FXPrimus Review 2026

See the Top 3 Alternatives in your location.

Awards

- Most Trusted Broker South East Asia & Africa 2020 - International Investor Magazine

- Best Forex Broker South East Asia 2020 - Finance Derivative

Pros

- High leverage available up to 1:1000, or 1:500 on the higher-tier raw spread account

- Excellent range of accepted funding methods with 12 accepted currencies, e-wallet and international banking options, and fees covered by the broker

- Choice of MT4, MT5 and cTrader platforms gives traders great flexibility

Cons

- This broker does not accept traders from the US

- Relatively small range of assets, with just 45+ forex pairs

- High $8 MT5/$10 MT4 commissions on the Primus Pro account

FXPrimus Review

FXPrimus is a financial trading broker that offers forex, stocks, indices, commodities and cryptos on several leading trading platforms. This 2026 review covers the broker’s benefits, security features, regulatory status and core trading services. Make sure you read before you open an account.

History & Overview

FXPrimus was launched in 2009 and has become a popular global trading broker, with offices in Europe, Asia and Dubai.

The group offers ultrafast trade executions with zero re-quotes. Clients also benefit from interbank spreads that start from 0.1 pips.

A variety of accounts are offered to suit different trader needs, including a $15 starting deposit with the Cent solution.

The global trading brand and its owners follow three core principles: safety, security and integrity. As a result, the brokerage is regulated by several leading financial watchdogs, including the Cyprus Securities & Exchange Commission (CySEC). Primus Markets INTL Limited is also regulated by the Vanuatu Financial Services Commission (VFSC). We break down the firm’s regulatory status and the various protections afforded to clients further below.

FXPrimus has over 300,000 customer accounts and is active in more than 140 countries. The award-winning trading brand offers opportunities on more than 200 markets.

Platforms

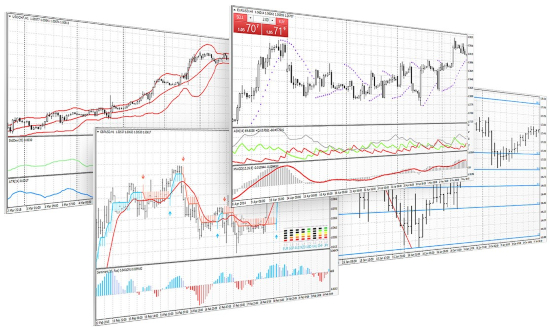

MetaTrader 4

The MetaTrader 4 (MT4) platform is available for download on Windows, Apple and Android and is also available through a web trader solution. MT4 is well known for its user-friendly dashboard and automated trading capabilities.

Features include:

- 23 analytical objects

- 30 built-in indicators

- 3 execution modes

- 2 market orders

- 4 pending orders

- Interactive charts

- Strategy tester

MetaTrader 5

For more experienced traders, FXPrimus also provides access to MetaTrader 5 (MT5). The platform is available as a free download or as a webtrader. The terminal is also available on mobile devices.

MT5 is the latest software from MetaQuotes and offers a range of useful features:

- 21 timeframes

- Market Depth feature

- 80+ technical indicators

- Financial news & economic calendar

- Automated trading through Expert Advisors (EAs)

- A variety of charting options, including line, bar and candlestick

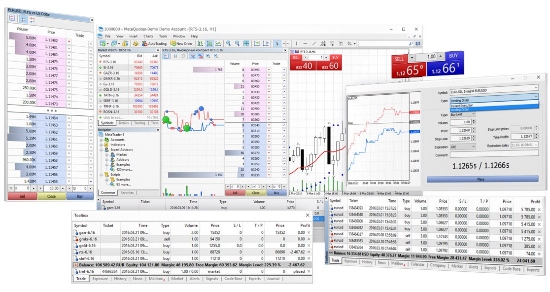

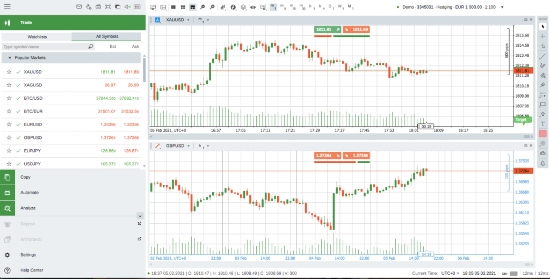

cTrader

Clients can also engage in copy trading via the cTrader platform. Signal providers can sell their strategies and positions while beginners can learn from established investors.

