Fulcrum Review 2024

Please see the list of similar brokers or the Best Brokers List for alternatives.

Fulcrum Review

Fulcrum is a decentralised finance (DeFi) platform for lending and margin trading cryptocurrencies (digital tokens) built on the Ethereum network. The platform allows clients to get involved with crypto lending, borrowing and leverage trading (long and short). The broker uses the bZx protocol for smart contracts and a decentralised oracle network for price information. This article will explore the platform’s systems, services, fees and cryptos.

Fulcrum Headlines

Fulcrum is a cryptocurrency trading platform that connects lenders and borrowers with a focus on decentralisation. The platform does not perform any credit checks or user verifications, choosing not to follow the know-your-customer (KYC) and anti-money-laundering (AML) practices, as is common within DeFi. Making use of its open-source bZx protocol, the Fulcrum platform boasts minimised risk of unauthorised access to your crypto wallets, where you as a client remain in control of your keys without the platform having direct access. The platform provides opportunities for cryptocurrency holders to gain passive income without “giving up control” of their tokens, making the loans safer but consequently incurring higher borrowing interest rates.

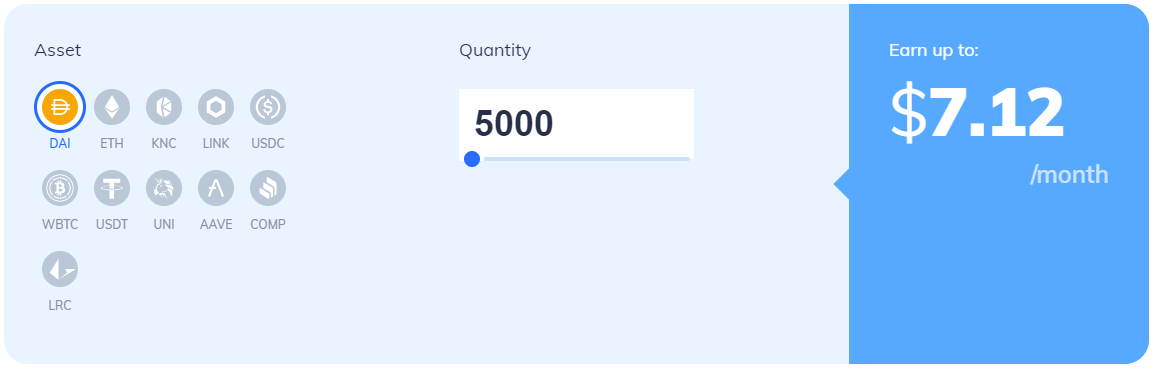

Lending

Fulcrum supports crypto lending without having to give up complete control of your tokens. It differs from some crypto lending platforms by promising no minimum deposit or lockup periods, as well as allowing you to withdraw at any time.

The cryptocurrencies you deposit are placed into a combined Fulcrum asset pool, which borrowers then use for margin trading. When you lend out funds, they are exchanged into the relevant iTokens (e.g. ETH → iETH, BTC → iBTC, etc). These iTokens are equivalent in value to their normal crypto counterpart (e.g. 2.5 iETH == 2.5 ETH), however, they are interest-accumulating tokens that are designed to continuously go up in value whilst you hold them.

When you withdraw your lent funds, you are paid out a proportional amount of the interest that was accrued.

iTokens

On the Fulcrum app, iTokens are utilised to represent a share in a lending pool. This then grows in size from the interest fees paid by borrowers. These tokens can be sold on Uniswap, DEXs or centralised exchanges as a means of exiting your position. In addition, these tokens can be used for collateral on the Fulcrum platform.

Calculating Earned Interest

The accrued interest on Fulcrum is split between all of the lenders that have deposited funds. If a lender leaves the pool (i.e. withdraws their funds), then the interest is split across fewer users and therefore the rest of the lenders earn more interest. The earned interest is distributed to lenders proportionally to the number of iTokens they hold.

To give an example, consider there are four lenders with equal holdings who are each earning 2.5% APR (10% total). When one lender withdraws their funds the interest is increased to 3.33% APR for each of the three remaining lenders.

