Infinox Review 2024

Awards

- Best Forex Broker For Long Term Trading 2022

- Best Forex Copy Trading Platform Africa 2021

- Best Trading Account Margin Rates 2020

Pros

- The advanced IX Exchange will serve active day traders with sophsticated analysis tools

- A well-rounded broker with a choice of pricing models, platforms, apps and accounts

- The copy trading service and zero minimum deposit make Infinox suitable for beginners

Cons

- Market research is less insightful and frequent than competitors

- No weekend customer support

Infinox Review

Infinox Capital Ltd is a CFD and forex broker based in the UK. Multi-asset trading is available on several platforms, including MT4. This review looks at regulation, account types, leverage, demo accounts, and more. Find out if you should login and trade with Infinox.

Infinox Headlines

Operating since 2009, Infinox Capital Ltd is a London-based broker regulated by the UK Financial Conduct Authority (FCA), the Securities Commission of The Bahamas (SCB), and the Financial Sector Conduct Authority (FSCA) in South Africa.

The award-winning company has over 100 employees based around the world, including the Bahamas, Asia, and the Middle East. The broker’s clients can also be found everywhere from Vietnam and Thailand to Dubai, Australia, and Portugal.

Infinox caters to all levels of traders who wish to invest in forex, indices, equities, commodities, and futures. With a focus on customer service and trading tools, the brokerage aims to be more than just a platform to its clients.

Trading Platforms

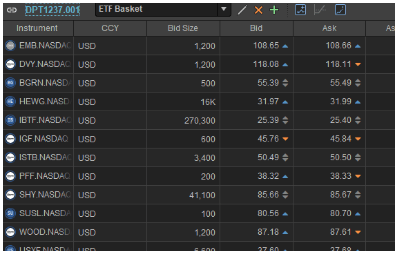

IX Exchange

IX Exchange is the firm’s own trading software. Aimed at active traders, the platform offers 20,000 investment opportunities spanning more than 50 global exchanges for portfolio diversification. The list of instruments also includes bonds and options, which are not available on the MetaTrader platforms.

The terminal offers various features for active users, including Basket Trader, whereby clients can create their own basket/index of instruments to trade at once. The platform is also home to a portfolio overview with performance monitoring, order tracking, and multiple risk management tools.

When we used Infinox’s IX Exchange, we found the platform challenging to get started with, but once it’s been configured and customized, it serves as an excellent tool for high-volume, multi-account trading.

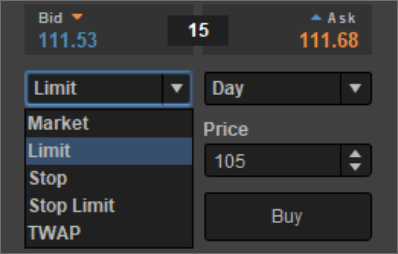

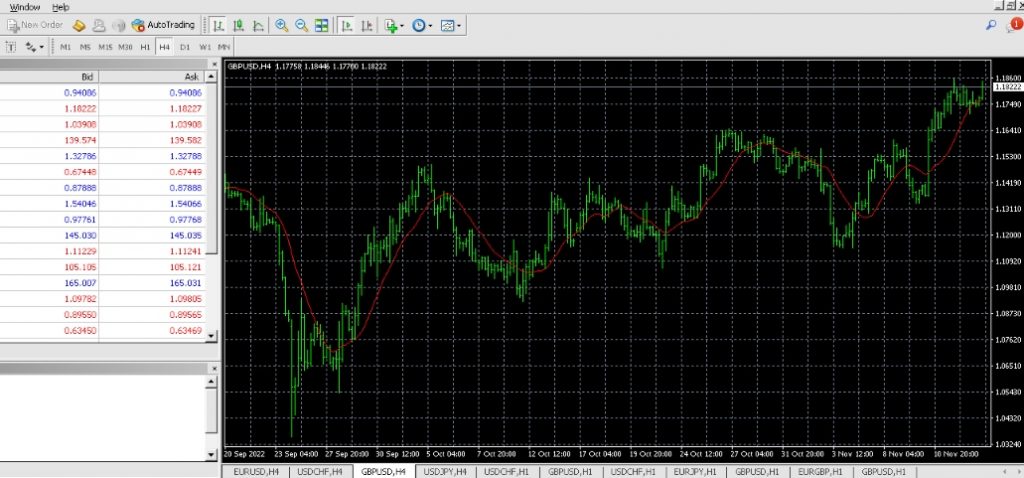

MetaTrader 4

Infinox offers the all-round MetaTrader 4 (MT4) platform. Popular in customers reviews, users can trade forex, CFDs, and futures with a long list of helpful features, including:

- 2000+ built-in technical indicators & multiple chart types

- Expert Advisors (EAs) for automated trading

- Real-time price quotes

- One-click trading

- Historical data

- 9 time frames

MT4 can be downloaded from the broker’s website.

MetaTrader 5

Infinox also offers MetaQuotes’ platform MT5. This is a more advanced platform with support for a greater range of assets, more charting and indicator options and a larger number of order types. All the same functionality of MT4 is maintained, with an increase in software efficiency and additional tools, plus access to equities.

