FairMarkets Review 2024

Pros

- Demo account

- MT4 integration

- Low minimum deposit

Cons

- No copy trading

FairMarkets Review

FairMarkets is an Aussie-headquartered forex and CFD broker, regulated by the ASIC and FSC. The brand offers multi-asset trading opportunities on the MT4 and MT5 platforms, with access to a MetaTrader booster pack and Trading Central analysis. Spreads also start from 0.0 pips and there is no minimum deposit, making the firm popular with beginners.

This 2024 FairMarkets review will cover account options, platform features, fees, payment methods, and more. Find out if our experts recommend trading with FairMarkets.

Company Details

FairMarkets was established in 2012 and is based in Sydney, Australia. The broker was formed following an acquisition by Trive Investment B.V, an organization based in the Netherlands which owns multiple fintech companies.

FairMarkets operates through two key entities:

- FairMarkets Trading Pty Ltd – regulated by the Australian Securities & Investments Commission (ASIC)

- FairMarkets International Ltd – regulated by the Mauritius Financial Services Commission (FSC)

FairMarkets aims to provide a secure, fair and transparent environment for retail investors. 500+ instruments are available spanning forex, commodities, stocks, indices, and cryptocurrencies.

Users also benefit from execution speeds under 0.1 seconds while a range of payment methods are supported, including bank cards and e-wallets.

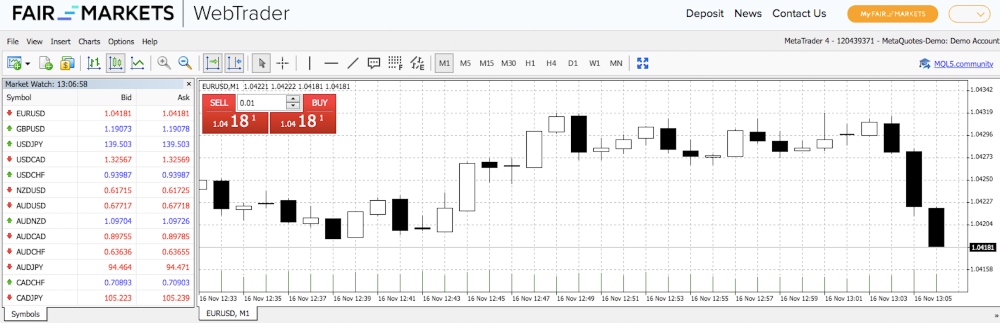

Platforms

FairMarkets offers two award-winning platforms; MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 and MT5 can be downloaded to either Windows, Mac, or Linux devices. Alternatively, you can use the terminals directly through all major web browsers.

The industry-recognized terminals offer a breadth of technical analysis features, custom graphs and charts, instant and pending orders, plus automated trading tools.

MetaTrader 4 is the better fit for beginners while MetaTrader 5 offers a wider range of analysis tools and order types for experienced investors.