Insurance Fund

If any loans on the Fulcrum platform are under-collateralised and not properly liquidated, an insurance fund is set up to mitigate any potential losses incurred by lenders. This insurance fund is paid for using 10% of the interest rates paid by borrowers. This reduces the risk of lending your cryptocurrencies on the platform.

Borrowing

Borrowing cryptocurrencies from the platform is not done directly through Fulcrum, instead, it is done through another loans platform owned by the same parent company: Torque. Borrowing is just as simple as the other platform functionalities, where the prerequisites involve having an Ethereum wallet, some ETH available for fees and some ERC20 tokens to use as collateral.

The amount of collateral that you must put in is calculated by a collateral-to-loan ratio, which is over-collateralised to reduce the risk to lenders. Your position will only be liquidated when the margin maintenance is below 15% and by an amount that brings the margin maintenance up to 25%. This partial liquidation reduces the risk of slippage that may occur if large liquidations were carried out.

Calculating Interest Rates

The interest rates used by Fulcrum follow the principle of “supply and demand”. When a lender adds funds, the interest goes down, and when a borrower takes funds the interest goes up. The borrowing interest rates for currencies can be between 1-40%, depending on the number of assets borrowed and available. Essentially, if there are a lot of assets in the lending pool, the borrowing interest is decreased to incentivise traders to use some of the assets. These interest rates can vary from day-to-day, currency-to-currency.

Staking

The Fulcrum platform, in addition to borrowing and lending, allows for its users to carry out yield farming through staking. Yield farming is a crypto concept, defined by “locking up” your cryptocurrency holdings, which in turn provides you with rewards. This allows you to earn fixed or variable interest by investing in DeFi markets. Fulcrum does this through the deposit of governance tokens (e.g. on Ethereum through BZRX) which then lets you earn part of the fees collected from the bZx protocol (i.e. the one used by Fulcrum).

In a nutshell, this means you can earn back some of the fees paid during borrowing or trading on Fulcrum, as well as giving you a stake in the protocol itself, allowing you to earn extra cryptos.

For example, if user A stakes 1,000 BZRX and there is a total of 2,000 BZRX in the circulating supply, then user A is entitled to half of the fees generated by the bZx protocol.

Trading

Fulcrum supports margin trading of cryptocurrencies on its platform, which encompasses trading with leverage and both purchasing and shorting. The use of leverage allows traders to increase the number of assets that they can trade, magnifying both the potential returns and losses. These borrowed assets are called margin loans and require the trader to deposit some of their assets to serve as collateral. This is calculated using a collateral-to-loan ratio, where, if the trade falls below said ratio then some/all of the position is liquidated and the lender is paid using the collateral.

To open a trade, you need to first have an Ethereum wallet set up that contains the cryptocurrency you wish to use. The Fulcrum platform then makes it simple and easy to select the market in which you wish to make a trade, such as “fWETH-DAI”, and the amount of leverage you wish to use for either long or short positions. On Fulcrum, you can use up to 1:15 leverage. Maintaining the “fWETH-DAI” example, using a 1:5 leverage on 200 fWETH would allow you to trade as if you had 1,000 fWETH. The extra 800 is borrowed from Fulcrum.

After opening a trade, you have the option of partially exiting your positions, rather than fully exiting. This may be beneficial to some that want to withdraw only some of the funds. Additionally, you can modify your collateral by depositing or withdrawing funds from it.

Fees

Fulcrum clients must front 28 days worth of interest payments when opening a trade, which is then dispersed to lenders over time. If you were to close your position before the end of this period, the remaining payments are returned to you. All Fulcrum fees are paid in Ethereum (ETH), though collateral can be provided with any ERC20 token.

The interest buffer must be maintained through manual payments or roll-over of the position, which uses the collateral to pay for the 28-day interest. Ethereum’s gas fees are also charged to the trade’s collateral (gas cost of roll-overs and the equivalent of the gas cost as a reward for the executor). Should the cost of the roll-over be more than the value of the collateral, part of the position will be liquidated.

The process of the automated roll-over is more expensive than manually paying interest upfront and Fulcrum recommends manual payments for roll-over as a means of saving money.

It should be noted that the increase/decrease in the number of lenders in Fulcrum’s asset pool does not mean a decrease/increase of interest, should you already have a position open.

