Interactive Investor Review 2025

Awards

- Investment Platform of the Year 2022

- Best Low-cost SIPP 2022

- Shareholder Rights Champion 2022

- Best Low Cost Stockbroker 2022

- Retail Investor Champion of the Year 2021

- Best Low Cost Stockbroker 2021

- Best Stocks and Shares ISA provider 2021

- Best Stocks & Shares ISA Provider 2020

- Best Stockbroker for International Dealing 2020

Pros

- Highly rated and trusted by 400,000 investors

- No minimum deposit

- Less than 1 minute average wait time for customer support

Cons

- No free demo account

- No copy trading tools

Interactive Investor Review

Interactive Investor (ii) is a flat-fee investment platform with a secure terminal for SIPP and ISA savings, alongside a comprehensive range of trading products spanning shares, funds, trusts, and ETFs. This Interactive Investor review will examine regular investing charges, trading apps, account security, customer service options, and more. Our expert team also share their verdict on Interactive Investor.

Company Details

Interactive Investor is a subscription-based investment platform, established in 1995 in the United Kingdom. The company operates from a registered head office address in Manchester and has additional offices in London and Leeds.

The platform offers trading accounts, Stocks and Shares ISA and Personal Pensions (SIPP) with expert guidance from a team of financial planning analysts. Interactive Investor has 400,000+ registered UK customers with over £50 billion in assets under management (AUM).

The company joined abrdn in May 2022, a FTSE-listed company with a shared vision of top-tier financial advice and planning services. Richard Wilson remained the CEO of the brand following the takeover. This acquisition also saw the launch of new services including a Pension solution for long-term savings and the Friends and Family tool to support the investment needs of loved ones.

Interactive Investor has been recognised with major industry awards including the Investment Platform of the Year and the Best Low Cost SIPP from the Investors’ Chronicle and Financial Times Celebration of Investment Awards 2022.

Investment Products

The Interactive Investor platform offers a range of financial products, making it a one-stop solution for all investment and savings requirements. Profiles include:

- Junior ISA

- Cash Savings

- Trading Account

- Stocks & Shares ISA

- Managed ISA

- SIPP & Retirement Funds

Investment products span a huge range of UK, US, and international shares on 17 global exchanges with big names like Lloyds Banking Group, Apple, Microsoft, and Tesla. Additionally, you can trade ETFs, funds, investment trusts, bonds, gilts, and VCTs.

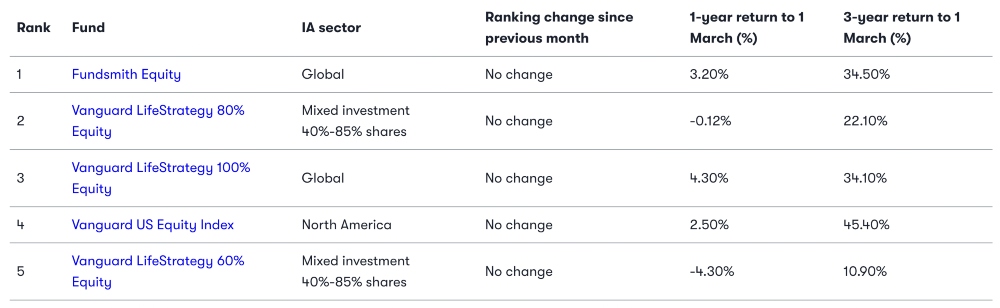

The broker offers simple and flexible investment opportunities, alongside ready-made portfolios by category, such as the top 10 performing products, sustainability, and ethical instruments. This also includes the iiSuper 60 and the ACE 40 list. The hand-picked products and funds are suggested by the team’s financial analysts.

Interactive Investor supports market, limit, stop loss and fill or kill orders when volume and pricing reach certain requirements.

However, it is worth noting that users cannot access commodities, options, futures, cryptocurrency, or CFDs. This may deter short-term traders looking for derivatives.

Platform

The Interactive Investor platform is easy to use, with most of the useful icons available from the main menu. This includes Find & Invest to search for instruments, Research to access company and market news, and the Cash & Transfers button for deposits and withdrawals. Other features include:

- Product watchlists

- Dividend payment history

- Level 2 pricing via Quotestream

- SMS or email price alerts for up to 10 positions

- Morningstar chart integration with 11 technical indicators

- Comprehensive settled and pending order lists by market and status

On the downside, the ii platform is not as well-equipped as the terminals offered by major trading brokers – there are limited technical and fundamental analysis tools.