WebTrader

The web-based version of MetaTrader means clients can invest without a software download. This is a great option for those looking to test the platform with a demo account, while getting access to a range of indicators and charts, including moving averages, Bollinger bands, and more.

WebTrader can be opened directly from the Platforms page on the Infinox website and is compatible with most internet browsers, including Chrome and Safari.

Assets & Markets

Infinox offers five main asset classes:

- Forex – Trade 45+ of the most popular currency pairs, including AUD/USD, EUR/USD, and EUR/GBP

- Indices – Trade on some of the world’s largest indices, including the FTSE100 and DAX40

- Commodities – Trade on hard and soft commodities such as gold, silver, and oil

- Equities – Buy and sell stocks in the world’s biggest companies, including Google and Facebook

- Futures – Trade on futures with real-time Direct Market Access (DMA)

Spreads & Commission

When we used Infinox, typical spreads on major currency pairs started at 0.3 pips for EUR/USD, 0.4 pips for GBP/USD, and 0.3 for EUR/GBP. For indices like the FTSE 100, typical spreads are from 0.42 to 2.2 pips; and for commodities, spreads are 22 for gold and 27 for silver.

Commissions are variable on equity CFDs and futures. Details of specific commission charges can be found on the broker’s website, but generally, charges are 1.5-2.8 pips for futures and $0.02 for equity CFDs.

Infinox Leverage

Leverage for forex, commodities, and indices ranges from 1:10 and 1:30. Leverage is capped due to ESMA regulations, but still provides enough flexibility for traders to substantially increase their positions. The margin on equity CFDs starts at 20% and varies for futures.

The maximum leverage is 1:200, which helps increase your trading power if you are in a region that isn’t regulated by ESMA or if you are a professional client.

Mobile Trading

The MetaTrader platforms are available as mobile apps, which are compatible with iOS and Android smart devices. Users can trade easily anywhere with much of the same functionality as the desktop platforms, including full trading history, financial news, real-time quotes, and more.

The apps can be downloaded from the Apple App Store or Google Play.

Payment Methods

Deposits and withdrawals can be made via debit/credit card, Skrill, Neteller, or bank transfer. Other e-wallets, cryptos, and local payment solutions may also be available depending on where you register an account from.

Infinox does not charge for deposits, however, there may be intermediary fees.

The minimum deposit is low at just £1, making the broker appealing to beginners.

Deposits are usually processed the same day while withdrawals require a payment request form to be filled out before processing can begin.

How To Make A Deposit

- Verify your account after completing the registration process

- Log in to the account area and select ‘Money In’

- Choose from the list of supported deposit methods, e.g. ‘Bank Wire’

- Enter the transfer details and follow the on-screen instructions

- Confirm the payment and check your Infinox account balance

Demo Account Review

Infinox offers a demo account with their ECN and STP accounts. The demo account allows users to practice their strategy in risk-free conditions.

Access to the demo account lasts for 30 days and investors receive 10,000 in virtual funds, although this can be increased upon request.

One drawback is that Infinox does not provide access to its proprietary platform with the demo profile. With that said, the minimum deposit is £1 so it’s still fairly easy for a potential client to test the broker’s trading tools.

Bonuses & Promotions

As per regulatory restrictions, Infinox does not offer any bonus deals or promotions. However, check the broker’s website and social media channels for news of any upcoming trading contests.

Regulation & Licensing

Infinox Capital Ltd is fully licensed and regulated by the UK Financial Conduct Authority (FCA). Should the broker receive too many online complaints, they may find themselves under investigation, which happened in 2021 after scam concerns were raised. Fortunately, the brokerage denied the allegations and did not lose its FCA license, a reassuring sign that the firm did not behave inappropriately.

Infinox ensures that client money is segregated from company capital, in accordance with regulatory conditions. The broker is also covered by the Financial Services & Compensation Scheme (FSCS), which compensates clients up to £85,000 in the event of insolvency.

Traders outside of the UK can register with Infinox Capital, an entity regulated by the Securities Commission of The Bahamas (SCB), registration number SIA F-188. Alternatively, the brokerage holds a license with the Financial Sector Conduct Authority (FSCA) in South Africa.

Additional Features

As user reviews show, Infinox’s educational resources are fairly limited to guides on trading basics. For in-depth resources, traders should look elsewhere.

Our experts did found the firm offers research through their IX Intel, where you can read the latest news and access user-friendly training guides and materials. The broker is doing a reasonable job of building out its library of market research and trading tips.

In addition, Infinox provides a VPS which offers low latency and lends itself to automated trading strategies that can run 24/7 with no downtime.

IX Social

The broker also offers a social trading platform that is integrated with MT5 to offer a wide range of assets and advanced tools. Social trading features include automated copy trading, community leaderboards and rewards, strategy sharing and social interactions.

The social investing app has been downloaded more than 20,000 times and has over 7000 monthly users with $30 billion traded.