The customizable interface also offers a variety of charting modes and colour options. In fact, 54 timeframes are available across 6 charting views. 4 order types are available: market, limit, stop and stop limit. A suite of additional features are supported on cTrader, including:

- Hotkeys and keyboard shortcuts

- Up to 50 charting templates

- Community forum

- Algorithmic investing

- One-click trading

Markets

FXPrimus offers trading across popular financial markets:

- Forex – trade 45+ currency pairs, including majors, minors, and crosses. There is also a selection of exotic pairs such as USD/ZAR

- Indices – invest in CFDs on 15 global indices including the FTSE 100, Dow Jones 30, STOXX 50 and NASDAQ 100

- Cryptocurrencies – invest in a modest selection of crypto coins, including Bitcoin, Litecoin and Ethereum

- Commodities – buy and sell gold, silver and platinum, plus energies such as natural gas and crude oil

- Shares – trade on over 100 publicly-listed companies, including Facebook, Google and IBM

Bonds, futures and options are also available on the broker’s trading platforms.

Fees

FXPrimus primarily makes its fees through variable spreads and commissions. Spreads start from 1.5 pips with zero commissions on the Cent and Classic accounts. Spreads drop to 0.3 pips alongside a $10 commission on MT4 and an $8 commission on MT5 with the Pro account. The firm’s ECN trading solution, FXPrimus Zero, offers zero-pip spreads with a $5 commission.

Importantly, the broker is transparent with its fees and there are no hidden charges. The firm’s advanced accounts also provide a particularly competitive trading environment versus competitors.

Leverage Review

Leverage at FXPrimus is capped at 1:1000. With that said, rates are limited to 1:500 with the firm’s Pro account and paper trading solution. Leverage also varies by asset. See the broker’s website for a detailed breakdown.

Prospective clients should be aware of the risks associated with leveraged trading, especially with particularly high rates.

Mobile App Rating

FXPrimus has fully-functioning MT4, MT5, and cTrader mobile apps that are available for download on Apple or Android phones. The applications have almost all the functionality available on the desktop solutions. They are also fully integrated, so all your trades and deposits are available to view on the respective mobile app, even if completed on your desktop terminal.

Deposits & Withdrawals

FXPrimus offers several deposit and withdrawal methods including bank wire transfer, credit cards such as Visa and Mastercard, plus e-wallets like Skrill and Neteller. Also available are FasaPay, UnionPay, ecoPayz, Bitcoin payments, plus emerchantpay, among others.

You can transfer using the following currencies:

- USD

- EUR

- SGD

- GBP

- PLN

- HUF

- ZAR

- BRL

- MYR

- IDR

- VND

- THB

The minimum deposit is $15 with the Cent and Pro accounts. Clients will need to deposit $500 with the Pro account and $1,000 to get started with the Zero solution.

Importantly, deposits and withdrawals are free. When funding your account, however, be aware that your bank may use an intermediary to hold the money in escrow and could charge a fee to do so.

This review was also pleased to see that FXPrimus has partnered with Boudica Client Trust to provide third-party monitoring of withdrawals. This helps ensure the broker pays clients promptly.

Demo Account

FXPrimus offers a free demo account. The sign-up process is quick and easy.

Following registration, prospective investors can access the client/member area from the trading tab on the homepage. The demo account is a great place to test a strategy or get a feel for the broker’s products and services.

Note, the paper trading account can be opened alongside a live account.

Bonuses & Rebates

FXPrimus runs monthly promotions. Head to the broker’s website for the latest deals. Previous offers have included welcome deposit bonuses and loyalty schemes. VIP trading signals are also available for qualifying traders.

Always check the terms and conditions of incentives and contests.

Regulation Review

FXPrimus is a global broker that is regulated in several major trading jurisdictions. The brokerage holds a license with the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). The firm also operates in compliance with the Markets in Financial Instruments Directive (MiFID) and requirements set out by the:

- UK’s Financial Conduct Authority (FCA)

- Germany’s Federal Financial Supervisory Authority (BaFin)

Client funds are segregated from the broker’s capital. In addition, the company has professional indemnity insurance up to €5 million, providing additional peace of mind to customers. Finally, the brokerage is fully audited, both internally and externally.

Note, the broker is available in multiple countries across Asia, including Indonesia, Malaysia, Vietnam and Thailand, as well as in Kenya, Singapore, Nigeria, Hong Kong, Dubai, India, South Africa and the Philippines. FXPrimus is not available in certain countries, including Australia, Belgium, Iran, Japan, Canada, North Korea and the US.

Additional Features

As a global company, FXPrimus is known for its innovative functionality and trading services. On its central website, it provides all the resources you would expect of a large brokerage to keep you in the know, including an education centre with seminars, daily market outlooks, educational videos and a regularly updated news blog.

