading on 1000+ short-term CFD products to over 900,000 clients. You can trade Forex CFDs from 0.0 pips on the RAW account through TradingView, MT4 or MT5. Vantage is ASIC-regulated and client funds are segregated. Copy traders will also appreciate the range of social trading tools.

- Axi - Established in 2007, Axi is a multi-regulated forex and CFD broker that has made strides to improve its trading experience over the years, from expanding its suite of stocks and upgrading the Axi Academy to launching its own copy trading app.

- Moneta Markets - Founded in 2019 and headquartered in Johannesburg, South Africa, Moneta Markets offers over 1000 instruments for short-term trading. New traders can choose between STP and ECN accounts while the smooth sign-up process has helped attract 70,000 registered traders.

Compare The Best JCB Card Brokers

| Broker | Minimum Deposit | Instruments | Platforms | Leverage |

|---|---|---|---|---|

| Exness | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | 1:Unlimited |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| FBS | $5 | CFDs, Forex, Indices, Shares, Commodities | FBS App, MT4, MT5 | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Vantage | $50 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | ProTrader, MT4, MT5, TradingView, DupliTrade | 1:500 |

| Axi | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Axi Copy Trading, MT4, AutoChartist | 1:500 |

| Moneta Markets | $50 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto | AppTrader, MT4, MT5, TradingCentral | 1:1000 |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

FBS

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Shares, Commodities |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Account Currencies | USD, EUR |

Pros

- FBS offers lightning-fast execution speeds from just 10 milliseconds, placing it among the industry leaders for highly active traders like scalpers who demand rapid order processing.

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

- 24/7 customer support that performed excellently during testing is available, alongside a $5 minimum deposit, high leverage options, and a huge variety of 200+ funding options, making it ideal for traders with small accounts.

Cons

- There are only two base currencies available - EUR and USD - which isn't practical for minimizing currency conversion fees for many global traders, and is especially striking given the broker’s user base spans over 150 nations.

- Although the FBS app offers a terrific mobile trading experience for aspiring traders and MT4/MT5 cater to advanced traders, the absence of cTrader and TradingView, which are increasingly offered by alternatives like Pepperstone, will deter day traders familiar with these platforms.

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds |

| Regulator | FCA, ASIC, FSCA, VFSC |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

- Vantage maintains its high trust score thanks to its strong reputation and top-tier regulation from the FCA and ASIC

- The low minimum deposit of $50 and zero funding fees make this broker a great choice for new traders

Cons

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

Axi

"Axi is a stand-out option if you want to day trade forex on the MetaTrader 4 platform thanks to the broker’s growing selection of 70+ currency pairs, the MT4 NextGen upgrade, and tight spreads from just 0.2 pips if you opt for the Pro account."

Christian Harris, Reviewer

Axi Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, ASIC, FMA, DFSA, SVGFSA |

| Platforms | Axi Copy Trading, MT4, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CHF, PLN |

Pros

- Axi's latest copy trading app is really intuitive based on our tests with useful filtering options to match strategies with individual risk preferences.

- Axi offers a terrific MT4 experience, enhanced with the NextGen plug-in for advanced order management and analytics, and complete with low execution latency of approximately 30ms.

- The growing educational resources in the Axi Academy, including free eBooks, video tutorials and notably interactive quizzes, are excellent for supporting beginner traders.

Cons

- Axi still has our confidence but issues with the ASIC and FMA in recent years mean it needs to continue providing a secure environment while adhering to licensing conditions.

- Despite bolstering its stock CFDs in US, UK and EU markets, it’s still nowhere near as extensive as firms like BlackBull which offer thousands of equities for diverse opportunities.

- Despite performing well whenever we use it, Axi's support is unavailable 24/7, which can be inconvenient for traders in different time zones or those needing assistance outside standard trading hours.

Moneta Markets

"With ECN pricing featuring spreads from 0 and commissions from $1, high leverage of up to 1:1000, and the terrific charting platforms, Moneta Markets is an excellent broker for experienced day traders."

Christian Harris, Reviewer

Moneta Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto |

| Regulator | FCA, ASIC, FSCA, FSA |

| Platforms | AppTrader, MT4, MT5, TradingCentral |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, CAD, NZD, JPY, HKD, SGD, BRL |

Pros

- Moneta Markets supports a growing suite of 1000+ tradable assets, with a particularly strong selection of commodities and more recently fresh index CFDs.

- Moneta Markets makes account funding a breeze, with plenty of account currencies, zero transfer fees and a wide selection of traditional, digital and now crypto-backed payment methods.

- The broker offers competitive leverage rates of up to 1:1000, allowing experienced day traders to amplify their positions and potentially increase their returns.

Cons

- Clients need an account balance of at least $500 to access educational materials, a serious drawback for beginners who can get free materials from brokers like IG and eToro.

