Exinity Review 2024

- Daytrading Review TeamExinity's competitive ECN pricing, excellent range of forex pairs and high leverage makes this a great choice for dedicated forex day traders.

Exinity provides flexible low-cost trading in FX, commodities, indices and equities alongside unique education and support provided by teams located across the world. Now operating in the Middle East, through regulation from the Financial Services Regulatory Authority in Abu Dhabi and the Financial Services Commission of Mauritius, Exinity provides a range of services to traders and investors looking for new opportunities in the financial markets.

Forex Trading

Exinity offers 150+ forex pairs to trade on a very competitive ECN pricing model, with spreads from zero and low commissions of $4 per round turn. Traders can access the powerful MT4 and MT5 platforms and trade with no restrictions on popular day trading strategies.

Stock Trading

Exinity clients can speculate on shares from US and Hong Kong companies. Traders can choose between trading stock CFDs or directly buying stocks in large firms commission-free. On the negative side, there are no equities from European and UK markets.

CFD Trading

Trade CFDs on forex, stocks, indices, energies and metals with fast execution and variable leverage. Spreads are tight and commission-free trading is available on some assets.

✓ Pros

- Very wide range of forex pairs, with 150+ on offer

- Excellent pricing with spreads starting from zero and just $2 per lot in commissions

- Leverage up to 1:2000 for traders with an appetite for risk

- No restrictions on day trading strategies such as scalping

- Supports MetaTrader 4 and MetaTrader 5 platforms

- Hold positions swap-free for up to 7 days

- 24-hour customer support

✗ Cons

- No cryptocurrency trading available

- Does not accept traders from the US

- No bonus schemes

Exinity is a multi-asset online broker based in the UAE, Middle East & North Africa (MENA). The broker focuses on retail investing and trading, combining risk-driven speculation with convenient technology. Our review will cover the account types available at Exinity, capital requirements, trading platforms, customer contact details and more. See what our experts have to say about Exinity.

Exinity Headlines

Exinity is a part of Exinity Group, a global wealth management organization with decades of experience in trading and investment.

The Group is home to its retail businesses including Exinity, Alpari International (Alpari Group) and ForexTime (Exinity Limited FXTM), brokerage firms with millions of clients worldwide.

Exinity (the name combines the word ‘exchange’ with the word ‘infinity’) encapsulates the brand’s core belief in trading – the exchange of value – as a vital engine of prosperity.

The company believes that the way to create returns over time is to combine longer-term investments with short-term higher-risk trading that offers the potential for returns in various market conditions.

The broker provides trading opportunities in the Middle East through regulation from the Financial Services Regulatory Authority (FSRA) in Abu Dhabi and the Financial Services Commission (FSC) of Mauritius.

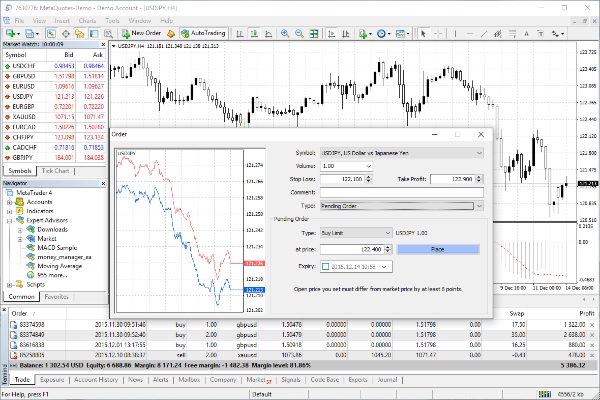

Trading Platforms

The firm offers MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both are industry-recognized platforms available for free download to PC desktop devices and compatible via all major web browsers.

MetaTrader 4

- 9 timeframes

- Live news streams

- Customizable charts

- 4 pending order types

- Copy-trading available

- Analysis of quote dynamics

- MQL4 programming language

- 30+ built-in technical indicators

- Access to Expert Advisors (EAs)

- Ability to overlay analytical objects

- User-friendly, multilingual interface

MetaTrader 5

- 21 timeframes

- One-click trading

- 6 pending order types

- Built-in virtual hosting

- Copy-trading available

- Integrated market news

- 4 order execution modes

- Built-in economic calendar

- 36 built-in technical indicators

- Sentiment and economic calendar

- Set stop loss and take profit levels

- Enhanced order management capabilities

- Customizable charts, view up to 100 simultaneously

Both MetaTrader platforms are available in 10+ languages.

Assets & Markets

The company offers clients trading opportunities in the following global markets:

- Indices: speculate on 30+ index CFDs, long or short

- Forex: 150+ FX pairs across major, minor and exotic currencies

- Stocks & Stock CFDs: available on popular US and Honk Kong shares

- Commodities: speculate on metals and energies including gold, silver, and oil

Cryptocurrency trading is not currently offered by Exinity.

Fees

The broker does not charge a commission for any trading activity across stocks (including stock CFDs), energies and indices. A $2 per lot commission applies on forex pairs and metals trades.