How To Place An Order

- Select Find & Invest from the dashboard main menu

- Search for the financial instrument you want to trade by name or symbol

- Click Buy or Sell

- Input the number of shares or investment value

- Select Get Quote to view the most recent price

- Select Place Order to confirm the position

Mobile App Review

Interactive Investor offers a free mobile app, available to download on iOS and Android devices. The application provides all the features needed to invest on the go, similar vs the Vanguard, Trading 212, AJ Bell, and Hargreaves Lansdown apps.

This includes full account management, customer service, market publications, and online trading. Users can create custom watchlists, view price fluctuations and read live news streams.

When we used the Interactive Investor app, we found the mobile dashboard easy to navigate with an intuitive menu at the bottom. Charts are also compatible with small screens and come in multiple timeframes.

You can use your registered ii username and password to get started. Users can also add face recognition and fingerprint technology for secure account login.

Interactive Investor Fees

Interactive Investor is transparent when it comes to trading fees and subscription charges. The brand offers a range of plans, with fixed monthly subscriptions and pricing to suit different styles of investing, similar vs FreeTrade with packages up to £9.99 per month. In contrast, some alternatives like Fidelity operate an annual service model based on the value of funds held in an account.

Fees by plan:

Investor Essentials Account

£4.99 subscription fee per month. A low-cost plan for individuals investing up to £50,000.

Additional charges include £5 for access to a Friends and Family profile, £3.99 for UK and US shares trading, UK funds, ETFs and investment trusts, £0.99 for dividend reinvestment, and £9.99 for non-US overseas trades.

Investor Account

£11.99 subscription fee per month. A plan for balances over £50,000. The brand’s most popular plan with a free trade per month.

Additional charges include £3.99 for UK and US shares trading, UK funds, ETFs and investment trusts, £0.99 for dividend reinvestment, and £9.99 for non-US overseas trades.

Super Investor Account

£19.99 subscription fee per month. The brand’s lowest trading program with two free trades per month.

There is no fee for a Friends and Family profile, but £3.99 for UK and US shares trading, UK funds, ETFs and investment trusts, £0.99 for dividend reinvestment, and £5.99 for non-US overseas trades.

Pension Essentials Account

From £5.99 per month. Available for pension bots below £50,000, making it one of the lowest-cost pensions available in the UK on amounts above £15,000.

When your pot grows above £50,000 you will move onto the Pension Builder plan, which has a £12.99 subscription fee per month for access to a low-cost SIPP.

Other Fees

Other costs to be aware of include:

- Telephone trades – £49 fee

- Foreign exchange rates – 1.5% fee (transaction values up to £24,999)

- Buying and selling of US shares over £100,000 – 0.04% of trade value

- Buying and selling of international shares over £100,000 – 0.10% of trade value

- Buying and selling of UK shares, funds, bonds, gilts, and ETFs over £100,00 – £40 fee

Interactive Investor will pay a 0.5% cash interest rate on account balances up to £10,000 and 1.5% on accounts holding over £10,000.

Retail investors are also liable for tax statement creation and payment including generating an annual capital gains tax report.

Leverage

Unfortunately, the broker offers limited leverage trading, which may deter short-term traders.

Having said that, Interactive Investor does offer leveraged exchange-traded funds (ETFs). These financial instruments offer returns by using equity swaps and options. A popular example is the WisdomTree FTSE 100 3x Daily Lvrgd ETF 3UKL, which provides retail investors access to triple exposure vs a traditional FTSE 100 investment.

Payment Methods

Deposits

Funds can be added to your Interactive Investor account by UK debit card (including Visa, Mastercard, and Maestro), bank wire transfer, or cheque. This includes monthly direct debits.

Debit card transfers are typically available instantly and payments made by wire transfer will be credited to your account by the end of the following day. A maximum debit card payment of £99,999 applies.

Bed and ISA transfers are also available to move money from a Trading Account to an ISA. There is also a Regular Investing function allowing users to top up accounts monthly, with a low £25 minimum investment per month. To set this up, select Portfolio from the account menu and then Free Regular Investing.

