Firstrade Review 2025

Awards

- Best for ETF & Active Investor Commission & Fees - 2019

Pros

- Enhanced stock trading environment with overnight trading and fractional shares added

- Highly trusted US-regulated brokerage and SIPC member

- Excellent broker for budget-conscious traders with low OTC fees

Cons

- Visa credit/debit card deposits and withdrawals are not accepted

- Customer support still needs work following testing with no 24/7 assistance

- Firstrade focuses on stocks at the expense of forex, limiting diversification opportunities

Firstrade Review

Firstrade Securities is a leading US discount broker that offers thousands of trading products, including stocks, options, mutual funds, and cryptos. Commission-free investing, proprietary trading apps, and an instant execution model have made the online brokerage popular at home and with non-US citizens.

This 2025 review of Firstrade unpacks minimum deposits, account types, margin rates, withdrawal fees, customer service options, and more. Find out what our experts made of Firstrade.

Company Details

Firstrade Securities was founded in 1985 and is headquartered in Flushing, New York.

With almost 40 years of service, the brokerage has built a solid reputation, with a string of awards and acknowledgments from industry-leading publications, including Forbes.

Firstrade aims to be a one-stop investing solution, enabling customers to take control of their financial future. The broker offers self-directed investing with proprietary trading platforms and commission-free executions. Account holders also benefit from professional-grade analysis tools, extended hours trading, and a rich video library for beginners. The company also provides retirement IRA accounts.

Firstrade is regulated by the SEC. The company is also a member of FINRA/SIPC. Accounts are insured up to $500,000, though crypto holdings are not insured.

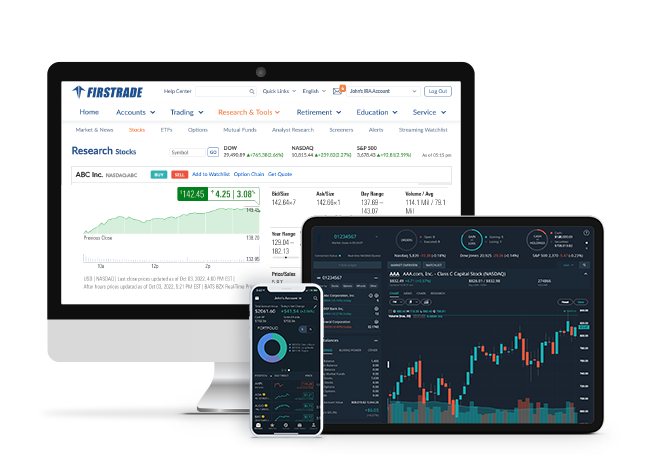

Trading Platforms

Firstrade offers three web-based trading platforms; WebTrader, Firstrade Navigator and Options Wizard.

WebTrader

Our experts were pleased with the stability and user-friendly design of the WebTrader. However, they were disappointed with the lack of customization available, particularly within the main desktop dashboard.

You can view a snapshot of your account, see daily market movers, and trade directly from the Order Entry Panel. But active retail traders may feel the platform lacks advanced analysis features. As a result, WebTrader is the best fit for beginners.

Firstrade Navigator

Firstrade Navigator allows day traders to manage their account and trade various assets within one screen.

You can add and drag market-related widgets with one click, access dozens of powerful technical studies, collapse columns and panels for an intuitive look and feel, and access live market data streaming. The pie chart summaries also show your overall account performance in a succinct view.

The advanced screener tool can also help narrow down your investment choices. Select from categories including large-cap growth stocks and other key trading criteria.

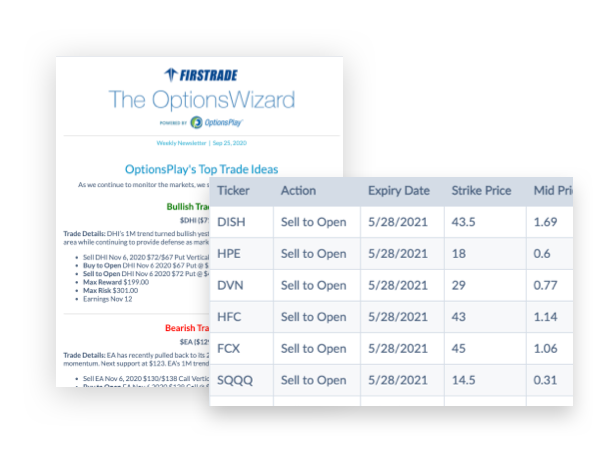

Options Wizard

Options Wizard is a specialty options analytics tool.