Exinity spreads are competitive, with ECN-level pricing. Typically these are 0 pips on major forex pairs like EUR/USD and USD/JPY. ECN spreads on US stocks are variable, for example, 1 pip on Apple and 7 pips for Visa. Contract specifications can be found on the broker’s website or directly on its trading platforms.

Investors can be assured of no additional account management and data fees if trades are executed at least once per month. Upon testing, we found the broker offers swap-free investing on positions held for up to 7 days.

Leverage

Exinity offers flexible leverage rates that can be selected at account opening. Maximum leverage opportunities vary by account type, though a breakdown of initial rates is given below. Bear in mind that some financial jurisdictions may limit the maximum leverage you can access.

Three maximum leverage levels exist:

- World account: 1:1000

- Trader account: 1:2000

- Trader Pro account: 1:500

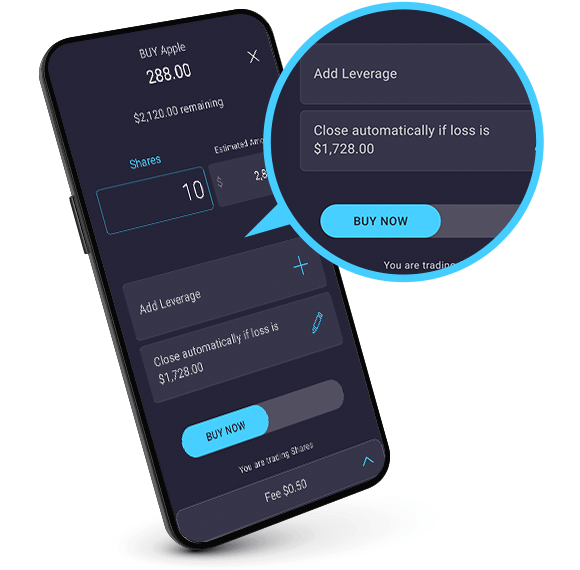

Mobile Apps

MetaTrader 4 and MetaTrader 5 are both available as mobile applications. The apps are free to download for Apple (iOS) and Android (APK) devices. They do not quite offer the same functionality as the desktop clients, limiting some analysis tools, indicators and charting customization options, though the overall functionality is very competitive for mobile platforms.

Payment Methods

This depends on the account. Overall, traders can deposit and withdraw funds from an Exinity account using Neteller, credit and debit cards and bank transfers. The broker does not accept cash deposits.

Most payments happen instantly, but if a withdrawal or deposit via bank transfer this can take up to 5 days.

Bonus & Promotions

The broker does not provide any bonuses or promotions, however, the brand has an extensive array of educational material to help investors get started.

Demo Account

No demo account is provided for traders to learn how to invest without risking their capital. The World account, however, has a minimum deposit of only $20. If customers wish to get the real market feeling without spending too much money, this is a good option, but there are other brokers that offer a trial account free of charge.

Regulation & Licensing

Exinity Group Limited has regulations across several countries of service. This includes authorization by the Financial Services Regulatory Authority (FSRA) in the UAE to offer the Pro Trader platform.

Other regulatory approval includes the Financial Conduct Authority (FCA) in the UK, Financial Services Commission (FSC) in Mauritius, and Capital Market Authority (CMA) in Kenya, East Africa. Card transactions are regulated by Cyprus laws because Exinity Services Limited (EU merchant company) is incorporated in Cyprus.

Exinity Ltd follows stringent compliance measures and traders should feel assured that client funds are held in segregated banks.

Additional Features

There are various additional education and analytical insights available to traders. This includes commentary from expert analysts highlighting trade ideas and what’s driving current market conditions. The commentary also has company news expectations and announcements.

Online workshops are available via the broker’s website. These are ideal for new and experienced traders, designed to build trading knowledge from market specialist knowledge.

A blog is available on the broker’s website for the latest news across the Exinity Group. Stay up to date with broker developments, market news, and economic publications.

Account Types

Exinity currently offers three trading accounts. Base currencies are available in either USD or AED.

Key features are as follows:

World

- Platform: app

- Analyst sentiment

- Minimum initial deposit $20

- No personal account manager

- Regulated by FSC in Mauritius

- No technical and algorithmic trading

Trader

- No analyst sentiment

- Platform: app & desktop

- No personal account manager

- Minimum initial deposit $100

- Regulated by FSC in Mauritius

- Technical and algorithmic trading

Trader Pro

- No analyst sentiment

- Platform: app & desktop

- Regulated by FSRA in the UAE

- Minimum initial deposit $10,000

- Technical and algorithmic trading

- Personal account management from a dedicated team in Abu Dubai

To open a Pro account you will need to provide identity verification, proof of address and evidence of net assets of at least $500,000. With that said, these may not be required if clients have sufficient trading experience or relevant industry documents. Applications are processed within 24 hours of completed documents being received by the broker.

All accounts also benefit from the following:

- ECN pricing

- 24 hour support

- Scalping opportunities

- Risk management tools

- Swap-free, halal trading

- Market insights and analysis from experts

- Commission-free trading on stocks, energies, indices and stock CFDs

Trading Hours

The brokerage follows standard office hours and 24-hour trading times, Monday to Friday. However, these timings may vary by instrument. Exinity publishes upcoming changes to trading hours, including public holidays, on its website.