How To Make A Payment

- Login to your Interactive Investor account

- Select Cash & Transfers and then Add Cash from the menu options

- Select Add Card to register a UK debit card

- Enter the card details including the long card number and CVV

- Input the amount to deposit and choose the account to add money to

- Click Add Cash to confirm

Withdrawals

Our experts found that you can withdraw cash from your account via bank wire transfer only. This is a notable drawback vs alternatives.

Fund requests from an Interactive Investor account will be credited to linked bank accounts within one working day if requested before 2 PM GMT. All transfers out of an Interactive Investor account are free, though urgent transfers (same day) or payments in currencies other than GBP or EUR will be liable for a £15 fee.

How To Withdraw Money

- Sign into your Interactive Investor account

- Select Cash & Transfers and then Withdraw Or Transfer Cash from the menu options

- Select Bank Transfer and choose Withdraw Cash

- Choose the bank account to withdraw funds from and select the processing currency

- Enter the value to withdraw and the ii account to remove money from

- Click Check And Preview to receive a mobile verification code

- Confirm the transfer

Demo Account

Interactive Investor does not offer a demo account. This is disappointing vs competitors like eToro and Interactive Brokers which offer paper trading accounts with virtual portfolios and revenue statements.

There is no option to sign up and explore the client dashboard before committing to a live profile. With that said, Interactive Investor is transparent when it comes to fees, account features, and services so it is worth spending some time reviewing the information available before signing up.

Bonuses & Promotions

Interactive Investor does not usually offer deposit bonuses or welcome incentives. However, there are occasional transfer rewards for moving funds from alternative firms. For example, Interactive Investor was offering up to £1000 cashback for a pension transfer from another provider in 2023.

Additionally, while using Interactive Investor, our team were offered a No Pension Builder Monthly subscription fee for six months.

A refer-a-friend scheme is also active, with up to a £200 referral reward for recommendations to the brand and an annual free service plan for the new account holder.

Interactive Investor Regulation

Interactive Investor Services Limited is authorised and regulated by the Financial Conduct Authority (FCA). The FCA is one of the best-regarded financial authorities, with rigorous compliance requirements for all member firms.

Client money is held in separate bank accounts with established statutory trust status. This means your money is kept separate from business funds and cannot be used in case of business insolvency.

Customers may also receive compensation from the Financial Services Compensation Scheme (FSCS), with protection up to £85,000 in the case of financial losses from business default.

Accounts including SIPP and ISAs are not permitted to reach a negative cash balance. Interactive Investor will contact you individually to add credit if required.

Note, US and international citizens are not permitted to open an account with Interactive Investor.

Additional Features

The brand provides innovative tools, advice, and trading tips to help you become a better investor and highlight the best funds depending on your goals and risk appetite. This includes pre-made investment portfolios, integrated educational videos and insights.

Investment Ideas

When we used Interactive Investor, we were impressed with the amount of information available, particularly for beginners. Content includes the most traded company shares by customers per day, the ii Super 60 list, and the ii Ace 40. The last two functions provide simple product filtering by asset group, investment category, dividend yield, and return period.

There are also several model portfolios to help you get started, selected by the brand’s research partner, Morningstar. The five portfolios are categorised by growth or income options.

Insights

The brand has a team of financial analysts and experts providing the latest news and market information. This includes podcasts and integrated YouTube video content with the latest research and product outlooks. You can also receive the latest news and articles in newsletter format via email.

But while contributors provide some useful information, there is no personalised investment support and one-to-one guidance for individuals.

Education

There is plenty of information available on the Interactive Investor website, suitable for beginners and experienced traders. This includes jargon busters, investing tutorials, podcasts, and useful articles on various categories, including SIPP income drawdown charges, inflation, dividend reinvestment and yield, recommended funds, gifting shares, and dealing charges.

Interactive Investor Accounts

Interactive Investor offers three main account types; Trading, ISA, and SIPP.

The Trading Account provides full flexibility to invest in financial products with no maximum trading limits. The ISA Account permits customers to invest up to £20,000 in stocks and shares per year with no tax ramifications. The SIPP profile supports pension contributions with tax relief boosts. Customers can invest up to 100% of annual income up to £40,000.

A flat fee subscription plan applies for Trading and ISA accounts, varying between £4.99 and £19.99 per month.