The platform offers profit and loss simulations, more than 65 technical indicators, fundamental rankings, and over 40 complex strategy models. The covered call income generator is also a useful tool to pinpoint the optimal call to sell or purchase against your current positions.

Retail clients also have access to the bespoke OptionsPlay score. The evaluation model indicates whether your proposed strategy is too risky vs the potential reward. An OptionsPlay ranking of below 100 means you are potentially taking on too much risk. Review the levels before opening a position.

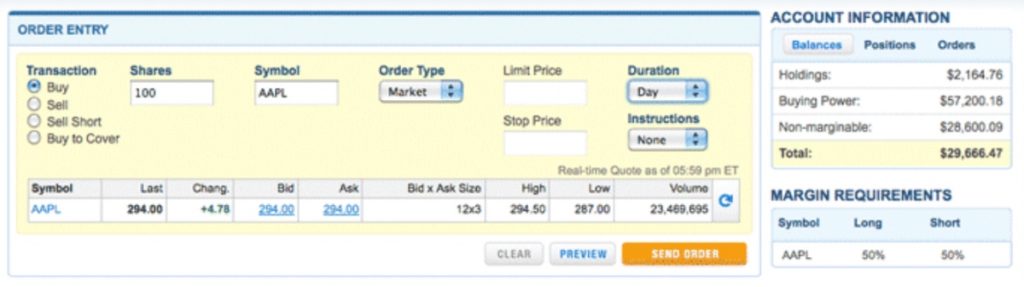

How To Place A Trade

For beginners, we would recommend placing orders via the Firstrade Securities Quick Bar tool.

The Quick Bar tool is positioned at the bottom of every screen within the WebTrader terminal. You can search for assets within the navigation bar, find price quotes, and track your account performance. It also won’t automatically close if you switch to another page.

- Select stocks or options from the menu on the left-hand side of the screen

- Search for the ticker/symbol in the top-left search bar

- Choose the trade type (buy, sell, sell short or buy to cover)

- Input the quantity

- Select the order type

- Add the limit/stop price if applicable

- Add instructions and the duration

- Click ‘Preview’

- Select ‘Send Order’

Firstrade guarantees trade executions in 0.1 seconds.

Products & Markets

Trading

Firstrade offers thousands of instruments:

- ETFs – Trade 2200+ commission-free exchange-traded funds including Vanguard, ProShares and WisdomTree

- Cryptocurrency – Speculate on the price of 38+ popular crypto assets including Bitcoin, Ethereum, Dogecoin, and Cardano

- Mutual Funds – Choose from over 11,000 listed mutual funds across different sectors and varying risk levels. An automatic investing plan is also available

- Fixed Products – Access long-term stability and hedging opportunities with fixed income vehicles. Products include Primary Market CDs, Treasury Bills, Notes & Bonds, and Municipal Bonds

- Stocks – Trade global stocks on the Nasdaq, NYSE, AMEX exchanges, or over-the-counter (OTC) markets. This includes large, mid, and small-cap firms, penny stocks and fractional stocks. Traders can also enrol in the broker’s dividend reinvestment programs

- Options – Trade options contracts with no contract charges. Options are available on the S&P 500 index, Morgan Stanley Consumer Index, and CBOE Volatility Index. Use the OptionsPlay analytics solution to find opportunities

On the downside, the broker does not offer forex or futures.

Retirement

Alongside traditional investment and trading opportunities, Firstrade offers no-fee IRA products:

- Roth IRA – Benefit from tax-free growth. Contributions are not tax-deductible, but earnings and qualified withdrawals are tax-free

- Traditional IRA – Gain tax-deferred savings. Contributions are tax-deductible and only taxed when you withdraw funds upon retirement

- Rollover IRA – Similar to the traditional savings IRA account. The Rollover IRA enables investors to consolidate retirement savings and possibly evade tax penalties

It is worth being aware of Good Faith Violations (GFV) when trading with Firstrade. A good faith violation occurs when you buy a security and sell it before the settlement date (transaction day+2).

The broker holds each Good Faith Violation on its account log for 12 months. A total of four strikes can be made within a year. After this, your account will be restricted, in which only settled funds are permitted to be used for purchases.