PAMM

FXPrimus offers a copytrade function on its PAMM terminal that allows clients to piggyback on the positions of successful traders. Masters’ trade results are published on the website upon login so that you can review their performance and risk profile to select a trader that is right for you.

Tools

FXPrimus also provides a free Virtual Private Server (VPS) to traders with a qualifying balance. In addition, eligible traders can utilize the broker’s Platinum API solution which operates outside of MT4 and enables enhanced automated and algorithmic trading systems.

Accounts

There are four main account types: Primus Cent, Primus Classic, Primus Pro and Primus Zero. All accounts come with 24/5 support, negative balance protection, free educational materials and live webinars.

The Cent account is a good option for beginners with a $15 starting deposit requirement and spreads from 1.5 pips.

The Pro solution is also popular, with spreads from 0.3 pips and commissions from $8 on MT5 and $10 on MT4. As the name suggests, the Zero account offers spreads from 0.0 pips with commissions from $5. Leverage is capped to 1:500 with the Zero account versus the 1:1000 available with the other trading solutions.

Head to the official website for a detailed comparison of the different accounts available, including minimum deposits, accepted base currencies, and copy trading support.

Note, an Islamic-friendly account is available upon request.

Trading Hours

Forex trading is available on the platform from Sunday evening through to Friday. Other opening hours vary depending on the financial market. Head to the broker’s official website for a breakdown by asset, including public holidays and closures.

Contacting Support

Customer support is available 24 hours, 5 days a week via email at support@fxprimus.com or through their live chat feature. The firm also has a Telegram support bot, WhatApp and Line accessibility, among other social media channels.

The telephone number for customer support is +357 25257687. Alternatively, you can submit a form via the Contact Us page.

Note, support is available in 15 languages. The group’s head office is located in Limassol, Cyprus.

Safety

The FXPrimus server is HTTPS secure meaning your personal data is protected from potential hackers trying to obtain your name, address and bank details along with other details. MT4 and MT5 also offer two-factor authentication at the login stage.

In addition, the broker segregates client funds from the firm’s capital in case of insolvency. FXPrimus is also routinely audited, adding an extra layer of trust.

FXPrimus Verdict

FXPrimus is a long-standing, regulated broker offering 200+ markets. Beginners can get started with a $15 minimum deposit and access leverage up to 1:1000. With the MT5 platform and ECN solution, seasoned traders are also well-equipped. Overall, FXPrimus is a highly rated online trading broker.

FAQs

Is FXPrimus A Good Broker?

FXPrimus has many hallmarks of a good broker including being regulated by the CySEC. It also provides the MT4 and MT5 platforms which enable swift trade executions with a raft of features. Regular promotions, plus free deposits and withdrawals are attractive features. Low ZAR account minimum deposits and access to popular assets like the US30 also make the broker popular in customer reviews.

What Base Currency Can I Open An FXPrimus Account With?

FXPrimus offers accounts with base currencies in EUR, GBP, USD, SGD, PLN and ZAR.

Does FXPrimus Offer A Demo Account?

Yes, FXPrimus offers a free demo trading account. Head to the broker’s homepage to register for a practice account.

Can I Trade Bitcoin At FXPrimus?

Yes – clients can trade Bitcoin and several other cryptos at FXPrimus, including Litecoin, Ethereum and Dash. The broker offers tight spreads and crypto-fiat pairs.

Best Alternatives to FXPrimus

Compare FXPrimus with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

FXPrimus Comparison Table

| FXPrimus | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 2.3 | 4.3 | 3.6 |

| Markets | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities, Bonds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $15 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | CYSEC, MIFID, ICF, FCA, BaFin, VFSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | Monthly Promos | – | 100% Anniversary Bonus |

| Platforms | MT4, MT5, cTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:200 |

| Payment Methods | 12 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXPrimus and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXPrimus | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | Yes | Yes | No |

| ETFs | No | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

FXPrimus vs Other Brokers

Compare FXPrimus with any other broker by selecting the other broker below.

Customer Reviews

5 / 5This average customer rating is based on 1 FXPrimus customer reviews submitted by our visitors.

If you have traded with FXPrimus we would really like to know about your experience - please submit your own review. Thank you.

FXPRIMUS distinguishes itself with its exceptional forex trading platform, known for its reliable execution and diverse range of market instruments. The platform’s intuitive design, combined with powerful analytical tools, caters to both beginner and advanced traders. Their commitment to security and transparent trading practices makes them a top choice for traders seeking a dependable and efficient trading environment.