MetaTrader 4

- VPS hosting

- Nine timeframes

- One-click trading

- Three execution types

- 30 built-in technical indicators

- Fully customizable and in-depth charts

- Four pending order types and trailing stops

- Direct access to Expert Advisors or build your own algorithms

MetaTrader 5

- 21 timeframes

- Trading signals

- 44 analytical objects

- Six pending order types

- One-click order execution

- MQL5 programming language

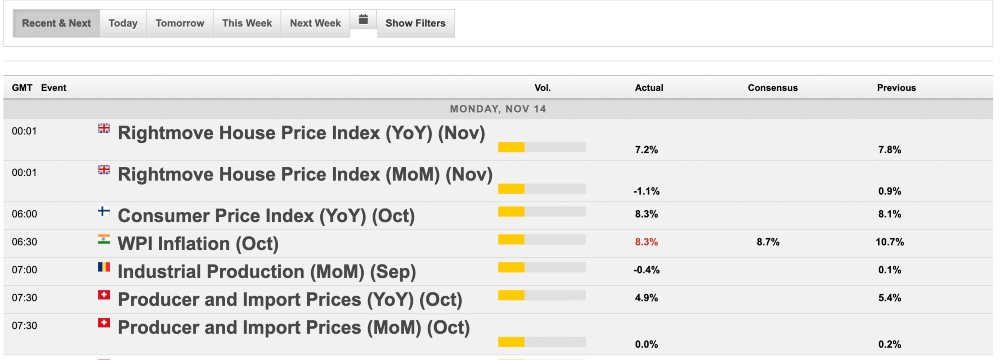

- Integrated economic calendar

- 38 built-in technical indicators

- Six pending order types and trailing stops

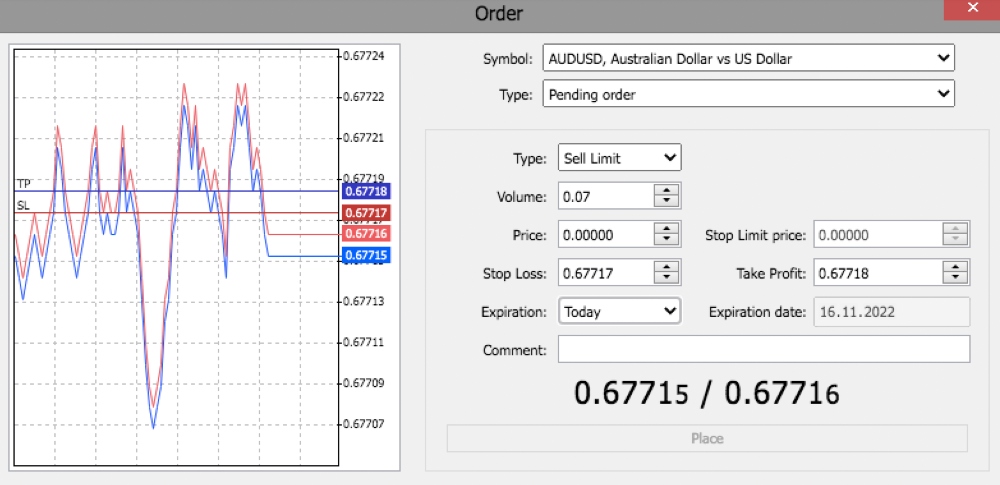

How To Place A Trade

- Download and open the MT4 or MT5 platform. Alternatively, log in via the WebTrader

- Select the asset you wish to trade using the drop-down menu or search bar

- Click on ‘new order’; the icon is located second from the left in the top navigation bar

- A ‘new order’ screen will then pop out. You can also execute trades directly from the chart

- Enter the trade details including order type (pending or instant), volume, and risk management parameters (take profit and stop loss)

- Select ‘buy’ or ‘sell’

- Confirm the order

Assets & Markets

FairMarkets offers 500+ global instruments:

- Invest in a variety of precious metals and energies including gold, silver and oil

- Trade stock CFDs on some of the world’s largest companies in the US, UK, and Europe

- Speculate on major and minor currency pairs including EUR/USD, GBP/USD, and AUD/CAD

- Trade on some of the world’s largest stock indices including the ASX200, FTSE100 and S&P500

- Take crypto positions across three digital currency USD crosses; BTC/USD, ETH/USD, LTC/USD

Spreads & Fees

FairMarkets offers fixed and variable spread models. Spreads on the Standard Fixed account start at 1.8 pips. Spreads on the Standard Variable account start at 1.2 pips. On the VIP Variable account, spreads start from 0.6 pips, but a $5000 minimum deposit is required. The Standard Fixed, Standard Variable and VIP Variable accounts all offer commission-free trading.

There is also a Raw Zero account with 0.0 pips alongside a $10 commission per lot.

There are no fees to open a new account or charges for inactivity. Swap fees apply for positions held overnight.

FairMarkets also hosts a ‘Market Information’ sheet on its website with details of average spreads and trading conditions by instrument.

Leverage Review

Clients signed up with FairMarkets can access high leverage, up to 1:1000 with stop-outs at 20%.

Note, trading with high leverage can increase profits but it can also amplify losses. Apply suitable risk management strategies.

FairMarkets Mobile Trading

Our experts found that FairMarkets does not currently offer a proprietary mobile app. This is a disadvantage versus competitors, many of whom offer their own copy trading solutions and forex apps.

Nonetheless, both MT4 and MT5 can be used on mobile devices, available on iOS and Android. You can manage your account, open and close positions, and customize charts while on the go. Set alerts and notifications to stay in the loop of market movers.

Payment Methods

Deposits

There is no minimum deposit required to get started with FairMarkets.

You can fund live accounts via credit/debit cards (Visa or Mastercard), bank wire transfers, Neteller, or Skrill. E-wallet and card payments typically support instant funding.

FairMarkets does not charge any deposit fees, but there may be third-party charges. Exchange rate fees may also apply if you are depositing in a currency other than your account base currency.