Fees & Charges

Trading Fees

When we used Firstrade, we were pleased with the pricing transparency. As well as no hidden charges, stocks, ETFs, options, and mutual funds can be traded commission-free. This is competitive vs Charles Schwab with a $0 online base commission + $0.65 per contract for options investments.

Fees for fixed-income bonds operate on a net yield basis.

Additional Services

Firstrade offers fee-free account maintenance including retirement account management. You can also access free real-time quotes, live stream pricing, and a dividend reinvestment plan (DRIP).

Withdrawal fees apply for international and domestic outgoing wire transfers. Currency conversion fees may also apply for deposits made outside of USD. Broker-assisted orders incur an average fee of $19.50.

There is no inactivity charge.

Regulatory Fees

Regulatory fees include a SEC charge ($22.90 for every $1,000,000 in sale proceeds), an Options Regulatory Fee (aggregate rate of $0.01815 per contract), and a French Financial Transaction Tax (FTT) on the purchase of certain French equities.

Margin Rates

Firstrade Securities offers margin loans to eligible day traders. Access additional funds to purchase securities with increased buying power.

But while Firstrade boasts some of the cheapest margin rates available; as low as 4.50%, our experts found this is only available on account balances of more than $1,000,000. A balance of up to $9,999 provides an industry base rate of +2% with an effective rate of 8.75%.

Retail clients must apply for a portfolio margin loan. You must demonstrate an understanding of the risks and benefits associated with trading on leverage. There is also a requirement that investors have a portfolio of $2,000 in their brokerage account.

Mobile App Review

Firstrade offers a mobile-compatible app, available for free download to iOS and Android devices.

The application offers all the powerful features and functionality of the desktop platforms in an interface compatible with smaller screens. You can track profits and losses in real-time, view pie chart account management data, see all asset data using horizontal scrolling, and access spark charts indicating a quick view of individual stocks within your portfolio.

Other features include:

- Create watchlists

- View full order history

- Enhanced trading workflow

- Consolidated portfolio dashboard

- Access user-friendly stock research pages

- Deposit and withdraw from live trading accounts

- Landscape mode compatibility for technical studies and advanced charting view

Useful integrated videos are also available within the app so you can learn how to place trades, manage your account and create a watchlist.

While using Firstrade’s mobile app, our experts were satisfied that it provided all the tools needed to trade on the move.

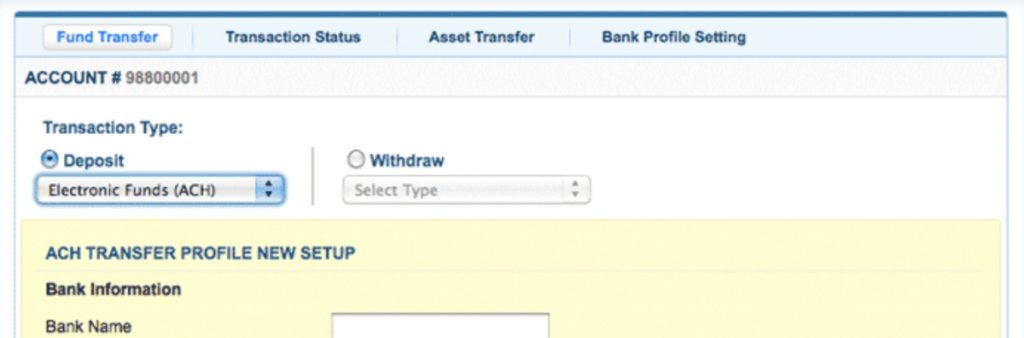

Firstrade Payment Methods

Deposits

Firstrade accepts payments via domestic and international bank wire transfers, ACH electronic transfers, checks, and financial asset transactions out of an alternative brokerage account. Firstrade does not accept debit/credit card payments including Visa, Mastercard, or Amex.

There is no minimum deposit requirement. There are also no fees to fund a live account, though third-party charges may apply.

It can take up to four working days for deposits made via ACH to clear. Bank wire transfers offer immediate processing, while checks can take up to five working days and asset transfers are available the following working day.

For wire transfers, account details including the bank routing number can be found on Firstrade’s website.

The online broker provides a provisional $1000 in buying power until funds are settled.