- While trading costs are generally competitive, index CFDs feature fairly high spreads especially on US products like the S&P 500, trailing IC Markets during testing.

- Whilst TradingView-backed ProTrader is intuitive, its time frames lacked seconds or ranges, and community scripts couldn't be added. The platform has been discontinued, and we're waiting to test ProTrader V2 when it's fully operational.

How Did We Choose The Best JCB Card Brokers?

To list the top JCB Card brokers, we:

- Identified which platforms accept JCB Card payments from our 500-strong database

- Verified that they support deposits and withdrawals via JCB Card for online trading

- Sorted them by their total ranking, leveraging 100+ data points and our in-depth tests

What Is A JCB Card?

The Japan Credit Bureau (JCB) is a leading payment player in East Asia. The company has a long history and was established in 1960 in Tokyo, Japan. Today, merchants and businesses use JCB credit cards spanning Asia, Europe and North America.

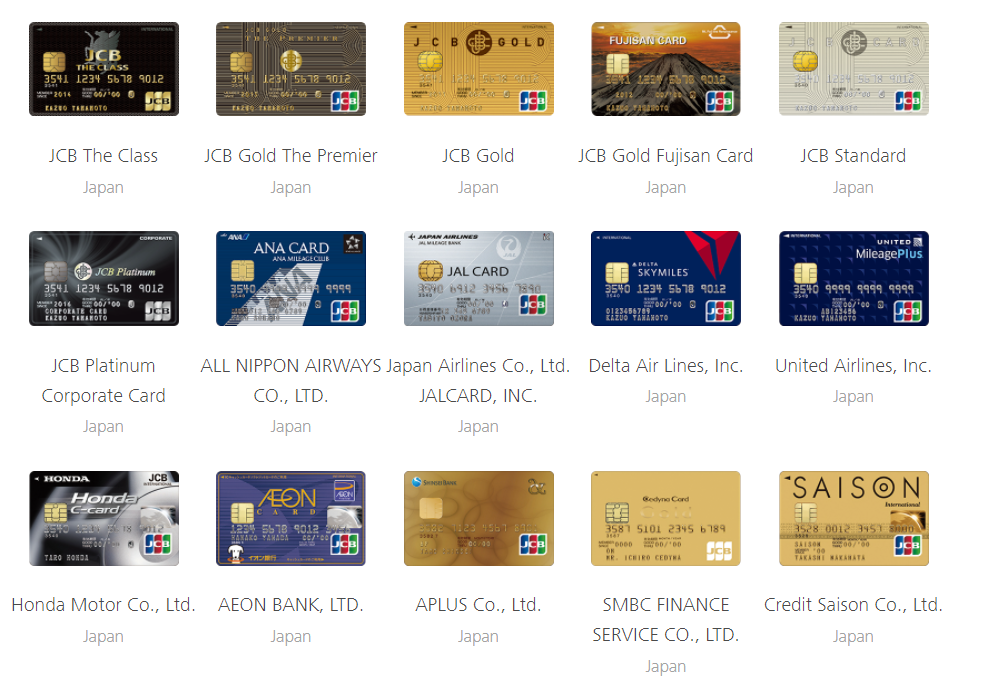

Traders can use a JCB card on several global networks including UnionPay in China, Discover in America and individual platforms operated by JCB merchants. The company currently has a market share of 1.1% of credit card issuers worldwide, behind MasterCard, UnionPay and Amex. A range of JCB card types is offered, including credit, debit, prepaid, visiting, premium and even gift cards.

Popular partners and JCB card providers include BDO, BCA, KBZ, UOB, OCBC and SBI Rupay.

One area that has seen strong growth for the company in recent years is day trading. A JCB card can be used to conveniently fund live trade accounts and an increasing number of brokers now accept their cards, including FXTM and Plus500.

Speed

Transactions using a JCB card are executed instantly, so traders can rely on being able to take advantage of market opportunities quickly. The market can often change at the drop of a hat and the ability to respond promptly can be the difference between profit and loss.

Withdrawal times are also prompt, although processing times may vary between brokers.

Security

JCB implements several measures to ensure the safety of client funds. In addition to being 3D secure (3DS) and using unique CVV codes, the company implements:

- J/Secure – An authentication program that protects against identity theft. The system adds an important identity verification step that enables people to authenticate their JCB card with a user password. It has been in operation since 2004.

- J/Smart – An EMV-compliant chip card application. JCB is a member of EMVCo alongside American Express, Discover, MasterCard, UnionPay and Visa.

In addition, alongside other leading payment networks, JCB founded the Payment Card Industry Security Standards Council in 2006. This was an initiative set up to manage the evolution of payment security on an international level. Today, it works to protect customer information and prevent card fraud.

Every JCB card also has a holographic magnetic strip, or ‘hologram’, that prevents counterfeiting.