When borrowing crypto from Torque, an origination fee of 0.09% is charged, as well as an interest fee of 10% of the interest paid. Traders that borrow crypto from Torque get 50% of their fees returned to them in the form of vBZRX tokens. There is also a 0.15% fee on all trades.

Creating An Account

With Fulcrum, you do not need to create a new account or login directly to begin accessing its services. Instead, you only require access to an Ethereum wallet that is supported by Fulcrum. When deciding to open a position, borrow or lend, simply link your wallet to the platform to start.

The ease of the platform’s use is in line with Fulcrum’s DeFi focus, not requiring any credit or user checks to trade.

Security

The security of the Fulcrum platform relies on the company’s bZx protocol for its DeFi transactions. The platform conducts periodic security checks of its protocol through audits that are conducted by reputable security auditors from the industry — CertiK and PeckShield.

CertiK and PeckShield are blockchain security companies built to prove the security and correctness of smart contracts (e.g. those that are used on Fulcrum) and blockchain protocols. A recent report compiled in September 2020 by PeckShield stated that the smart contracts used by Fulcrum are “well-designed and engineered”. Similarly, a report by CertiK published around the same time also stated that the smart contracts used by Fulcrum “[achieved] a high standard of code quality and security”.

Customer Support

Fulcrum offers two kinds of customer support: FAQs and live chat. The FAQ pages give traders a basic understanding of the platform and how it works, as well as some underlying details on how the protocol and Fulcrum work under the hood. Users can initiate a live chat through the platform’s website, though this service is not available 24/7. The live chat feature may therefore not give instant responses to your queries.

Regulation

The Fulcrum platform is not registered or licensed with any regulatory body and does not perform any KYS and AML checks. Laws and regulations for DeFi are still in their infancy and it is likely that, in the future, Fulcrum will need to register with a regulatory body. However, given that this is not currently the case, it is advised to proceed with caution.

Fulcrum Verdict

The Fulcrum platform provides a quick and easy way to lend and margin trade cryptocurrencies. Although smaller than some of its other competitors, Fulcrum does offer some extra benefits that might not be seen on other DeFi platforms. Before dealing with trading cryptocurrencies you must make yourself familiar with the topic, especially with the Ethereum network in the context of using Fulcrum. If any of the lending, borrowing, staking and trading services take your fancy, you can sign up using the button below.

FAQs

What Is DeFi?

DeFi stands for decentralised finance, which refers to financial applications in crypto/blockchain that allow for users to interact with each other without a “middleman” (i.e. peer-to-peer trades).

What Is Crypto?

Cryptocurrency, or crypto, is a form of digital asset based on a network that is distributed across many devices. Cryptocurrency is decentralised and is not controlled by any single authority or group. Exchanges like Fulcrum are also decentralised, allowing crypto traders, stakers and lenders to connect.

How Do I Get A Fulcrum Crypto/Ethereum Wallet?

Getting a wallet to store your cryptocurrency is simple and easy. Many different websites offer such services, such as “Ethereum Wallet”, “AlphaWallet” and “MetaMask”. Creating a wallet is free on most websites or platforms.

Can I Use Crypto Just Like Normal Currencies?

Yes and no. Cryptocurrency is yet to be widely accepted as a means of making most day-to-day purchases, although this is changing. For the most part, you will have to sell your crypto, whether you made it on Fulcrum or not, for standard fiat currencies to make real-life purchases.

Are Cryptocurrencies Stable?

No. Cryptocurrencies are more volatile than standard currency, with the slight exception of “stablecoins”, which are pegged to a fiat currency to provide a centralised digital alternative. Fulcrum offers both cryptocurrency and stablecoin trading opportunities.

Top 3 Alternatives to Fulcrum

Compare Fulcrum with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Fulcrum Comparison Table

| Fulcrum | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 0.8 | 4.4 | 4.3 | 4 |

| Markets | Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $1 |

| Minimum Trade | $1 | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | Own | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | – | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Fulcrum and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Fulcrum | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | Yes |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Fulcrum vs Other Brokers

Compare Fulcrum with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Fulcrum yet, will you be the first to help fellow traders decide if they should trade with Fulcrum or not?