Contact Details

Support is available 24 hours a day Monday to Friday, then 9 am to 2 pm on Saturdays, and 10 am to 6 pm on Sundays (all GMT).

- Email: Visit the Contact Us page

- Contact Number: +971 2418 0300

- Live Chat: logo at the bottom right of each webpage

- Address: 16-104, 16 Floor, Al Khatem Tower, ADGM Square, Al Maryah Island, Abu Dubai, UAE

Note that Exinity Group has an office presence in London under the name Exinity Works UK LTD. You can also find it on the Companies House website. However, the Group in Lagos with the same name is not part of the corporation; meaning they are different firms.

Safety & Security

The Exinity Group presents a high standard of security protocols in place for traders with positive reviews. Personal area and portal access are password protected. Secure login protection is also present for the MT4 and MT5 platforms, with high-tech encryptions and industry-standard data privacy.

Exinity Verdict

Exinity offers a competitive investing environment with an ECN pricing structure, industry-renowned platforms and swap-free, halal trading.

There is a variety of accounts to suit all client needs across the board. The Pro Service is advanced and aimed mostly toward experienced investors, requiring evidence of trading experience and a large minimum deposit. The World account offers the lowest deposit, while the Trader version has the highest leverage of 1:2000. The broker is globally regulated and provides 24/5 support.

FAQs

What Trading Platform Does Exinity Offer?

Exinity offers industry-established MetaTrader 4 and MetaTrader 5 terminals. These boast advanced features, including technical indicators, customizable interfaces and sophisticated graphs and charts.

Is Exinity Regulated?

Yes, Exinity Limited is regulated by several established financial bodies. This includes the Financial Services Regulatory Authority (FSRA) in the UAE, Financial Conduct Authority (FCA) in the UK, Financial Services Commission (FSC) in Mauritius and Capital Market Authority (CMA).

Can I Trade With Leverage With Exinity?

Exinity offers flexible leverage depending on the account type, which can be selected at sign-up. This can go as high as 1:2000 for the Trader account.

Does Exinity Group Have Global Presence?

Yes, the Exinity Group has a global presence, offering financial services to investors across the world. The broker’s office network includes Hong Kong, Yerevan in Armenia and Abuja, Nigeria.

What Customer Service Options Does Exinity Offer?

Exinity offers several customer support options available 24/7, Monday to Friday. This includes email, telephone and live chat via the website. While using Exinity, our experts were pleased with the fast response times and knowledgable customer service representatives.

Top 3 Alternatives to Exinity

Compare Exinity with the top 3 similar brokers that accept traders from your location.

-

Pepperstone – Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Go to Pepperstone -

Swissquote – Swissquote is a Switzerland-based bank and broker that offers online trading and investing. The company has a high safety score and is listed on the Swiss stock exchange. The firm offers a huge range of products, from stocks, ETFs, bonds and futures to 400+ forex and CFD assets. Hundreds of thousands of traders have opened an account with the multi-regulated brokerage. Clients can get started in three easy steps while 24/7 customer support is available to assist new users.

Go to Swissquote -

FP Markets – FP Markets is an ASIC- and CySEC-regulated broker that offers forex and CFD trading on a broad range of assets through the MT4, MT5 and IRESS platforms. With trading available through standard and raw spread accounts on thousands of international stocks, forex, indices, commodities, cryptocurrencies, bonds and ETFs, this broker has some of the most comprehensive market coverage available. FP Markets also offers a full range of additional features, including educational resources and access to powerful software such as Autochartist.

Go to FP Markets

Exinity Comparison Table

| Exinity | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| Rating | 3.4 | 4.8 | 4 | 4 |

| Markets | Stocks, Stock CFDs, Forex, Commodities, Indices | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | Forex, CFDs, Indices, Stocks, ETFs, Bonds, Options, Futures, Cryptos (location dependent) | CFDs, Forex, Stocks, Indices, Commodities, Bonds, ETFs, Crypto |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $20 (World), $100 (Trader), $10,000 (Trader Pro) | $0 | $1000 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | FSRA, FCA, FSC, CMA | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB | FCA, FINMA, DFSA, SFC | ASIC, CySEC, ESMA |

| Bonus | – | – | – | – |

| Education | Yes | Yes | No | Yes |

| Platforms | MT4, MT5 | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | MT4, MT5, AutoChartist, TradingCentral | MT4, MT5, cTrader, TradingView, AutoChartist, TradingCentral |

| Leverage | 1:2000 | 1:30 (Retail), 1:500 (Pro) | 1:30 | 1:30 (UK), 1:500 (Global) |

| Payment Methods | 6 | 11 | 5 | 9 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Pepperstone Review |

Swissquote Review |

FP Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by Exinity and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Exinity | Pepperstone | Swissquote | FP Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | Yes | Yes |

| Corn | No | Yes | No | Yes |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | No | Yes | Yes |

| Options | No | No | Yes | No |

| ETFs | No | Yes | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | Yes |

Exinity vs Other Brokers

Compare Exinity with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Exinity yet, will you be the first to help fellow traders decide if they should trade with Exinity or not?