How To Start Copy Trading

- Download the IX Social app from the Apple App Store or Google Play

- Build a copy trader or strategy provider profile following the on-screen prompts

- Connect your Infinox app with IX Social. Alternatively, register for a new brokerage account

- Choose between pro traders – browse profiles in the app’s leaderboard and strategy provider database

- Mirror the strategy provider’s trading volume and/or risk with flexibility and start automatically copying their positions

Infinox Account Types

There are two main account types to choose from at Infinox. Traders can sign up for the STP (Straight Through Processing) account, where you only pay the spread on a trade (starting from 0.9 pips); and the ECN (Electronic Communication Network) account, where you pay lower spreads (from 0.2 pips) but also commission (£5/€5.5/$7).

For the STP/ECN accounts, the minimum deposit is just £1 (or EUR/USD/AUD). The minimum order size is 0.01 lots.

Joint and corporate accounts are also available. MAM/PAMM profiles are also supported.

Trading Hours

Trading hours for forex are Monday 00:00 to Friday 23:59 UK time. Most equity CFDs are open daily form 08:00 to 16:30 EST and most futures are open Sunday to Friday 6:00 pm to 5:00 pm EST.

Opening hours for other markets are more specific and can be found in the broker’s trading platforms.

Infinox Customer Support

Customer service is available 24/5 and in six languages, including English, Portuguese, Italian, and Arabic.

Investors can contact the customer support team via:

- Email – support@infinox.com

- Telephone – 0-800-060-8744

- Live chat – located in the bottom right-hand corner of the website

When our experts tested the broker’s customer support, they received helpful responses within a few minutes.

Infinox’s registered office address is Birchin Court, 20 Birchin Lane, London, EC3V 9DU. Details for the Hong Kong office can be found on the website.

Security & Safety

The MetaTrader 4 platform follows industry-standard security protocols, including using Secure Sockets Layer (SSL) encryption to protect data exchange between servers.

As per the General Data Protection Regulations (GDPR), Infinox also ensures the safety of their data collection processes. The broker’s Privacy Policy can be viewed on the official website.

In addition, negative balance protection is provided, meaning clients cannot lose more than their account balance.

Infinox Verdict

Infinox Capital Ltd has a competitive offering for traders of all levels. Despite the lack of educational resources, the broker offers multiple trading platforms, three account types, £1 minimum deposits, and is FCA regulated. We’re happy to recommend Infinox to our readers.

FAQs

Is Infinox A Scam?

Infinox is an FCA regulated and a legitimate broker. But whilst the company is licensed, online trading does come with risks so make sure you take a careful approach to money management.

It is also worth noting that the broker was embroiled in scam complaints in 2021, though the firm has maintained it acted lawfully. The broker has not lost its FCA license following the incident.

Is Infinox A Good Broker?

Infinox offers competitive spreads on forex and reliable trading platforms. The broker is also regulated by the FCA. With that said, there are other brokers offering lower fees and more advanced trading tools.

Is Infinox Suitable For Beginners?

Infinox has a $1 minimum deposit requirement, a copy trading service, plus market insights and analysis. As a result, beginner traders have all the tools they need to start trading on popular financial markets, including stocks, forex and commodities.

What Accounts Does Infinox Offer?

Infinox offers two main account types: the ECN (Electronic Communication Network) account, and the STP (Straight Through Processing) account. The ECN account is commission-free while the STP account charges through the spread and commissions.

Does Infinox Offer A Demo Account?

Yes, Infinox offers a demo account with the ECN and MT4 accounts. Demo accounts are available for 30 days from sign-up and come with 10,000 in virtual funds.

What Platforms Does Infinox Offer?

Infinox offers the MT4 and MT5 desktop and mobile platforms. These are industry favorites and offer all the tools that beginner and seasoned investors need to trade popular financial markets.

The broker also offers a copy trading platform called IX Social. In addition, an advanced platform for long-term investors and active traders called IX Exchange is available to download once you have registered for a live account.

Top 3 Alternatives to Infinox

Compare Infinox with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Infinox Comparison Table

| Infinox | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.4 | 4.4 | 4.3 | 4.5 |

| Markets | Forex, CFDs, Indices, Shares, Commodities, Futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | £1 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, SCB, FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:30 (UK), 1:200 (Global) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:50 |

| Payment Methods | 14 | 6 | 6 | 8 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Infinox and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Infinox | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | No |

Infinox vs Other Brokers

Compare Infinox with any other broker by selecting the other broker below.

The most popular Infinox comparisons:

Customer Reviews

1 / 5This average customer rating is based on 1 Infinox customer reviews submitted by our visitors.

If you have traded with Infinox we would really like to know about your experience - please submit your own review. Thank you.

Scammers who were exposed in a BBC documentary. You need to avoid them. Hundreds of people have been scammed by this organisation.

Infinox was mentioned in the reporting by BBC, but it does not seem entirely clear if, or how, they were involved or even aware. Regardless, we agree that traders should be cautious and that it would be reasonable for Infinox to clarify what they knew or did at the time, and why they failed to identify and act on this. If traders from the UK registered with Infinox's non FCA-regulated entity, those traders should have been redirected to the UK-based entity.