How To Transfer Money To A Firstrade Account

- Login to your profile

- Select ‘Accounts’

- Choose ‘Fund Transfer’

- Select ‘Electronic Funds (ACH)’ for example from the drop-down deposit menu

- Enter the deposit value

- Click ‘Submit’

Withdrawals

You can withdraw funds from your Firstrade account via bank wire transfer, check (US domestic accounts only), or ACH electronic transfer.

Typical withdrawal processing times are as follows:

- ACH Transfer – 5 business days from the date of deposit

- Asset Transfer – 30 days after the transfer completion date

- Check – Available 10 business days from the date of deposit

- Bank Wire Transfer – Available the next working day

- Withdrawal Of Sale Proceeds – Settlement period of T+2 with fund withdrawal then available immediately

ACH electronic transfer withdrawals requested before 1 PM (ET) will be submitted to Apex for same-day processing. Note, there is a wise withdrawal limit of $50,000 per day via ACH transfer.

How To Withdraw Funds From A Firstrade Account

- Login to your profile

- Select ‘Accounts’

- Choose ‘Fund Transfer’

- Select ‘Wire Transfer’ for example from the drop-down withdrawal menu

- Choose ‘Start’ if it is your first fund request. You will need to provide a verification code

- Complete the bank wire transfer request form

- Review via the ‘Preview’ tab

- Click ‘Submit’

Note, international and domestic bank wire transfer withdrawals are liable for a $25 fee.

Demo Account

Firstrade does not offer a demo account. This puts the broker at a disadvantage vs other major brokerages, including Interactive Brokers (IB), Webull, TradeStation, and eToro.

Deals & Promotions

Firstrade offers a sign-up deposit bonus for US residents. The cash bonus gives new users a $50 reward for depositing $5000+. The gratuity also increases as the deposit amount increases, with up to $4000 available to accounts loaded with $1,500,000.

Ongoing promotions include a $200 transfer rebate when you switch from another broker or a $25 wire transfer refund when you send money directly from your bank account. Firstrade also occasionally offers a referral program with 2 or 3 free stocks available per new verified account.

Note, bonus eligibility may vary between jurisdictions. Also, always review bonus terms and conditions before signing up.

Regulation & Licensing

Firstrade is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These are top-tier financial authorities with stringent compliance requirements for all registered companies.

Firstrade is also a member of the Securities Investor Protection Corporation (SIPC), which protects retail clients with up to $500,000 in compensation (including $250,000 of cash claims).

Additionally, the broker provides extra coverage via Apex Clearing Corporation. The firm purchased an insurance policy to supplement SIPC protection. This registration offers clients further securities protection including cash up to an aggregate limit of $150 million.

Firstrade Additional Features

Education

Day traders benefit from a wealth of educational resources. This includes a live market news stream, details of upcoming IPOs, and a glossary of key terms.

The education center is helpfully split into asset classes so you can access information relevant to your preferred instruments. There are also useful integrated videos to support your learning.

In addition, Firstrade offers online webinars and courses for both beginners and experienced investors. This includes a weekly morning market overview webinar to share trade ideas, discuss best practices and review key instruments of interest. You can also subscribe to the broker’s YouTube channel for the latest webinar updates.

Tools

There is no shortage of research tools at Firstrade. These include the latest news publications from Morningstar, PR Newswire, and Zacks. Also available are:

- Analyst Ratings – Access Morningstar ratings, reviews and reports from professional analysts

- Video Commentary – Daily, weekly, and quarterly video discussions on specific topics from trusted independent experts

- Screening – Fine-tune investment decisions with the predefined market screener, including on large-cap growth stocks

- Market Heatmap – Access a visual representation of bullish and bearish markets demonstrating a stock’s performance

- Fundamental Data – Explore detailed company statistics, Wall Street stock recommendations, and competitor trends

- Economic Calendar – Monitor upcoming events, announcements, and activities specific to your asset class or investment portfolio. This includes dividend publications, IPOs, organization splits, and earnings announcements

- FirstradeGPT – Added in 2024, novel-AI enabled market insights with information on global stocks and company-specific key performance indicators (KPIs).

- Trading Central – Added in 2o24, a firm favorite in the industry and with our experts for its advanced market research and trading ideas presented in a clear, easy-to-digest format.

Options Wizard

Firstrade’s Options Wizard program provides instant feedback on the potential success of a trade. The solution offers insightful data to help you formulate a prosperous options trading strategy. It uses historical data and plain language analytics to offer suggestions and trend indicators in a digestible manner.

