Fair Forex Review 2024

Fair Forex Review

Established in 2019, Fair Forex advertises itself as one of the most transparent and reliable trading brokers. However, there are certain factors that investors should consider when attempting to gauge a broker’s reliability and trustworthiness. This review assesses the merits and drawbacks of Fair Forex, and gives an overview of where the broker stands in terms of fairness to clients, regulation, mobile apps, jurisdiction, login security, and withdrawal constraints. Find out whether to open a Fair Forex trading account.

Fair Forex Headlines

Fair Forex Ltd, or Fair Forex FX is an offshore global trading brokerage registered in both Saint Vincent and the Grenadines (SVG) and Vanuatu. The broker offers trading in CFDs, cryptocurrencies, indices, stocks, commodities, and currency pairs.

The firm was founded by entrepreneur and philanthropist Krissy Jones in 2019, and presents itself as a ‘true ECN broker’. As the owner, Jones has stated that she founded the company with the aim of creating the first truly transparent forex brokerage. But as the company is still relatively new, there are not many user reviews available online which makes it difficult to assess the truth of Jones’ statement.

Like many traditional brokers, Fair Forex offers MetaTrader 4 and MetaTrader 5, plus cTrader. These are the most popular and functional trading platforms, with MetaQuotes being among the first to offer an online forex trading platform to retail traders. The broker also facilitates trade execution in under 50ms.

Fair Forex offers a wide range of trading accounts to its customers. These include Multiple-Account Manager (MAM) investment accounts managed by professional traders and automated trading accounts.

Trading Platforms

Fair Forex provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) software, two frontrunners due to their wide range of features and user-friendly interface. The cTrader terminal is also available.

Both MT4 and MT5 come with highly advanced technical analysis tools, in-depth charts, and easily placeable orders. They are available for download using Windows, Apple, and Android as well as being available in various online browsers.

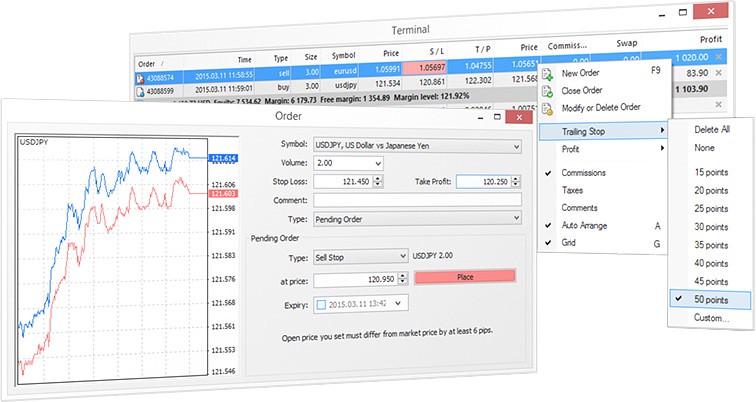

MetaTrader 4

MT4 has a long-standing reputation for being the best trading software in the industry, and is one of the most popular platforms used by traders.

Through the use of MT4, Fair Forex is able to offer traders 30 built-in technical indicators, 23 analytical objects, 3 execution modes, and real-time market prices. MT4 also comes with options for automated trading through Expert Advisors (EAs), interactive charts, and 2 market orders.

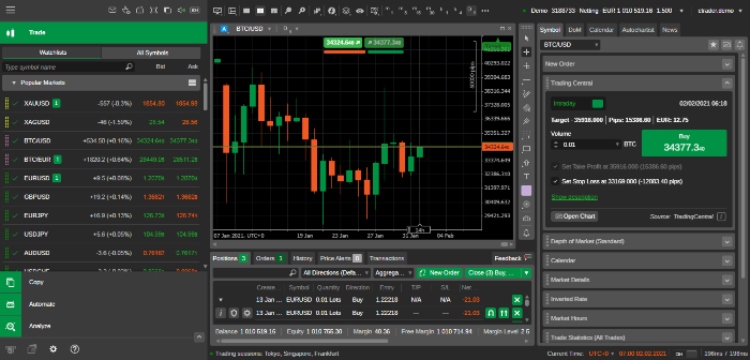

MetaTrader 5

MT5 is also offered by Fair Forex. This gives traders access to the latest version of the MetaTrader software by MetaQuotes.