Be wary of any website that claims to be a JCB card generator or offers to test or sample your JCB card number, these tend to be fraudulent operations and you could be putting your capital at risk.

How To Deposit Using A JCB Card

To use a JCB card to fund a trading account, you will need a card registered in your name. You can apply for a JCB card from your bank or a merchant partner of the network.

Once you own a JCB card, head to the payment section of your broker’s online platform. At Vantage, for example, you can click the wallet icon from your dashboard, or click on the profile tab and select ‘Deposit’.

Then enter your card details to either make a deposit or withdraw funds. Deposits made with a JCB card are normally executed instantly. The minimum sum tends to be set by the individual broker, so check out the relevant terms.

JCB cards can also be used to draw money from ATMs. You will need your 4 digit pin code to do so.

Pros Of Using A JCB Card For Traders

Using a JCB card to fund your trading account can make sense for many traders. In addition to its convenience, benefits include:

- Broker integration – JCB cards are accepted by an increasing number of brokers, meaning that traders today have more choices than ever.

- Range of cards – JCB offers several different cards, including options tailored to specific markets. Whether you’re interested in a credit or debit card, you can find an option that works for you.

- Reputable – a brand isn’t everything but, in this case, it does afford a sense of security. Traders can relax knowing that their funds are in the hands of a massive global corporation.

- Security – JCB take security seriously. There are several measures in place on their own systems and the company plays an active role in working to improve transactional security on the global stage.

Cons Of Using A JCB Card For Traders

Traders should also be aware of the limitations of using a JCB card to fund their live accounts:

- Limited acceptance – not all brokers accept a JCB card for deposits. Be sure to check the broker’s payment terms before you invest.

- US operations closed – whilst JCB cards are still accepted on the Discover network, the company has closed its US credit card operations.

- Competitors – when comparing JCB against competitors, such as Mastercard, it trails in market share, exchange rates and acceptance. JCB does, however, offer both free and paid options, whereas Mastercard only offers paid solutions. Other competitors, like PayPal and Paymaya, also have benefits over a JCB Card.

Additional Benefits

A wide range of JCB card options are offered, including credit, debit, prepaid, plus gift cards to spend on Amazon. Some of the more premium card options include JCB The Class Card, JCB Gold Card BDO, Aaeon J-Premier Platinum Card and JCB Platinum – RCBC Bankard. These options provide tiers of benefits not available to standard cardholders, including access to VIP lounges.

Not all benefits are exclusive, however, as standard JCB cardholders can enjoy free access to attractions like riding the Hawaii Waikiki Trolley. Promotional schemes change year by year, so stay up to date with what’s on offer.

Accepted Countries

Not all JCB credit and debit cards will be available in every country. Accepted countries include Japan, India, Sri Lanka, Cambodia, Brazil, Mongolia, Myanmar, Germany, Pakistan, Russia, Austria, Bangladesh, Malaysia, Laos, Vietnam, China, France, Taiwan, Hong Kong, Indonesia, Korea, Philippines, Thailand, Bangladesh, Pakistan, Australia, New Zealand, Canada, USA, UAE, Singapore, UK, Turkey and Egypt.

Customer Support

Existing cardholders can contact the JCB team by calling the number on the back of their card. If you’re new to JCB, head to the contact tab on the website.

You’ll find a card issuer list in addition to contact details and a credit card hotline. The support team is responsive and able to assist with a range of queries, from account login to registration, validation and how to deal with your card being declined.

The company is not currently active on social media platforms like Facebook or Twitter but, whilst they do not operate their own YouTube channel, others have taken the time to create videos detailing their experiences with their JCB card and, specifically, their use for trading.

Are JCB Card Payments Good For Day Trading?

A JCB card could make funding your trading account quicker, easier and more convenient, especially if you’re already a cardholder. The company is accepted by brokers worldwide, so whether you’re in Cardiff or Hong Kong, you should have plenty of trading platform options to choose from.

The major positives of JCB’s services include their robust security, instant execution and range of card options. Much like Visa or Mastercard, the JCB logo is an icon and indication of quality reassuring traders that their money is in safe hands. Overall, we recommend a JCB card as a reliable method to fund your trading account. See our list of brokers that accept JCB Card deposits to start trading today.

FAQ

How Can I Use A JCB Card To Deposit To My Broker?

A JCB credit card operates just like a standard credit card but is issued by the Japan Credit Bureau. This means you can transfer funds to and from your live trading account using the credit/debit card payment option at your broker.

Is It Possible To Use A JCB Credit Card At UK Brokers?

Yes, JCB cards are widely used by UK-regulated brokers and accepted by most merchants. Popular firms include AvaTrade, Vantage and Saxo.

How Do I Contact JCB If There Is An Issue With My Trading Deposit?

The phone number for customer support if you’re based in Japan is 0120 500 544. Alternatively, head to the ‘contact’ tab on the company website to get in touch with the international customer service team.