To make a deposit:

- Login to your account with the login credentials provided when you sign up

- Select the ‘Funds’ tab

- Select the account you want to add money to

- Choose the deposit method

- Enter the amount and complete the payment

Withdrawals

Profits can be withdrawn from your account balance using the original deposit method. However, you must verify your FairMarkets account before funds can be withdrawn.

The broker processes requests daily but the time taken for funds to be received will vary by payment method.

There are no withdrawal fees.

Demo Account

A free demo account is available to prospective traders. Practice trading forex and CFDs risk-free with up to $100,000 in virtual funds.

When we tested the FairMarkets paper profile, we were offered the MT5 terminal, however we could open a separate MT4 account once we registered. A simple online registration form is required and it took us less than 1 minute to apply.

Bonuses & Promotions

Clients trading with FairMarkets can opt-in to bonuses and promotions. The broker offers a 100% margin bonus and trading prizes, including electronic devices and high-end cars.

Note, always check the terms and conditions of joining bonuses as there can often be strict volume and withdrawal requirements.

Regulation & Licensing

FairMarkets International Ltd is authorized and regulated by the Mauritius Financial Services Commission (FSC), with Global Business Licence number GB21026295.

It is worth noting that this is not a tier-one regulator, meaning fewer recourse options for disgruntled customers.

The flip side is that the online broker can offer higher leverage and welcome bonuses.

Additional Features

Education

Educational content at FairMarkets is fairly limited, with no in-built learning academy often provided by competitors. Nonetheless, the broker does offer free e-books, prepared by industry experts which can be downloaded as PDFs straight to your desktop device.

For beginners, our experts recommend downloading the ’Basics of Trading’ e-book which has trade examples, step-by-step guidance on opening a position, and keyword definitions. For more advanced investors, consider the ’Building Strategies’ or ’Pivot Points’ e-books.

Alternatively, FairMarkets occasionally runs online webinar courses. Live content offers strategy ideas, projections for the forex and commodity markets, analysis of major economic events, plus Q&A sessions with experts. You can register for the broker’s webinars on their official website. If you cannot attend, you can also watch them on YouTube.

MetaTrader Booster Pack

An interesting tool pack is also offered by FairMarkets. The kit offers nine add-ons that can be integrated into your MT4 and MT5 platforms.

- Sentiment Trader – View the overall market emotion and historic sentiment of selected instruments

- Session Map – View upcoming events in your local time and analyze major price movements for market sessions with color-coded indicators

- Alarm Manager – Set alerts for activities/events that may impact your open positions. You can also set up an auto open and close trade function

- Correlation Matrix – This analyzes the correlation between instruments, helpful for diversifying portfolios. You can add and remove forex, indices, and commodities within the matrix and view different periods.

These features can be downloaded via the ‘Tools’ tab in the client portal. Simply follow the download instructions and restart your MetaTrader platform to get started.

Note, the package is only available to retail clients who deposit a minimum of $1,000.

Trading Central

FairMarkets customers also benefit from access to Trading Central. The leading provider of real-time research is a one-stop solution to support investment decisions. Access advanced analysis with easy-to-understand market data for better-informed decisions, view trading signals, and use automated investment tools including EAs.

- Alpha Generation – Integrated indicators with ‘Patent Recognition’ technology

- Adaptive Candlesticks – A market scanning tool that looks for chart patterns with informative comments

- Adaptive Divergence Convergence (ADC) – A powerful tool for short-term traders that spots market opportunities and suggests entry and exit points

- Analyst Views – View numerous daily updates based on your trading instruments. Observe directional outcomes, support levels, pivot levels, and alternative scenarios directly in your charts

Note that while Trading Central is available to all retail clients, with no minimum deposit requirement, you will need approval from the broker’s customer support team to get started.

FairMarkets also offers some useful calculators; a margin calculator, a profit calculator, and a currency converter. An economic calendar is also available with details of major news and significant dates.

FairMarkets Accounts

FairMarkets offer four trading accounts; Standard Fixed, Standard Variable, VIP Variable, and Raw Zero.

The Standard Fixed account offers straightforward access to the financial markets with fixed spreads and low fees on popular CFDs. There is no minimum deposit, commission charges, or additional fees, making it a good option for beginners.

The Standard Variable account offers similar trading conditions but with low and variable spreads. Depending on the asset and market conditions, the variable pricing structure can prove better value, though with less certainty.

The VIP Variable account offers leading trading conditions with no commissions. Users also benefit from premium charts and tools, including free access to a VPS.