Although it is not as popular as MT4, MT5 provides clients with the user-friendly interface that they are accustomed to, with additional advanced features including compatibility with multiple devices, more than 80 technical indicators, sophisticated analytics, plus charting options such as line, bar, and candlestick.

MT5 users also get access to a large selection of custom indicators and automated trading strategies that are shared in the MetaQuotes marketplace.

cTrader

Fair Forex also offers the cTrader platform. Available via software download or on major web browsers, the trading terminal offers a string of useful features, from price alerts and built-in indicators to advanced take profit levels, trailing stops, news calendars, and multi-window views.

The solution also offers copy trading. Master traders can broadcast their positions and strategies for a commission while newer traders can learn from seasoned investors. Clients can also keep their own risk management parameters.

Assets & Markets

Fair Forex offers a wide range of trading assets:

- 40+ currency pairs

- 60+ stocks on the NASDAQ and NYSE exchanges

- 10+ indices on markets such as the VIX75, US30, S&P500, UK100

- 15+ commodities including energy, agriculture and metals

- 15+ cryptocurrencies including Bitcoin and Dogecoin

Fair Forex Payment Methods

Before you open an account, familiarize yourself with any deposit and withdrawal guidelines, as well as the fees that are charged for each transaction.

Deposits

The lowest minimum deposit to begin trading on Fair Forex is $50. However, the deposit requirements vary depending on the kind of account you are opening. For the Raw Spread and Standard accounts, the minimum deposit remains at $50. For the Pro account, you must deposit at least $10,000, and for the Enterprise account, it’s $250,000.

Fair Forex allows you to deposit money into your account via bank transfer, debit and credit card (Visa, MasterCard), as well as through Bitcoin, Ethereum, VLoad, and PayPal.

Withdrawals

Several payment methods are accepted by the broker for withdrawing funds, including Bitcoin, Ethereum, wire transfer and PayPal. Fair Forex states that for all withdrawal methods except credit cards, transfers are instant.

When withdrawing directly to your bank account, you will have to pay a $35 processing fee, regardless of the amount you are withdrawing. Furthermore, when using Bitcoin to withdraw funds, Fair Forex state that “fees vary,” but no more specification is given. There are no fees for any other withdrawal type, except a 20% fee that will be charged if you withdraw your deposit without making any trades first.

When withdrawing using Visa or Mastercard, it can take between two and five days, but for all other withdrawal methods, traders can expect the transfer to take place on the same day. The minimum withdrawal is $50.

The high withdrawal fees with several of the payment options are a real drawback versus competitors.

Bonuses & Promotions

There is a bonus promotion offered by Fair Forex, designed to attract traders to sign up. However, investors must meet the requirements of a high trading turnover to withdraw any of their funds from the welcome bonus.

There is also a clause in the terms and conditions stating that if traders do not meet withdrawal requirements for the bonus, then the broker can cancel the withdrawal request completely. This is a common technique used by brokers to mislead traders, and it’s why many financial regulatory bodies have banned regulated brokers from offering promotional bonuses.

If you are willing to risk depositing your funds with an unregulated brokerage, it is recommended that your first deposit is only for the minimum amount required. The next step is to try and withdraw a small sum of money to ensure there are no hidden fees or delays that are charged unexpectedly when you try to take out money. If there are hidden fees or delays that have not been disclosed in advance, it is not advisable to use Fair Forex any further.