With the Options Wizard, day traders can make use of support/resistance levels, profit & loss simulations, 65+ technical indicators, fundamental data rankings, and more. These can be used alongside the Options Trading 101 course, integrated videos, and webinars.

Securities Lending Income Program

Firstrade offers an additional income opportunity on fully-paid shares held in your cash account. When stocks in your account are identified as ‘in-demand’ products, they will be loaned out. You retain full ownership of the assets under management and you can sell the shares when you decide.

Interest rate income is accrued daily and credited to your account on a monthly basis.

You will need to enrol within your account dashboard to get started.

Account Types

Firstrade Securities offers several online trading accounts including investment profiles and retirement accounts. The most common solutions are the Individual Investment Account and the Traditional IRA Retirement Account.

You can link various accounts within one client portal and review all performance data from your dashboard.

Brokerage Account

Individual or Joint brokerage accounts with no minimum deposit. Access a wide selection of assets including stocks, cryptocurrencies, mutual funds, and options. All are available commission-free.

You can apply for an international account if you are a non-US citizen or resident without a Social Security Number (SSN) or Tax ID Number.

The broker complies with KYC and AML protocols, meaning you will need to provide identity verification to get started. This includes a copy of a passport, driving license, or state-issued ID (US residents only).

Retirement (IRA) Account

Long-term savings account to earn money for retirement in a tax-advantaged manner. Accrue retirement savings with a Traditional, Roth, or Rollover IRA.

A custodial account can be set up for a minor.

How To Open An Account

You can open a Firstrade international or domestic account in three minutes:

- Select the ‘Open An Account’ logo located along the navigation bar on the official website

- Add your contact telephone number to receive a verification code by text or phone call

- Enter your country of residency and country of birth

- Upload identity verification documentation

- Complete personal information including email address and employment status

- Provide additional information including annual income, investment experience, and financial objectives

- Select account features such as margin trading, options trading, and access to extended hours investments

- Create your individual user ID and password

- Confirm your account

Trading Hours

Trading hours will vary by instrument. The cryptocurrency market for example is open 24/7, 365 days a year. Alternatively, stock markets can be traded Monday to Friday.

Keep an eye on the market holiday schedule within the trading platform. Note, public holiday dates or market closures can cause volatility.

Extended Hours

A key advantage of Firstrade is its after-hours and pre-market trading opportunities with securities listed on the NYSE, NASDAQ, or AMEX exchanges. This means day traders can trade between 8 AM and 8 PM (ET) (vs regular market hours of 9 AM to 4 PM).

Firstrade has also announced plans to roll out overnight trading in 2025, further enhancing stock trading opportunities.

To place an extended hours trade:

- Login to your account using your registered credentials

- Select the ‘trading tab’

- Click on the ‘order entry’ panel

- Select the ‘duration’ dropdown navigation

- Choose either ‘pre-mkt’, ‘after-mkt’, or ‘day+ext’

Note, only limit orders are permitted.

Customer Service

A help center is available on the broker’s website with detailed articles regarding account management, trading rules, promotions, cryptocurrency, and more.

The question-and-answer forum is ideal for quick self-help support and guidance. Topics include how to buy, sell, or short stocks, how to trade options, how to close a Firstrade account, and how to set a stop loss on Firstrade. Alternatively, it is a good source of information for login problems, setting up a beneficiary, evaluating a total account value, why a platform is not working, crypto trading fees, tax documents, username queries, and more.

Alternatively, you can contact Firstrade on the methods below. Customer service office hours are Monday to Friday 10 AM to 4 PM (ET):

- Fax – 1-718-961-3919

- Live chat – Virtual assistant link via the ‘Contact us’ webpage

- Phone Number – 1.718.961.6600 (international), 1.800.869.8800 (US toll-free)

- Email – service@firstrade.com or find the online contact form via the ‘Contact us’ webpage

- Headquarters Address – Firstrade Securities, Inc, 30-50 Whitestone Expwy, Ste. A301, Flushing, NY 11354

The brokerage is also present on social media sites including Twitter, LinkedIn, and Facebook. Our experts confirmed that posts are frequently updated with the latest market and product information.

Security & Safety

Firstrade offers a safe and secure trading environment. The broker maintains physical and electronic personal information safeguarding systems that comply with federal standards. All data is protected with industrial-strength firewalls and encryption technology. The platform servers use Secure Sockets Layer (SSL) technology and digital certificate services to encrypt information exchanged between customers and the platform.