The Raw Zero account is the best option for high volume forex traders. FairMarkets offers spreads from 0.0 pips on majors like EUR/USD with a $10 commission per lot. There is no minimum deposit requirement.

The minimum order size on all accounts is 0.01 lots and the maximum trade size is 100 lots. All accounts offer leverage up to 1:1000 apart from the VIP Variable account which is capped at 1:400. All accounts have a 20% stop-out.

How To Open A FairMarkets Account

When we used FairMarkets, we were pleased with how quick and easy it was to register for a new account:

- Select ‘Open Account’ found on the top right of each webpage (click either live or demo account from the dropdown)

- Complete the online registration form

- Select a live account within the client area (Aussie Premium or Standard)

- Verify your profile (this must be done before making a withdrawal)

- Make a deposit

- Start trading

The client portal is user-friendly. You can toggle between demo and live profiles, view deposit and withdrawal transactions and compare the available tools.

Benefits

While using FairMarkets, our experts found several benefits to registering for a live account:

- VPS

- 500+ assets

- Top-tier regulation

- Free price calculator

- $0 minimum deposit

- Spreads from 0.0 pips

- Commission-free trading

- MetaTrader booster pack

- MT4 & MT5 integration

- Free access to Trading Central

- <0.1 second execution speeds

Drawbacks

Our review also found several drawbacks to signing up with FairMarkets vs the competition:

- No halal account

- No weekend customer support

- No proprietary trading platform or mobile app

Trading Hours

Trading hours vary by instrument. The forex market, for example, is available 24 hours per day between Sunday to Friday. The broker’s ‘Market Information’ sheets provide useful trading updates including public holidays.

Remember you may be liable for overnight swap fees if you hold positions into the next day. The rollover time is at the end of the trading day in New York. All positions left open between 21:59:45 and 21:59:59 GMT will be rolled over to the following day.

Customer Support

Customer support is available 24/5. This includes via telephone, email, and an online contact form. The live chat service is available during business hours; Monday to Friday, 9 AM – 7 PM (AEST).

- Telephone – +61 2 7254 1437

- Email – support@fair.markets

- Live Chat – bottom right of each webpage

- Head office address – Level 26, 1 Bligh St, Sydney, NSW 2000

A comprehensive FAQ section is also available on the broker’s website. Questions are sorted by category including accounts, platforms, payments, and trading.

Security & Safety

FairMarkets uses industry-standard encryption technology to process client data. The broker’s payment portals also use well-known security protocols. In addition, users can activate two-factor authentication on the MetaTrader platforms.

FairMarkets Verdict

FairMarkets is a multi-asset broker offering 500+ instruments with no minimum deposit and spreads from 0.0 pips. The choice of trading accounts alongside access to useful extras like Trading Central and the MetaTrader booster pack, also means that FairMarkets is set up to meet the needs of both beginners and experienced traders.

FAQs

Does FairMarkets Have A Minimum Deposit Requirement?

There is no minimum deposit requirement to open a FairMarkets account. This makes the online broker a popular option for beginners and those on a budget.

What Trading Platforms Does FairMarkets Offer?

FairMarkets provides trading through MetaTrader 4 and MetaTrader 5. Both platforms can be downloaded to desktop devices or used via web trader terminals. The MT4 and MT5 platforms are also compatible with mobile devices.

Is FairMarkets A Good Broker?

FairMarkets is a legitimate online broker offering a stable and secure trading environment. It is good to see top-tier regulatory oversight, various analysis tools, and award-winning platforms. See our full review for our experts’ findings.

Does FairMarkets Offer A Demo Account?

Prospective traders can open a free demo account. Access up to $100,000 in virtual funds to practice trading risk-free. Register on the broker’s website via the ’Open Account’ logo found on the top right of each webpage.

Is FairMarkets Regulated?

Yes. FairMarkets Trading Pty Ltd is regulated by the Australian Securities and Investment Commission (ASIC). FairMarkets International Ltd is regulated by the Mauritius Financial Services Commission (FSC).

Top 3 Alternatives to FairMarkets

Compare FairMarkets with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

FairMarkets Comparison Table

| FairMarkets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Stocks, Forex, Commodities, Indices, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, FSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (Aussie Retail), 1:500 (Aussie Pro), 1:1000 (Global) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by FairMarkets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FairMarkets | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

FairMarkets vs Other Brokers

Compare FairMarkets with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of FairMarkets yet, will you be the first to help fellow traders decide if they should trade with FairMarkets or not?