Leverage

Leverage on Fair Forex can go as high as 1:500, however leverage should always be treated with caution. High leverage can make large profits for clients if the trade goes well, but also a significant amount of capital can be lost. For this reason, regulatory bodies tend to cap leverage offered by retail brokers. This does not apply to Fair Forex as they are unregulated.

Typically speaking, a reputable and reliable broker would not offer leverage that exceeded 1:30 on standard accounts. Those that do offer higher leverage are usually aiming it at more experienced traders.

Account Types

Fair Forex allows users to open four different account types: a raw spread account, a standard account, a pro account, and an enterprise account. The difference between these account types is the available spread, leverage, minimum deposit amount, and commission rates. All of the accounts allow trading on the same assets.

The key differences, therefore, are in the minimum and maximum lot sizes, the commission per lot, the leverage, and the spreads. Below is an overview of how these differ:

Raw Spread Account

This is where the lowest spreads can be found, and it’s also where traders pay the highest commission. This means that for independent traders, the Standard Account is likely to be a better deal.

- Spreads from 0.0 pips

- $6 commission per lot

- Minimum lot size of 0.01

- Maximum leverage of 1:500

- Minimum deposit: $50

Standard Account

The Standard Account offers a significantly better deal for smaller traders. 0.8 pips are offered on the most liquid trading pairs with no commission fee.

- Spreads from 0.6 pips

- No commission

- Minimum lot size of 0.01

- Maximum leverage of 1:500

- Minimum deposit: $50

Pro Account

The Pro Account also offers low spreads with lower commissions than the Raw Account, but the minimum deposit amount is much higher.

- Spreads from 0.0 pips

- $5 commission per lot

- Minimum lot size of 0.1

- Maximum leverage of 1:500

- Minimum deposit: $10,000

Enterprise Account

The Enterprise Account offers low spreads and even lower commissions than the others, as well as lower leverage. However, the minimum deposit amount is the highest of any account offered by the broker.

- Spreads from 0.0 pips

- $4 commission per lot

- Minimum lot size 1

- Maximum leverage of 1:100

- Minimum deposit: $250,000

Note, a swap-free, Islamic-friendly trading account is also available.

Demo Account

Fair Forex offers a free demo account with a quick and easy sign-up form so that users can test their strategies and practice trading through both MT4 and MT5.

After registering for an account, users can open a trading tab and begin testing. The demo account is a good opportunity to see if you are satisfied with the services offered by Fair Forex before using real funds.

Demo accounts are available for all of the account types offered by Fair Forex.

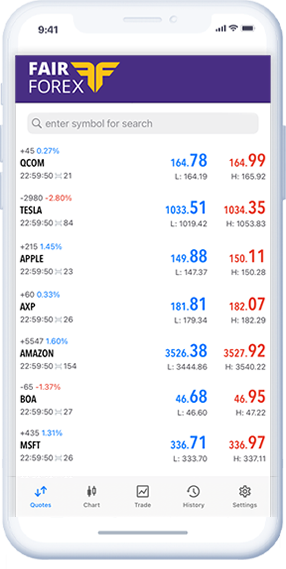

Mobile Trading

Mobile trading is possible on Fair Forex using both iOS and Android, as long as you are using MT5. Despite the fact that app use is permitted within MT4, you cannot use mobile trading with MT4 via Fair Forex.

The mobile trading app offers one-click trading, interactive charting, and a selection of instant and pending orders. Deposits and withdrawals can also be made using the mobile app and customer support can be contacted.

Benefits Of Fair Forex

- User-friendly trading platform with lots of features

- Positive customer reviews on Trustpilot

- Supports the use of MT4 and MT5

- True ECN broker

- Signal providers

- Welcome bonus

- Crypto deposits

Drawbacks Of Fair Forex

- Lack of robust regulation

- High leverage increases risk

- Difficult terms of bonus withdrawal

- Lack of educational resources and tutorials

- Excessive withdrawal fees and complicated rules

Regulation & Security

Fair Forex is owned by an SVG-based company operating under the name Fair Forex Ltd. They are regulated by the SVGFSA (St. Vincent and the Grenadines Financial Services Authority) and the VFSC (Vanuatu Financial Services Commission). These regulatory bodies offer little protection to investors in comparison to top-tier regulatory bodies like the Cyprus Securities and Exchange Commission (CySEC).

