eToro To Introduce Extended Hours Trading On 100 US Stocks

eToro is launching pre- and after-hours trading on 100 major US equities, including Apple, Tesla, and Nvidia.

This follows other big brands like CMC Markets, Firstrade, and Plus500, which have all added extended hours trading in the last 12 months.

Key Takeaways

- eToro has announced it will make 24/5 trading available on 100 popular US stocks shortly.

- All order types, market, stop loss, and take profit will be supported around the clock.

- All position types, including non-leveraged, leveraged, long, and short positions, will be available outside of traditional hours.

Why The Rise In Extended Hours Trading?

We’ve seen a growing trend of stock brokers rolling out extended hours trading in recent years, catering to active traders seeking volatility.

Extended hours trading provides opportunities for traders to react quickly to news events, such as earnings reports, outside of traditional market hours.

For short-term traders, it also provides an opportunity to seize on price gaps that can occur overnight, as well as an early view on market sentiment before the opening bell.

However, caution is required – trading out of hours comes with heightened risks like lower liquidity and larger price swings, making it best suited to experienced traders.

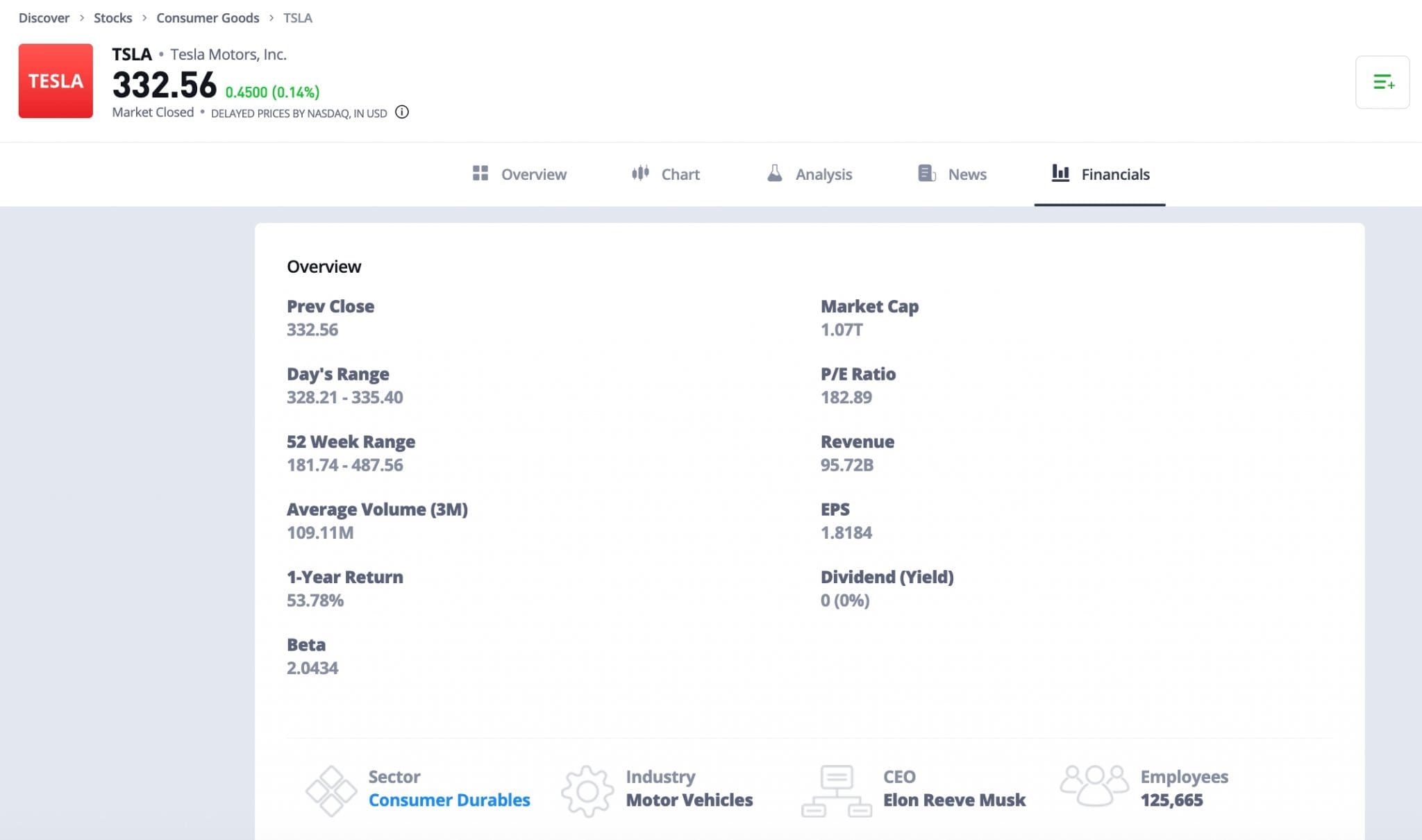

List of eToro’s 24/5 trading assets.

About eToro

eToro is a trusted broker, best known for its user-friendly social trading platform that counts over 38 million clients.

Regulated in the US, UK, Europe, and beyond, it regularly makes improvements to its services, including most recently letting eToro users fund their accounts in BTC and ETH.

The minimum deposit to open an account varies by country, but typically starts at $50.