Interactive Brokers Adds Cboe Europe Derivatives (CEDX)

European stock options, European index futures and European index options are now available at Interactive Brokers through Cboe Europe Derivatives (CEDX).

Key Takeaways

- Clients of IBKR can trade more than 300 stock options on prominent European companies spanning 14 countries and indices.

- Futures and options for single and trans-European indices are available on key benchmarks, such as France 40 and Eurozone 50.

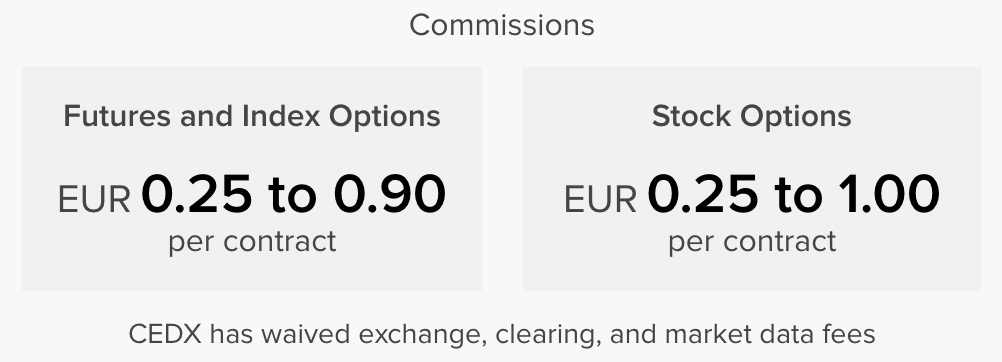

- Interactive Brokers is waiving CEDX’s exchange, market data and connectivity charges until the close of 2024.

CEDX forms one branch of Cboe Global Markets, which operates some of the biggest options markets in the US. It distinguishes itself by trading products from across Europe on one streamlined platform, helping to lower fees.

If you do not already have futures and options trading permissions, you can request them in the IBKR Client Portal. Simply press the My Investment Accounts icon (head and shoulders image), press ‘Settings’ and then click ‘Trading Permissions’ within ‘Trading’.

CEO of Interactive Brokers, Milan Galik, commented: “The introduction of Cboe Europe Derivatives underscores our commitment to providing clients with an extensive range of products to enhance their trading strategies at low cost. As investors increasingly use derivatives to diversify and fine-tune market exposure, CEDX broadens the investment options available for our clients.”

Head of European Derivatives, Cboe Europe, added: “We’re thrilled that clients of Interactive Brokers can now access Cboe Europe Derivatives’ suite of pan-European equity derivatives contracts. This is a significant milestone in CEDX’s journey to improve the ability of retail investors to gain access to and benefit from European derivatives, particularly options.”

About Interactive Brokers

Interactive Brokers is one of the industry’s longest-standing brokers, boasting more than 40 years of experience and authorization from a string of respected regulators, notably the SEC in the US, CIRO in Canada and FCA in the UK.

Geared towards experienced traders, the brokerage provides live market data and sophisticated charting platforms, especially via the recently upgraded IBKR Desktop app.

Alongside the newly added European derivatives, clients of IBKR can trade forex, bonds, funds, digital currencies, futures and CFDs spanning 150 markets in 34 countries.