Both SVG and Vanuatu are offshore zones that have little regulation. Furthermore, SVGFSA operates by registering financial companies and then having them opt out of further regulation.

SVG has publicly stated that they do not regulate forex trading, and that they only oversee banking and insurance activity. Therefore, Fair Forex is not a regulated broker. Trading with a brokerage that is based offshore and unregulated is risky for traders, as the broker can offer no guarantee to keep user funds safe. There is no insurance policy should the company face bankruptcy, and traders could permanently lose access to their funds.

Due to the lack of regulation, Fair Forex is under no legal obligation to be honest with its claims like companies in countries such as the UK or the US are. This means that anything they claim to be true must still be investigated by the trader.

If you are looking for a secure trading brokerage, it is best to choose a forex broker that is highly regulated. Unregulated brokers cannot guarantee that you will always be able to withdraw your funds, or that your funds will be safe in the case of bankruptcy.

Customer Service

The Fair Forex support team is available to answer queries via phone number and email, and also by joining a chat group on the Telegram app. The broker does not state its operating hours for support so it’s unlikely that they offer 24-hour coverage.

Users also have the option to access the Help Center Blog which aims to answer common questions.

Fair Forex Verdict

Fair Forex does offer some useful trading tools and supports the use of MT4 and MT5, which could be attractive to prospective traders. However, there are some key issues that should be taken into account by anyone considering signing up with this broker.

Fair Forex is an unregulated brokerage, which means there is no guarantee that your funds are safe. There is no protection for you as a user if something goes wrong, and you could permanently lose access to any capital that you deposit onto the trading platform. There are also high withdrawal fees and limited educational tools for beginners. As a result, we would recommend signing up with an alternative provider listed below.

FAQs

Is Fair Forex Legitimate?

There are many factors that cast doubt on the legitimacy of Fair Forex. The key factor is that the broker is not sufficiently regulated. This means that there are no legal guarantees that traders’ funds are safe on Fair Forex. With that said, the brand does have a long list of good reviews on forums like Trustpilot.

Is Fair Forex Regulated?

Fair Forex operates in two offshore locations: Saint Vincent and Grenadines and Vanuatu. The regulatory bodies in both locations do not regulate forex trading. This means that the broker is not required to be honest about what they promise traders. It also means that there are no guarantees that your deposited capital is protected.

What Platform Does Fair Forex Use?

Fair Forex offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular and well-known trading platforms available on the market. The cTrader terminal is also available to account holders.

What Instruments Can I Trade On Fair Forex?

Fair Forex offers a wide range of underlying assets for trading, including cryptocurrency, stocks, and currency pairs.

What Payment Methods Does Fair Forex Support?

You can withdraw and deposit capital on Fair Forex using credit and debit cards, PayPal, VLoad, plus Bitcoin and Ethereum.

Top 3 Alternatives to Fair Forex

Compare Fair Forex with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

Fair Forex Comparison Table

| Fair Forex | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4 | 4.3 |

| Markets | CFDs, Forex, Stocks, Cryptos, Commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $0 | $1 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | SVGFSA, VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Bonus | – | – | 100% Deposit Bonus | – |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5, cTrader | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:500 | 1:30 (Retail), 1:250 (Pro) | 1:1000 | 1:50 |

| Payment Methods | 7 | 6 | 10 | 6 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

World Forex Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by Fair Forex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Fair Forex | IG | World Forex | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | No |

Fair Forex vs Other Brokers

Compare Fair Forex with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Fair Forex yet, will you be the first to help fellow traders decide if they should trade with Fair Forex or not?