Intraday traders can enable two-factor authentication (2FA) as an additional security layer. The Firstrade ‘online protection guarantee’ states that the brand will restore an account if it is concluded that unauthorized transactions were made resulting in a loss, so long as relevant online protection measures are adhered to. Note this does not include any trading losses experienced or activities when login credentials were given to someone else or a third party.

Firstrade Securities Verdict

Firstrade has built a solid reputation, with almost 40 years of providing investment solutions. Its commission-free trading model and proprietary technology and apps are also appealing. Firstrade is regulated by the SEC, offers extensive education and market resources and permits extended trading hours.

Overall, Firstrade is an excellent discount broker for stock and options traders based in the US and abroad.

FAQs

What Is Firstrade Securities?

Firstrade Securities Inc is a US-based brokerage with headquarters in Flushing, New York. It provides commission-free investment opportunities on stocks, ETFs, mutual funds, options, and more. New traders can also get started with no minimum deposit requirement.

Is Firstrade A Chinese Company?

No, Firstrade is a US broker-dealer registered in New York. The company is regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Who Owns Firstrade Securities?

The company was founded in 1985 by John Liu as First Flushing Securities. Today it is a subsidiary of Firstrade Holding Corporation.

What Payment Methods Does Firstrade Offer?

You can fund your Firstrade account with domestic or international bank wire transfers, ACH electronic transfers, check, and financial asset transactions from other brokerage accounts, such as Robinhood. Incoming wire transfers to a Firstrade account are not accepted from any online money transfer services, including TransferWise or PayPal.

Does Firstrade Charge Fees?

Firstrade is a commission-free broker-dealer. Having said that there are some costs to be aware of, including regulatory charges, broker-assisted trades, exercise options, and some withdrawal fees. The broker is relatively transparent so you can view all potential costs before signing up. Alternatively, head to the ‘Fees & Charges’ section of our review.

Is Firstrade Safe And Legit?

Firstrade is a legitimate brokerage, offering investment services for almost 40 years. The company operates with top-tier regulation and provides tier-one security standards, including 2FA at the login stage.

Does Firstrade Offer Fractional Shares?

Yes, Firstrade added fractional shares in 2024.

As an alternative, Firstrade also offers penny stocks, suitable for those on a budget. These are available to traders from various locations, including non-US citizens.

Does Firstrade Offer Cryptocurrency?

Yes, the online brokerage offers 38 cryptos, including big names like Bitcoin (BTC) and Ethereum (ETH). Crypto investors can get started with $1.

Top 3 Alternatives to Firstrade

Compare Firstrade with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA – eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Zacks Trade – Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

Firstrade Comparison Table

| Firstrade | Interactive Brokers | eToro USA | Zacks Trade | |

|---|---|---|---|---|

| Rating | 4 | 4.3 | 3.4 | 3.9 |

| Markets | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, Options, ETFs, Crypto | Stocks, ETFs, Cryptos, Options, Bonds |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $2500 |

| Minimum Trade | $1 | $100 | $10 | $3 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA | FINRA |

| Bonus | Deposit Bonus Up To $4000 | – | Invest $100 and get $10 | – |

| Education | Yes | Yes | Yes | No |

| Platforms | TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | eToro Trading Platform & CopyTrader | Own |

| Leverage | – | 1:50 | – | – |

| Payment Methods | 4 | 6 | 4 | 3 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

eToro USA Review |

Zacks Trade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Firstrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Firstrade | Interactive Brokers | eToro USA | Zacks Trade | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | No | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | No | No |

| Oil | No | No | No | No |

| Gold | No | Yes | No | No |

| Copper | No | No | No | No |

| Silver | No | No | No | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | Yes | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Firstrade vs Other Brokers

Compare Firstrade with any other broker by selecting the other broker below.

Customer Reviews

4 / 5This average customer rating is based on 1 Firstrade customer reviews submitted by our visitors.

If you have traded with Firstrade we would really like to know about your experience - please submit your own review. Thank you.

Available in United States

Available in United States

I chose Firstrade because I’d heard good things and I could a transfer reimbursement. Only a few months in but I’ve found em easy to use and the $0 options fees keep pricing low and simple. Not wild about the platform – it feels a little 2010s but I can live with it. It’s good you can trade FANG stocks after houirs too.