Investor Essentials Plan

Invest up to £50,000 per year

- Trading account

- Stocks and shares ISA

- Regular Investing access

Investor Plan

Invest over £50,000 per year

- Trading account

- Access to Junior ISA

- Stocks and shares ISA

- One free monthly trade

- Regular Investing access

The broker supports shares trading in the following currencies; GBP, EUR, USD, AUD, CAD, HKD, SGD, SEK, and CHF.

Trading Account

The Interactive Investor Trading Account is designed for DIY retail investors looking for flexibility and uncapped investment options. Customers can open multiple trading accounts including a joint profile with a spouse.

Clients can trade various financial instruments including more than 40,000 UK and global shares, funds, trusts, and ETFs. The brand’s team of expert analysts provides six quick-start funds, suitable for beginners or experienced traders looking for guidance. The portfolios are designed with different attitudes to risk and goals in mind. Examples include the Columbia Threadneedle sustainable funds or the Vanguard LifeStrategy funds.

ISA Account

Interactive Investor ISA customers can invest up to £20,000 per year in funds, shares, ETFs, investment trusts, and more. There are no income or capital gains tax charges for investments, though the maximum annual transfer amount applies across all ISA options (lifetime, cash, etc).

The flexible ISA profile allows users to choose where and how their money is invested. Our experts were pleased to see some useful investment ideas, top-rated and most popular fund lists, and model portfolios to help you get started.

SIPP Account

The Interactive Investor SIPP Account offers pension flexibility. Customers can combine individual pension pots into a single ii account and make the most of a single account fee. Key benefits include full control of pension investments, a convenient account with all funds visible, tax advantages, and flexible retirement options.

How To Register For An Interactive Investor Account

It is reasonably easy to open an account with Interactive Investor. To get started, choose either a Trading, ISA, or SIPP account. Note, you will need payment details and a National Insurance number to hand.

To get started with the Trading Account:

- Declare your expected investment amount (less than or over £30,000)

- Review the plan suggestions and choose the most appropriate for your goals

- Review/agree to the terms and conditions and select Next

- Fill in the personal details page, providing tax information and your employment history

- Click Go to Step 3 and then Agree & Continue once you have reviewed the terms & conditions

- Enter card payment details to verify your identity and select Add Card

- Finish the sign-up and start trading

Customer Support

3.3 / 5The brand directs users to online help resources, which are detailed but lack human interaction. There is a secure messaging system available to users with an account, and a telephone contact number Monday to Friday 7:45 AM to 5:30 PM (GMT). Contact details:

- UK Phone Number – 0345 607 6001

- Non-UK Resident Phone Number – +44 113 346 2309

- Address – Interactive Investor, 2nd Floor, One Embankment, Neville Street, Leeds, LS1 4DW

The Interactive Investor help centre has plenty of frequently asked questions and answers including market opening hours, how to receive dividend payments, how to set a stop loss on an order, and how to close an Interactive Investor account.

You can also find links to useful forms, exit fees, earnings calendars, dividend history, online exchange agreements, quick-start funds, and more.

Security & Safety

When saving money, or investing with ii, your personal information and accounts are secure. The investment platform offers two-factor authentication (2FA) on the login page. A one-time, 24-digit recovery code can also be used to authorise new devices or changes to account security procedures.

All personal data is encrypted on the website platform and mobile app. You can tailor your security settings to log in with face recognition on iPhones and fingerprint scans on iPhones and Androids.

Interactive Investor also undergoes an annual security audit from Cyber Essentials Plus.

Interactive Investor Verdict

Interactive Investor is a well-rounded investment platform offering thousands of trading instruments, as well as ISA and pension accounts. The FCA-regulated company provides a safe and secure platform, with portfolio insights, product suggestions, and analysis from the company’s team of experts.

However, Interactive Investor is best suited to longer-term traders and those interested in equities. Short-term traders looking for derivatives on global markets like forex, commodities and cryptos may want to consider alternatives.

FAQs

Is Interactive Investor Good Or Bad?

Interactive Investor is an all-in-one investment solution where UK citizens can save and trade. The brand offers various subscription plans, with access to thousands of financial instruments, SIPP, and ISA profiles. The company is regulated and authorised by the FCA, and operates with a high standard of safety and security.

Is My Money Safe With Interactive Investor?

Yes, our team are comfortable that Interactive Investor provides a high level of account security and fund protection for customers. This includes multi-factor authentication upon login, data encryption, compliance with the rules of the Financial Conduct Authority (FCA), plus access to compensation from the FSCS in the case of business failure.

What Is Interactive Investor?

Interactive Investor (ii) is a subscription-based investment and savings solution for UK citizens. The brand provides customers with access to ISAs, pension accounts, and flexible investment profiles, alongside financial market news, expert insights, and learning materials to give everyone the ability to invest and save.

Who Owns Interactive Investor?

Interactive Investor is owned by abrdn following an acquisition in May 2022. abrdn is listed on the UK FTSE and has an extensive background in investment services and financial planning.

What Are Trading Credits On Interactive Investor?

Interactive Investor trading credits are provided to Investor and Super Investor account holders as a benefit of the subscription plans. They can be used against trading fees when investing in shares, ETFs, funds, and investment trusts.

Does Interactive Investor Pay Dividends?

Interactive Investor customers can receive dividend payments if provided by the company in question. To qualify for a dividend, you must own shares by end of the day before the ex-dividend date. Entitlement details are available in the Company Profile section of the investments table in the client dashboard.

Does Interactive Investor Offer A Lifetime And Cash ISA?

A Stocks & Shares ISA is the sole investment profile at ii. Alternative ISAs can be opened with other providers, so long as the maximum annual investment amount is not exceeded.

Does Interactive Investor Pay Interest On Cash?

Yes, Interactive Investor provides 0.5% interest on cash balances up to £10,000 and 1.5% interest on account holdings over £10,000. Note, interest rates may change – see the official website for the latest details.

Can I Buy Bitcoin On Interactive Investor?

No, Interactive Investor does not support cryptocurrency trading and investments, including Bitcoin. The platform primarily offers trading on stocks, ETFs, and funds.

How Safe Is Interactive Investor?

Interactive Investor is a safe brand, with FCA oversight and membership with the FSCS. Additionally, client money is held in segregated bank accounts. Other customer reviews of Interactive Investor are also good, with many praising the security features.

Is Interactive Investor Covered By FSCS?

Yes, customers have access to up to £85,000 in compensation from the FSCS if Interactive Investor is unable to fulfil its business obligations, for example, in the case of bankruptcy.

Does Interactive Investor Have An App?

Yes, Interactive Investor offers a free mobile app, available to download on iOS and Android devices. It is user-friendly, with portfolio oversight and full account management features. You can move money, review investments and see the latest market news and expert insights.

Top 3 Alternatives to Interactive Investor

Compare Interactive Investor with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Interactive Investor Comparison Table

| Interactive Investor | Interactive Brokers | Firstrade | Dukascopy | |

|---|---|---|---|---|

| Rating | 4.6 | 4.3 | 4 | 3.6 |

| Markets | Stocks, Funds, Trusts, ETFs, Bonds, Gilts, VCTs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | No | Yes | No | Yes |

| Minimum Deposit | £0 | $0 | $0 | $100 |

| Minimum Trade | £25 | $100 | $1 | 0.01 Lots |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA | FINMA, JFSA, FCMC |

| Bonus | – | – | Deposit Bonus Up To $4000 | 10% Equity Bonus |

| Education | Yes | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | TradingCentral | JForex, MT4, MT5 |

| Leverage | – | 1:50 | – | 1:200 |

| Payment Methods | 6 | 6 | 4 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Firstrade Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Interactive Investor and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Interactive Investor | Interactive Brokers | Firstrade | Dukascopy | |

|---|---|---|---|---|

| CFD | No | Yes | No | Yes |

| Forex | No | Yes | No | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | No | Yes |

| Oil | No | No | No | Yes |

| Gold | No | Yes | No | Yes |

| Copper | No | No | No | Yes |

| Silver | No | No | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

Interactive Investor vs Other Brokers

Compare Interactive Investor with any other broker by selecting the other broker below.

The most popular Interactive Investor comparisons:

Customer Reviews

3 / 5This average customer rating is based on 1 Interactive Investor customer reviews submitted by our visitors.

If you have traded with Interactive Investor we would really like to know about your experience - please submit your own review. Thank you.

ii have been good to me as a share dealer. They’ve got tonnes of US, UK and Asia Pacific equities with strong exposure to tech and finance industries. I know it can be marmite for some people but I like thje flat fee model. And the fiver or 12 quid a month is affordable if you’re a moderately active trader like me. Would I use ii for day trading though? Nah. Their software, infrastructure, tools etc just aren’t set up for that sort of volume of trades from what I’ve seen.